Is the Stock Market Correction Over?

One of the better-known quotes from legendary money manager, Peter Lynch (there are many) is: “more money has been lost trying to predict a correction than during the correction itself” which seems especially appropriate in the current environment.

The traditional “correction” definition is a 10% decline. By this measure, the SPDR S&P 500 Index (SPY) and Nasdaq 100 Powershares (QQQ), with both bottoming out on Monday morning about 7% from the all-time highs hit in early September, have yet to achieve correction status.

But, what I’ve been trying to hammer home the past few weeks is that the SPY and QQQ no longer represent the broad market due to the big six; FAAMG or whatever acronym you want to ascribe to FaceBook (FB) Apple (AAPL) Amazon (AMZN), Microsoft (MSFT) and Google (GOOGL) represent some 25% of the SPY and 47% of the QQQ.

This has masked the correction that occurred for the past few months underneath the headline number. Let me regurgitate the numbers; 35%-plus of SPY stocks are down 10% from their 52-week high and over 25% are down 20%. There have been more new lows than new highs over the past month. Despite this week’s rebound, nearly 45% of the NYSE Composite Index is below its 100-day moving average.

This leads me to conclude that the market already had a correction among the soldiers and it was only in the past few weeks — when the FAAMG generals retreated — that it became evident and headline-worthy.

But the big question remains; “Is the correction over?”

In my mind, we still have a significant technical break in the uptrend. The snapback “V” bottom has already dissipated. And short-term gains will face resistance at the gaps at $442 in the SPY at $373 in the QQQ. The levels and push/pull dynamic was discussed earlier this week in Why the Market is at a Crucial Crossroads.

iShares Russell 2000 (IWM) bullish position for the past few weeks

Again, as disclosure and a glimpse into my thinking. Options360 has been holding an iShares Russell 2000 (IWM) bullish position for the past few weeks. With several rolls under our belt, it will solidly in the green while risk is down to de minimus. Okay, that’s a stupid word. The risk is down from an original $4.50 to a current 0.90 costs basis.

I really want to reinforce the notion that sector rotation has been the theme to the extreme since the March 2020 pandemic low. So yes, we finally see the mega-cap tech names retreating. However, we have also seen the small-cap and cyclical sectors, such as energy, enjoy a nice rally. But, their weighting in the SPY or QQQ is too small to move the needle. The Invesco S&P 500 Equal Weight Index (RSP) made a low on September 21, which was 10% off the August high. It has now rebounded some 4.8% over the past two weeks.

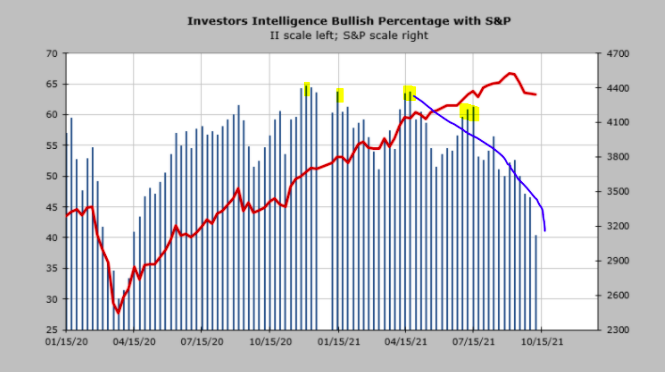

For months, professional and retail inventors were extremely bullish, hitting early this year before a precipitous decline the past two weeks.

Increased bearish or caution actually becomes bullish

As with most sentiment indicators, whether it be put/call reading, the VIX, or Fear and Greed Index, the Investor Intelligence Survey tends to be a contrary indicator, meaning increased bearish or caution actually becomes bullish. The nervous or weak hands are selling, leaving less ammo for the bears while also creating the infamous “wall of worry” stocks to climb.

All of this amounts to me falling back on the “cautiously-optimistic and patiently waiting for good setups” mantra. In practice, this means I’ve been taking early and conservative rolls, selling in or close-to-the-money weekly calls in bullish diagonal positions such as Ford (F), Advanced Micro Devices (AMD), and even IWM. As I wrote in Wednesday’s Alert, “I’m perfectly happy being taken out of these positions if the stock can stay above the short strike over the next week” even though we have three-four weeks remaining on the long leg.

Of course, the market and I will shift its focus to earnings. It kick off next week with the big banks. This is when sentiment, technicals, and even policy get kicked to the side for fundamentals to take center stage. With quarter-to-quarter estimates reduced for the first time since the Q2 of 2019, marking the brunt of the pandemic lockdowns, companies may actually have a low bar to hurdle. Meaning a correction already prived in and we could see some buy-the-news reactions.

The post Is the Stock Market Correction Over? appeared first on Option Sensei.