Buy Alert! Inflation ETF To Spike Higher

RoboStreet – October 21, 2021

Markets Revisit High On Strong Consumer Spending

It’s pretty common knowledge that consumer spending drives 70% of GDP, which is forecast to end the year at around 5.7% according to S&P Global Economics. The most recent retail sales data for September released on October 15 showed a stunning increase of 0.7% versus economists’ estimate of -0.2% and retail sales ex-auto rose to 0.8% versus forecasts of 0.4%.

What’s most impressive is that the retail beat came during a time when the stock market was teetering on the brink of a full-blown correction amid rising inflationary pressures impacting gasoline, food, travel, entertainment, and eating out. Apparently, there is still $1.6 trillion in unspent government stimulus money in the hands of consumers that might be starting to loosen up after recent data showing progress on Covid and jobs.

“I’m investing my own money in each and every stock as my AI platform identifies.”

And remember we’re not talking about day-trading here. I’m looking for 50-100% gains inside of the next 3 months, so my weekly updates are timely enough for you to act.

Click Here – To See Where I Put My RoboInvestor Money

Newfound bullish consumer spending binge has fed into market sentiment

In any event, this newfound bullish consumer spending binge has fed into market sentiment, taking the major indexes back up to the all-time highs with earnings season only 20% in the books. This higher move in stocks also comes at a time when the yield on the 10-yr Treasury is 1.67%, a level not seen since this past May, and WTI crude trading up to $83/bbl. To see the consumer exhibiting strength in the face of the cost of living and the declining market is counterintuitive and impressive.

CURRENT TRADING LANDSCAPE

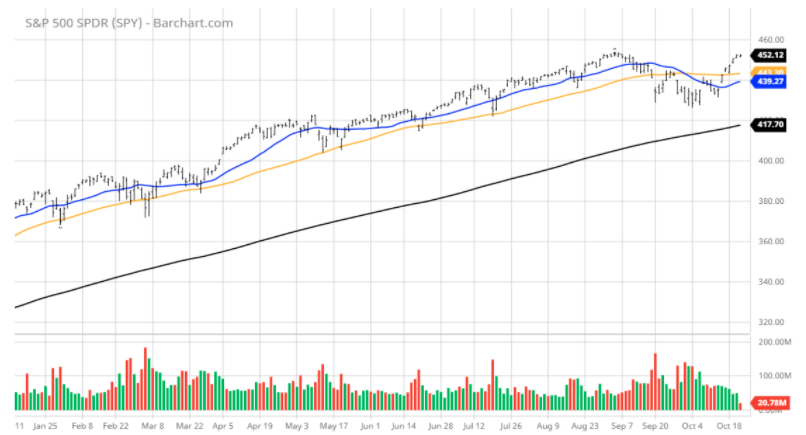

The $SPY settled at the all-time high, of $452 on Wednesday. The value/reflationary stocks traded higher, up 1%, and closed at the all-time high. The technology stocks closed in the red, down 0.3%, and settled 2% away from the all-time high.

The $DXY is short-term overbought and retesting key long-term support at $93.5 (break of this support will be bullish for the reflationary stocks). The $TLT continued the bottoming process, retesting recent lows near the 200-day moving average.

SPY overhead resistance is at $452/$455

The $SPY short-term support level is at $449, followed by $445. The SPY overhead resistance is at $452/$455. Short-term, the market is overbought and due for a shallow pullback in the next few sessions. Based on our models, the market (SPY) will trade in the range between $428 and $455 for the next 2-4 weeks.

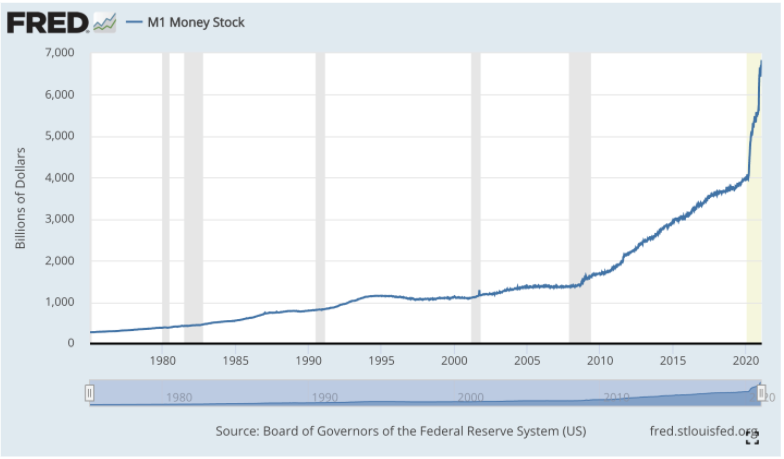

One recent development that deserves the attention of investors is how the dollar has started to weaken, even with the widespread consensus of Fed tapering to be announced at the upcoming FOMC meeting on November 2. The surge in the money supply since the pandemic took hold has been almost straight up. Yet the dollar has held its ground relatively well during this unprecedented time of liquidity creation.

The recent break in the dollar’s uptrend triggered an array of signals in our proprietary AI models that guide our investment decisions in our RoboInvestor advisory service. I look for confirmation of when key macro components, like the dollar, make a sudden directional move, and what that means for market sectors and stocks that we want to consider for the RoboInvestor portfolio.

The one-month chart below shows the dollar index (DXY) topping out just under 94.60. Now in a downtrend where 93.00 is the next level of support.

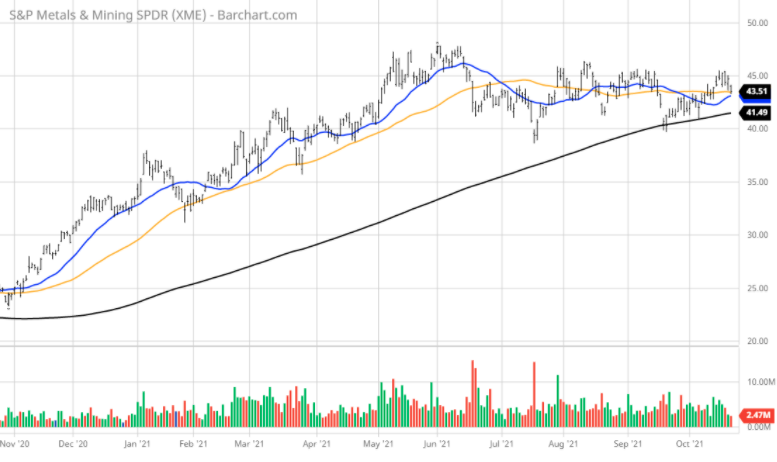

A weaker dollar bullish for metals, miners

A weaker dollar is bullish for metals, miners, and materials. With a broad majority of the stocks in these sectors trading near the low end of their respective intermediate-term ranges, there are several compelling opportunities that our AI platform has identified and are actionable.

Looking at our A-driven Forecast Toolbox the S&P Metals & Mining SPDR ETF (XME) is most attractive in that the ETF registers a Model Grade “B” rating and a short-term Predicted Resistance price target of $48 over the next two weeks, implying a move higher of more than 10%.

The one-year chart of XME below shows a well-defined trading range. A technical pennant formation that typically culminates in an upside breakout. The 20, 50, and 200-day moving averages are all converging in the $43 range, where if our AI signals validate the technical, we’ll be advising RoboInvestor members to buy.

27 straight gains with the last loss of -4.73% incurred on April 21 of this year

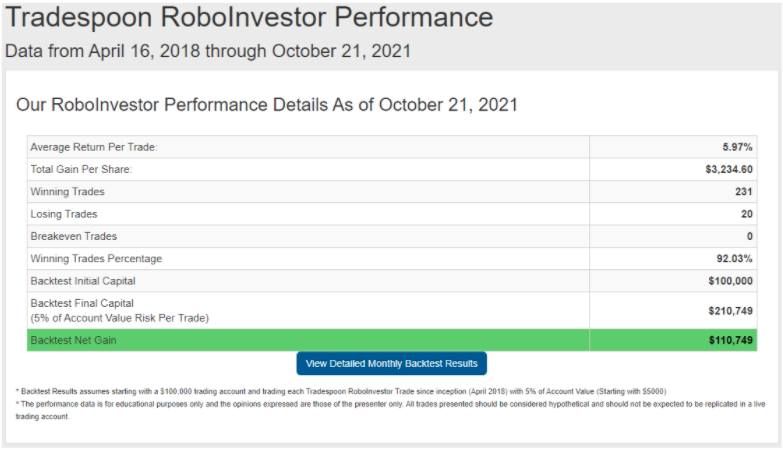

RoboInvestor is very unique in that the service is unrestricted in asset selection. Our AI platform identifies trades in blue-chip stock and ETFs that represent market indexes. Also the 11 market sectors, commodities, interest rates, currencies, and volatility. It also signals when to reduce market exposure and utilize inverse ETFs for shorting purposes.

Every other week, we email out the RoboInvestor newsletter over the weekend with two new picks to act on the following Monday. I also update our current holdings and review whatever profits we’ve booked along the way. It’s a very simple service to follow in that I do all the work with my AI models and you simply follow my lead.

Speaking of booking profits, our Winning Trades Percentage is an amazing 92.03% going back to early 2018. We’ve booked 27 straight gains with the last loss of -4.73% incurred on April 21 of this year. Imagine having that kind of winning streak taking place in your portfolio. It’s how we build wealth for our clients over time…consistently.

I invite you to come alongside me in joining RoboInvestor and bringing real change to how your portfolio performs on a steady basis. Our system finds opportunities all the time where capital gains are an all the time occurrence for the service. I invest my own personal capital in every trade I recommend, so I’m there with you in real-time. Thanks for reading this blog and I hope to be welcoming you aboard.

“I’m investing my own money in each and every stock as my AI platform identifies.”

And remember we’re not talking about day-trading here.

Click Here – To See Where I Put My RoboInvestor Money

*Please note: RoboStreet is part of your free subscription service. Not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.