Fed Alert! Two Banks To Buy Now

RoboStreet – December 2, 2021

Volatility Spikes New Virus Headlines

Investors are dealing with one of the most headline-driven markets in recent memory, making for a white-knuckle ride entering the last trading month of the year. Historically, December has been very good to those fully invested, but this year a series of high-profile developments have fueled a big spike in market volatility, thereby rattling year-end enthusiasm, at least in the very short term.

The emergence of the Omicron variant of Covid-19 is full of unknowns as to how dangerous it is and to what extent it will stifle the reopening of global economies. To date, the world has been dealing and coping much better with the Delta variant amid rising vaccination rates. The first case of Omicron was announced Wednesday where a patient in California had traveled to South Africa where the variant was first discovered.

“I’m investing my own money in each and every stock as my AI platform identifies.”

And remember we’re not talking about day-trading here. I’m looking for 50-100% gains inside of the next 3 months, so my weekly updates are timely enough for you to act.

Click Here – To See Where I Put My RoboInvestor Money

In another market-rattling situation, Fed Chairman Jerome Powell caught investors flat-footed when he volunteered his thoughts on speeding up the taper by a few months to fight persistent inflation pressures, dropping the “transitory” talk altogether. This sudden change of rhetoric gave the market a double dose of negative news that pulled the rug out from under the rally leading up to Thanksgiving, putting the market on defense.

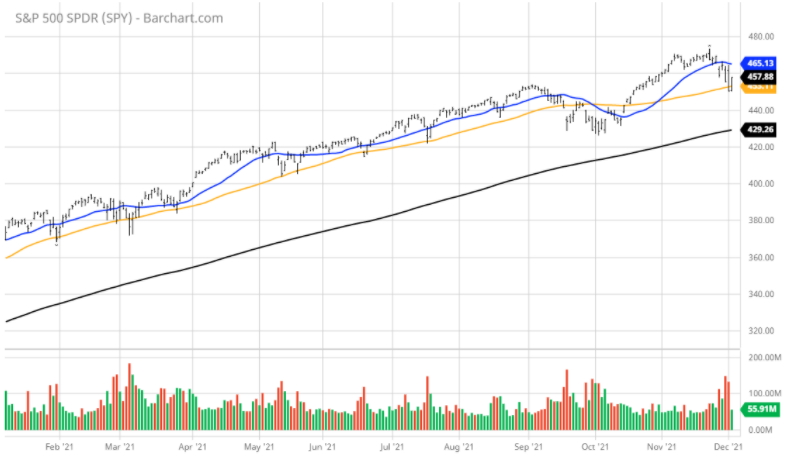

Sector rotation is fast and furious, with the tech sector showing resilience early in the week followed by a big shift into cyclicals Thursday as commentary is surfacing that the Omicron variant is not nearly as deadly as Delta. As such, capital flows are moving back into value, reopening, and reflation stocks as the market attempt to stabilize. Anyone using sell stops is probably getting picked off, the price swings being so wide. It’s a true shakeout that has resulted in a 5% correction for the S&P 500.

CURRENT TRADING LANDSCAPE

The $SPY continued the sell-off and closed below the key long-term support, down 1.0% at $450, below the 50-day moving average and below the previous breakout in September. The value/reflationary stocks pulled back, down 0.5%, and closed within striking distance from the 200-day moving average, $VTV at $137. The technology stocks sold off today, down 1.7%.

The $DXY traded flat closed at $96 above key breakout at $94.50. The $TLT traded flat, at $152, and testing the key overhead resistance at $152. The $VIX traded higher and closed at 32.

The $SPY short-term support level is at $444 followed by $426 (low probability level at this point). The SPY overhead resistance is at $468. Short-term, the market is oversold and due for a rebound in the next couple of sessions. Volatility can persist for the next couple of weeks.

I would consider starting to start accumulating reflationary/value stocks ($XME, $XLI, $XLF, $XLB and $XLE). I expect the market to pull back further. $QQQ can sell off further, in the next couple of weeks (5-10% from the market top) and then start rebound toward the end of December.

I would consider rebalancing my portfolio at this time, raise cash and have an overall bullish portfolio.

If you are trading options consider selling premium with February and March expiration dates.

Based on our models, the market (SPY) will trade in the range between $445 and $480 for the next 2-4 weeks.

The Fed moved the goal posts this week and the market is now expecting higher interest rates sooner than initially expected. That being the case, it stands to reason that bond yields will rise in anticipation of a more hawkish fiscal policy that bodes particularly well for the financial sector and especially the big mega banks.

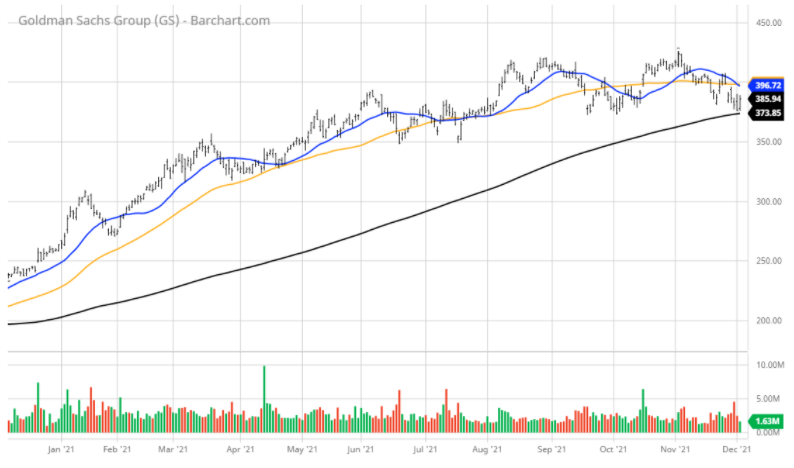

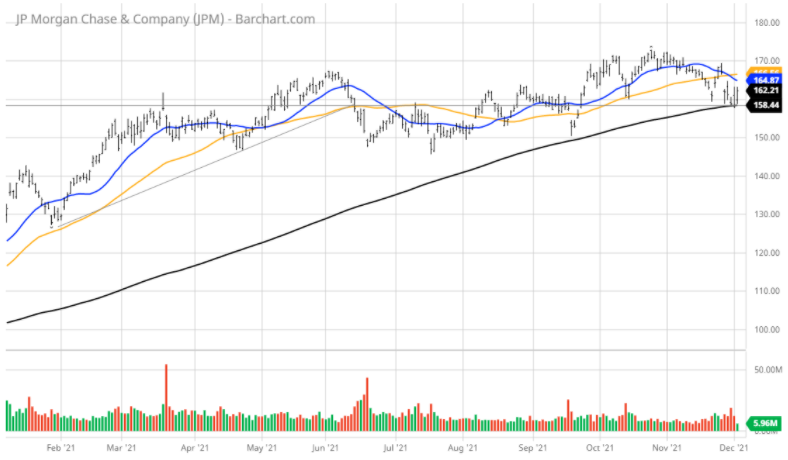

Investors don’t have to look beyond the two banks within the Dow Jones Index – namely Goldman Sachs Group Inc. (GS) and JP Morgan Chase & Co. (JPM). Both stocks are top holdings within the leading financial ETFs and are institutional favorites as core portfolio holdings because they offer multiple profit centers within each company.

Aside from lending to commercial and retail customers, GS and JPM have extensive trading operations, underwriting, M&A consulting, and research covering both the credit and equity markets. Rising interest rates fuel net interest income and profits, which result in higher earnings forecasts going forward.

Both stocks have very similar charts where each stock tested its 200-day moving average this week, held, and is pivoting higher in Thursday’s session, gaining just under 3%. Short-term technical indicators are very oversold, setting the stage for a strong year-end rally as money rotates hard into the banks.

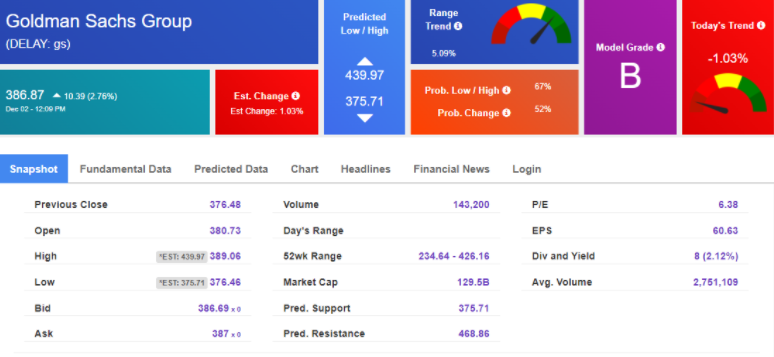

Much of our decision-making process depends heavily on the proprietary AI platform we utilize in our RoboInvestor advisory service. The Forecast Toolbox is one of two primary tools we use to crunch data and determine if a stock or ETF is a timely fit to the RoboInvestor model portfolio.

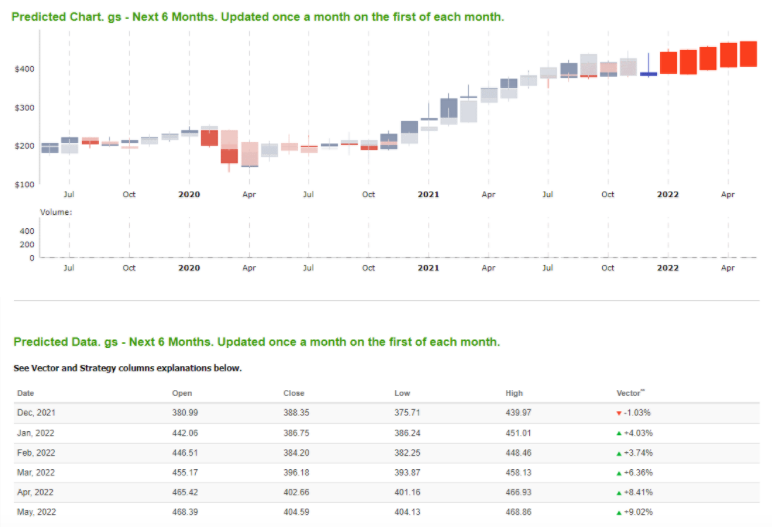

For Goldman Sachs, we get a Model Grade “B” rating with a Predicted Resistance price target of about $469 for an implied move higher of 21%. That’s terrific for those investors seeking a strong return in a blue-chip stock within the market’s sweet spot.

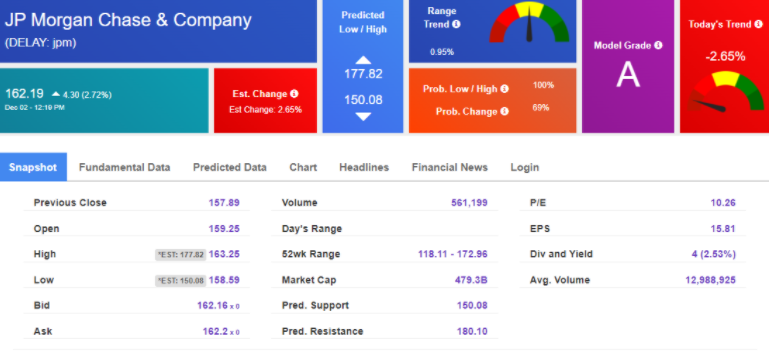

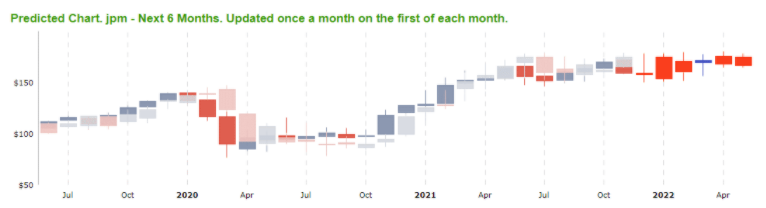

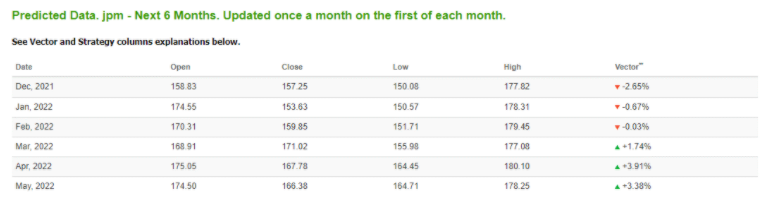

For JP Morgan, we get an even higher Model Grade “A” rating for the stock with a Predicted Resistance price target of $180 that would take the stock to new all-time highs and likely much higher being it would be a major technical upside breakout.

We own JPM in the RoboInvestor portfolio and I’m considering getting long GS as well. I say “we” because after I recommend a stock or ETF to our RoboInvestor members, I also buy the same stock or ETF for my personal account. I’m fully involved from every level with each trade I bring to the RoboInvestor portfolio – and I’m very happy to report that the many years of honing and refining the algorithms that our AI platform runs on have produced some incredible results.

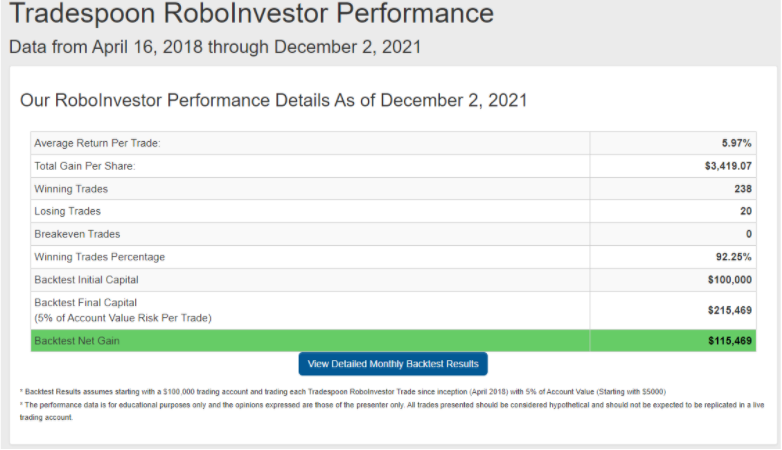

Since launching RoboInvestor in early 2018, our Winning Trades Percentage is an amazing 92.25%. To my knowledge, I don’t know of another service that can boast the same performance. In fact, we’ve booked 35 straight profitable trades with the last nominal loss of -4.7% realized back on April 21 of this year.

Within RoboInvestor, we publish an online newsletter that members receive every other week over the weekend so they have actionable trades on Monday morning before the market opens. I will recommend two trades that will include blue-chip stocks or ETFs in indexes, market sectors, sub-sectors, commodities, precious metals, currencies, interest rates, volatility, and shorting opportunities via inverse ETFs.

Put the power of AI into your portfolio today and give yourself an early gift of boosting the potential of market gains starting today! There is no time better than the present to up your game when it comes to investing and having AI tools that are always learning, always thinking, and always screening out attractive risk/reward trades. RoboInvestor is a wonderful present to give yourself or someone you know that can fully appreciate and benefit from an AI platform that doesn’t get rattled by headlines.

“I’m investing my own money in each and every stock as my AI platform identifies.”

And remember we’re not talking about day-trading here. I’m looking for 50-100% gains inside of the next 3 months, so my weekly updates are timely enough for you to act.

Click Here – To See Where I Put My RoboInvestor Money

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.