Buy Alert! Big Bank Set To Soar

RoboStreet – December 9, 2021

Is Inflation Transitory Or Not? That Is The Question

Every day investors wake up to a number of variables that can impact equity markets and their portfolios. Lately, there have been a host of economic and geopolitical factors making for a very volatile landscape. The highly contagious omicron variant put the market on its heels as there was little information about how lethal it was. Thankfully, as more information has surfaced about omicron, it is being viewed as not as deadly as the delta variant or the original COVID-19 strain.

In Eastern Europe, Russia has amassed more than 100,000 troops and large quantities of heavy artillery on the Ukraine border in a show of force to prevent Ukraine from joining NATO. Other hotspots include the United States’ decision to boycott the Winter Olympics in China over human rights abuses, Iran increasing weapons-grade uranium in violation of the IAEA agreement.

One would think these fluid situations would have a dampening effect on the stock market, but with some 40% more liquidity in the global money supply than just two years ago from all the QE by the world’s central banks, capital flows into the U.S. market remain very bullish, especially on big dips such as what occurred on Black Friday and the week following Thanksgiving. That 5% correction for the S&P and its subsequent rally back to test the recent all-time high was a testament to the rally’s resilience.

“I’m investing my own money in each and every stock as my AI platform identifies.”

And remember we’re not talking about day-trading here. I’m looking for 50-100% gains inside of the next 3 months, so my weekly updates are timely enough for you to act.

Click Here – To See Where I Put My RoboInvestor Money

About the only thing that seems to have the ability to alter the primary bull trend is inflation, and a big part of the post-Thanksgiving pullback was the comments stemming from Fed Chairman Jerome Powell to a Congressional committee, acknowledging that inflation is more stubborn than they had predicted, dropping the use of “transitory” altogether from his statement. Since then bond yields have crept higher with the 10-year Treasury pushing up against 1.5%, but well off the 1.7% level pre-Thanksgiving.

How the market handles today’s November CPI data and next Tuesday’s November PPI data will resolve a lot of speculation as to whether inflation is indeed starting to plateau or whether the Fed’s plan to speed up the taper and raise short-term interest rates is fully warranted. Given the positive price action of this week, the market doesn’t seem to be too concerned.

CURRENT TRADING LANDSCAPE

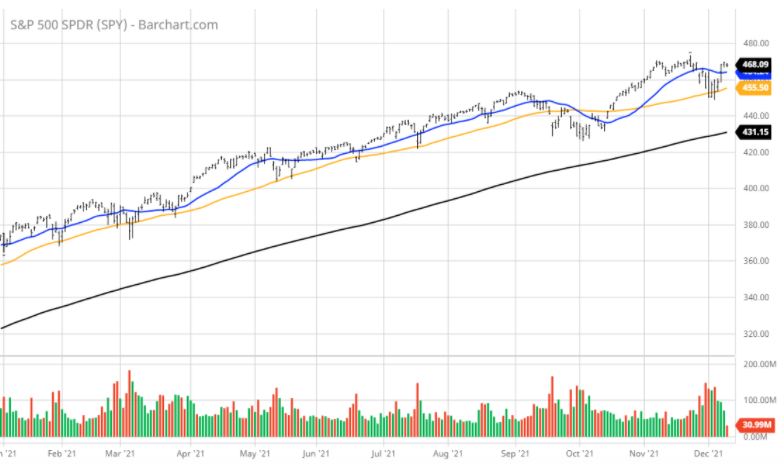

The $SPY continued to trade higher, up 0.2% and closed within 1% of an all-time high. The value/reflationary stocks closed lower, down 0.2%, and closed right above the 50-day moving average, $VTV at $143. The technology outperformed the market, up 0.5%.

The $DXY traded lower and closed at $96 above the key breakout level of $94.5. The $TLT traded significantly lower, at $148, and below the key overhead resistance at $152. The $VIX traded lower, back to the historical average, closed at 20.

The $SPY short-term support level is at $464 followed by $450. The SPY overhead resistance is at $472. Volatility can persist for the next couple of weeks. The short-term market is overbought and due for a pullback in the next few trading sessions.

I would consider starting to start accumulating reflationary/value stocks ($XME, $XLI, $XLF, $XLB, and $XLE). I expect the market to pull back again but most likely the $SPY will not revisit the $450 level and then the rebound will continue toward the end of December.

I would consider rebalancing my portfolio at this time, raising cash, and having an overall bullish portfolio.

If you are trading options consider selling premium with February and March expiration dates.

Based on our models, the market (SPY) will trade in the range between $445 and $480 for the next 2-4 weeks.

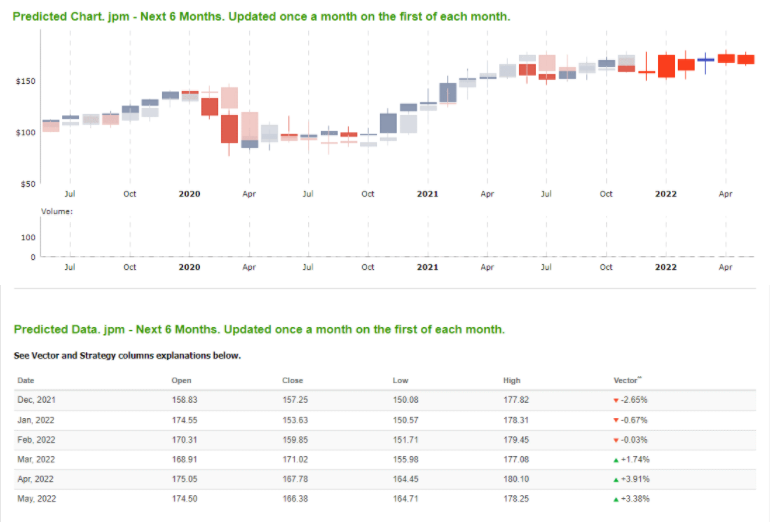

Heading into the inflation data, there is some rotation back out of growth and into cyclical sectors and stocks leveraged to benefit from higher bond yields – namely the megabanks. Assuming the inflation data is stubbornly strong and perceived as persistent, bond yields should push higher into 2022. Hence, the net interest income that banks depend heavily on for-profits will expand, thereby increasing margins.

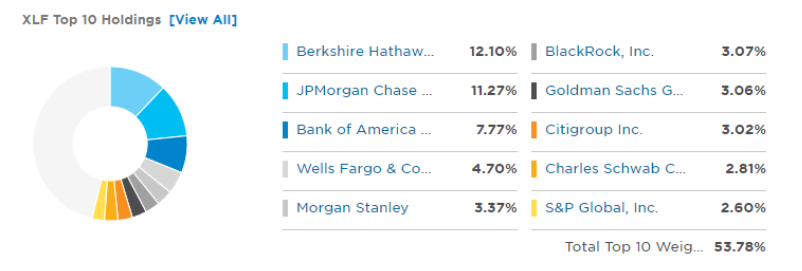

This development could be an excellent opportunity to own the big banks while they are consolidating. The Financial Select Sector SPDR (XLF) is the most widely traded ETF that holds all the best stocks in the sector. The top 10 holdings in XLF are all familiar names that provide a nice blend of banks, brokers, asset managers, and fintech.

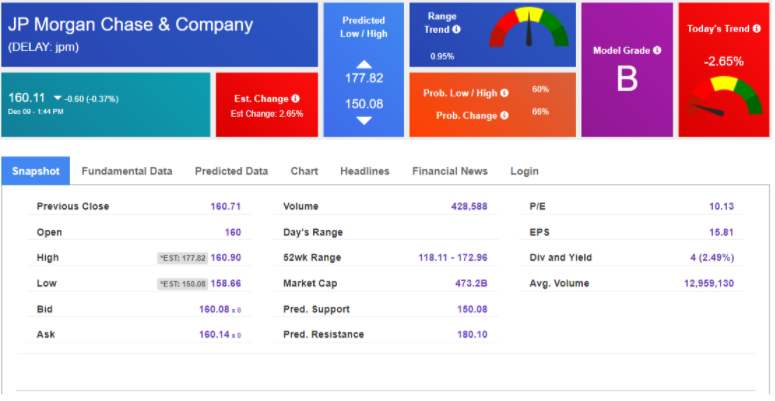

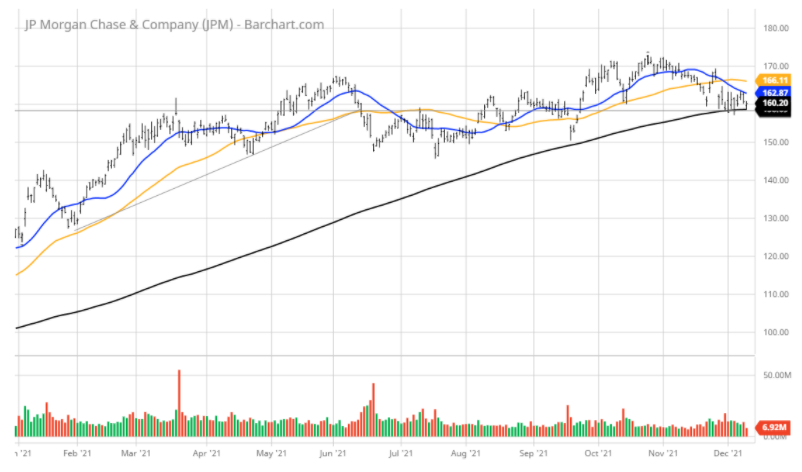

Within our RoboInvestor advisory service, we apply proprietary AI models to each and every stock and ETF selection. The AI-driven Forecast Toolbox does an excellent job rating our recommendations by providing a price target over the short and intermediate-term. One of our favorite stocks to own and trade is JP Morgan Chase & Co. (JPM).

For JPM, we get a strong Model Grade “B” rating and a Predicted Resistance price target of $180 for the stock, implying an upside move of 12% to a new all-time high.

The stock not only rates well through our AI platform but sets up well technically with JPM shares sitting right at a convergence of moving averages where a move higher in bond yields should break JPM out of a multi-month range.

Trades like JPM are exactly the high-quality stocks we position in the RoboInvestor portfolio that can own blue-chip stocks and ETFs of market indexes, market sectors, sub-sectors, commodities, currencies, interest rates, volatility, and shorting opportunities via inverse ETFs. Our AI platform is always seeking the smartest trades from every corner of the listed marketplace, where potential profits have the highest probability of being realized.

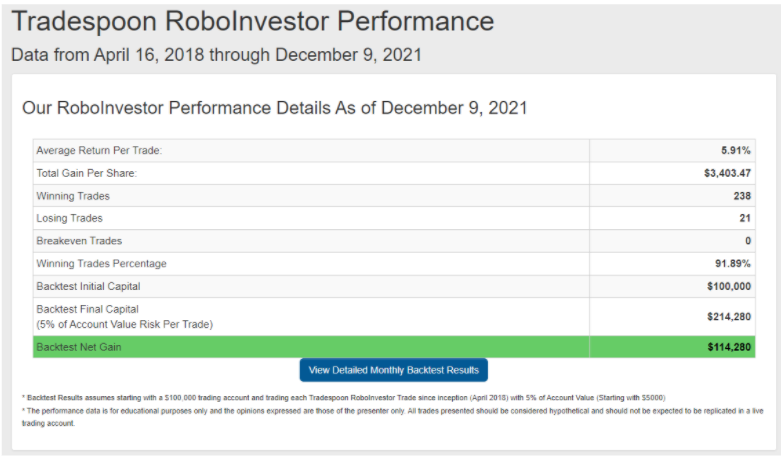

As to how our many years of development into our AI platform have paid off, the results so far have been stunning. Our Winning Trades Percentage is an amazing 91.89% going back to early 2018 when we launched RoboInvestor. We are extremely proud of our performance record and, to my knowledge, is the only advisory service available to everyday investors with that kind of torrid track record.

I want to encourage every reader of this blog to take stock of their year-end plan to up their returns in 2022 and beyond. Having the power of AI in one’s investment stable of tools is a powerful addition of wealth-creation potential. Making money on better than nine out of every ten trades executed can be life-changing and bring a whole new level of stress-free satisfaction to the business of investing.

I participate in every trade I recommend – so I’m there with you for the entire journey to growing our net worth together. I hope you are enjoying this newsletter and want to be the first person to welcome you aboard RoboInvestor.

Happy Holidays and Good Investing!