Friday’s Fade Threatens Christmas Rally

Every year the talking heads chime-in about a possible Santa Claus rally BEFORE Christmas but in reality, the time frame involves the last five trading days in December and the first two trading days in January. For 2024, that time period started on Christmas Eve and the shortened session provided a much need relief rally following the prior week pullback.

Last Tuesday’s gains averaged around 1% and helped pushed the Dow and S&P back near their current uptrend channels. The Nasdaq briefly fell out of its uptrend channel after the Fed news the prior week but continues to maintain its bullish thesis.

The follow through on Thursday to higher highs looked bullish but volatility ticked higher on the session and was likely a prelude to Friday’s action. The bounce off the intraday lows helped in keeping the technical outlook slightly bullish but it remains shaky.

The Russell continues to be the wild card as the index typically leads any December and into January gains versus the other major indexes. Key support from October at 2,225 was tripped but held on Monday’s fade to 2,219 with Friday’s low at 2,227. The next waves of support are 2,175-2,135 with the 200-day moving average at 2,159 sandwiched in between.

We mentioned a recovery of the 2,300 level is needed to regain a bullish thesis with a close above 2,325 and the 50-day moving average likely confirming a near-term bottom. Last Thursday’s peak was at 2,281.

The bottom of the uptrend channel for the Nasdaq is at 19,500 with wiggle room down to 19,250 and the 50-day moving average (currently at 19,160). There is also some support at 19,000 with a close below this level confirming a near-term top and downside pressure towards 18,600.

We said last Monday morning continued closes back above 19,750 would be bullish and this level was cleared and held to start the week. Friday’s close was just below this level so let’s consider it “stretch”. Last Tuesday and Thursday’s closes were just north of 20,000. The all-time high from December 16th is at 20,204.

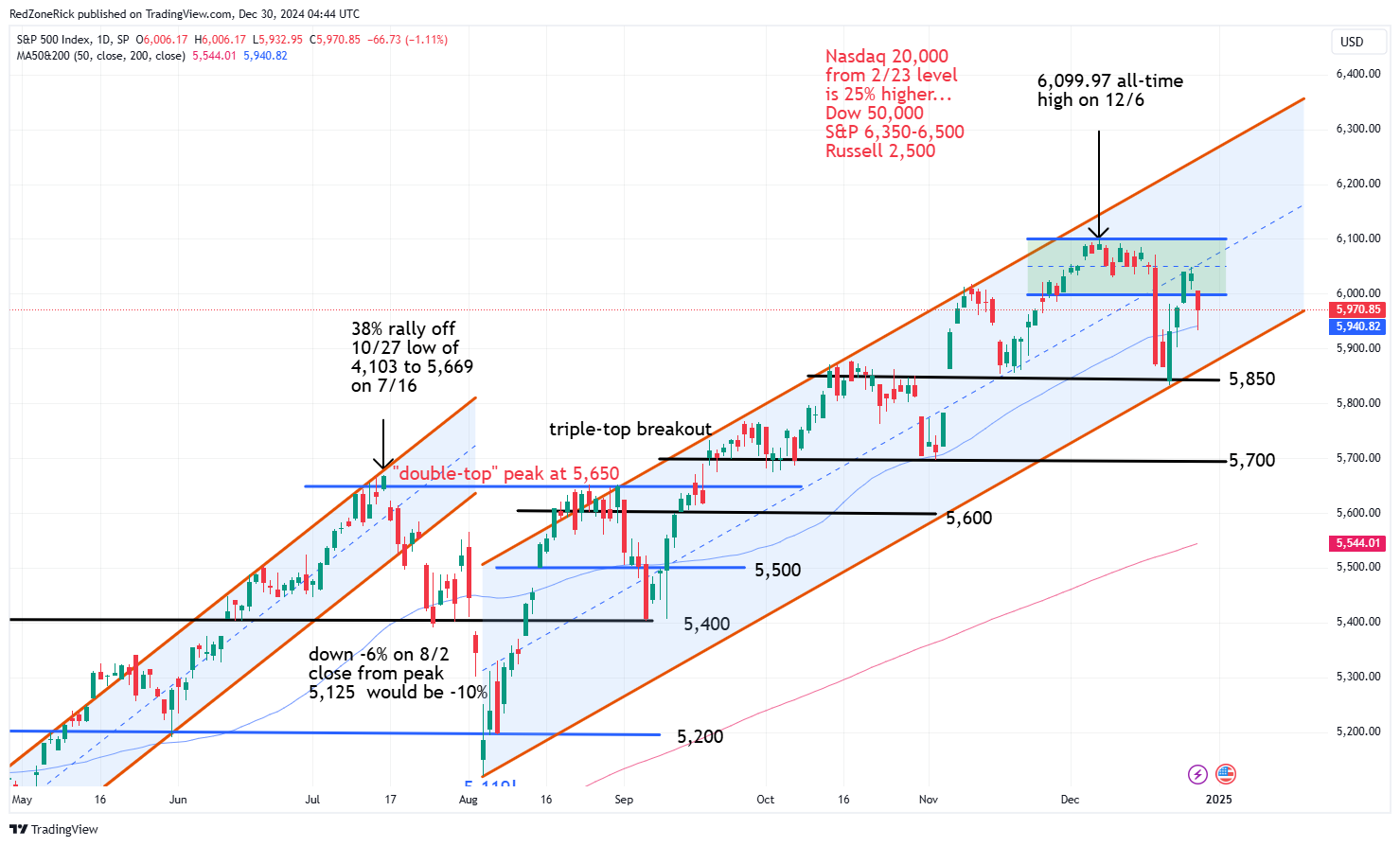

The S&P tested the middle of its prior trading range on Thursday trip to 6,049 before Friday’s backtest to the the 50-day moving average. The December 6th all-time high reached 6,099.97 with multiple closes above this level getting 6,350 in play on a readjusted uptrend channel.

Friday’s low kissed 5,932 with wiggle room down to 5,850. A close below this level could lead to a swift selloff towards 5,700.

The Dow cleared and held key resistance at 43,250 on Tuesday with light follow thru on Thursday. We mentioned coming into last week a recovery of the 44,000 level would alleviate some selling pressure. Same deal again this week.

Key support remains at 42,500 and the bottom of a readjusted uptrend channel with wiggle room down to 42,000. A move below this level would imply risk down to 41,000-40,750 and the 200-day moving average.

The Volatility Index (VIX) breached both its 200-day and 50-day moving averages with Friday’s peak at 18.45. Key resistance at 17.50 was triggered but held. A close back above 20 would be a slightly bearish development. Key support is at 15.

Going forward, we clearly have key support levels to watch going into 2025 for the major indexes. The bulls have had an incredible year with the major indexes pushing high double-digit gains and something we will talk about next week.

Going forward, we clearly have key support levels to watch going into 2025 for the major indexes. The bulls have had an incredible year with the major indexes pushing high double-digit gains and something we will talk about next week.

We will monitor the Santa Clause “time period” as it can typically shape how January might play out. The Nasdaq closed at 19,764 last Monday; the S&P at 5,974; the Dow at 42,906; and the Russell at 2,237. The former two indexes are down 42 and four points while the latter two are up 86 and seven points.

We mentioned fourth-quarter and yearend earnings results will also have a major impact on market direction from mid-January and into February. The financial sector will get the action started on Thursday morning, January 16th.