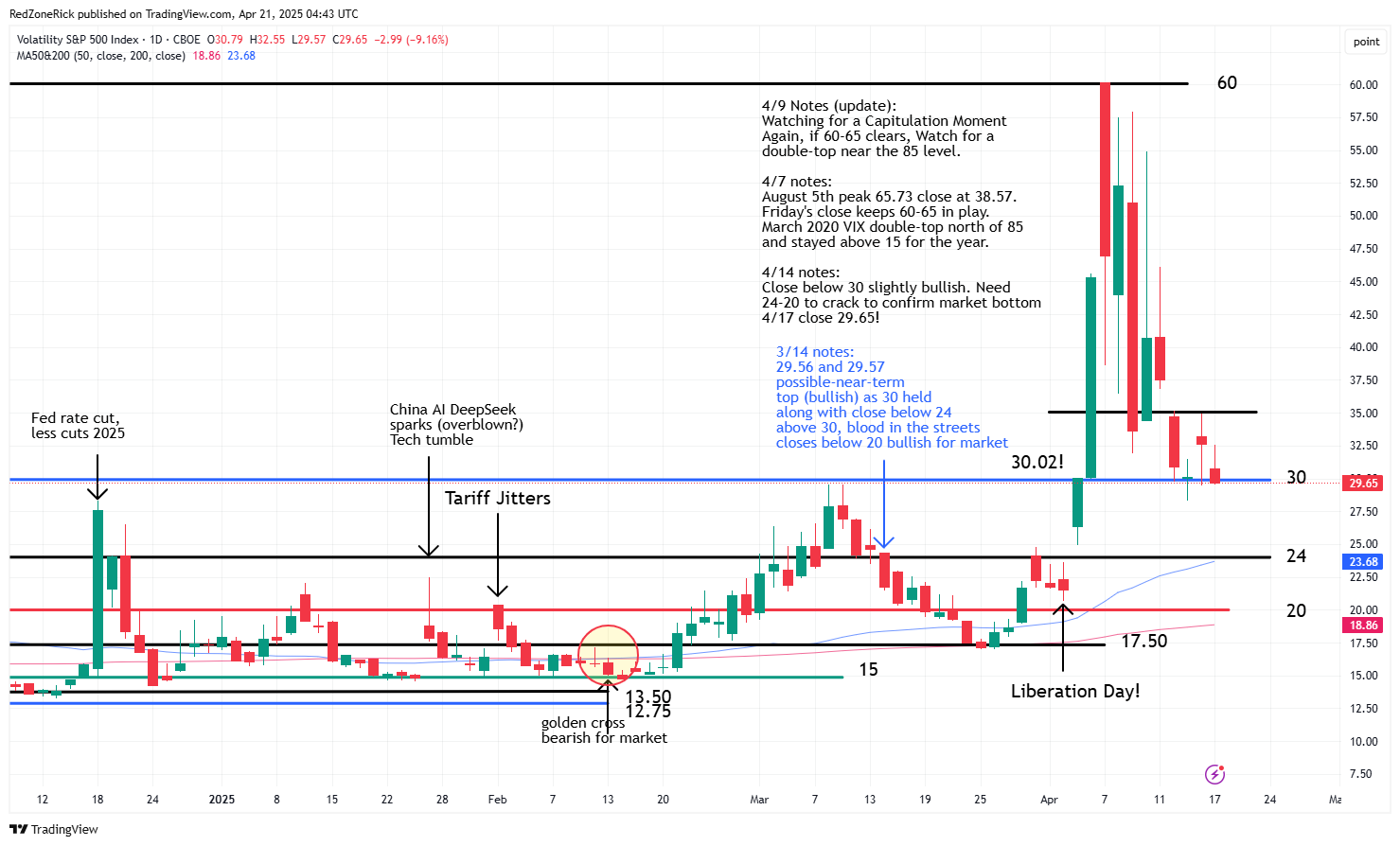

Volatility Closes Below Key Support (Slightly Bullish)

- Although the bears won the shortened week, volatility closed below a key level of support (30) that had served as prior resistance ahead of the three-day selloff from the beginning of the month. A rising VIX is bearish for the market while a falling VIX is bullish for the major indexes.

- NFLX posted a solid beat as earnings per share of $6.61 topped forecasts for a print of $5.67. Revenue of $10.54 billion also outpaced estimates of $10.5 billion for the quarter.

- The technical outlook still favors the bears as downtrend channels remain firmly outlined. This is a big week for earnings and there could be trade deals announced so any massive moves, or short-covering, could help the bulls and improve the picture.

The stock market was mixed on Thursday with Tech and the blue-chips showing weakness to close out the shortened week. Much of the Dow’s damage can be blamed on the 22% plunge in shares of UnitedHealth (UNH) following the company’s earnings miss.

The Nasdaq closed at 16,286 (-0.1%) with the low hitting 16,181. Support at 16,250 was cracked but held. Resistance remains at 16,750.

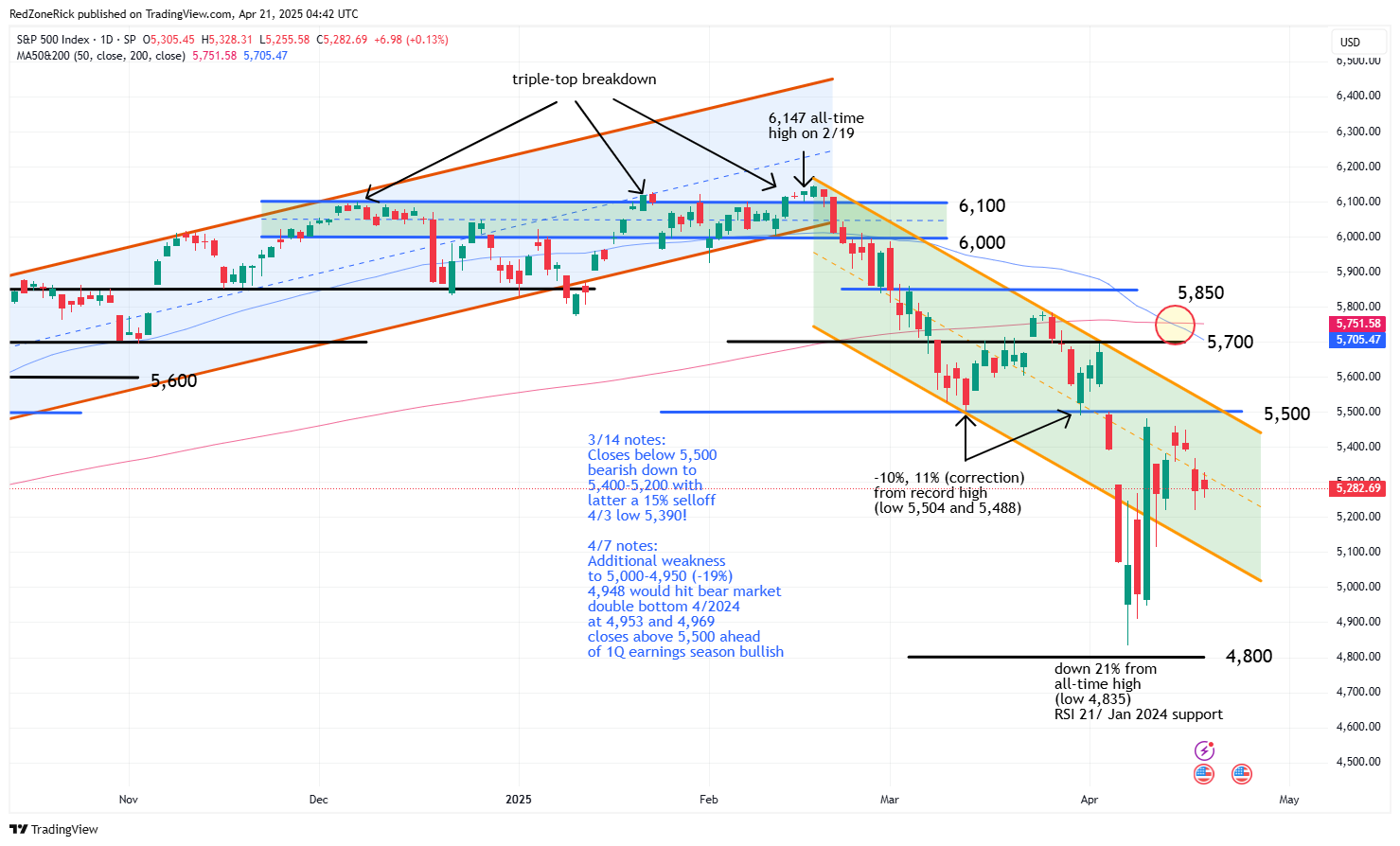

The S&P 500 traded down to 5,255 before settling at 5,282 (+0.1%). Support at 5,200 held. Resistance is at 5,400.

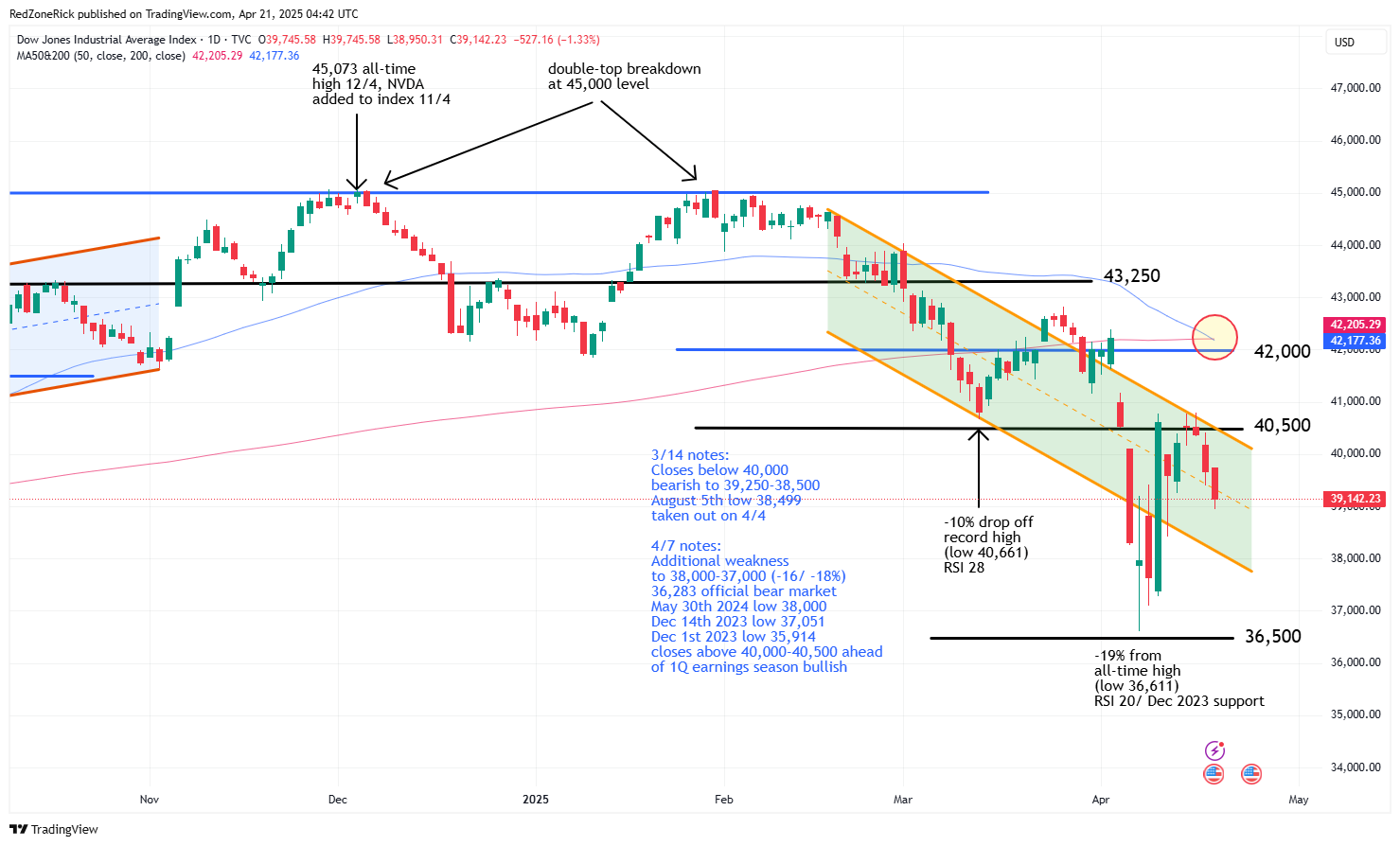

The Dow finished at 39,142 (-1.3%). Support at 39,000 held. Resistance is at 39,500.

Earnings and Economic News

Before the open: Bank of Hawaii (BOH), Capital City Bank Group (CCBG), Dynex Capital (DX), Washington Trust (WASH)

After the close: Calix (CALX), W.R. Berkley (WRB), Zions Bancorporation (ZION)

Economic News

Leading Indicators – 10:00am

Technical Outlook and Market Thoughts

Although the bears won the shortened week, the Volatility Index (VIX) closed below a key level of support (30) that had served as prior resistance ahead of the three-day selloff from the beginning of the month. For new subscribers, a rising VIX is bearish for the market while a falling VIX is bullish for the major indexes.

We mentioned a close below 30 last week on the VIX would be slightly bullish for the market. However, this level needs to hold throughout this week with a big push lower towards 27.50 and then 24.

There is wiggle room up to 35 on a move back above 30 with last Monday and Wednesday’s highs at 35.17 and 34.96, respectively. If 35 clears, 40-45 could come quickly.

The Nasdaq fell back below 16,750 on Wednesday with an inside day afterwards, meaning a higher high or lower low was not made on Thursday. The back-to-back closes above this level to start last week was a tease with the top of the downtrend channel at 17,000. We would like to see 17,500 cleared before we would call a possible near-term bottom.

Key support is at 16,000 with a move below this level getting 15,750-15,500 in focus. The low for the month and year is at 14,784 which represented a 27% drop from the all-time high of 20,204 from December 16th.

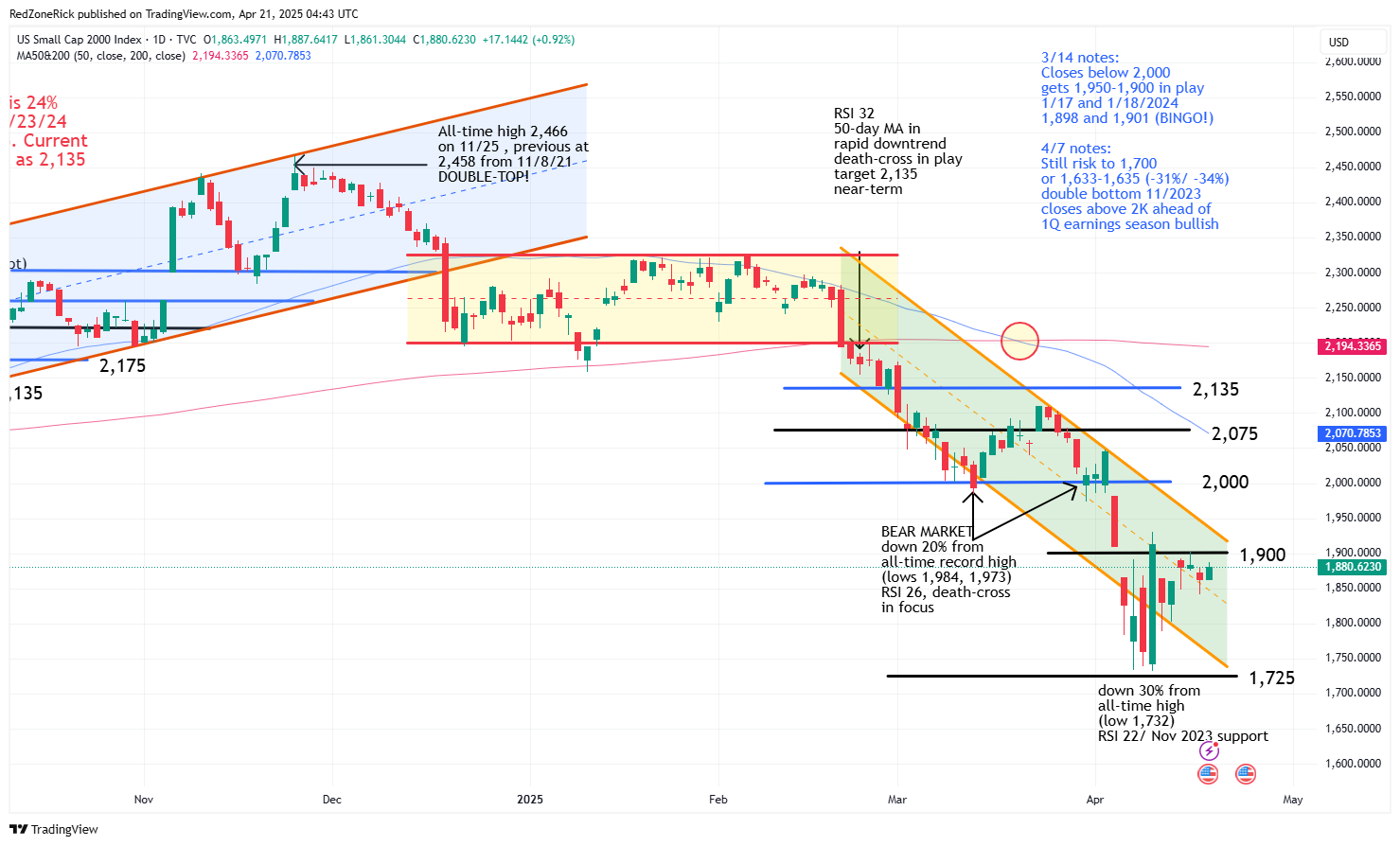

The Russell 2000 went out at 1,880 (+0.9%) with the high at 1,887. Key resistance at 1,900 easily held. Multiple closes above this level and last Tuesday’s top at 1,902 could lead to a quick trip to 2,000.

Support is at 1,850-1,825. A close below 1,800 likely leads to further weakness down to 1,750-1,725.

The S&P held current support at 5,200 throughout last week with the low at 5,220. There is wiggle room down to 5,100 with a close below this level suggesting weakness to 4,900-4,800. The 50-day moving average recently fell below the 200-day moving average earlier this month to form a death-cross and typically signals lower lows.

Resistance is at 5,300-5,350 followed by 5,400. We would like to see 5,500 cleared and held before saying a near-term bottom is in for the index.

The Dow fell back into its downtrend channel on Wednesday and towards the middle on Thursday. Support is at 39,000 and 1,000-point intervals afterwards. The April 7th low is at 36,611 and represents a 19% drubbing from the December 4th all-time high at 45,073.

Key resistance remains at 40,500 with multiple closes above this level implying additional upside towards 42,000. The 50-day moving average closed below the 200-day moving average on Thursday to officially form a death-cross near 42,200.

After Thursday’s close, Netflix (NFLX) posted a solid beat as earnings per share of $6.61 topped forecasts for a print of $5.67. Revenue of $10.54 billion also outpaced estimates of $10.5 billion for the quarter.

Shares were back above the $1,000 mark in after-hours with the recent all-time high at $1064.50 from February 14th. NFLX is one of our favorite stocks to do credit spreads, and if the gains hold, the action should provide a lift to Monday’s open.

The technical outlook still favors the bears as downtrend channels remain firmly outlined. This is a big week for earnings and there could be trade deals announced so any massive moves, or short-covering, could help the bulls and improve the picture.