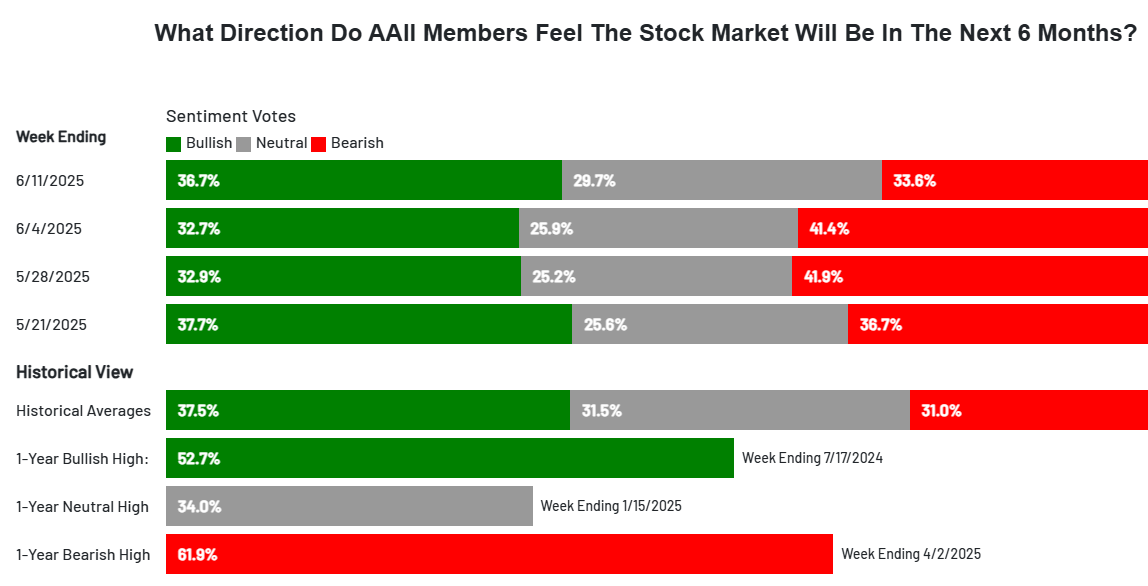

Tracking Bullish and Bearish Sentiment

The AAII Sentiment Survey is a weekly survey which indicates if investors are “Bullish,” “Bearish,” or “Neutral” on the stock market over the next six months. It can be a useful indicator for market sentiment that highlights if investors are typically bullish or bearish.

Optimism among individual investors about the short-term direction of the stock market improved last week to 36.7% despite last Friday’s pullback. Pessimism declined while neutral sentiment rose.

Bullish sentiment, expectations that stock prices will rise over the next six months, jumped 4% to 36.7% for the week ending June 11th. Optimism is nearing the historical average of 37.5%. The one-year bullish peak hit 52.7% last July.

Neutral sentiment, expectations that stock prices will stay essentially unchanged over the next six months, rose 3.8% to 29.7%. This is just below the historical average of 31.5%. The 52-week top for neutral sentiment reached 31.5% in mid-January of this year.

Bearish sentiment, expectations that stock prices will fall over the next six months, sank 7.8% to 33.6%. Pessimism fell near the historical average of 31%. The 52-week bearish high hit 61.9% for the week ending April 2nd of this year. The market bottom occurred April 7th for the major indexes.

As noted above, bullish sentiment is near its historical level but likely fell following Israel’s attack on Iran last Thursday night. Monday’s rebound helped keep the bullish technical outlook intact.

If bullish sentiment remains strong again next week, fresh all-time market highs will likely be achieved at some point this summer.