Volatility Spikes On Fed Drama

- The Nasdaq and S&P traded to fresh all-time highs on Tuesday but remain in tight two-week ranges. The action has pushed the two indexes slightly out of their current uptrend channels but key support levels held on Wednesday’s lows.

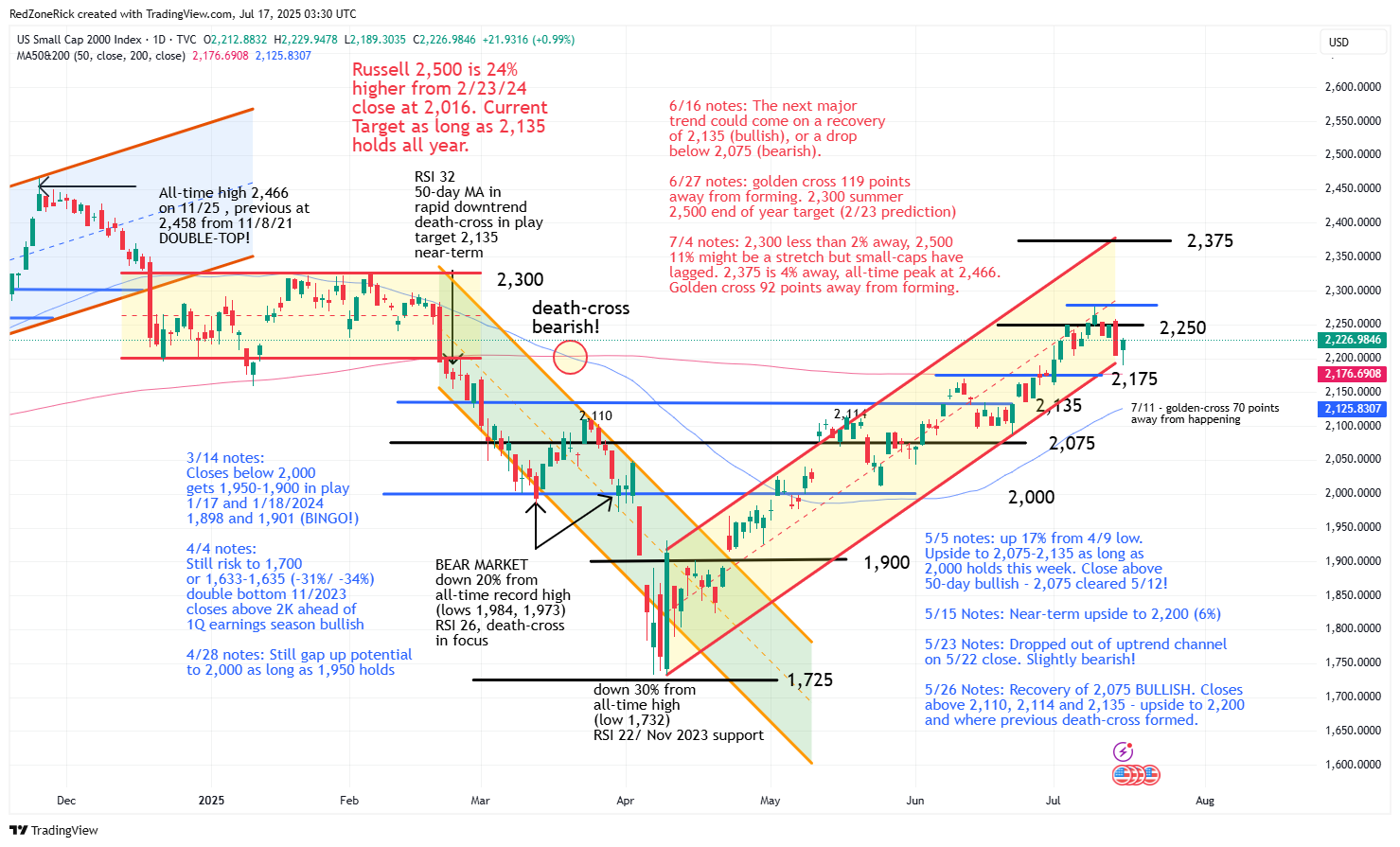

- The Dow and the Russell have struggled with near-term resistance but are holding their uptrend channels and key support levels, as well. We mentioned coming into the month there was a chance a consolidation phase could come ahead of the start of the second-quarter earnings season as the market was becoming overbought.

- The recent action and Wednesday’s volatility took some of the fluff out of the major indexes and the market outlook remains slightly bullish. However, if key support levels start to crack, a deepening pullback could be in the works.

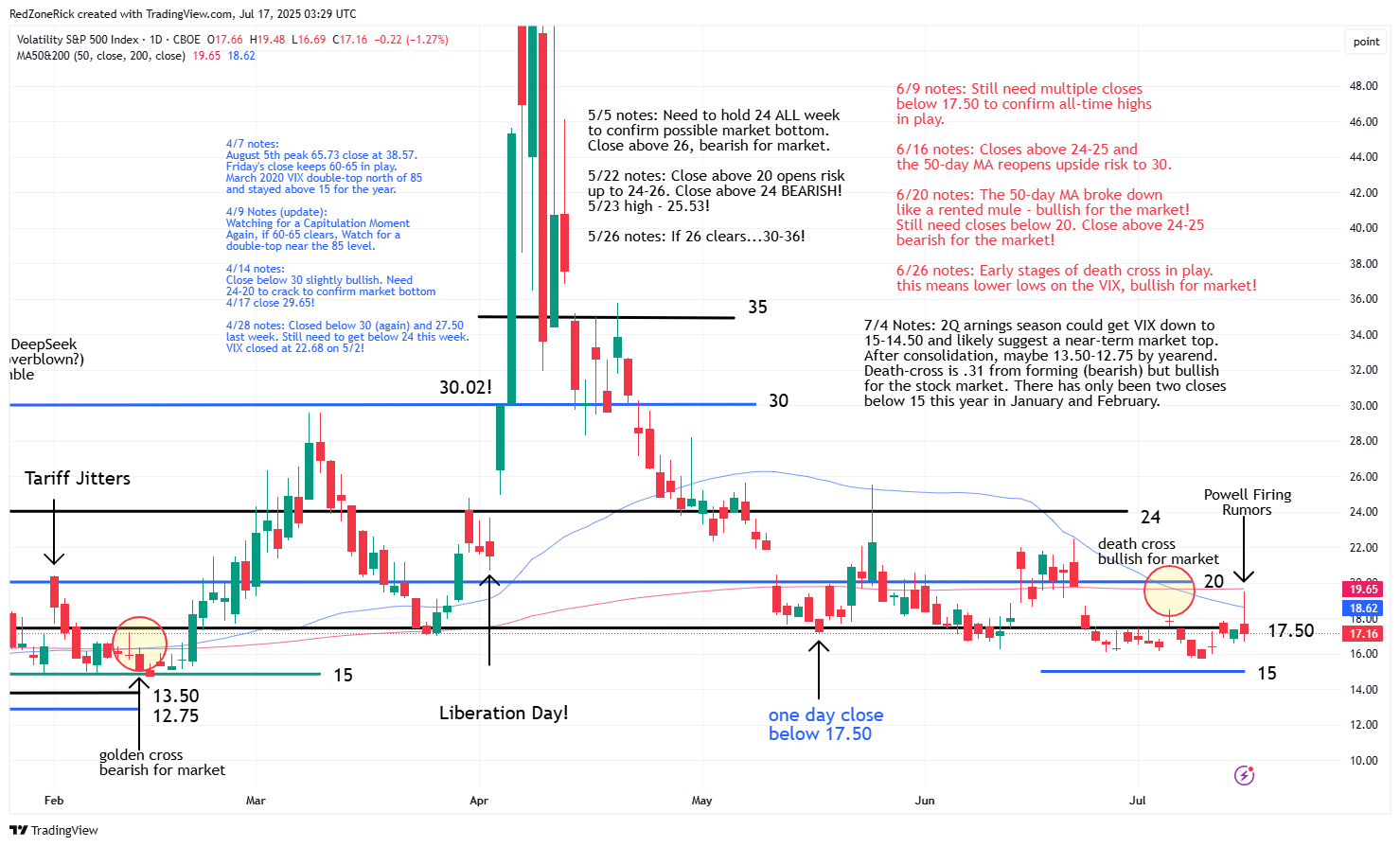

Wall Street was skittish on Wednesday following renewed rumors of President Trump’s threats to fire Fed Chair Powell. The midday volatility eased after the President stated he was not planning to do so and the major indexes rebounding off the lows.

The Nasdaq tagged a high of 20,751 while settling at 20,730 (+0.3%). Fresh resistance at 20,750 held. Support is at 20,500.

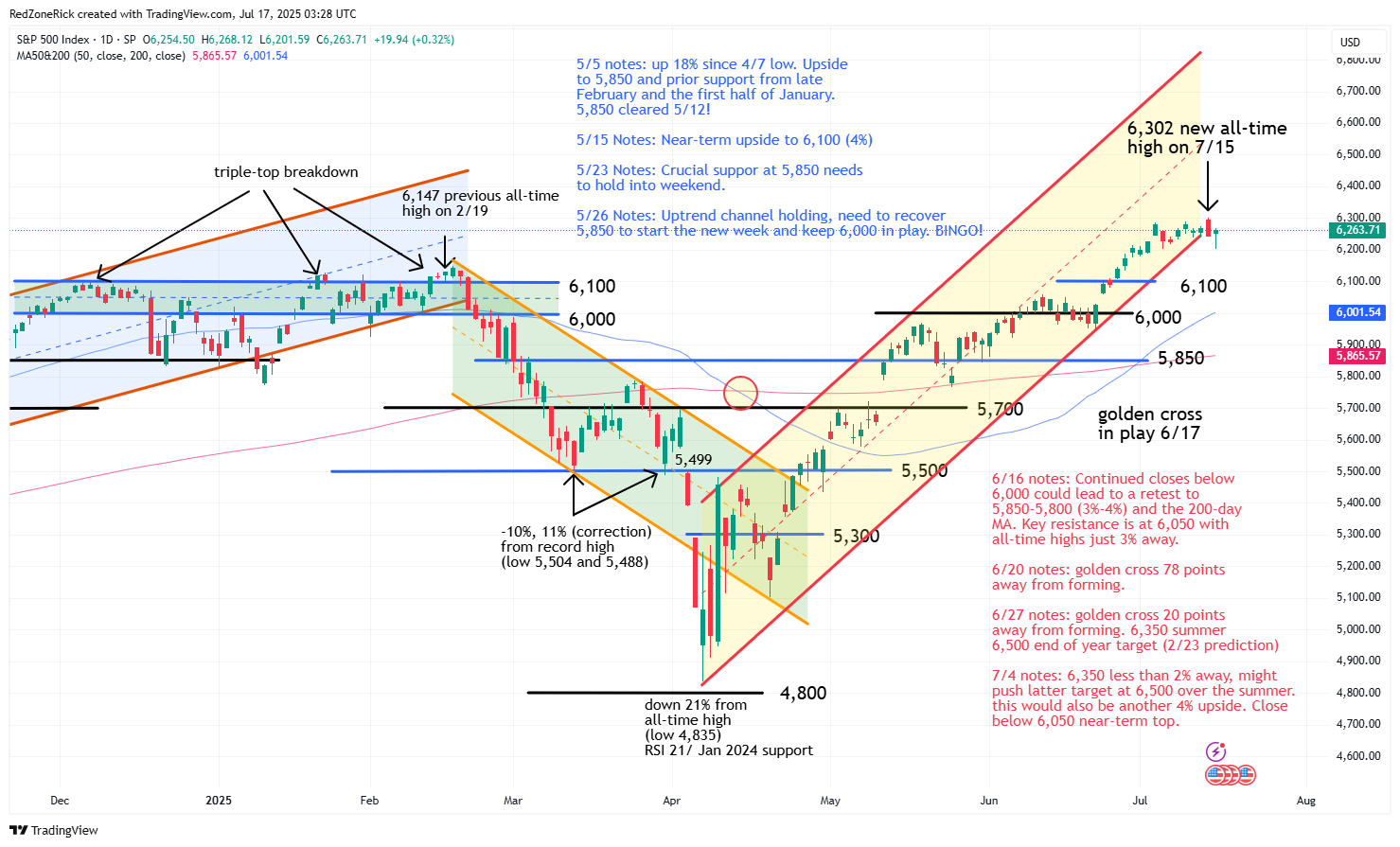

The S&P 500 closed at 6,263 (+0.3%) with the peak at 6,268. Resistance at 6,300 held. Support is at 6,200.

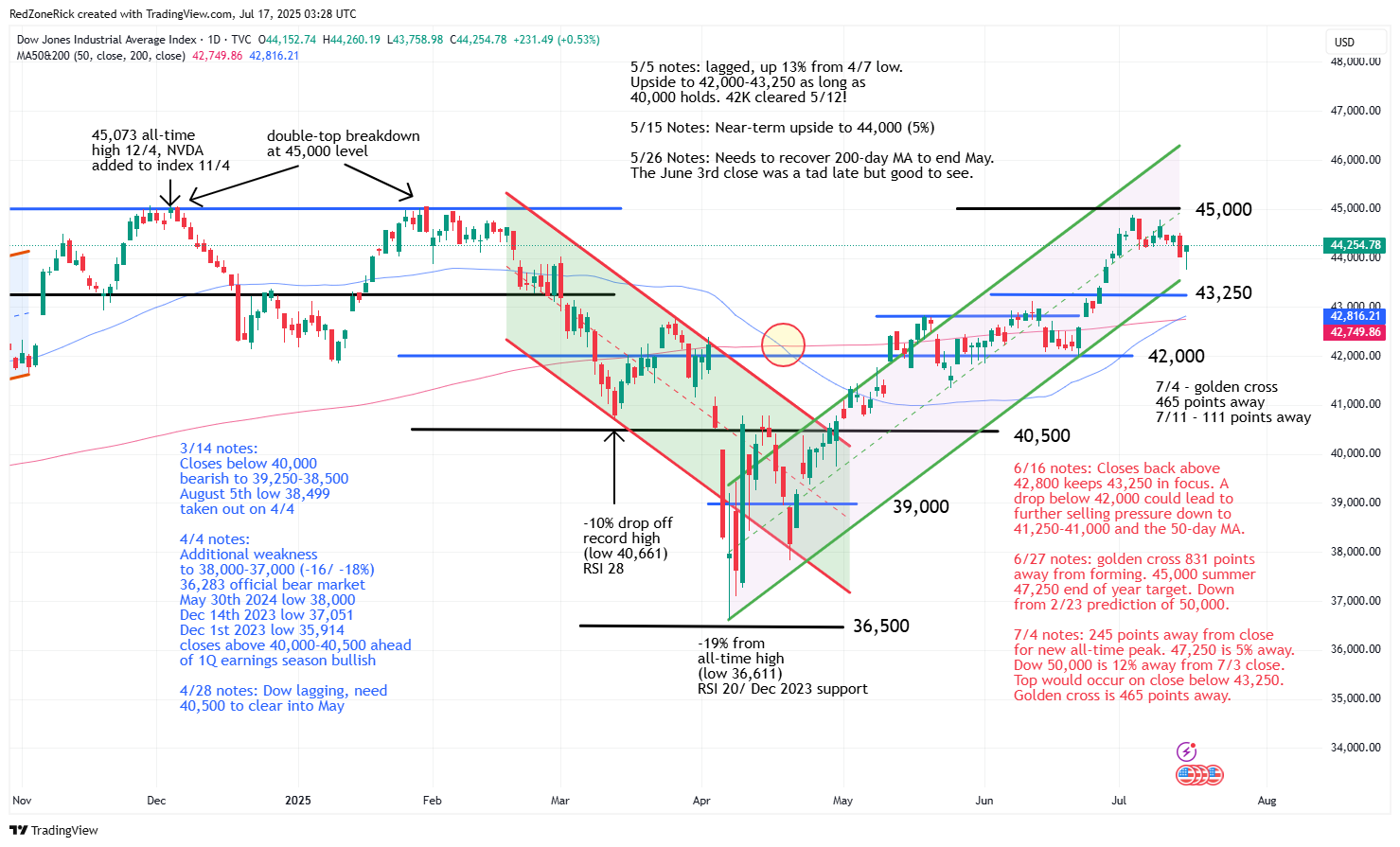

The Dow traded to an afternoon high of 44,260 before ending at 44,254 (+0.5%). Resistance at 44,250 was recovered. Support is at 43,750.

Earnings and Economic News

Before the open: Abbott (ABT), Cintas (CTAS), PepsiCo (PEP), Taiwan Semiconductor (TSM)

After the close: Interactive Brokers (IBKR), Netflix (NFLX)

Technical Outlook and Market Thoughts

The Nasdaq and S&P traded to fresh all-time highs on Tuesday but remain in tight two-week ranges. The action has pushed the two indexes slightly out of their current uptrend channels but key support levels held on Wednesday’s lows.

The Dow and the Russell have struggled with near-term resistance but are holding their uptrend channels and key support levels, as well. We mentioned coming into the month there was a chance a consolidation phase could come ahead of the start of the second-quarter earnings season as the market was becoming overbought.

The Nasdaq has been holding support at 20,500 with Monday’s low at 20,492. Backup help is at 20,100-20,000. Fresh resistance remains at 20,750-21,000. Our near-term target is at 21,500.

The S&P 500 has basically been holding 6,200 since late May with the July 1st intraday low at 6,177. If the latter is breached, expect a quick back test to 6,100. Our Price Targets for the index from February 23rd are at 6,350-6,500 with the former coming within 48 points.

The Russell 2000 bottomed at 2,189 while holding its uptrend channel and key support at 2,175. The next wave of support is at 2,135. Our near-term target Price Target for the index is at 2,375 on continued closes above 2,275.

The Dow held key support at 43,500 and a level that has been holding since the June 27th breakout. A close below 43,250 and out of the uptrend channel would be slightly bearish. Our near-term Price Target for the index is at 47,250 on a breakout above 45,000. A golden cross has officially formed.

The Volatility Index (VIX) zoomed up to 19.48 intraday with key resistance at 20 holding. A close above this level would imply a near-term market top. The close below 17.50 remains bullish for the market and keeps 15-14.50 in play.

The recent action and Wednesday’s volatility took some of the fluff out of the major indexes and the market outlook remains slightly bullish. However, if key support levels start to crack, a deepening pullback could be in the works.