Currency Crisis in Turkey and Slumping Tech Sector Ignite Selloff

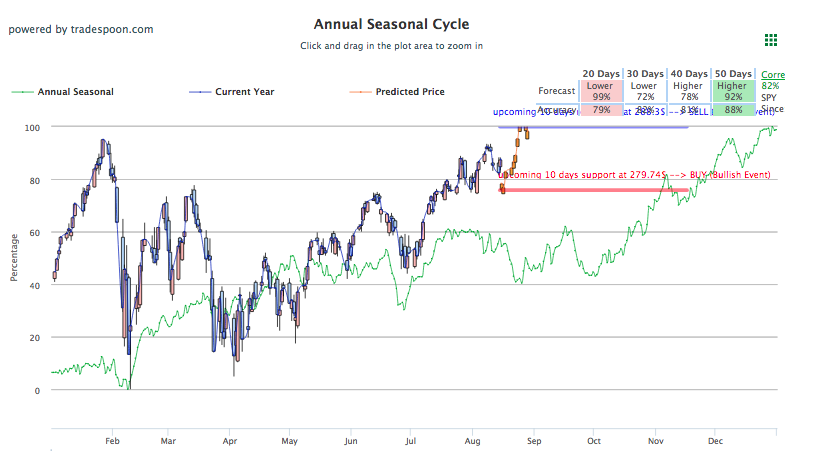

The second largest single-day selloff this summer has the Dow down 300 points, with both the Nasdaq and S&P also significantly down. Key support level for traders sits at 280, major indices closed higher yesterday signaling continued volatility from Turkey’s currency crisis. Also hurting major U.S. indices today is the usually market-supporting tech sector, with both Facebook and Microsoft down and pressuring the Nasdaq to trade lower. Support levels should be monitored in seasonality charts for good indication of current market trends and where to best enter and exit positions.

Turkey recently raised tariffs on American goods in response to Trump’s raising duties on Turkish steel and aluminum. The lira slightly rebounded today, up 5.4% against the dollar, after a rough 20% drop against the dollar that occurred to end last week. With escalating tariff tension in Turkey, along with other global tariff standoffs the U.S. is currently in, it is promising to see stocks have mostly faired well and only faced two major selloffs this summer, the other taking place in mid-June. This is both proof that positive earnings can support most market conditions and that the fundamentals of the U.S economy seem to stand strong against geopolitical tension and tariff escalation.

Earlier in the week, all three economic reports that were set to release hit their marks, providing some residual support against a sliding market. For the month of July, retail sales rose by 0.5%, while second-quarter numbers on productivity and output were also up. Tesla is currently down and now officially involved in an SEC investigation following Elon Musk’s now infamous “taking tesla private at 420” tweet. Other big movers for the day include Macy’s, with second-quarter numbers beating expectations but significantly lower from last year bringing the stock down 14%, and Canopy Growth Corp, which jumped almost 30% after the liquor giant Constellation Brands Inc committed to investing $4 billion into the cannabis company.

Using the ^GSPC symbol to analyze the S&P 500, our 10-day prediction window shows mixed signals. Today’s vector figure of +0.21% moves to -0.12% in five trading sessions. The predicted close for tomorrow is 2,842.89. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Highlight of a Recent Winning Trade

On August 14th, our ActiveTrader service produced a bullish recommendation for Dollar General Corp (DC). ActiveTrader is included in all paid Tradespoon membership plans and is designed for intraday trading.

Trade Breakdown

DC opened within Entry 1 price range of $102.47 (± 0.27) and moved through its Target price of $103.49, in the first hour of trading, reaching a high of $105.24. The Stop Loss was set at $101.45.

ALL-NEW

Breakthrough, mind-boggling, high-tech Artificial Intelligence platform available to Tradespoon’s individual investors:

Click Here – To See Where AI Places My Money

Thursday Morning Featured Stock

Our featured stock for Thursday is Verizon Communications Inc (VZ). VZ is showing a confident vector trend in our Stock Forecast Toolbox’s 10-day forecast. This stock is assigned a Model Grade of (A) indicating it ranks in the top 10th percentile for accuracy for predicted support and resistance, relative to our entire data universe.

*Please note: Our featured stock is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader or ActiveInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

The stock is trading at $53.22 at the time of publication, up 0.66% from the open with a +0.14% vector figure.

Thursday’s prediction shows an open price of $52.39, a low of $52.35 and a high of $52.95.

Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Note: The Vector column calculates the change of the Forecasted Average Price for next trading session relative to the average of actual prices for last trading session. The column shows expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

Oil

West Texas Intermediate for September delivery (CLU8) is priced at $64.74 per barrel, down 3.43% from the open, at the time of publication. Once more, U.S. crude inventories were up for the week as reported by the EIA. Other factors that could be suppressing the commodity are the strong dollar and the ongoing Turkey situation which could affect global demand.

Looking at USO, a crude oil tracker, our 10-day prediction model mostly all negative signals. The fund is trading at $13.6 at the time of publication, down 2.75% from the open. Vector figures show -0.24% today, which turns -1.80% in three trading sessions. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Gold

With the dollar continuing to surge, gold slid to an 18-month low today. The lira issue in Turkey does not seem to currently affect interest in the dollar and with a trifecta of positive economic reports released this week it seems there is little demand for the safe-haven commodity. The price for December gold (GCZ8) is down 1.44% at $1,182.70 at the time of publication.

Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows all negative signals. The gold proxy is trading at $111.55, down 1.324% at the time of publication. Vector signals show -0.24% for today. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Treasuries

The tension in Turkey and global reactions continue pressuring yields, causing long-dated yields to lower today. As treasury note yields lower, note prices increases. The yield on the 10-year Treasury note is down 1.72% at 2.85% at the time of publication. The yield on the 30-year Treasury note is down 1.19% at 3.03% at the time of publication.

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see positive signals in our 10-day prediction window. Today’s vector of 0.25% moves to +1.46% in three sessions. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Volatility

The CBOE Volatility Index (^VIX) is up 18.41% at $15.76 at the time of publication, and our 10-day prediction window shows mostly all negative signals. The predicted close for tomorrow is $14.49 with a vector of -9.42%. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.