A Bullish Alibaba Play

Alibaba (BABA) is known as the Chinese Amazon, and it’s set to report earnings prior to the open tomorrow. This is a great – and time-sensitive – options trading opportunity.

The great thing about earnings reports is you can get quick swift move and when coupled with options can deliver large, sometimes in excess of 100% gains in a single day.

I have such a play in Alibaba; here are the basic stats of the set up:

Current Price: 176.40

Reports: 8/23 Before Open

Implied Volatility: 81%

Expected Move: 6.2% or $10.70

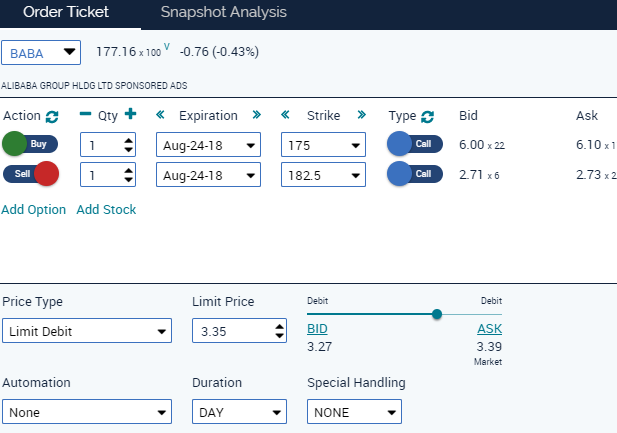

Strategy: Bullish Vertical Call Spread

Entry Net Debit $3.35 (Do not pay more than $3.50)

Exit Target: Credit $6.85 with maximum of $7.50

Basically, if the shares move above $182.50, or just a 3.3% or $6, can realize a 115% return.

Alibaba shares have recently com under pressure, along with many Chinese stocks, for two main reasons. Tencent (TCEHY), it’s main rival, reported disappointing earnings last week casting a pall over the group. But much of TCHY’s problems were isolated to the company’s video game sector which saw the government ban/censor some of the most popular games.

As a related side note, while the BABA and TCHEY are fierce rivals, BABA has a distinct competitive advantage that its founder and CEO, Jack Ma, is the governments favorite son and held forth as the ambassador for Chinese style capitalism. TCHEY CEO Tony Pa has a more antagonistic relationship with the powers that be. But that’s just background.

- There is general concern about the health of the Chinsese economy related debt, tariifs and the weakening yuan.

- For the above reasons estimates have been cut from $1.37 to $1.21 per share over the past 30 days making for low expectations.

- This would still be a 10% YoY growth.

- Revenue is expected to grow over 60% YOY.

- I think the company delivers and investors are reminded there are very few companies of this size and market dominance –and great margins—able to grow at such a rate at a reasonable p/e of 22 forward earnings.

- And institutions will pile back into the shares.

Lastly, the $175 level is key support on the chart.

I suspect that if I’m wrong, it’s going to be very wrong, so I don’t need to have too much intrinsic value.

Let’s use a vertical spread that tries to capture a decent move, and has the potential for over 100% gain.

ACTION:

-Buy to open 1 contract August (8/24) 175 Call

-Sell to open 1 contract August (8/24) 182.5 Call

For a Net Debit $3.35 (+/-$0.10)

Related: Learn How You Can Net Huge Profits in the Weed Market!

Related: Learn How You Can Net Huge Profits in the Weed Market!

The post Options Trading: A Bullish Alibaba Play appeared first on Option Sensei.