Nasdaq Hits All-Time High, Good U.S. Economic Reports Continue

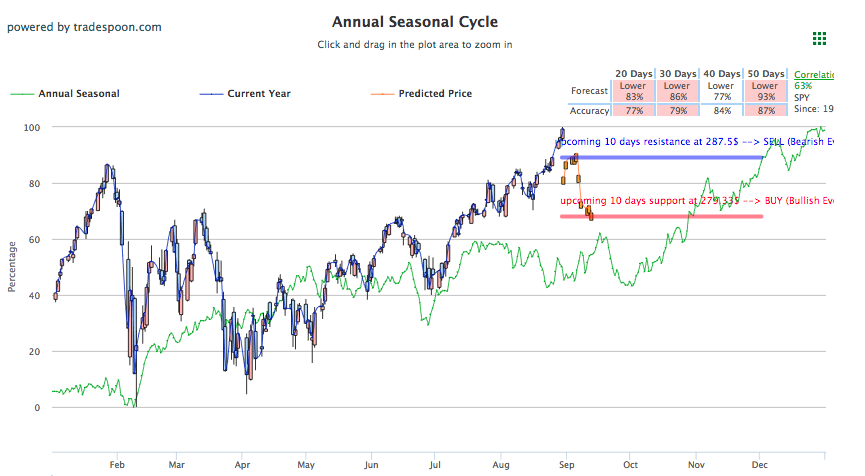

U.S. assets slowed their growth today after a strong week powered by the optimism behind U.S. trade negotiations with Canada and Mexico. Wise-investors will continue monitoring the $2900 psychological level that the SPY has been floating around. Below, my SPY seasonal chart is forecasting support and resistance levels and probabilities for the next 20-50 days, crucial for investors looking for optimal entry and exit positions. September is usually a volatile month so it is strongly recommended investors consider hedging. Currently, the S&P and Dow Jones are down while Nasdaq continues climbing to record highs.

All three major U.S indices are significantly up for the month of August, which is usually a turn for more bearish conditions and volatile times, which certainly could still be ahead, but for the time being, optimism is high and assets continue notching record highs. As stated before, to prepare for the likely volatility of September investors should consider hedging. Tensions continue to ease between the U.S. and its former NAFTA partners which has helped support the previously shaky market conditions as analysts and strategist prepared and even sometimes declared a full-out trade war. Right now, talks with China are tabled but the progress with Canada and the bilateral agreement with Mexico is enough to push U.S. shares up. While tariff concerns and their effect on U.S. industries remain, the Trump administration has begun attending to and preventing any possible fallout. Recently Trump approved aluminum and steel quotas as a targeted relief.

In other news consumer spending has climbed 0.4% in July which coupled with the recent higher than expected growth of U.S. economy report presents a growing and spending economy that has strengthened over the summer, and largely throughout the year. Earnings season has almost completely wrapped up which leaves the upcoming FOMC meeting as the next major financial event to watch for. As mentioned before, more interest rate hikes are not only likely but, at this point, guaranteed in the continued effort to control inflation.

Using the ^GSPC symbol to analyze the S&P 500, our 10-day prediction window shows mixed signals. Today’s vector figure of +0.19% moves to -0.15% in three trading sessions. The predicted close for tomorrow is 2,900.50. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Highlight of a Recent Winning Trade

On August 28th, our ActiveTrader service produced a bullish recommendation for Alphabet Inc. (GOOGL). ActiveTrader is included in all paid Tradespoon membership plans and is designed for intraday trading.

Trade Breakdown

GOOGL entered the forecasted Entry 1 price range of $1240.35 (± 5.00) in its last hour of trading on Tuesday and opened above its Target price of $1252.75 today, reaching a high of $1261.11 in the first hour of trading. The Stop Loss was set at $1227.95.

We are offering LIFETIME ACCESS to our Stock Forecast Toolbox Membership for less than the cost of 6 months!

Click here to read more…

Friday Morning Featured Stock

Our featured stock for Friday is Microsoft (MSFT). MSFT is showing a confident vector trend in our Stock Forecast Toolbox’s 10-day forecast. This stock is assigned a Model Grade of (A) indicating it ranks in the top 10th percentile for accuracy for predicted support and resistance, relative to our entire data universe.

*Please note: Our featured stock is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader or ActiveInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

The stock is trading at $112.34 at the time of publication, up 0.28% from the open with a +0.19% vector figure.

Fridays prediction shows an open price of $110.40, a low of $109.23 and a high of $111.76.

Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Note: The Vector column calculates the change of the Forecasted Average Price for the next trading session relative to the average of actual prices for last trading session. The column shows expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

Oil

West Texas Intermediate for October delivery (CLV8) is priced at $69.76 per barrel, up 0.33% from the open, at the time of publication. Oil prices continued to climb to new heights for the month August behind two consecutive drops in U.S. crude supplies. U.S. sanction on Iran could be some cause for concern as commodity investors look ahead.

Looking at USO, a crude oil tracker, our 10-day prediction model mostly all negative signals. The fund is trading at $14.68 at the time of publication, up 0.14% from the open. Vector figures show +0.28% today, which turns -0.86% in two trading sessions. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Gold

The price for December gold (GCZ8) is down 0.60% at $1,205.30 at the time of publication. With the dollar putting together a nice rally behind all-time highs in Nasdaq and a generally strong week for stocks, gold is on track for its thirds straight day of losses. The safe-haven continues to depreciate as U.S. economic growth continues to topple expectations.

Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows positive signals. The gold proxy is trading at $113.44, down 0.66% at the time of publication. Vector signals show +0.36% for today. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Treasuries

The yield on the 10-year Treasury is down 0.79% movement at 2.86% at the time of publication. Notes were mostly unchanged ahead of Federal Reserve preferred inflation measure reading, which will likely guide the rates of next few interest rate hikes. Yesterday, two treasury auctions took place which powered yields higher.

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see mostly negative signals in our 10-day prediction window. Today’s vector of +0.07% moves to -0.73% in three sessions. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Volatility

The CBOE Volatility Index (^VIX) is up 4.82% at $12.84 at the time of publication, and our 10-day prediction window shows mostly all negative signals. The predicted close for tomorrow is $12.67 with a vector of -0.26%. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.