Markets Continue To Withstand Tariff Escalation

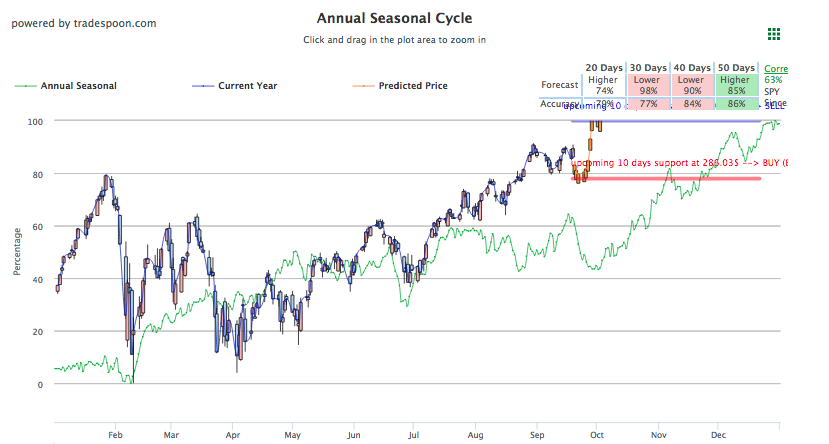

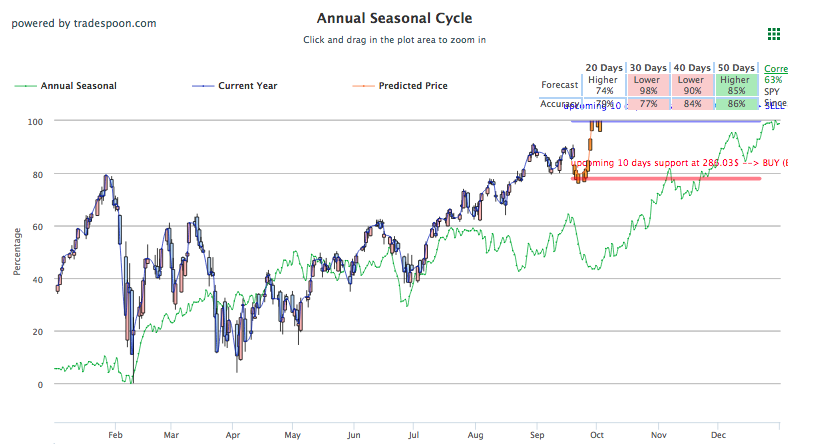

U.S stocks have been on the move up today, with the S&P on track for its seventh day of gains in the last eight sessions. September is usually a fairly quiet month for action with earnings in the rearview, volume seasonally low, and economic reports sparse. On investors’ mind is the continued back and forth between China and the U.S. as trade tensions escalate although the market has been little moved by these fears, requiring a watchful eye on the continuous tariffs and the aftermath both in the short and long term. Yesterday, after meeting with Polish President Duda, Trump announced the U.S. has “no choice” but to levy the additional $267 billion in tariffs on Chinese goods on top of the previous $200 billion. Trump indicated additional penalties could be added but worth noting is the decrease in duties as original tariffs levied were at 20% while these will remain at 10%. China responded with additional tariffs on $60 billion worth of U.S. products, going into effect next week. SPY Seasonal Chart forecast is shown below:

Although trade talk continues to dominate financial headlines it seems that actual market response is slight to none as indices continue on their march up this week. Most sectors are on the rise helping indices withstand any negative reaction from the tariff back and forth, with only the tech sector currently holding back the Nasdaq from reaching positive gains for the day. Still, China-U.S. trade relations should not be ignored. Continuous tariffs could build up to more sizeable reactions and these developments should inform investors and traders alike. Some analysts project a longstanding multi-year trade war while others point to more-optimistic resolutions in the near future.

Look for next week’s FOMC meeting for good indicators of market direction, condition, and other trends. A new interest rate hike is likely but not yet confirmed. Big market movers today include Tilray, rocketing 45% today and over 900% since July, and Tesla, which dropped significantly behind the news of an ongoing Department of Justice investigation yesterday only to bounce back today and recoup those losses. In the tech sector, Microsoft dropped almost 2% as the company announced just yesterday it will raise its quarterly dividend by nearly 10%.

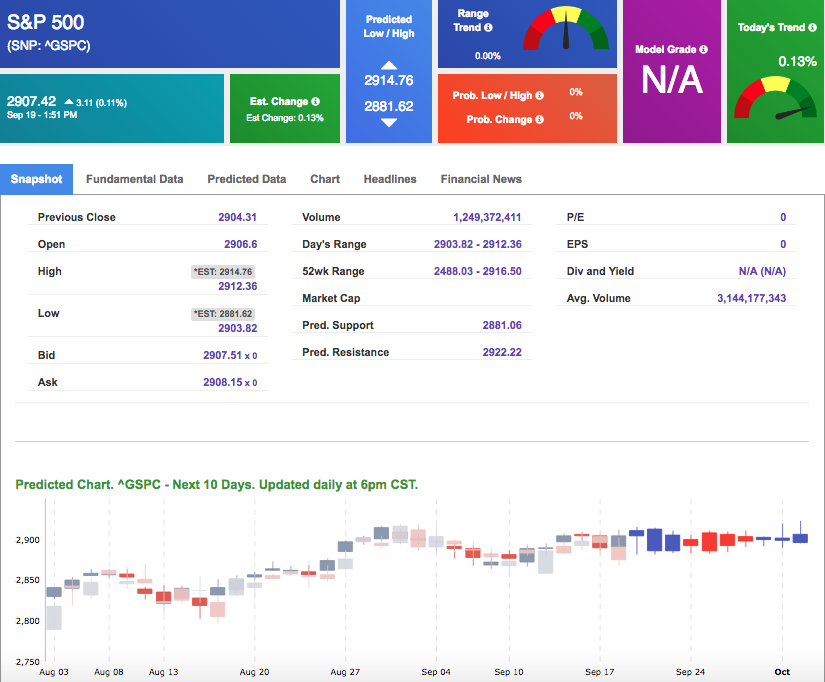

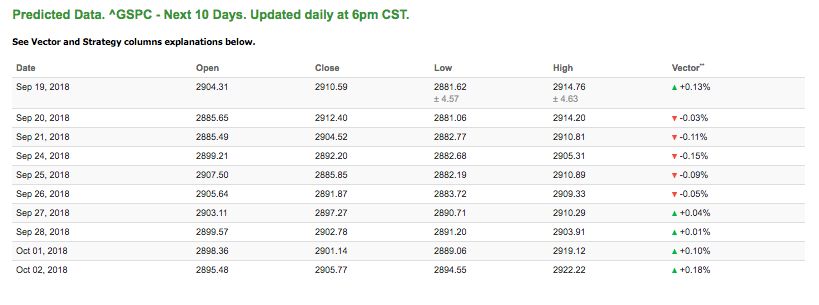

Using the ^GSPC symbol to analyze the S&P 500, our 10-day prediction window shows mixed signals. Today’s vector figure of +0.13% moves to -0.05% in five trading sessions. The predicted close for tomorrow is 2,912.40. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Highlight of a Recent Winning Trade

On September 14th, our ActiveTrader service produced a bullish recommendation for Colgate Palmolive Co (CL). ActiveTrader included in all Tradespoon membership plans and is designed for intraday trading.

Trade Breakdown

CL entered the forecasted Entry 1 price range of $67.59 (± 0.21) in its first hour of trading and moved through its Target price of $68.27 the following trading session in its first hour of trading. The Stop Loss was set at $66.91.

You Don’t Want to Miss This!

Today only, we are going to do something we RARELY do!

We are offering LIFETIME ACCESS to our Tools Membership!

This means that you will get Lifetime Access to our entire suite of trading tools, and after your initial payment, you will never be billed again for as long as you remain a member!

Click Here To Sign Up…

Live Trading Room Update

See how we traded in volatile conditions and what you might expect in our next Live Trading Room. During recent volatility, we held Live Trading Room Session, on September 18th, where we had some great trades below!

| Symbol | Net Gain% |

| PFE(OPTION) | 31.71% |

| D | -22.83% |

| D | 39.22% |

| BAC(OPTION) | 28.57% |

| CVS | 57.53% |

| CSV(OPTION) | 45.45% |

| GD | 44.04% |

Our Live Trading Room is open every trading day from 9:15 am Eastern Time for the first hour of trading, but these Live Trading Sessions are only available for Premium Members.

We wanted to share the recording with you so you can see the profits you might be missing- even during volatile markets.

Click Here to Watch the Recording

Thursday Morning Featured Stock

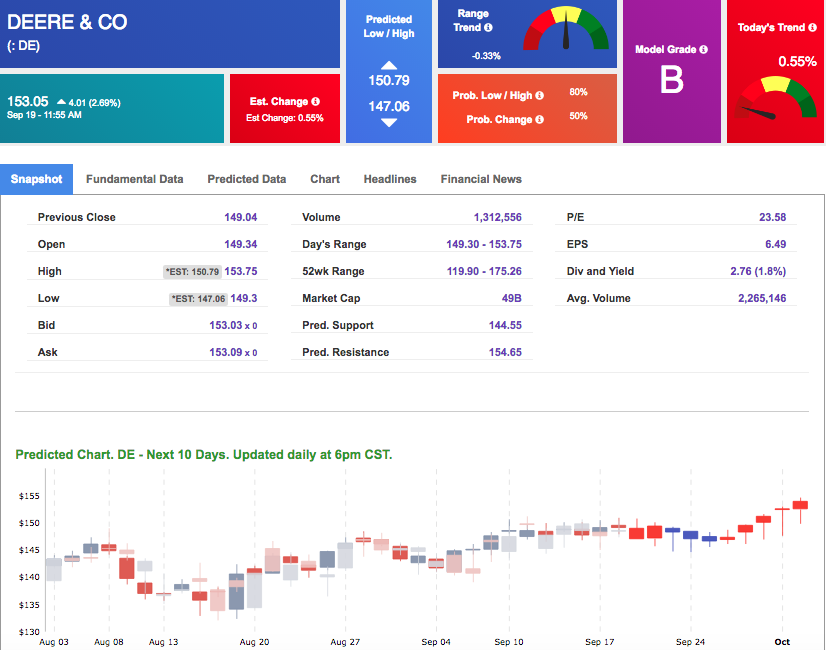

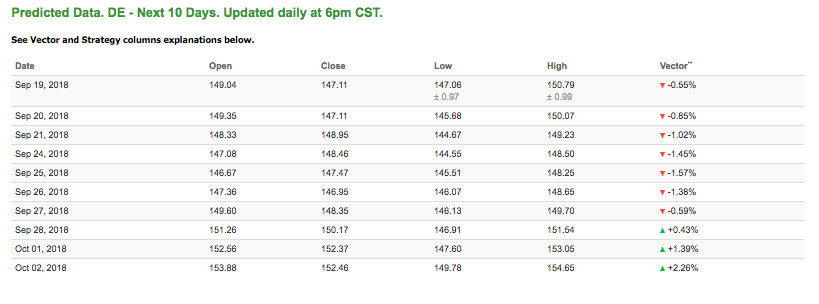

Our featured stock for Thursday is Deere & Co (DE). DE is showing a confident vector trend in our Stock Forecast Toolbox’s 10-day forecast. This stock is assigned a Model Grade of (B) indicating it ranks in the top 25th percentile for accuracy for predicted support and resistance, relative to our entire data universe.

*Please note: Our featured stock is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader or ActiveInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

The stock is trading at $153.05 at the time of publication, up 2.69% from the open with a -0.55% vector figure.

Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Note: The Vector column calculates the change of the Forecasted Average Price for the next trading session relative to the average of actual prices for last trading session. The column shows expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

Oil

West Texas Intermediate for October delivery (CLV8) is priced at $71.05 per barrel, up 1.70% from the open, at the time of publication. With the recent EIA report indicating U.S. crude stockpiles are significantly down, oil futures were able to record some nice gains today.

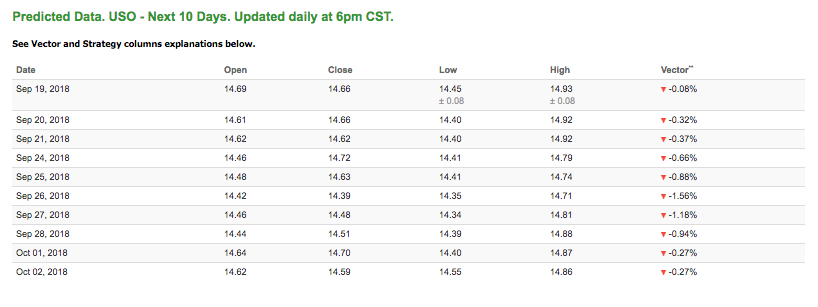

Looking at USO, a crude oil tracker, our 10-day prediction model mostly all negative signals. The fund is trading at $14.94 at the time of publication, up 1.70% from the open. Vector figures show -0.08% today, which turns -0.37% in two trading sessions. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Gold

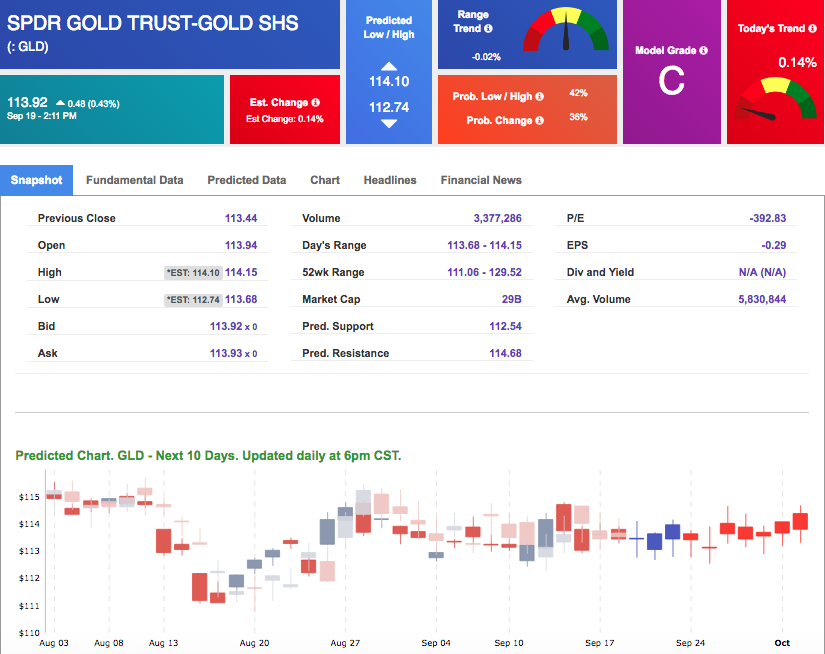

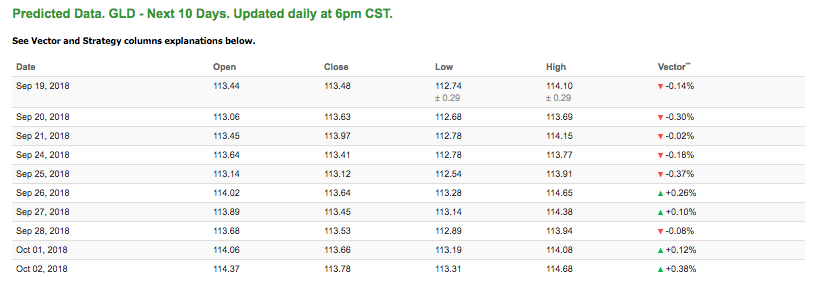

The price for December gold (GCZ8) is up 0.43% at $1,208.20 at the time of publication. With a mostly unmoved dollar, gold was able to remain above the $1,200 threshold for its seventh straight day. Next week’s FOMC and likely interest rate hike will certainly have an effect on both the safe-haven commodity and the dollar.

Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows mostly negative signals. The gold proxy is trading at $113.92, up 0.43% at the time of publication. Vector signals show -0.14% for today. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

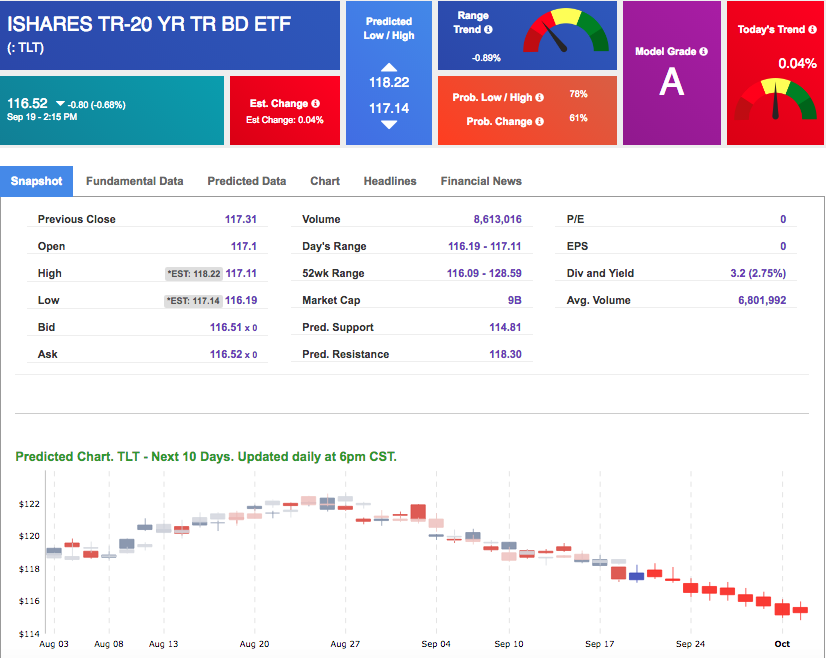

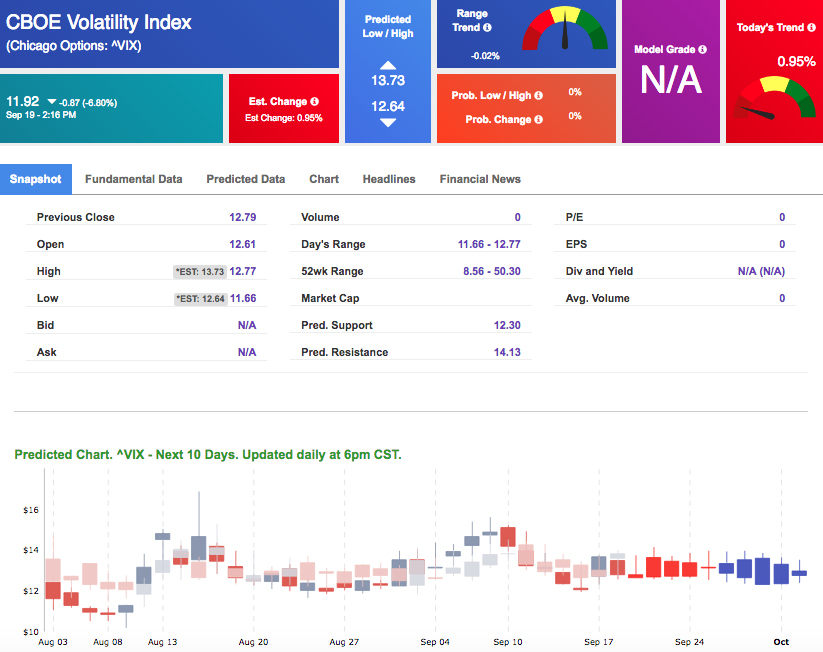

Treasuries

The yield on the 10-year Treasury note is up 0.79% at 3.08% at the time of publication. The yield on the 30-year Treasury note is up 1.00% at 3.24% at the time of publication. Longer-dated contracts are up today while shorter ones are down likely to the pressure of recent trade-tension and tariff escalation.

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see negative signals in our 10-day prediction window. Today’s vector of -0.04% moves to -0.71% in three sessions. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

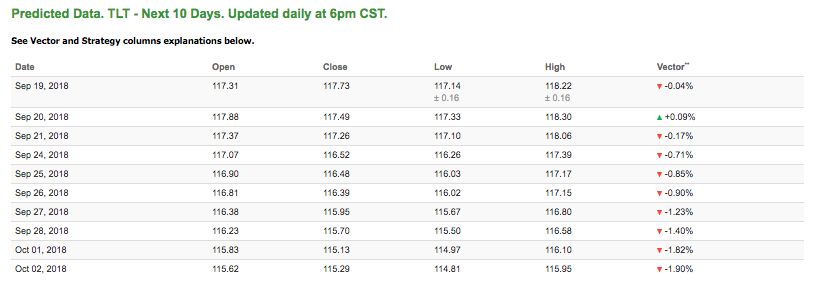

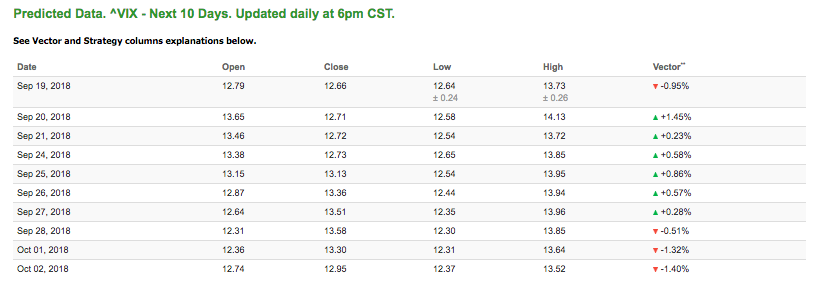

Volatility

The CBOE Volatility Index (^VIX) is down 6.80% at $11.92 at the time of publication, and our 10-day prediction window shows mostly positive signals. The predicted close for tomorrow is $12.71 with a vector of +1.45%. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

You Don’t Want to Miss This!

Today only, we are going to do something we RARELY do!

We are offering LIFETIME ACCESS to our Tools Membership!

This means that you will get Lifetime Access to our entire suite of trading tools, and after your initial payment, you will never be billed again for as long as you remain a member!