Day After FOMC, U.S. Tickers Rebound

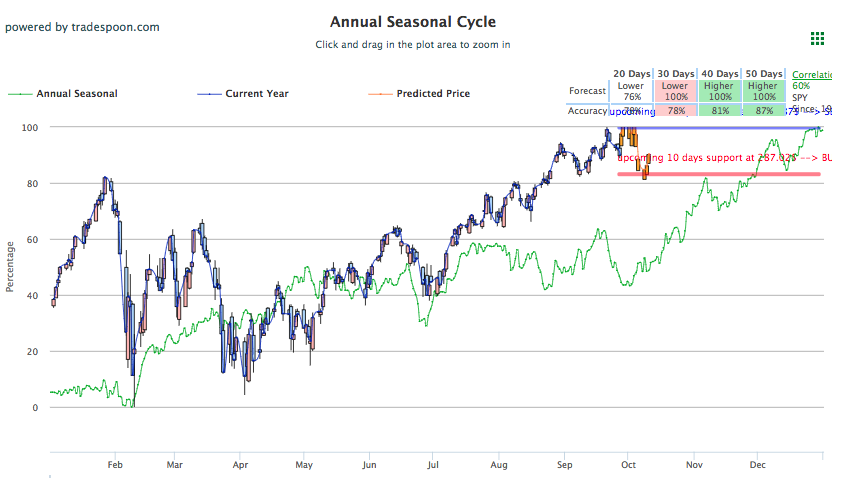

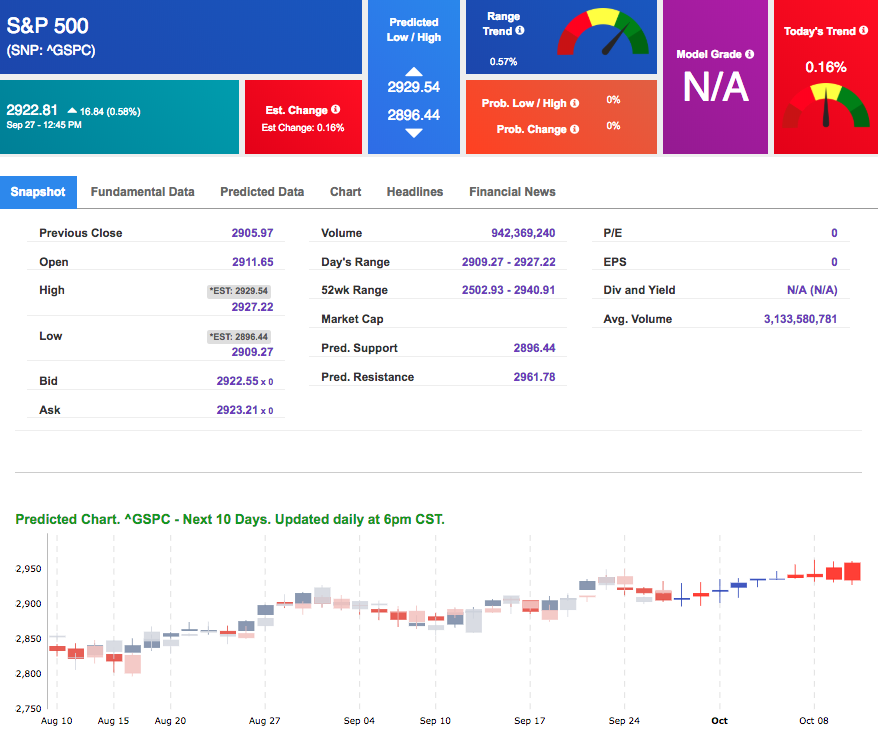

Major indexes are trending higher today after a volatile Wednesday that saw indexes open higher, continue to trend higher through the FOMC meeting, and then sharply drop as Fed Chairman Jerome Powell met with the press and details of the new policy were dissected. Yesterday’s volatility was somewhat of a surprise as September has been generally low on volume while the S&P, in particular, has not closed with 1% move in either direction for over 50 days, a historically long run. The sharp decline to close most U.S. tickers lower yesterday looks to have come from the indication of the next Fed interest rate hike to come in December and then at least three more in 2019. The next scheduled FOMC meeting will take place in November. SPY Annual Seasonal Chart forecast is shown below:

Gross domestic product growth forecasts for 2018 and 2019 were also raised by the Fed. Other notable changes in the Fed policy include the removal of the phrase “accommodative” which instigated some on-set worry that Powell addressed in his comments to the press after the meeting. With tickers up today, it looks as though the market continues to solely react to economic data and ignore the clutter of trade-worry or financial clickbait. The headline-worthy news that is finance-adjacent has yet to stick or influence market movement strongly, which comes as a surprise as September, a low volume month, is very susceptible to volatility.

China-U.S. tariff escalation, the Kavanaugh hearing, and the upcoming midterm elections seem like events that would regularly move the market but have yet to show signs of significant impact. Still, these should remain on investors’ mind as any of the three can bloom into larger issues that could certainly have a bigger impact on markets. Kavanaugh’s hearing can lead the day in headline news and in turn cause low volume as investors turn their attention to the deposition on Capitol Hill. While yesterday, Trump accused Beijing of attempting to meddle in the upcoming midterm elections which added more tension in the already growing rift between U.S and China relations.

In economic data news, U.S. pending home sales had an unexpected drop in August as seen in the August housing report published today. U.S. real gross domestic product rose in the second quarter at a 4.2% annualized rate while orders for durable goods rose 4.5%, both much faster than expected. Finally, jobless claims continue to fall, however at a slightly lower rate than expected.

Big market-movers today include Bed Bath & Beyond which fell over 20% after earnings and revenue missed expectations by a wide margin. On the other end, Salesforce.com Inc. made nice gains today after a late Wednesday report that upheld previous expectations and forecasts. Globally, Asian stocks have lowered today while European stocks grew modestly. Tomorrow, we’ll see August reports on personal income, consumer consumption, and core inflation, while a Consumer Sentiment report for September will also be released.

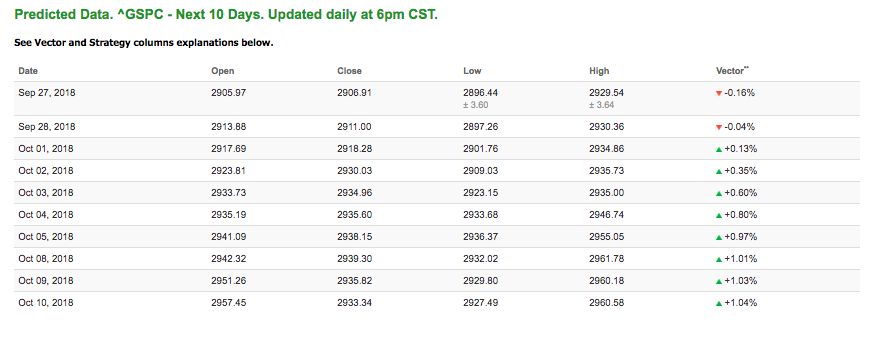

Using the “^GSPC” symbol to analyze the S&P 500, our 10-day prediction window shows mixed signals. Today’s vector figure of -0.16% moves to +0.80% in five trading sessions. The predicted close for tomorrow is 2,911.00. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Highlight of a Recent Winning Trade

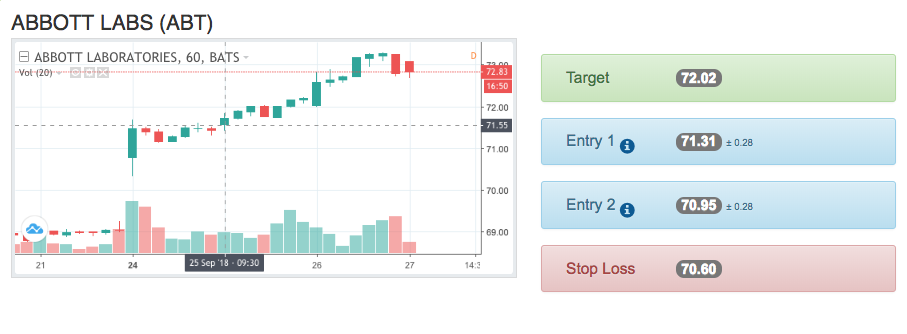

On September 25th, our ActiveTrader service produced a bullish recommendation for Abbott Labs (ABT). ActiveTrader included in all Tradespoon membership plans and is designed for intraday trading.

Trade Breakdown

ABT entered the forecasted Entry 1 price range of $71.31 (± 0.28) in its first hour of trading and moved through its Target price of $72.02 in its second to last hour of trading that day. The Stop Loss was set at $70.60.

Special Lifetime Offer – Watch where I trade my personal money, propose specific stop losses, time the market, show how I trade step-by-step, consider underlying volatility, and sell for big profits!

Click here for my Special Lifetime Offer!

Friday Morning Featured Stock

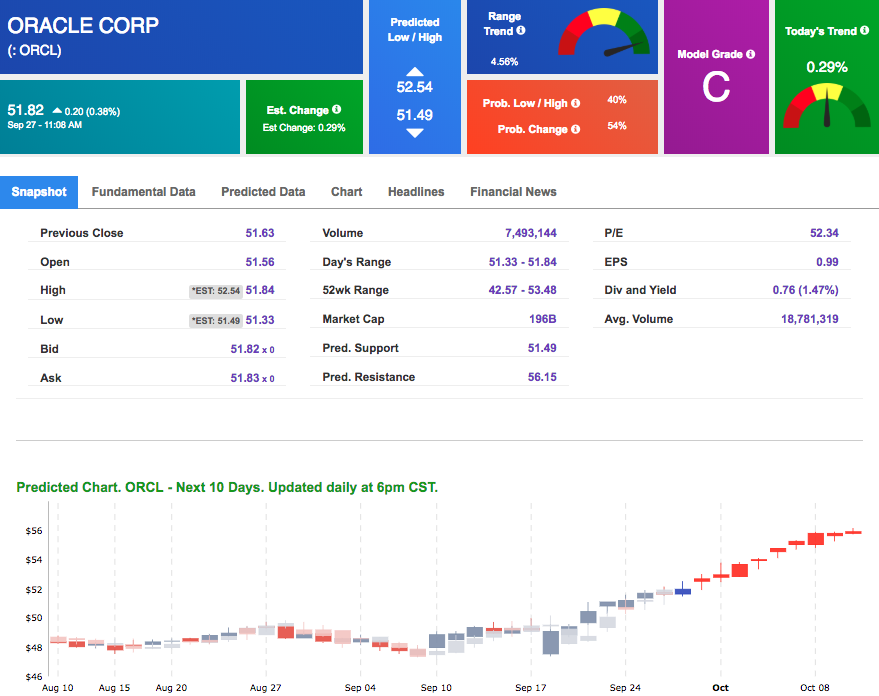

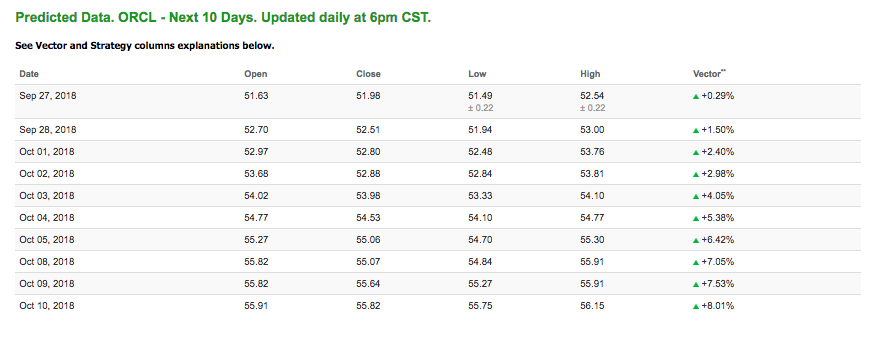

Our featured stock for Friday is Oracle Corp (ORCL). ORCL is showing a confident vector trend in our Stock Forecast Toolbox’s 10-day forecast. This stock is assigned a Model Grade of (C) indicating it ranks in the top 50th percentile for accuracy for predicted support and resistance, relative to our entire data universe.

*Please note: Our featured stock is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader or ActiveInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

The stock is trading at $51.82 at the time of publication, up 0.38% from the open with a +0.29% vector figure.

Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Note: The Vector column calculates the change of the Forecasted Average Price for next trading session relative to the average of actual prices for the last trading session. The column shows expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

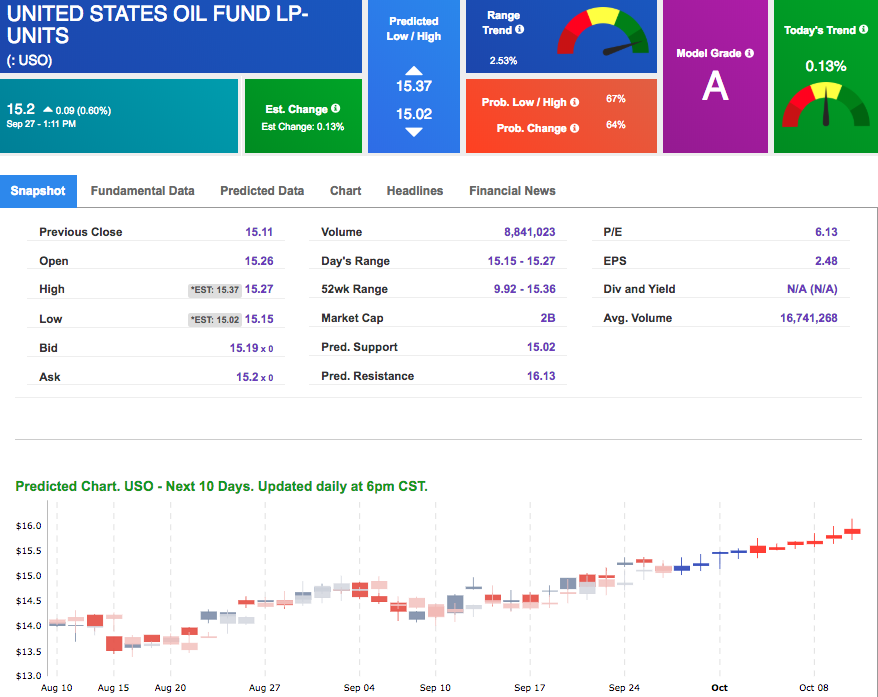

Oil

West Texas Intermediate for October delivery (CLX8) is priced at $72.06 per barrel, up 0.70% from the open, at the time of publication. Looking at USO, a crude oil tracker, our 10-day prediction model positive signals. The fund is trading at $15.2 at the time of publication, up 0.60% from the open. Vector figures show +0.13% today, which turns +2.66% in five trading sessions. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

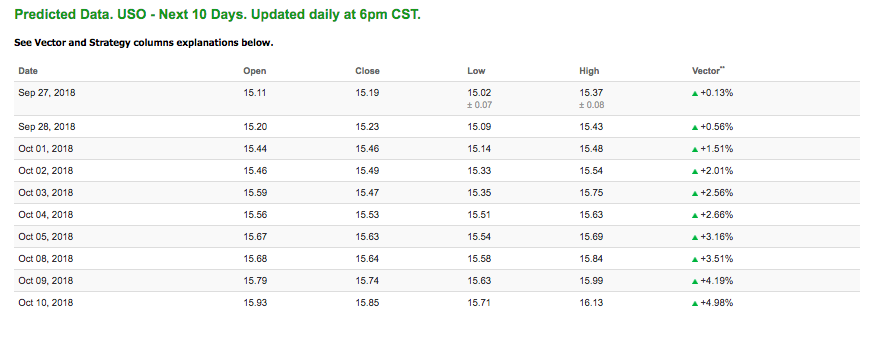

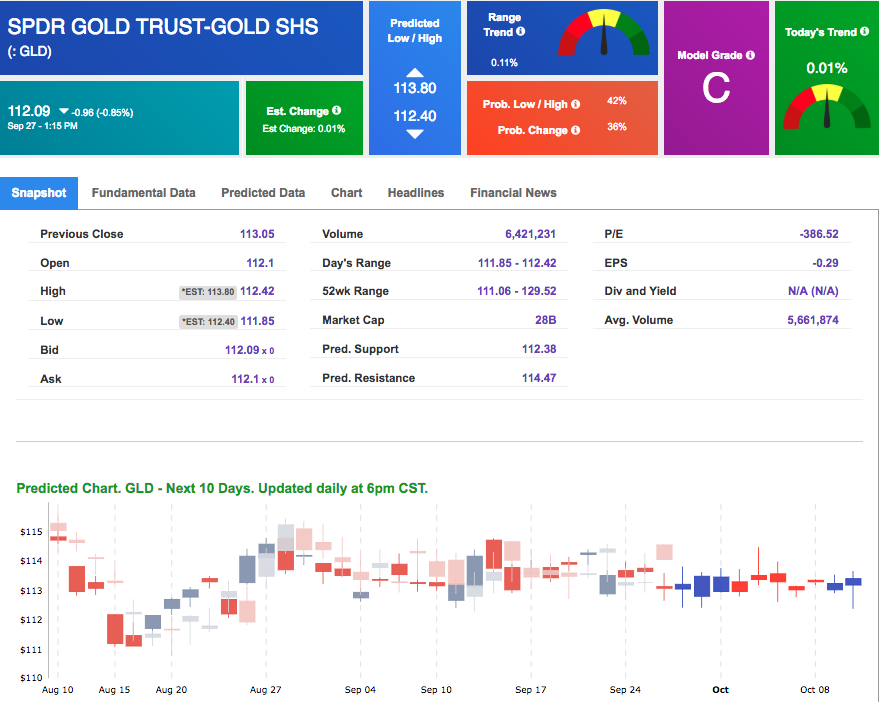

Gold

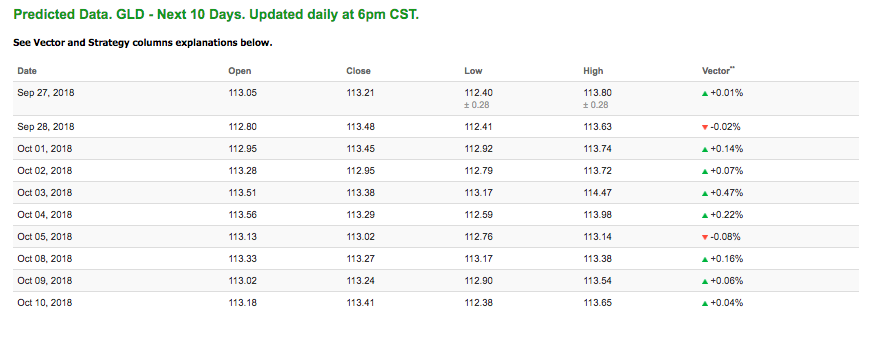

The price for December gold (GCZ8) is down 0.87% at $1,188.80 at the time of publication. Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows mostly positive signals. The gold proxy is trading at $112.09, down 0.85% at the time of publication. Vector signals show +0.01% for today. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

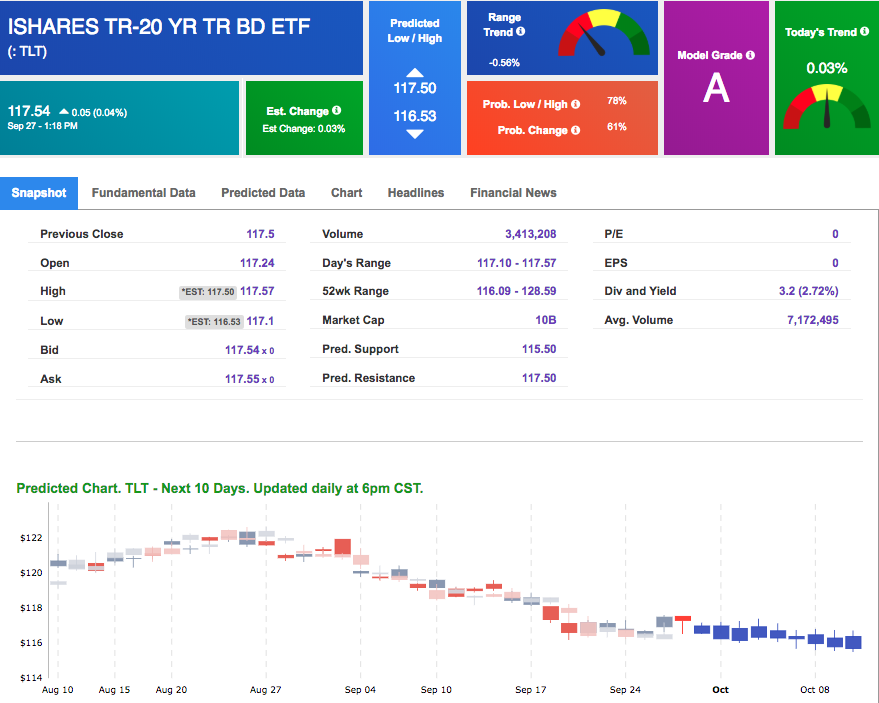

Treasuries

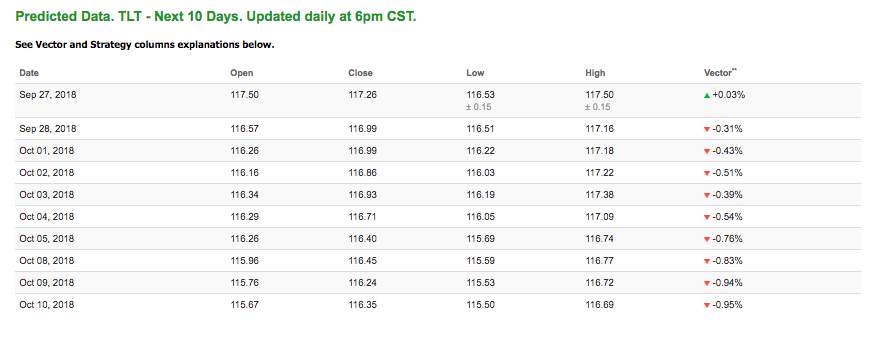

The yield on the 10-year Treasury note is up 0.31% at 3.06% at the time of publication. The yield on the 30-year Treasury note is up 0.04% at 3.18 % at the time of publication. Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see negative signals in our 10-day prediction window. Today’s vector of +0.03% moves to -0.51% in three sessions. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Volatility

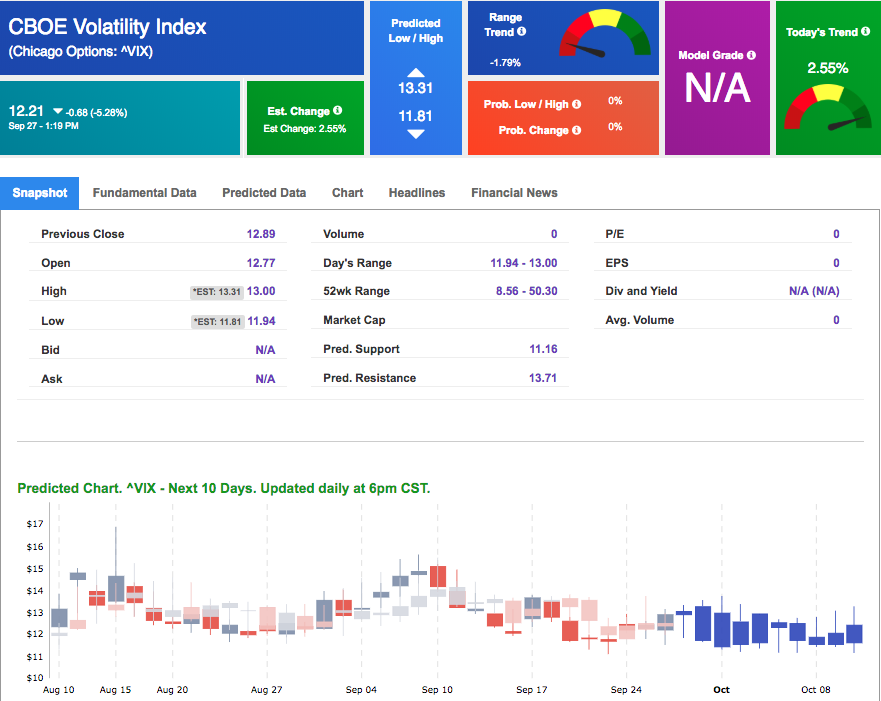

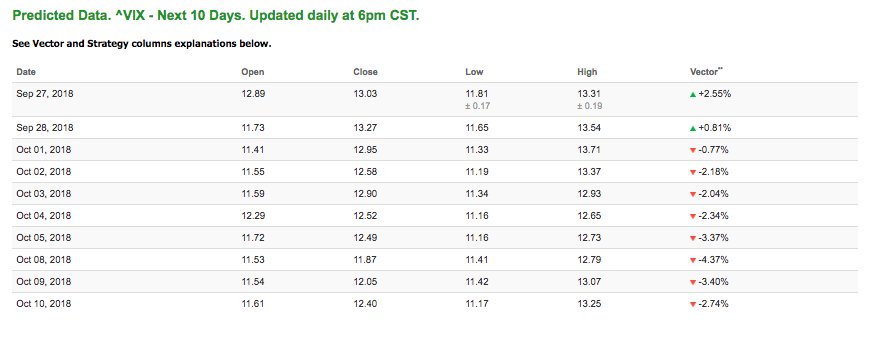

The CBOE Volatility Index (^VIX) is down 5.28% at $12.21 at the time of publication, and our 10-day prediction window shows mixed signals. The predicted close for tomorrow is $13.27 with a vector of +0.81%. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.