Third Quarter Earnings Ahead, Volatility Remains

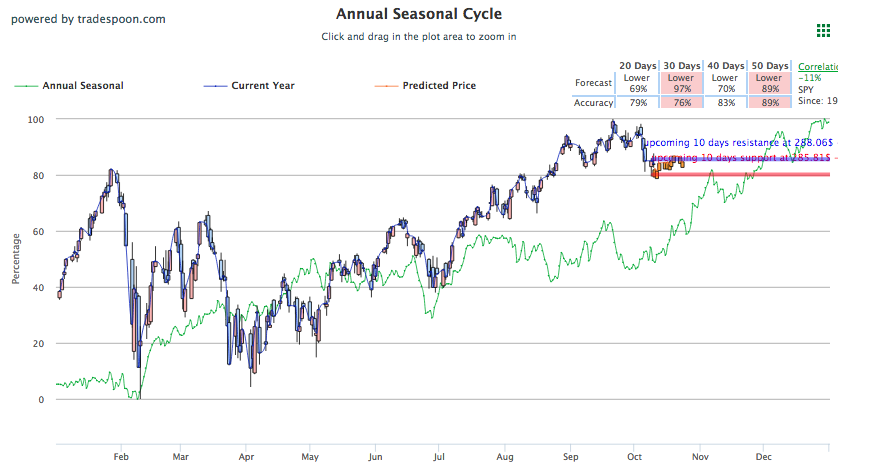

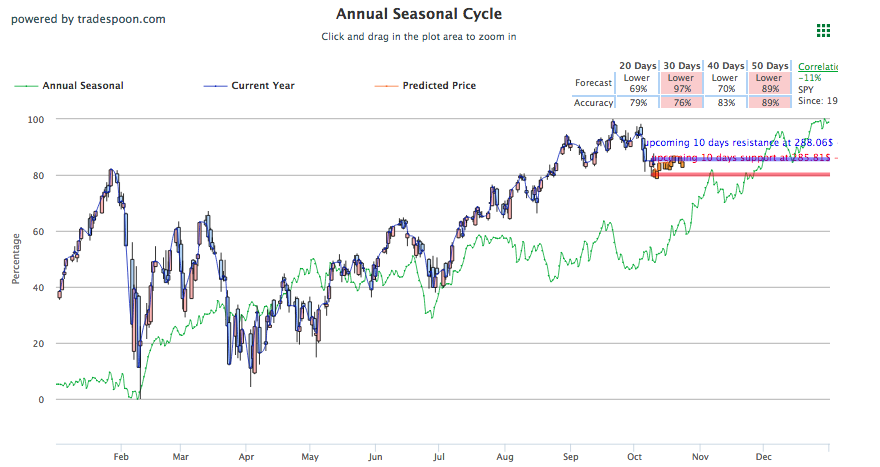

Major U.S. indexes are down today continuing a bad streak that followed last week’s interest rate hike. The S&P is on track to finish below its 50-day moving average for the fourth straight session while both Nasdaq and Dow are seeing triple digits losses. Volatility is up and $VIX is close to $20 while TLT has not sold off today. The market selloff is approaching an end and once volatility-spikes reach upper panic levels, around 20-25, selloff should start bottoming process. SPY is approaching $280 level, 100-days moving average and a strong support. SPY Seasonal Chart forecast is shown below:

The selloff’s timing seems to indicate the recent FOMC interest rate hike motivated the skid, which has pressured yields and stalled optimism from the continued flow of positive economic reports. The continued rising of the interest rates indicates a strong and growing economy which could also lend itself to the recent volatility we have seen. The start of third quarter seems to be likely remedy for the selloff as big banks are set to report Friday.

Citigroup, JPMorgan Chase, Wells Fargo, PNC, and First Republic Bank are all set to announce earnings officially kicking off third-quarter earnings season. Next week, over 100 earnings will be reported and plenty will be available to support rally or at the very least ease pressure if earnings return positively, as they have, for the good majority of companies, all year. Continued criticism of the FOMC interest rate hike from the Trump administration looks to be another point to monitor, whether it will influence the market or Reserve itself.

In large, analysts believe the market is being oversold and due for a rebound. European markets are slightly down today while Asian Markets, though down earlier this week, have edged higher. Besides Friday’s big bank reports, major reporting next week will include Netflix, Morgan Stanley, eBay, Bank of America, and more.

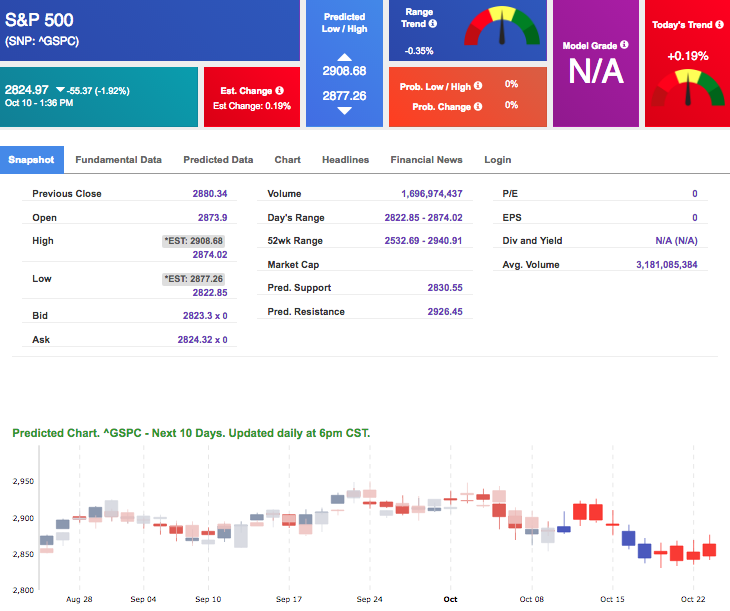

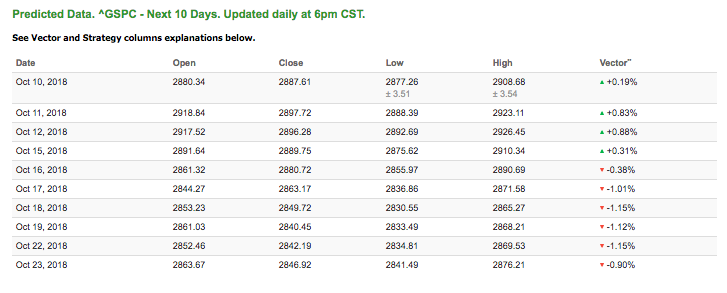

Using the “^GSPC” symbol to analyze the S&P 500, our 10-day prediction window shows mixed signals. Today’s vector figure of +0.19% moves to -1.01% in five trading sessions. The predicted close for tomorrow is 2,897.72. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Highlight of a Recent Winning Trade

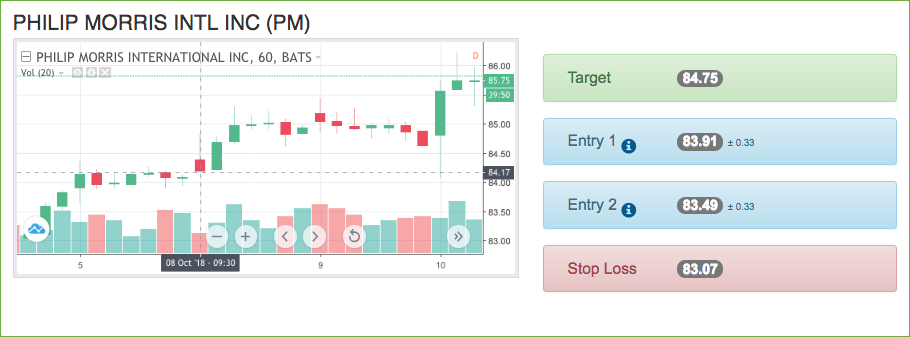

On October 8th, our ActiveTrader service produced a bearish recommendation for Philip Morris Intl Inc (PM). ActiveTrader included in all Tradespoon membership plans and is designed for intraday trading.

Trade Breakdown

PM entered the forecasted Entry 1 price range of $83.91 (± 0.33) in its first hour of trading and moved through its Target price of $84.75 in its third hour of trading. The Stop Loss was set at $83.07.

Columbus Day Sale!

With gains to date of 836%*, and an 80% win-rate, a lifetime Premium Membership could easily help you turn your $100,000 into $836,000 and if the next few years are as good as the last you can make. . . $1,600,000. . . $2,400,000 or more*. Limited time offer!

CLICK HERE NOW

Thursday Morning Featured Stock

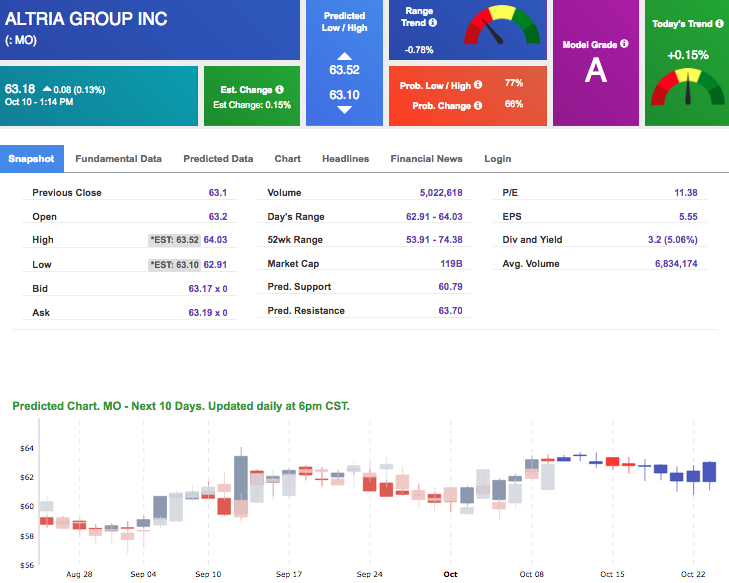

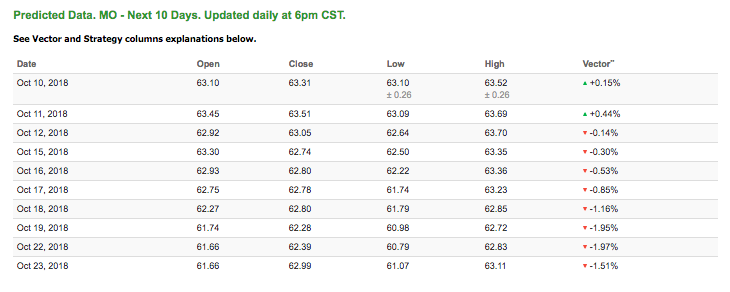

Our featured stock for Thursday is Altria Group Inc (MO). MO is showing a confident vector trend in our Stock Forecast Toolbox’s 10-day forecast. This stock is assigned a Model Grade of (A) indicating it ranks in the top 10th percentile for accuracy for predicted support and resistance, relative to our entire data universe.

*Please note: Our featured stock is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader or ActiveInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

The stock is trading at $63.18 at the time of publication, up 0.13% from the open with a +0.15% vector figure.

Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Note: The Vector column calculates the change of the Forecasted Average Price for next trading session relative to the average of actual prices for the last trading session. The column shows expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

Oil

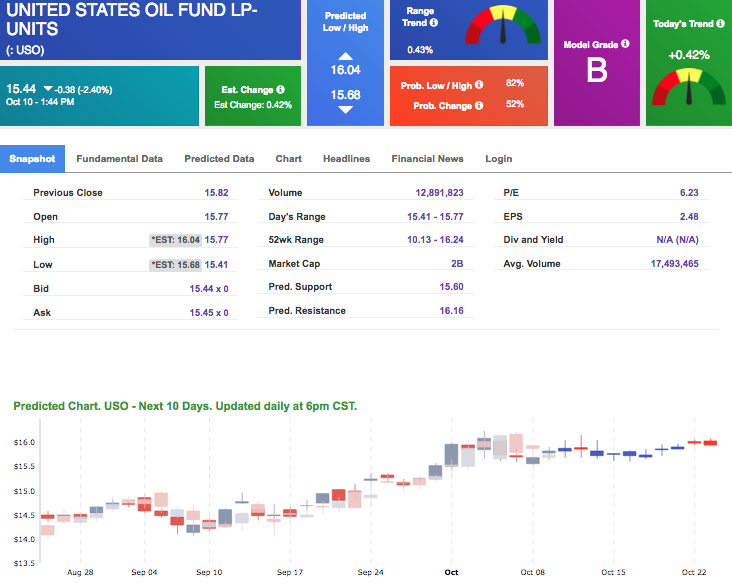

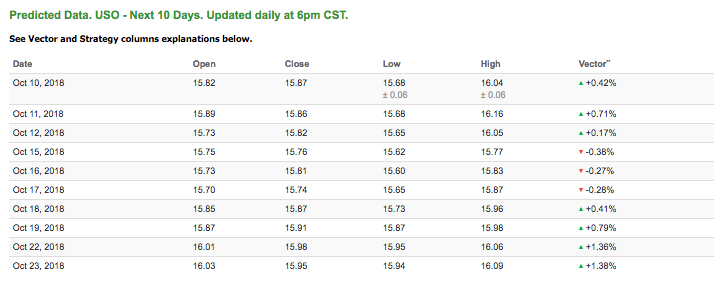

West Texas Intermediate for November delivery (CLX8) is priced at $73.14 per barrel, down 2.31% from the open, at the time of publication. Looking at USO, a crude oil tracker, our 10-day prediction model shows mixed signals. The fund is trading at $15.44 at the time of publication, down 2.40% from the open. Vector figures show 0.42% today, which turns -0.26% in five trading sessions. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

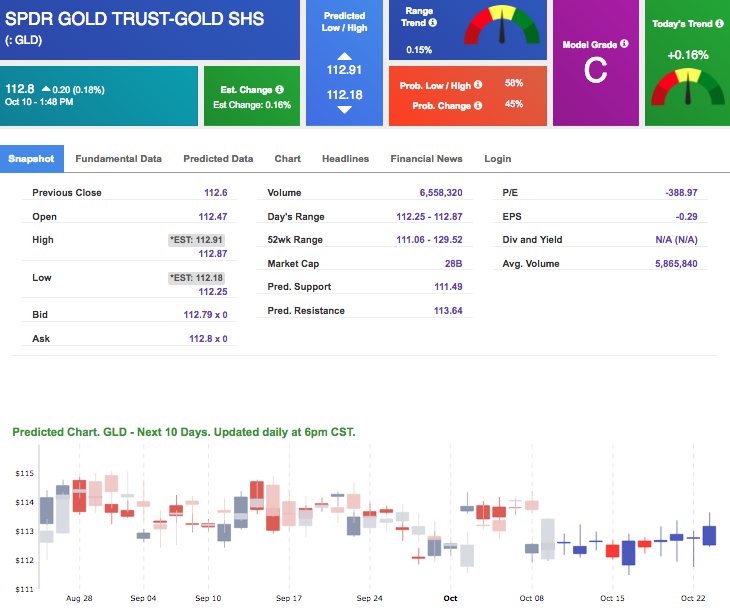

Gold

The price for December gold (GCZ8) is up 0.33% at $1,195.40 at the time of publication. Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows mixed signals. The gold proxy is trading at $112.80, up 0.18% at the time of publication. Vector signals show +0.16% for today. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Treasuries

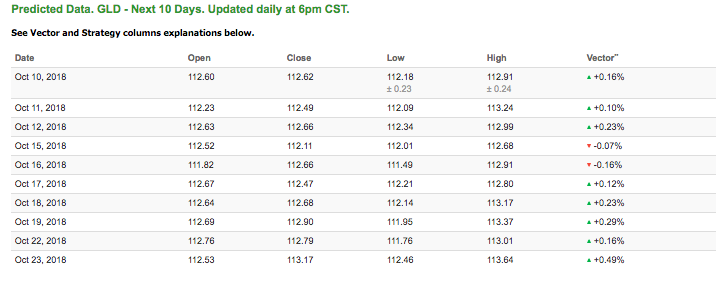

The yield on the 10-year Treasury note is up 0.68% at 3.23% at the time of publication. The yield on the 30-year Treasury note is up 0.81% at 3.40% at the time of publication.

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see mostly negative signals in our 10-day prediction window. Today’s vector of +0.01% moves to -0.74% in three sessions. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

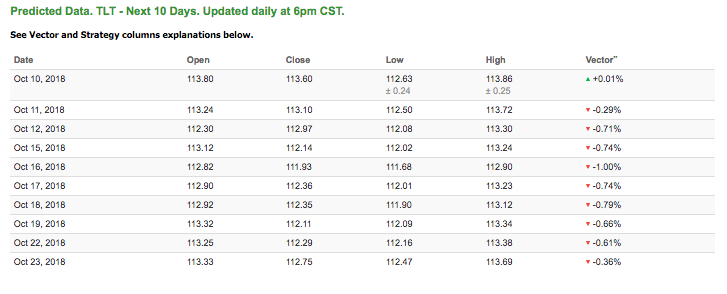

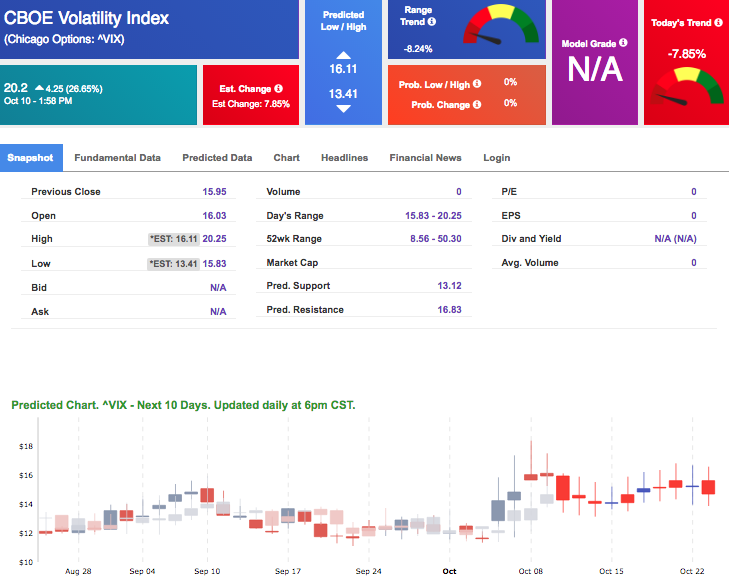

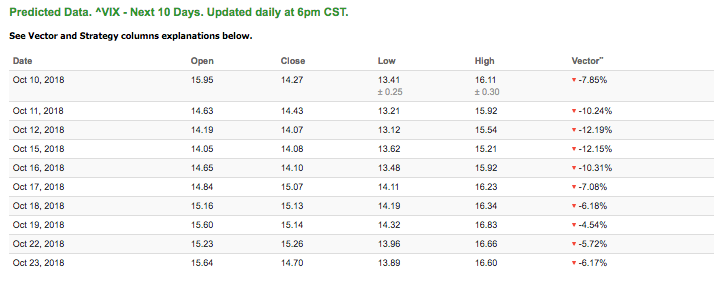

Volatility

The CBOE Volatility Index (^VIX) is up 26.65% at $20.2 at the time of publication, and our 10-day prediction window shows negative signals. The predicted close for tomorrow is $14.43 with a vector of -10.24%. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.