AI Predicts Market Rebound to Perfection

RoboStreet – October 11, 2018

Trap Door Sell Off Catches Wall Street by Total Surprise

The current selloff in the stock market is about to make it six straight sessions as of Thursday if bulls can’t gin up the buying power to turn the outgoing tide of risk-on capital. Leading the way lower are the most crowded of trades with Amazon.com, at the top of the list among big cap tech stocks followed closely by the bank sector, and the balance of the other nine sectors save for a few stalwart utility stocks.

Market volatility is way up for the first two weeks of October, initially taking the major averages to new all-time highs in the first couple of days only to run into a violent bout of sharp profit taking that erased most of the gains achieved for all of September. The shakeout is a result of a convergence of a few factors – a spike in the 10-yr Treasury yield, a deepening of the trade war with China, further deterioration in the distressed European bond sector, stubbornly high oil prices, and stronger-than-expected economic data that has investors conceding to another rate hike in December.

Federal Reserve Chair Jerome H. Powell said last Tuesday in a speech at the annual meeting of the National Association for Business Economics (NABE) in Boston that the U.S. economy appears to be in the midst of a “remarkably positive” period that is unprecedented in modern history. “This historically rare pairing of steady, low inflation and very low unemployment is a testament to the fact we remain in extraordinary times.”

“I’m investing my own money in each and every stock as my AI platform identifies.”

And remember we’re not talking about day-trading here. I’m looking for 50-100% gains inside of the next 3 months, so my weekly updates are timely enough for you to act.

Click Here – To See Where I Put My RoboInvestor Money

New data from the Fed is now predicting unemployment will remain below 4% through 2020 and inflation will stay low, averaging around 2% during that time. This has never happened in modern U.S. history. The last time unemployment was that low for several years was in the 1960s and it ultimately triggered high inflation, but Mr. Powell and the majority view of the central bank do not think that will occur this time.

There is a massive rotation out of the high-flying growth stocks and into high-quality value stocks that have more defensive business models. When the markets are in decline where selling pressure is exacerbated by computerized program trading, it can really rattle investornerves. Gradual gains realized all year long can and do evaporate in a matter of a few days. That’s the stock market.

Fear emotion outweighs that of greed by a factor of at least three-fold and maybe more. And while there are external concerns outside America’s borders that have potential to weigh on future growth, the $20 trillion U.S. economy that represents roughly a quarter of the entire global GDP is on track to post second half 2018 growth of better than 3.5%. This outstanding economic momentum that isn’t easily derailed by a trade war or some elements of emerging market debt falling into default.

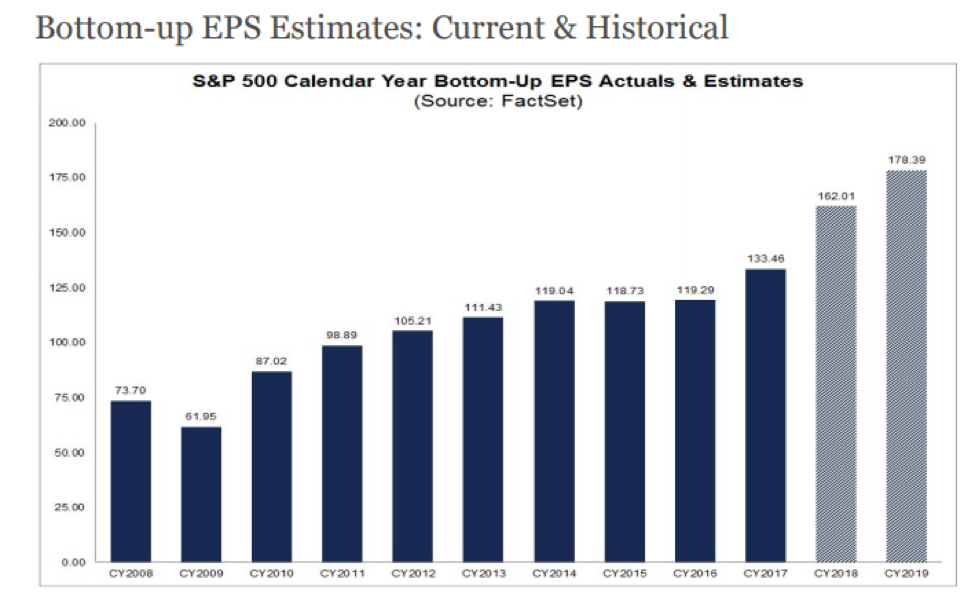

The latest forecast of S&P 500 earnings from FactSet has the S&P earning $162.01 which puts the market’s PE at 17x for this year while trading at 15.4x that of next year’s earnings forecast of $178.39 for the S&P. Historically, 17x is on the upper end of the range while 15.4x is an attractive level to own the market at. So, while October is delivering a rolling correction that should run its course over the next couple of days, it doesn’t mean more market-jarring headlines won’t cross the tape over the weekend.

When markets are in a protracted slide, smart investors start to seek out those stocks that seem to matter most to the integrity of the underlying bull trend that, in my view, is still intact. Now is when the wheat gets separated from the chaff, especially in the tech sector which accounts for the largest market weighting. I can tell you right now that professional money is squarely focused on the trading behavior of Apple, Adobe Systems, Cisco Systems, Microsoft, and Amazon.

What these five stocks have in common is that not only are they huge core holdings of the biggest ETFs traded, they are all trading above their respective 200-day moving averages whereas many other popular tech stocks have undergone severe technical damage, especially in the semiconductor space. It the kind of sell-off the cleans out all the margin accounts, short-term call option trades and feeds the algorithm trading programs downside momentum that dominates daily volume.

It’s exactly this kind of market that requires the science of artificial intelligence to guide investors where to look for stocks and ETFs that are fully discounted and make for timely purchases. AI can sift through thousands of stocks and find the best values that also have bullish fund flows and positive technical aspects. The flip side is that AI provides the timely information necessary to take profits on positions that are extended and deserve a rest.

Our RoboInvestor subscribers have booked no less than nine solid gains over the past two months in market leading stocks. And it’s not just enough to bank profits on the way up, but to also have money invested in stocks that don’t get crushed when the market corrects. Case in point, Wal-Mart. I recommended WMT to RoboInvestors on September 4that a price of $95.82. Today, after a 2,000 point sell off for the Dow of which Wal-Mart is a component., shares of WMT are trading at $95.

That is simply remarkable performance and there is more where that came from as my AI platform unveils one great stock pick after another in the best of breed names. My best recommendation of the week is for readers of this column to get involved with our RoboInvestor Portfolio that has produced a wave of winners throughout 2018 and put the power of AI to work right away while the market is giving us unique buying opportunity – and one that I don’t believe will last much longer.

“I’m investing my own money in each and every stock as my AI platform identifies.”

And remember we’re not talking about day-trading here. I’m looking for 50-100% gains inside of the next 3 months, so my weekly updates are timely enough for you to act.