Options Trading: Using a Butterfly for a Bounce

Stocks have been suffering the past few days, but it seems we might have reached a short term washout or capitulation point. So today, I’ll explain how to use options trading to take advantage of the current environment.

We’re already getting snap back rally this morning and while there might be some big intraday swings I think The S&P 500 Index moves back higher over the next week.

I’m using a low cost skip-strike butterfly spread to take advantage of a rebound in price and a decline in implied volatility.

Here are the pieces that are coming into play:

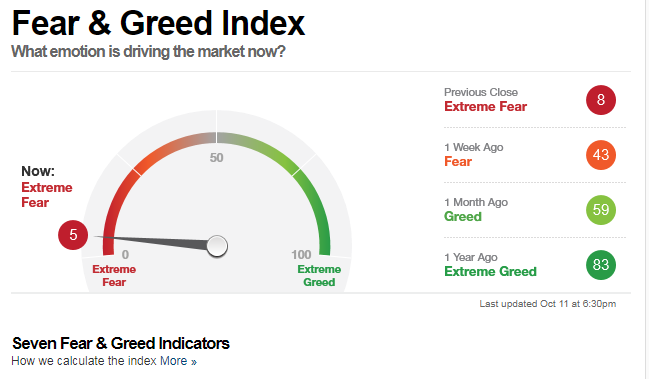

Sentiment reached decidedly fearful if not outright panic on Thursday with the lowest Fear & Greed reading since February.

Source: CNN Money.com

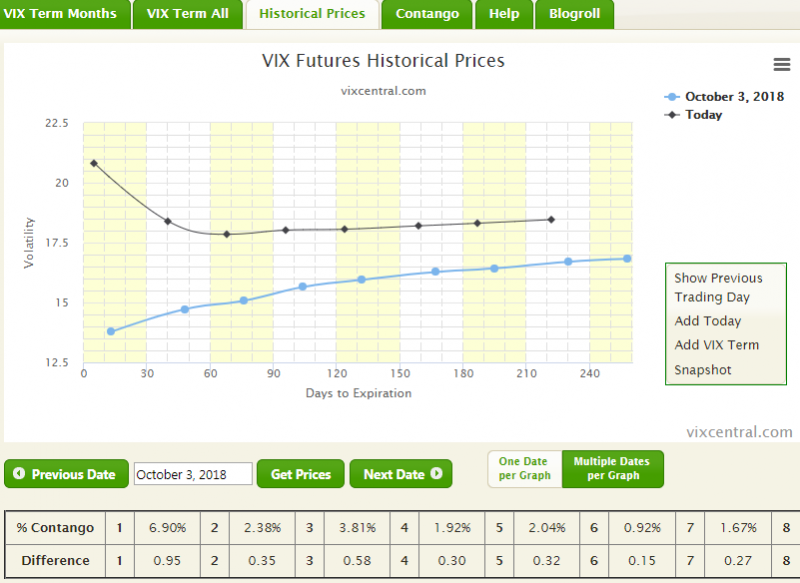

Implied Volatility on the S&P 500 jumped by over 50% in the past two days. The VIX hit a high of 28.50 on Thursday and settled at 25.

Not only is this an extreme move in percentage terms but is also sent the term structure into backwardation. That is front month futures trade at a premium to later dated months.

As the below image shows, compared to week earlier when term structure was in normal contango, there has been a big bend.

Source:VIXCentral.com

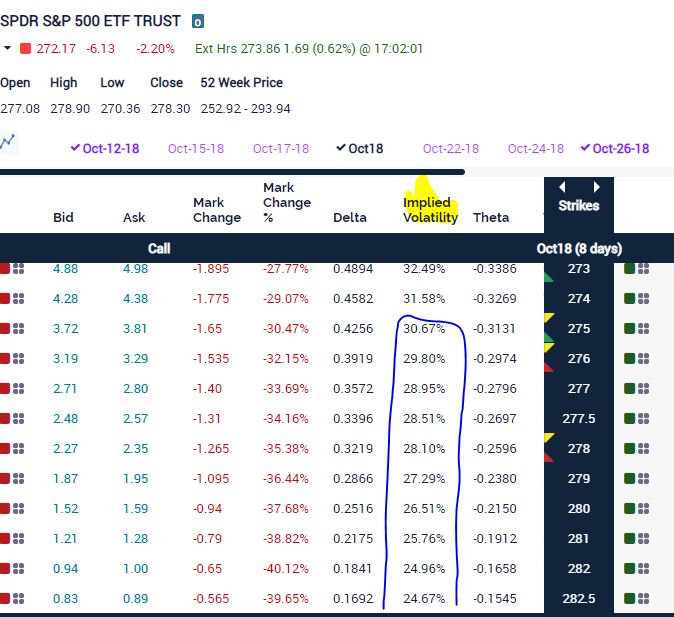

The backwardation is even more extreme when looking at the actual implied volatility of weekly options— remember the VIX is a 30-day snapshot.

Here we see the implied volatility of SPY options is at the 27%-30% level as of Thursday’s close.

Source:ETrade.com

SPY Chart: It looks like it washed out at the $270 and it could bounce and consolidate near resistance at the $280 level.

Source:Freecharts.com

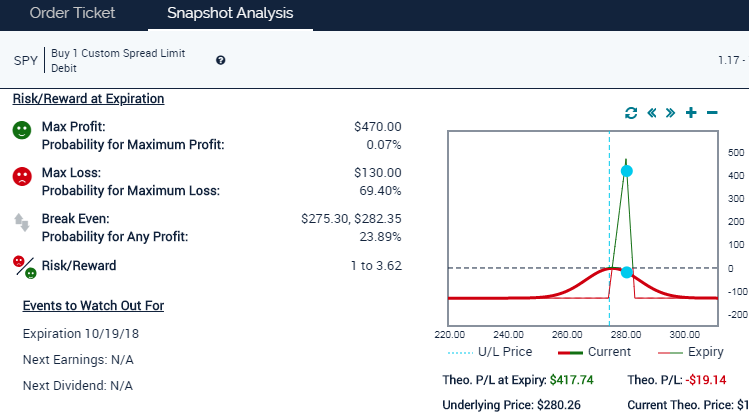

Strategy: Skip Strike Butterfly Spread. Unlike the traditional butterfly, which as a 1x2x1 structure with strikes equally far apart, the skip-strike (sometimes called a ‘broken wing’) has a 1x3x2 contract structure.

Here is the trade:

-Buy 1 Oct. 274 Call

-Sell 3 Oct. 280 Call

-Buy 2 Oct. 286 Call

For a Net Debit of $1.30(+/-0.10)

The advantage of the skip strike structure is it reduces cost and expands the profit range.

Be aware the risk/reward of butterflies. This position will need to be held until at least next Wednesday to realize a decent profit and the max value of the spread can be $6 or a $4.70 or 360% profit.

Max profit is only achieved if shares are at $280 on expiration, which is a low probability.

A realistic goal will be closing it on Wednesday or Thursday for $3 credit or about a 135% gain.

Here is the p/l risk/reward graph.

Related: The Top Stock to Buy After a Market Sell-Off

The post Options Trading: Using a Butterfly for a Bounce appeared first on Option Sensei.