Fed Beige Book and More Big-Name Third Quarter Earnings Today

Major U.S. stocks are down today after a volatile morning that edged indices higher off of positive earnings but ultimately saw stocks fall in afternoon trading, on track for another losing session. The S&P is on track for its sixth straight session of trading lower while all three major U.S. indices are in the negative for the month of October. Midterm elections will hold a cap on any serious rallies despite help from positive earnings. Volatility looks to bottom out soon and late stages of a bull market indicate a run through first quarter 2019. SPY continues to trade in the range of $270-280, next level of support and resistance is at $268 and $287 if these levels are violated. SPY Annual Seasonal Chart forecast shown below:

The Federal Reserve’s Beige Books is due to release today and will provide good data on market trends and condition. Recent economic reports have begun to underwhelm after a stellar 2018 of reporting. New home sales dropped to a multi-year low while third-quarter earnings have been largely hit and miss, unlike the previous two quarters which saw an overwhelming majority of companies report at or above expectations. Boeing reported above expectations which help shares rise 3% while supporting the Dow to a short-lived early morning rally. The Dow Jones is on a three-day losing streak, currently down 0.86%. Other big market movers include AT&T, which dropped over 6% after earnings missed expectations, Texas Instruments, which dropped over 4% after earnings missed expectations yesterday, and UPS, which is seeing shares lower although earnings met expectations. Microsoft, Visa, and Ford are due to report after the close today while Amazon, Alphabet Inc, and Twitter will close out the week in big-name reporting. Next week, over 700 companies will report third-quarter earnings.

Globally, both Asian and European markets were split with the Hong Kong, French, and German markets down and Chinese and UK markets up. The dollar is slightly up today which has gold lower while oil is also slightly up today after trading mostly lower this week in anticipation of the Iran sanctions. On Friday, U.S. GDP and Consumer Sentiment Index reports are due.

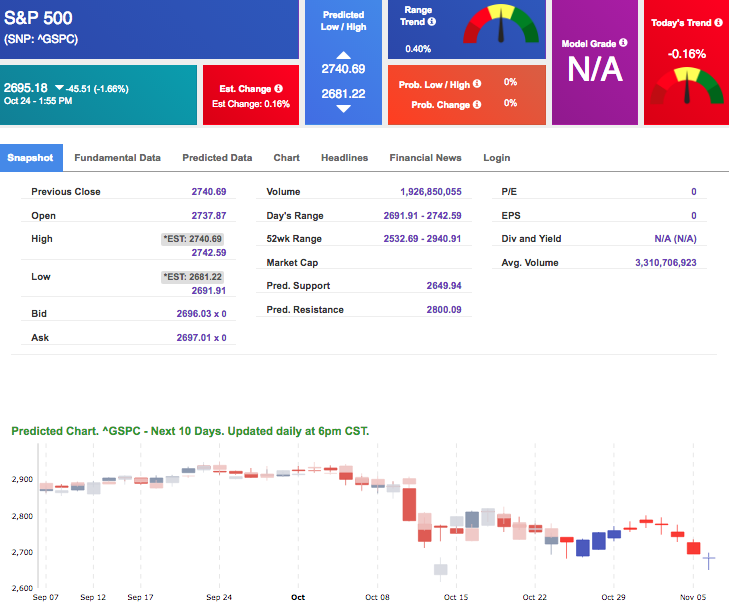

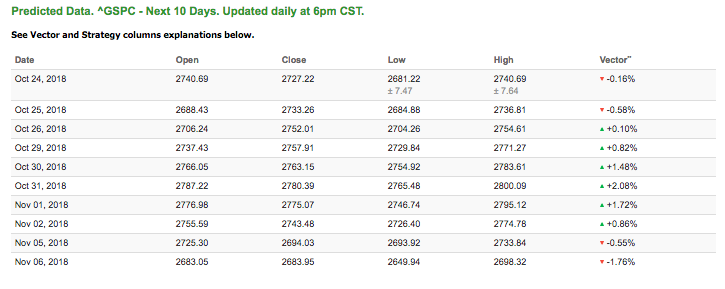

Using the “^GSPC” symbol to analyze the S&P 500, our 10-day prediction window shows mixed signals. Today’s vector figure of -0.16% moves to +2.08% in five trading sessions. The predicted close for tomorrow is 2,733.26. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Highlight of a Recent Winning Trade

On October 17th, our ActiveTrader service produced a bullish recommendation for The AES Corporation(AES). ActiveTrader included in all Tradespoon membership plans and is designed for intraday trading.

Trade Breakdown

AES entered the forecasted Entry 1 price range of $15.07 (± 0.06) in its SECOND hour of trading and moved through its Target price of $15.22 in its THIRD hour of trading. The Stop Loss was set at $14.92.

Volatility Performance

Even with increased volatility, Tradespoon technology has been able to provide strong results and accuracy in our post-selloff trading. Similar selloff, to the one we’re seeing this week, in mid-August resulted in 77% winning trades, or 7 out of 9!

Trade Breakdown

On October 16th, in the midst of last week’s volatility, we recommended Netflix (Option) at $0.54 and shorted the stock at $0.10 (36.36% Net Gain!), and that’s just one of many winning trades we had during volatility!

Special Lifetime Offer – Watch where I trade my personal money, propose specific stop losses, time the market, show how I trade step-by-step, consider underlying volatility, and sell for big profits!

Click here for my Special Lifetime Offer!

Thursday Morning Featured Stock

Our featured stock for Thursday is Walmart Inc. (WMT). WMT is showing a confident vector trend in our Stock Forecast Toolbox’s 10-day forecast. This stock is assigned a Model Grade of (C) indicating it ranks in the top 50th percentile for accuracy for predicted support and resistance, relative to our entire data universe.

*Please note: Our featured stock is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader or ActiveInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

The stock is trading at $98.54 at the time of publication, up 0.76% from the open with a +0.72% vector figure.

Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Note: The Vector column calculates the change of the Forecasted Average Price for next trading session relative to the average of actual prices for the last trading session. The column shows expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

Oil

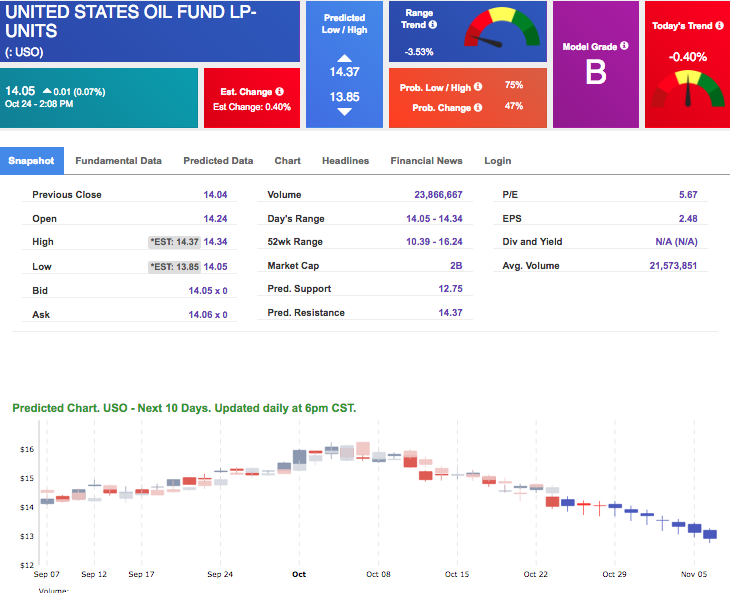

West Texas Intermediate for December delivery (CLZ8) is priced at $66.74 per barrel, up 0.45% from the open, at the time of publication. Looking at USO, a crude oil tracker, our 10-day prediction model shows mixed signals. The fund is trading at $14.05 at the time of publication, up 0.07% from the open. Vector figures show -0.40% today, which turns -3.46% in five trading sessions. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Gold

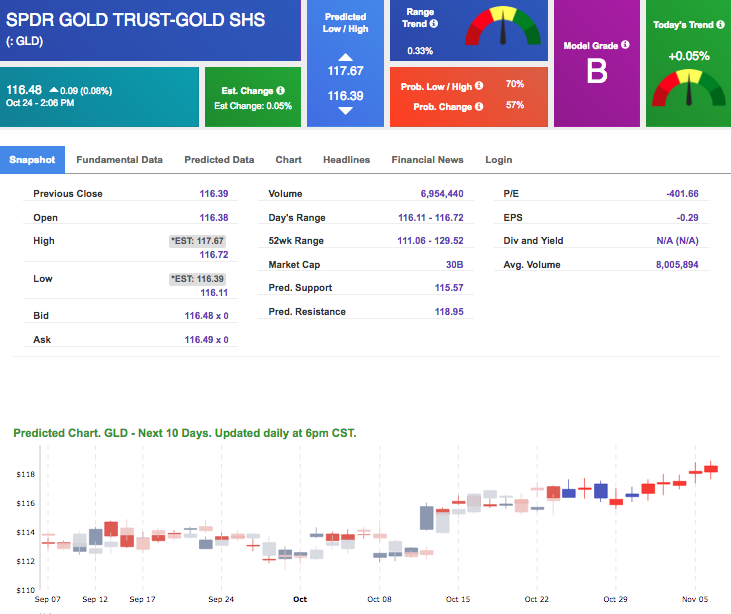

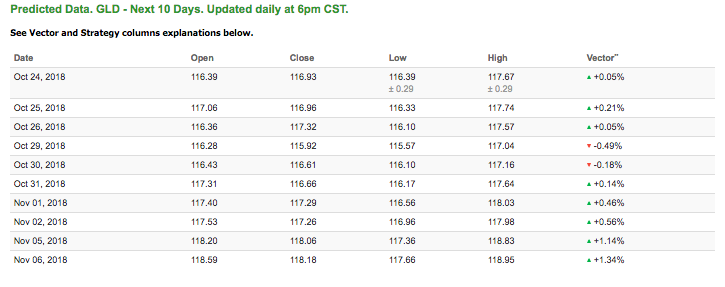

The price for December gold (GCZ8) is down 0.25% at $1,233.70 at the time of publication. Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows mixed signals. The gold proxy is trading at $116.48, up 0.08% at the time of publication. Vector signals show +0.05 % for today. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Treasuries

The yield on the 10-year Treasury note is down 1.58% at 3.13% at the time of publication. The yield on the 30-year Treasury note is down 0.84% at 3.35% at the time of publication.

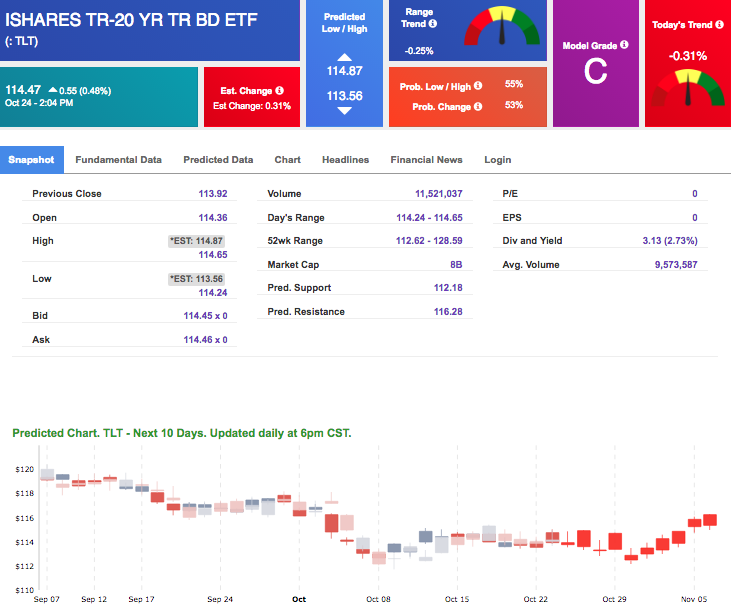

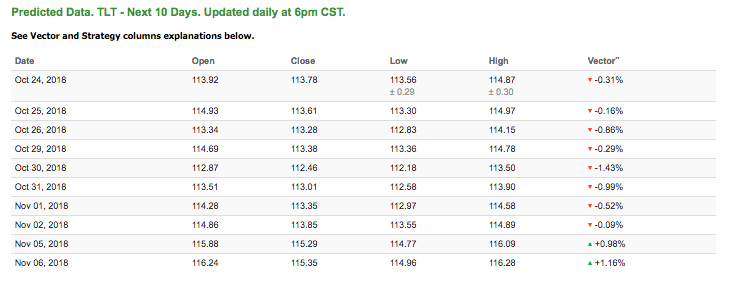

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see negative signals in our 10-day prediction window. Today’s vector of -0.31% moves to -0.29% in three sessions. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Volatility

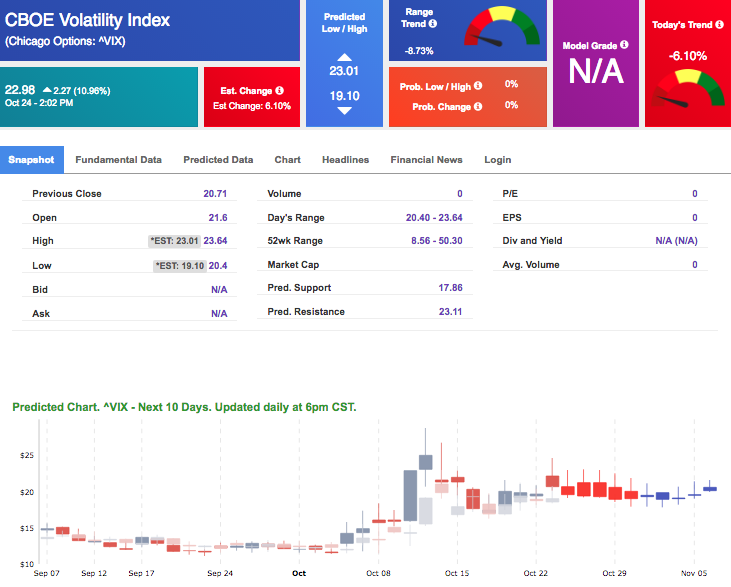

The CBOE Volatility Index (^VIX) is up 10.96% at $22.98 at the time of publication, and our 10-day prediction window shows negative signals. The predicted close for tomorrow is $19.38 with a vector of -5.48%. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.