Beige Book Provides Hope After Tuesday’s Selloff

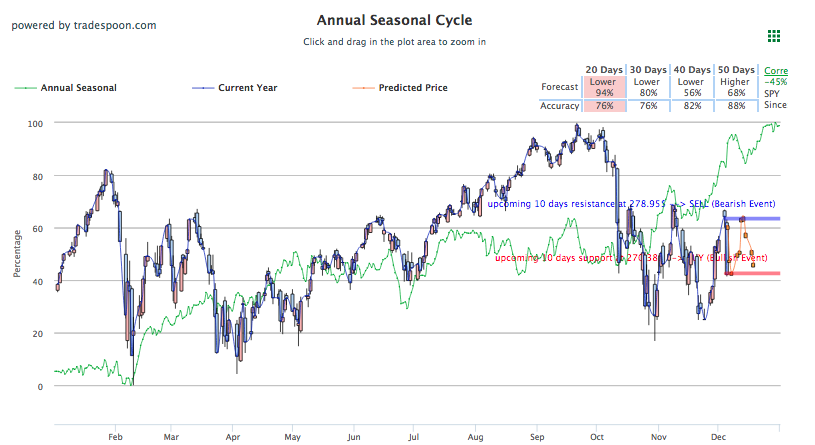

U.S. Stocks traded sharply lower yesterday as the optimism that came from the G20 trade agreements wore off and turned skeptical due to the escalation of the tariff rhetoric that followed. As long as SPY is above $263 level, I believe the market is oversold and presenting opportunities to buy on any corrections. Although the market is closed for President George H.W. Bush’s funeral, electronic trading of stock-index futures is still happening and U.S. futures made some early morning gains today. Right now, risk vs reward profile is optimal for going long. If SPY breaks below $260 level, I expect an outright bearish market. For reference, the SPY Seasonal Chart is shown below:

All three major U.S. stock-index futures are modestly up today. Yesterday’s sharp 3% loses recorded for all three major u.s. indices were the worst for each respective benchmark since October 10 and come after a solid market-wide rally that followed the G20 summit. A temporary lift of tariffs and 90-day timeframe to work out trade differences between the U.S. and China that came following the Buenos Aires summit initially injected optimism in the global trade relations and thus the market but have since severely worn off. Whether the two sides will be able to come to an agreement is yet to be seen and should be closely followed following the new year, when the 90-day window begins. An inversion of treasury yields has alarmed some investors and should also be followed tomorrow when bond markets open up again. One sign of progress that has come from the agreement between the U.S. and China is China’s recent announcement to severely punish for Intellectual Property theft, something that was a main point of contention between the two economic powerhouses.

Economic reports will come into focus as the year comes to close and January’s earnings season approaches. Another Fed Reserve meeting is scheduled for later this month and another interest rate hike is expected, making four for the year. Today, the release of the Fed Beige book showed modest growth for all twelve Fed Reserve district. Consumer spending and manufacturing remained at a healthy rate while home sales lowered. Inflation and economic growth will be the main point of concern as several economic and geopolitical factors will come to a head in the weeks to come. Globally, Asian and European markets closed lower for the second day in a row.

Using the “^GSPC” symbol to analyze the S&P 500, our 10-day prediction window shows mixed signals. Today’s vector figure of -1.97% moves to +0.47% in five trading sessions. The predicted close for tomorrow is 2,617.21. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Highlight of a Recent Winning Trade

On November 30th, our ActiveTrader service produced a bullish recommendation for General Motors (GM). ActiveTrader is included in all Tradespoon membership plans and is designed for intraday trading.

Trade Breakdown

GM entered the forecasted Entry 1 price range of $36.76 (± 0.28) in its first hour of trading and hit its Target price of $37.13 in that same hour, reaching a high of $37.89 for the trading day. The Stop Loss was set at $36.39.

LIFETIME ACCESS to our Stock Forecast Toolbox Membership for less than the regular price we normally charge for only 6 months of service!

I want to make this offer a complete no-brainer! Would you rather sign up for just one year of service or get Lifetime Access for an even lower price?

In addition, you will get Lifetime Access to our ActiveTrader service which includes daily high-probability stock & option trade ideas with exact entry/exit points for both bullish and bearish traders!

Click Here to Sign Up