Major Earnings and FOMC Headline Busy Post-Shutdown Week

Markets are on the move down today with all three major indices lowering in early morning trading. This comes ahead of tomorrow’s two day Federal Open Market Committee meeting and following the temporary deal to reopen the government for three weeks, which was announced Friday. Earnings continue with Caterpillar and Nvidia reporting before open and many more scheduled for this week including Facebook, Microsoft, and Apple. Although we saw a robust rebound following December’s historic lows, the market could still revert to $254-257 level for SPY in the next few weeks. Going forward our strategy remains to buy the selloffs. We believe the market could rebound to $274-280 level by end of 2019 first quarter. In our opinion, and based off most technical indicators, the market is overbought. Investors should avoid chasing the rallies and monitor seasonal charts for support and resistance levels. For reference, the SPY Seasonal Chart is shown below:

The first 2019 FOMC meeting is scheduled to begin tomorrow though no interest rate hike is expected. As previously announced, Chairman Jerome Powell will meet with the press afterward and will do so for every meeting this year. Investors should expect more on the updated policy on Wednesday, in the middle of a particularly busy earnings week. Caterpillar released earnings this morning before market open which came in below expectations and took shares of the construction manufacturer down over 9%. AK Steel, Celanese, and Whirlpool are set to report after the close. Tomorrow, look for Apple and eBay earnings after market close and Pfizer, Verizon, 3M, and Biogen before the open.

Last Friday, President Trump signed into effect a temporary bill to reopen the government ending the longest U.S. government shutdown at 35 days. The deal opens the government for three weeks, through February 15th, to allow both sides to continue negotiations regarding the funding dispute and border security. IPOs and economic data reporting that had been set back due to the shutdown will likely pick back up, though with only a temporary solution in place there is still uncertainty regarding both. The U.S. Treasury is looking to borrow another $1 trillion for the second year in a row to support the widening budget deficit. Currently, all three major indices are down over 1%.

Other news to note today includes Nissan’s SEC entanglement, Schultz added to the growing list of presidential nominees, and China’s continued industrial struggle. Due to its former Chairman Carlos Ghosn, who has also received international attention from Interpol for his financial wrongdoings, Nissan is now part of U.S. Securities and Exchanges Committee inquiry. Ghosn was arrested in November by Japanese authorities for failure to properly disclose salary, potentially over $80 million going back as far as 2010. After several policymakers threw their name in for Presidential consideration ahead of the 2020 election, several names for the private sector are emerging as potential candidates. Former Starbucks CEO Howard Schultz recently announced he is considering running for president “as a centrist independent.”

Elsewhere, Chinese industrial data is returning lowering for the second straight month after profit, price, and demand data all lowered in December. However, profits for the year are up for while economic expansion rose over 6% in 2018. Today, Asian markets closed lower, as did European markets which also struggled.

Using the “^GSPC” symbol to analyze the S&P 500, our 10-day prediction window shows mixed signals. Today’s vector figure of +0.45% moves to -0.74% in five trading sessions. The predicted close for tomorrow is 2,672.07. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Today’s Live Trading Room Profits

See today’s action below and how we trade this volatile market and what you can expect in our next Live Trading Room.

During today’s session, we were able to hedge and make money in a down market. We recorded 4 of 5 winning trades, ranging from 21% to over 75% ROI!

Symbol Net Gain%

| PG (Option) | 21.74% |

| VIX (Option) | 75.26% |

| UTX (Option) | 45.45% |

| IBM | 47.75% |

| CAT (Option) | -47.54% |

Our Live Trading Room is open every trading day from 9:15 am Eastern Time, but these Live Trading Sessions are only available for Premium Members.

Don’t miss our next winners.

TODAY ONLY! We are doing something we RARELY do!

We are offering LIFETIME ACCESS to our Tools Membership!

This means that you will get Lifetime Access to our entire suite of trading tools, and after your initial payment, you will never be billed again for as long as you remain a member!

In addition, you will get Lifetime Access to our ActiveTrader and MonthlyTrader services which includes daily and weekly high-probability stock & option trade ideas with exact entry/exit points for both bullish and bearish traders!

This offer is only available until Midnight, so please act Fast before you miss out!

Just click the link below and it will take you to an upgrade page where you can claim this special offer!

Click Here to Sign Up

Highlight of a Recent Winning Trade

On January 23rd, our ActiveTrader service produced a bullish recommendation for The AES Corporation (AES). ActiveTrader is included in all paid Tradespoon membership plans and is designed for day trading.

Trade Breakdown

AES opened in its forecasted Strategy B Entry 1 price range $15.61 (± 0.11) and passed through its Target price $15.77 within the second hour of trading, reaching a high of $15.84. The Stop Loss price was set at $15.45.

Tuesday Morning Featured Stock

Our featured stock for Tuesday is Procter and Gamble Co. (PG). PG is showing a confident vector trend in our Stock Forecast Toolbox’s 10-day forecast. This stock is assigned a Model Grade of (B) indicating it ranks in the top 25th percentile for accuracy for predicted support and resistance, relative to our entire data universe.

*Please note: Our featured stock is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader or ActiveInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

The stock is trading at $93.44 at the time of publication, down 0.17% from the open with a +0.01% vector figure.

Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Note: The Vector column calculates the change of the Forecasted Average Price for next trading session relative to the average of actual prices for the last trading session. The column shows expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

Oil

West Texas Intermediate for March delivery (CLH9) is priced at $52.01 per barrel, down 3.13% from the open, at the time of publication. Looking at USO, a crude oil tracker, our 10-day prediction model shows positive signals. The fund is trading at $10.92 at the time of publication, down 2.93% from the open. Vector figures show +1.29% today, which turns +7.86% in five trading sessions. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Gold

The price for February gold (GCG9) is up 0.29% at $1,301.80 at the time of publication. Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows mostly negative signals. The gold proxy is trading at $123.1, up 0.19% at the time of publication. Vector signals show -0.10% for today. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Treasuries

The yield on the 10-year Treasury note is up 1.08% at 2.74% at the time of publication. The yield on the 30-year Treasury note is up 0.73% at 3.06% at the time of publication.

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see negative signals in our 10-day prediction window. Today’s vector of +0.11% moves to -0.11% in three sessions. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Volatility

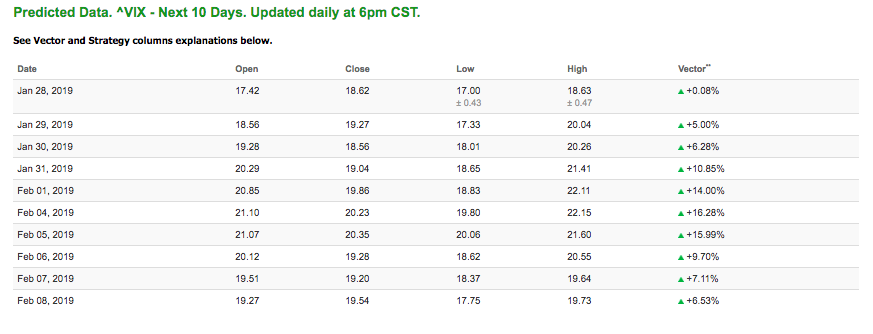

The CBOE Volatility Index (^VIX) is up 12.17% at $19.54 at the time of publication, and our 10-day prediction window shows positive signals. The predicted close for tomorrow is $17.33 with a vector of +5.00%. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

TODAY ONLY! We are doing something we RARELY do!

We are offering LIFETIME ACCESS to our Tools Membership!

This means that you will get Lifetime Access to our entire suite of trading tools, and after your initial payment, you will never be billed again for as long as you remain a member!

In addition, you will get Lifetime Access to our ActiveTrader and MonthlyTrader services which includes daily and weekly high-probability stock & option trade ideas with exact entry/exit points for both bullish and bearish traders!

This offer is only available until Midnight, so please act Fast before you miss out!

Just click the link below and it will take you to an upgrade page where you can claim this special offer!

Click Here to Sign Up