Alert! Cannabis ETF to Sprout!

RoboStreet – March 21, 2019

Harvesting Pot Profits in a Hot ETF

The first quarter of 2019 is off to a fantastic start with the major averages on the verge of vanquishing fourth-quarter losses. There are several factors contributing to the rally, the biggest being the now well-coined “pivot” by the Fed on their monetary policy. Just last quarter the bottom was seemingly falling out from under the market when the cavalry rode into the rescue: the Fed essentially redacts their dot plot plan for four planned rate hikes in 2019 and instead states they will take a patient “wait and see” stance on future interest rate increases.

That single event created the massive capital flow into the U.S. stock market that has been relentless for the past two months. This week’s FOMC meeting only reinforced this dovish stance further when Fed Chairman Jerome Powell stated in the post-meeting press conference that the new dot plot plan would reduce the planned two hikes in 2019 to no-hikes while also stating that quantitative tightening, or QT, where the Fed is shrinking its balance sheet, would cease in September.

Now, the fear-of-missing-out-trade is in full swing as underinvested asset managers are going to “window dress” their portfolios and up their equity weighting to show clients they are fully exposed to a rally that has defied any meaningful bouts of selling pressure. While there are legitimate concerns surrounding the trade war with China, Brexit, and a potential credit event in Italy, the bigger story is the Fed taking a much more accommodative position, a strong job market, and low inflation.

So, while the FANG trade is back in fashion, the chip sector is showing signs of a second-half earnings recovery. Oil prices are trending back up to the high end of the range toward $60/bbl, the center stage for total return for 2019 belongs to the cannabis stocks and the incredible gains that have been realized this year. Investors are rapidly embracing the various medicinal uses of marijuana in all its forms like topical oils, pills, injections, and edibles. Plus, the spreading of the legalization of more U.S. states for medicinal weed and the new wave of laws allowing for recreational use is fueling the appetite for owning pot stocks.

And remember we’re not talking about day-trading here. I’m looking for 50-100% gains inside of the next 3 months, so my weekly updates are timely enough for you to act.

Click Here – To See Where I Put My RoboInvestor Money

The year-to-date performance of the cannabis sector is stunning. In just the past two and a half months shares of Cronos Group (CRON) have soared 110%, Aurora Cannabis (ACB) shares are up 100%, the stock of GW Pharmaceuticals (GWPH) is higher by 95% and Canopy Growth Corp. (CGC) stock has rallied 80%. No sector or group of stocks within the broader stock market can come close to matching this torrid set of gains. And the really great news is that it’s still early in the cannabis cycle.

But for investors trying to sift through the weeds, so to speak, and uncover which companies to invest in at this point, it might make perfectly good sense just to cast a net over the sector itself in the form of an Exchange Traded Fund (ETF) and let the internal managers that evaluate and analyze the sector 24/7 take care of all that brainwork, research, and due diligence. Fortunately, investors have that ETF available to them.

From its own website: “ETFMG Alternative Harvest ETF (MJ) is an exchange-traded fund that invests in stocks of companies operating across health care, pharmaceuticals, biotechnology, and life sciences, biotechnology, agricultural biotechnology, legal cultivation of cannabis, or the legal production, marketing or distribution of cannabis products for medical or non-medical purposes, engage in the lawful creation, marketing or distribution of prescription drugs that utilize cannabinoids as an active ingredient, trade tobacco or produce tobacco products, produce cigarette and cigar components, and engage in the creation, production, and distribution of fertilizers, plant foods, pesticides or growing equipment to be used in the cultivation of cannabis or tobacco sectors.”

“The fund invests in growth and value stocks of companies across diversified market capitalization. It seeks to track the performance of the Prime Alternative Harvest Index,by using full replication technique. ETF Managers Trust – ETFMG Alternative Harvest ETF was formed on December 2, 2015, and is domiciled in the United States and trades under the ticker symbol ‘MJ’.”

Investors have been richly rewarded owning shares of MJ in 2019 with the ETF having gained +48.83% YTD. Net assets for MJ have grown to over $1.2 billion and the annual management fee is only 0.75%. It’s holdings, of which there are currently 36 stocks, are rebalanced quarterly. And what makes this even more interesting is that the managers can use margin, short sell and utilize put and call options to enhance total return and hedge their gains.

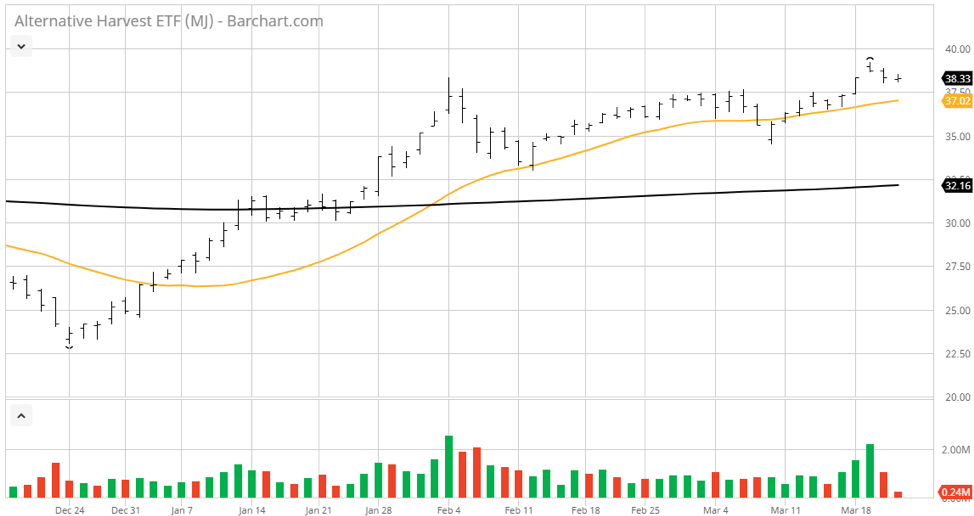

Here’s the thing though, while the market has provided a wonderful ride for MJ shareholders year-to-date, this ETF, and the stocks that make it up, have all had an erratic history of trading. Looking at the one-year chart, it’s easy to see where the power of AI timing of entry and exit points would have been vital to successfully trading MJ.

Rest assured, there are investors out there whose emotional greed got the best of them and they bought MJ at $45 and then their fear also got the best of them and they sold at $23, losing -48%. Greed and fear are powerful forces and is why having a market-tested AI system that is unemotional is so important in trading the hottest sectors.

And while the wind is to the back of the market at present, rest assured there will be plenty of shakeouts that will knock the wind out of the pot stocks for periods of time as well. My AI data has been downloading key indicators that will produce specific buy and sell points that will afford investors a big-time advantage to trade the cannabis sector with, both in the stocks and the ETF MJ.

To fully utilize my Tradespoon AI system and reap the rewards of the burgeoning cannabis sector trend, sign up today to RoboInvestor where we put hard-earned investment capital to work in the very best stocks that are in powerful uptrends as vetted by my Tradespoon platform. Make RoboInvestoryour go-to stock advisory today and start seeing a bullish difference in your portfolio tomorrow.

“I’m investing my own money in each and every stock as my AI platform identifies.”

And remember we’re not talking about day-trading here. I’m looking for 50-100% gains inside of the next 3 months, so my weekly updates are timely enough for you to act.

Click Here – To See Where I Put My RoboInvestor Money

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.