“A Sizable Distance” Remains Between U.S. and China

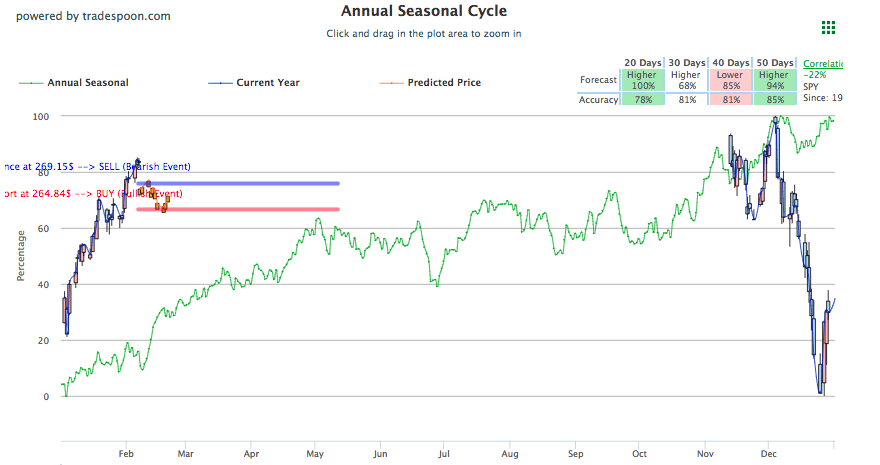

Markets are trading lower today as global unrest returns after unfavorable news from China-U.S. trade talks shows how far apart the two sides are from coming to an agreement. Elsewhere, corporate earnings continue to dominate financial headlines with a large number of before-market reports releasing today including T-Mobile, Philip Morris, Yum! Brands and more. Twitter made the biggest waves this morning when the social-media giant topped expectations but saw shares lower nearly 10%. In our opinion and according to most indicators, the market is overbought. At its current state, we could see the market revert to $260-264 support level for SPY but should not retest last years lows until summer 2019. Investors should monitor support and resistance levels in our Seasonal Charts and avoid chasing the market. We encourage our members to buy the selloffs and hold off on the rallies. For reference, the SPY Seasonal Chart is shown below:

Optimism regarding U.S.-China relations has lowered after recent comments from White House Adviser Larry Kudlow tampered enthusiasm that was sparked earlier this week when it was announced U.S. delegates led by Treasury Secretary Mnuchim were to meet with Chinese officials later this week. The meeting was set to schedule the next meeting between Trump and Xi, ideally ahead of the March 1st deadline. Kudlow recently reiterated the notion China and the U.S. still have a long way to go before a deal can be brokered and that “a sizeable distance” remains between the two sides. Also affecting global trade sentiment is the continued impact of lowering Chinese manufacturing numbers, which last week showed struggles in the Chinese economy. The European Union echoed a similar sentiment thereafter with lowering industrial production in the final months of 2018 and cutting its 2019 forecasts.

With earnings season winding down, today’s release of Twitter’s fourth-quarter earnings marked one of the last significant major-name reports to be released. Twitter topped expectations but saw shares significantly drop amid spending and growth concerns. Cardinal Health and Chipotle Mexican Grill are reaping the benefits of positive earnings with sizeable gains in shares ranging from 6-12%. Several other companies are seeing modest gains off positive reports such as GoPro, T-Mobile, and Philip Morris. Next week look for earnings from Loews, Activision Blizzard, Cisco Systems, Coca-Cola, and more. Next week look for several key economic reports to be released such as Consumer and Producer Price Index, household credit, and the Federal Budget.

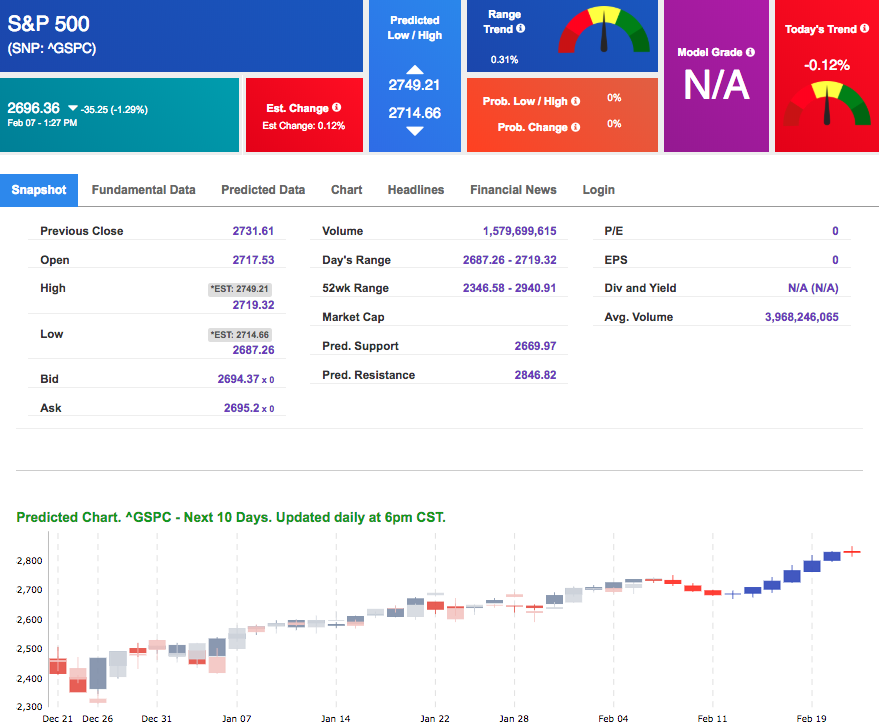

Using the “^GSPC” symbol to analyze the S&P 500, our 10-day prediction window shows mixed signals. Today’s vector figure of -0.12% moves to -0.52% in five trading sessions. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Volatility Performance

See yesterday’s action below, how we trade this volatile market, and what you can expect in our next Live Trading Room. During yesterday’s session, we recorded 6 of 8 winning trades, ranging from 0% to 325% ROI!

| HD (Option) | -7.14% |

| DE (Option) | 16.67% |

| OXY (Option) | 57.89% |

| DE (Option) | 325.00% |

| ROST (Option) | 0.00% |

| TXT (Option) | 54.55% |

| OXY (Option) | 16.22% |

| HD (Option) | -15.00% |

Our Live Trading Room is open every trading day from 9:15 am Eastern Time, but these Live Trading Sessions are only available for Premium Members.

We wanted to share the recording with you so you can see the profits you might be missing- even during volatile markets.

Click Here to Watch Recording

Going, Going, Gone…

LAST CHANCE: This Limited-Time Offer Expires at Midnight

TODAY ONLY – If you sign up for the Tools Membership, we will automatically upgrade your account to our Premium Membership which includes access to our entire suite of trading tools as well as our Premium Member Picks, SMS Alerts, and Live Trading Room!

CLICK HERE TO LEARN MORE!

Highlight of a Recent Winning Trade

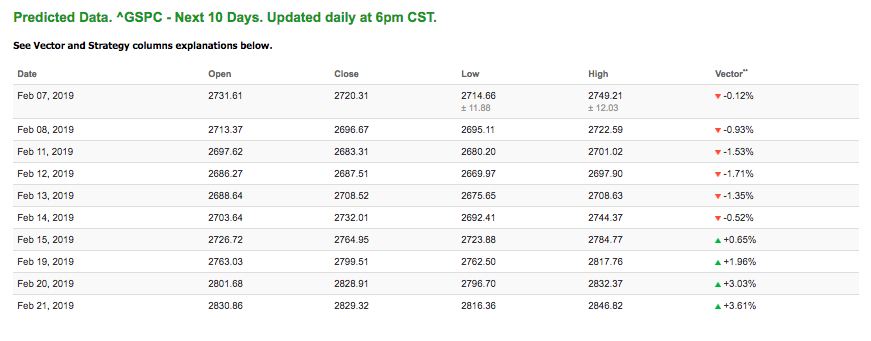

On February 1st, our ActiveTrader service produced a bullish recommendation for NetApp, Inc. (NTAP). ActiveTrader is included in all paid Tradespoon membership plans and is designed for day trading.

Trade Breakdown

NTAP opened in its forecasted Strategy B Entry 1 price range $63.77 (± 0.43) and passed through its Target price $64.41 in the first hour of trading, reaching a high of $67.06. The Stop Loss price was set at $63.13.

Friday Morning Featured Stock

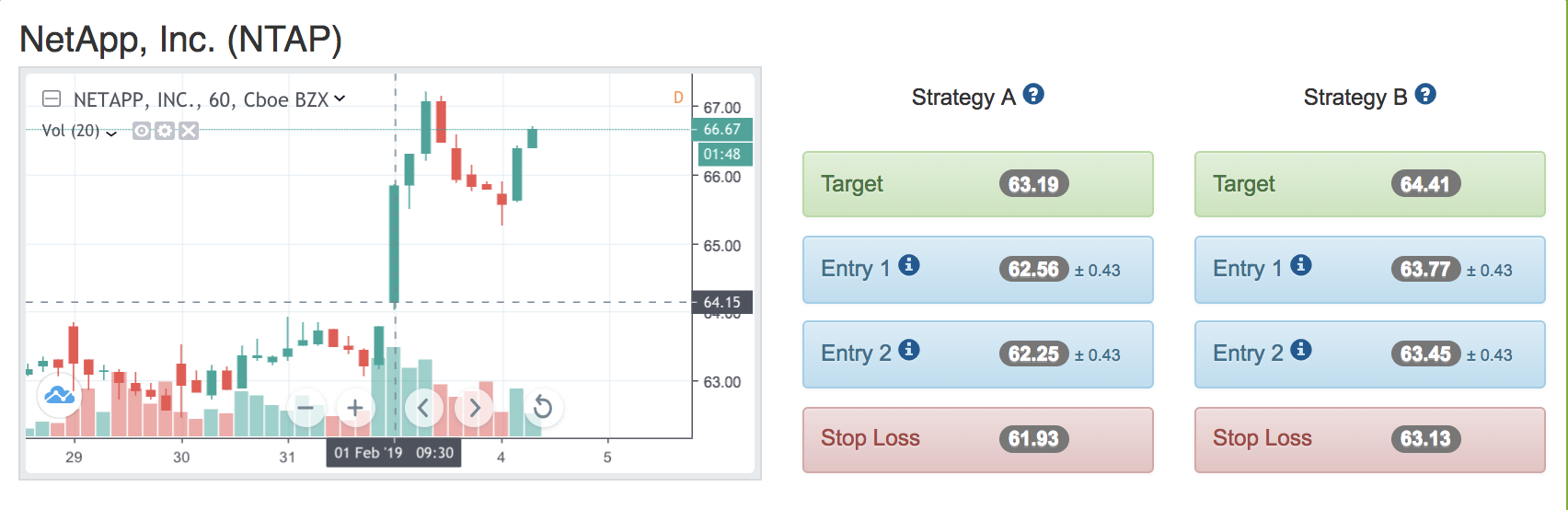

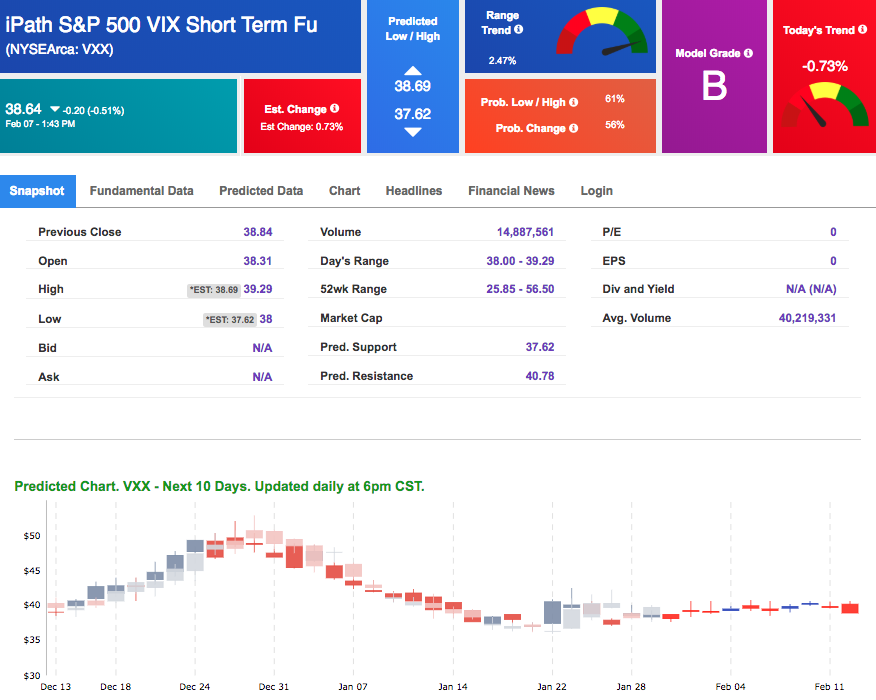

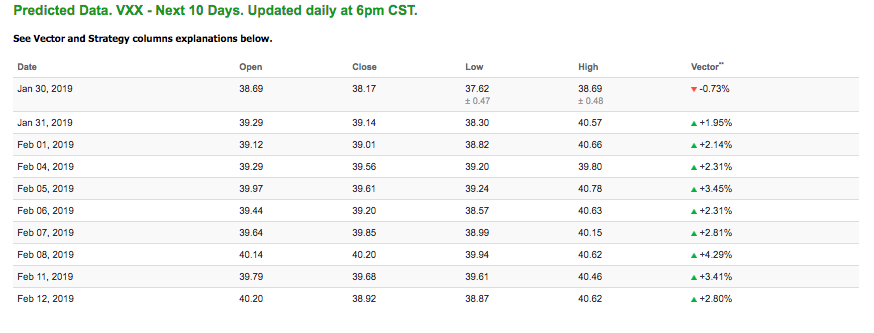

Our featured stock for Friday is iPath S&P 500 VIX Short Term (VXX). VXX is showing a confident vector trend in our Stock Forecast Toolbox’s 10-day forecast. This stock is assigned a Model Grade of (B) indicating it ranks in the top 25th percentile for accuracy for predicted support and resistance, relative to our entire data universe.

*Please note: Our featured stock is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader or MonthlyTrader recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

The stock is trading at $38.64 at the time of publication, down 0.51% from the open with a -0.73% vector figure.

Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Note: The Vector column calculates the change of the Forecasted Average Price for the next trading session relative to the average of actual prices for the last trading session. The column shows expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

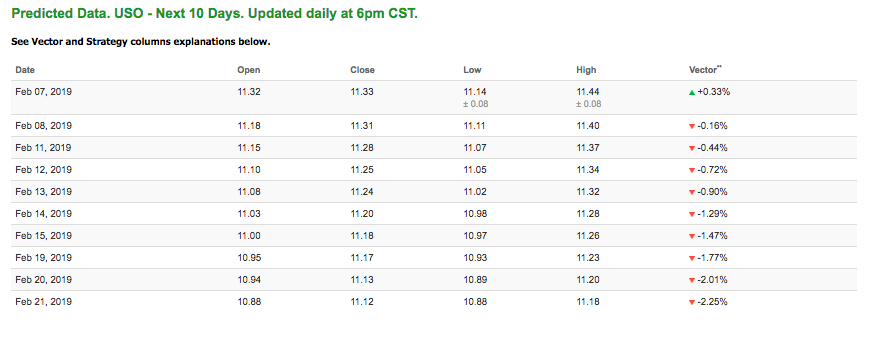

Oil

West Texas Intermediate for March delivery (CLH9) is priced at $52.70 per barrel, down 2.43% from the open, at the time of publication. Looking at USO, a crude oil tracker, our 10-day prediction model shows mixed signals. The fund is trading at $11.07 at the time of publication, down 2.21% from the open. Vector figures show +0.33% today, which turns -1.29% in five trading sessions. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Gold

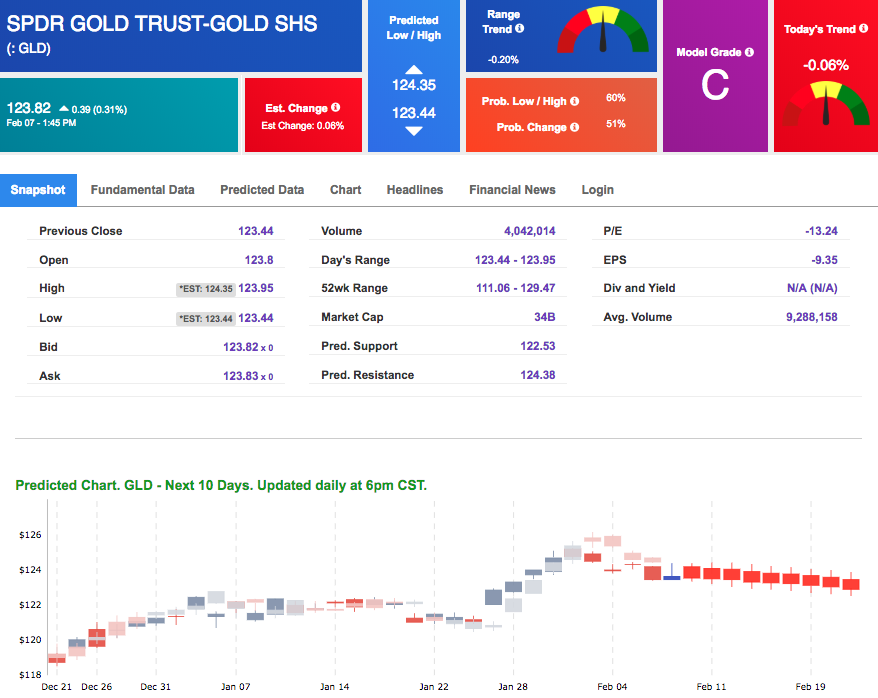

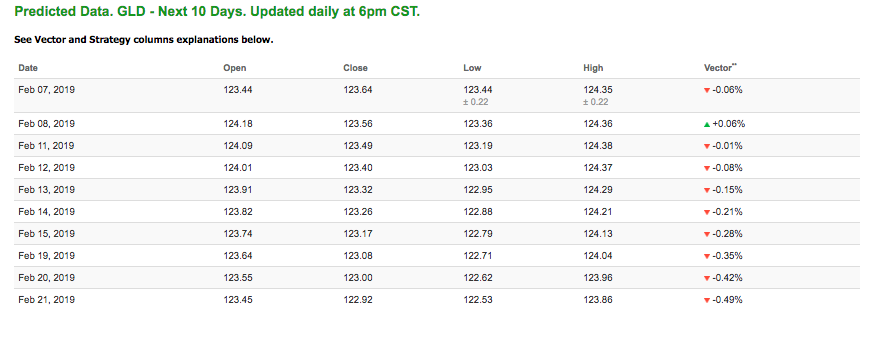

The price for April gold (GCJ9) is down 0.01% at $1,314.40 at the time of publication. Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows mostly negative signals. The gold proxy is trading at $123.82, up 0.31% at the time of publication. Vector signals show -0.06% for today. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

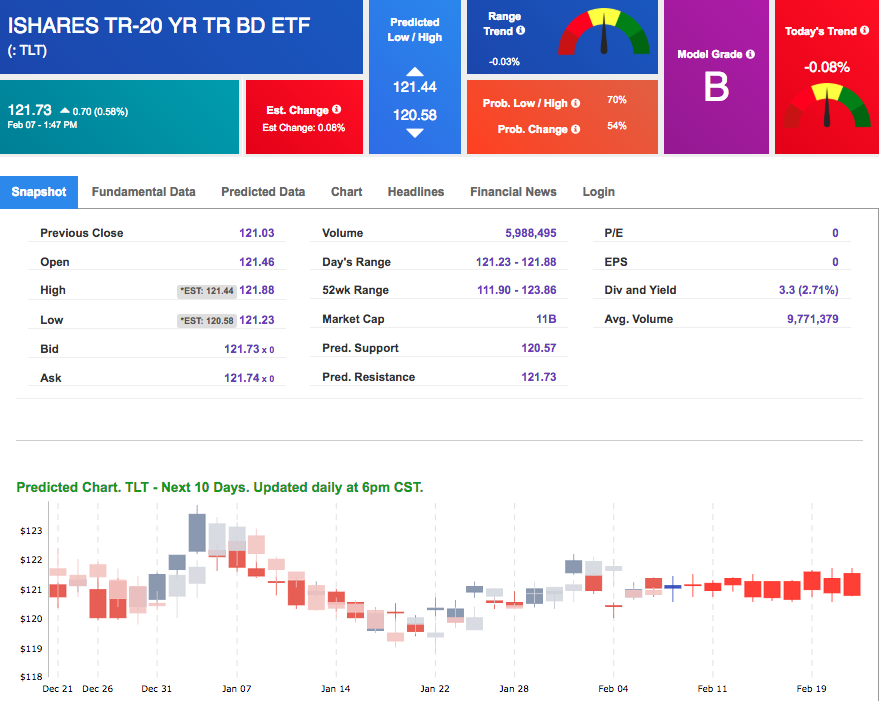

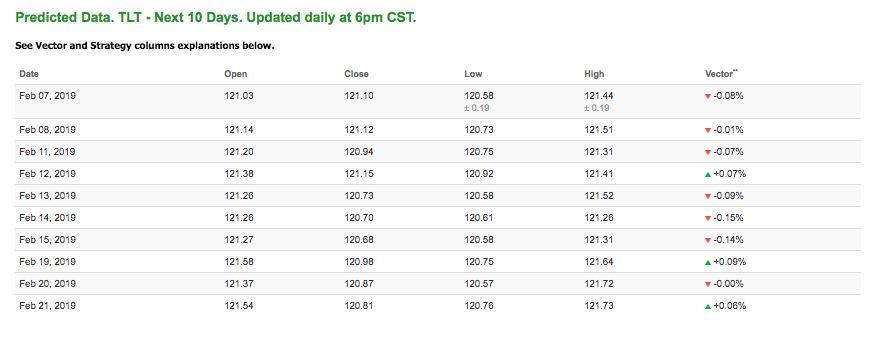

Treasuries

The yield on the 10-year Treasury note is down 2.13% at 2.65% at the time of publication. The yield on the 30-year Treasury note is down 1.37% at 2.99% at the time of publication.

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see mixed signals in our 10-day prediction window. Today’s vector of -0.08% moves to +0.07% in three sessions. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

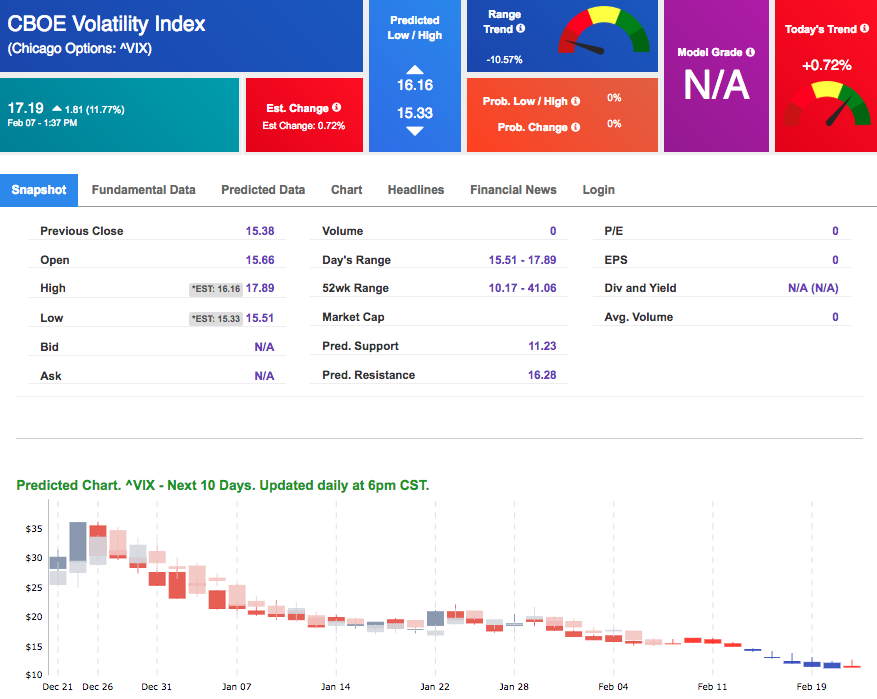

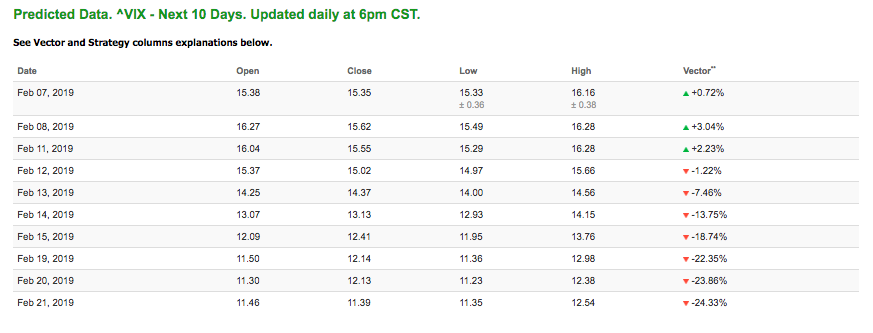

Volatility

The CBOE Volatility Index (^VIX) is up 11.77% at $17.19 at the time of publication, and our 10-day prediction window shows mixed signals. The predicted close for tomorrow is $15.62 with a vector of +3.04%. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.