AI Buy Signal – Commodity ETF In Focus

RoboStreet – November 25, 2021

Overbought Dollar Is Buy Signal For Commodities

What a wild week for the stock market. The Nasdaq rallied to a new all-time high early Monday, only to reverse sharply lower and take the tech-rich index down by 3.8% by early Wednesday before catching a bid and closing higher. It was a dramatic sell-off for the high beta PE growth stocks as the narrative surrounding Fed policy triggered a change in perception about the pace of tapering and future rate hikes.

The market reacted to the notion that the Fed will pull forward its schedule to end tapering by May instead of July and begin to raise the Fed Funds Rate soon thereafter. In doing so, this typically brings about multiple compression for stock PE ratios, which leads to the selling of stocks trading at 100 times sales that generate no earnings. The selling of richly valued growth stocks leads to the rotation into growth stocks with strong cash flows and visible earnings growth.

During favorable market conditions, such as the present, money never really leaves the market, it simply moves into other sectors when there is a big rotation occurring. On the receiving end of the outflows of the sky-high PE growth stocks were financials, industrials, energy, REITs and retail. And while the tech sector took a much-deserved breather, it will still lead the market higher as the FAANG plus Microsoft, Nvidia, Adobe, Salesforce trade resumes.

“I’m investing my own money in each and every stock as my AI platform identifies.”

And remember we’re not talking about day-trading here. I’m looking for 50-100% gains inside of the next 3 months, so my weekly updates are timely enough for you to act.

Click Here – To See Where I Put My RoboInvestor Money

CURRENT TRADING LANDSCAPE

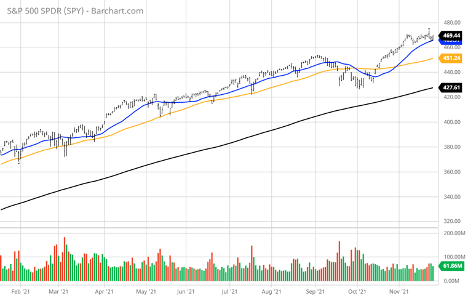

The $SPY closed flat today and settled right near the last’s week low, $468. The value/reflationary stocks had rebounded today, up 0.8%. The technology stocks sold off after a volatile session, down 0.5%.

The $DXY traded higher, and closed right at the 50% retracement for the past 7 years high and low. The $TLT pulled back and settled below the 50-day moving average.

The $SPY short-term support level is at $463 followed by $452. The SPY overhead resistance is at $473. Short-term, the market is overbought and volatility can persist for the next couple of weeks. I expect market to pull back further in the next couple of weeks.

I would consider rebalancing portfolio at this time, raise cash and have overall bullish portfolio.

If you are trading options consider selling premium with January and February expiration dates.

Based on our models, the market (SPY) will trade in the range between $445 and $480 for the next 2-4 weeks.

The notion that the Fed will tighten fiscal policy faster than first anticipated put a huge bid under the dollar, taking the dollar index (DXY) up to the 97.0 level where a key technical overhead resistance level comes into play. It was back in July when the DXY was at this level, followed by a protracted period of selling that tested 89.0 twice before the ensuing rally based on the tapering narrative.

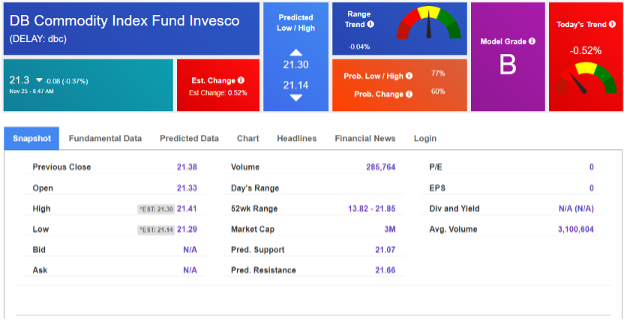

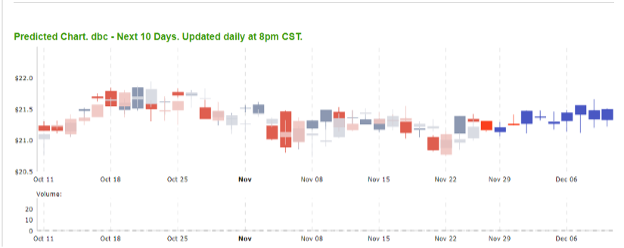

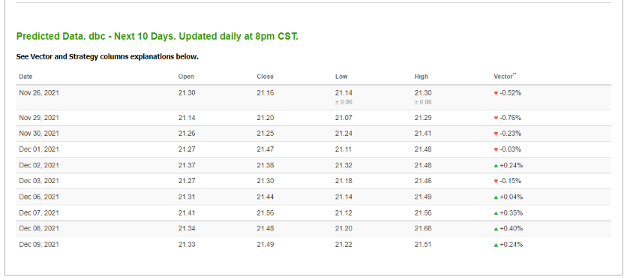

Now that the market has a good idea of how the Fed plans to unwind QE, the dollar should peak right in this area, at least for the short-term, and allow the commodities market to trade higher as the dollar consolidates. The Invesco DB Commodity Index Tracking Fund ETF (DBC) shows a well-defined double-bottom pattern just above its 50-day moving average that looks poised to trade to new highs over the near term.

DBC get a bullish Model Grade “B” rating

Astute fund managers will put on “pair trade”, where the short the dollar and go long the commodities. This set up looks very attractive at the moment. When we apply our AI-driven Forecast Toolbox to DBC, we get a bullish Model Grade “B” rating with a strong forecast for steady uptrend going forward.

We apply my proprietary AI tools to all our trades recommended in our RoboInvestor advisory service. Within RoboInvestor our AI platform identifies high-percentage rewarding trades in blue-chip stocks and ETFs that represent indexes, sectors, sub-sectors, commodities, currencies, interest rates, volatility and shorting opportunities. It’s an unrestricted platform that finds the best risk/reward opportunities for our members to benefit from in the short and intermediate term.

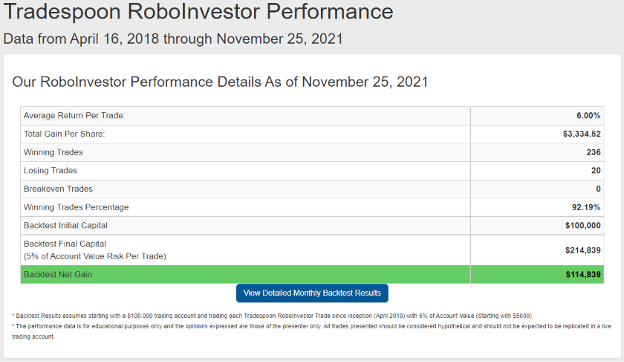

Since launching RoboInvestor in early 2018, our Winning Trades Percentage is an enviable 92.19% – a scorecard unmatched, to my knowledge, anywhere in the market place for advisory services. I am both very proud of our work over the years to produce such outstanding returns and am also humbled by knowing that we have to keep working just as hard or harder to keep producing such great numbers.

Last time we booked a loss was back in April of this year

We’re entering a time when the Fed is beginning to wind down stimulus, which is going to make the investing landscape more challenging on a number of fronts. Inflation is still running hot; supply chain disruptions still persist around the globe and the potential for higher taxes in various forms is being debated.

It’s precisely why RoboInvestor can be such a valuable service to those that take investing as seriously as we do. The last time we booked a loss was back in April of this year, and it was only -4.7% on the trade. Imagine going 7 months of trading without a single loss? That’s what RoboIvestor is delivering – winning trades all the time!

‘If you’re looking for free trading resources… click here’

Take me up on my offer to come alongside and let’s build real wealth, consistently in the bluest of blue-chip stocks and ETFs and have a great story to tell when we retire in comfort. My money is in on every trade I recommend. We are on this journey together, and so far, it’s been a bullish path to successful portfolio growth for over three years. Let me be the first to welcome you aboard as a RoboInvestor member and let’s finish 2021 on a high note with real momentum heading into 2022.

“I’m investing my own money in each and every stock as my AI platform identifies.”

And remember we’re not talking about day-trading here. I’m looking for 50-100% gains inside of the next 3 months, so my weekly updates are timely enough for you to act.

Click Here – To See Where I Put My RoboInvestor Money

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.