AI Energy Sector Buy Alert!

RoboStreet – August 5, 2021

Mixed Signals Fuel Higher Volatility

Recent data and developments have investors wondering whether to hit the gas or hit the brakes in their portfolios. Clearly, the delta variant is wreaking havoc on sentiment, not knowing the breadth of the impact on business conditions and the timeframe by which this phase of COVID-19 will pass.

This week showed considerably slower job growth from the ADP report where 330K private-sector jobs were created versus 650K consensus while the ISM Non-Manufacturing Index for July came in at 64.1 making for the highest reading on record and the fourteenth month of expansion for the services industry which accounts for two-thirds of domestic GDP growth.

“I’m investing my own money in each and every stock as my AI platform identifies.”

And remember we’re not talking about day-trading here. I’m looking for 50-100% gains inside of the next 3 months, so my weekly updates are timely enough for you to act.

Click Here – To See Where I Put My RoboInvestor Money

Adding to the conundrum is the collapse of bond yields on the long end of the yield curve with the benchmark 10-yr Treasury Note paying 1.18%, a level not seen since this past February. This counterintuitive move comes at a time when the CRB Index that measures 19 of the most widely traded commodities, is trading within 2% of its 5-year high, and the CPI index that measures inflation is running at a 5.4% annual rate.

So, it’s not hard to understand why the market is finding it hard to steer a straight path higher when the data is full of cross-currents, China is cracking down on its tech industry and global supply chains are facing more interruptions from COVID-19. What this simply means is that stock picking is at a premium and where the power of AI models in our RoboInvestor advisory service becomes so valuable.

TRADING LANDSCAPE

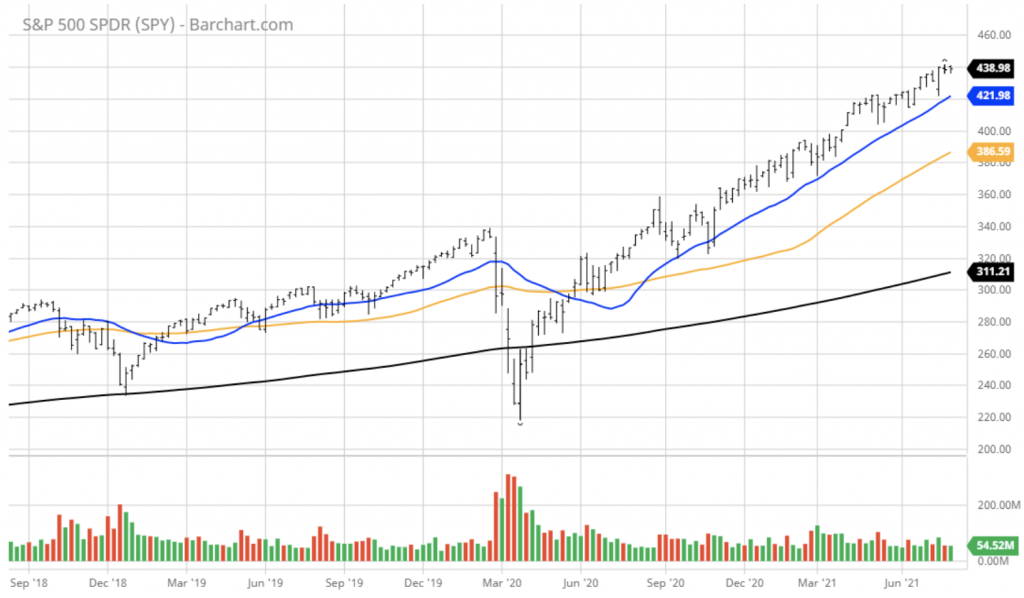

The $SPY continued to trade in the small range. The most important catalyst to consider is July unemployment numbers.

The $DXY has broken above $90.60 resistance and has confirmed its breakout. The next level of resistance is at $93. The $TLT continued to trade higher and has more room for the upside (lower yield).

Based on the steep correction in the reflationary stocks, strong dollar, and overbought technology stocks, the market will continue the correction in August. The $SPY short-term support level is at $435, followed by $430. The SPY overhead resistance is at $445. I expect the next stage of correction to resume this week or next.

I would consider rebalancing portfolio at this point to be more market neutral. The second wave of the sell will continue for the next 2-4 weeks. Market corrections are never a one-way trade.

Based on our models, the $SPY can pull back 5-10% from the all-time highs in the next 2-4 weeks. If you are trading options consider selling premium with October and November expiration dates.

Based on our models, the market (SPY) will trade in the range between $400 and $440 for the next 2-4 weeks.

SECTOR FOCUS

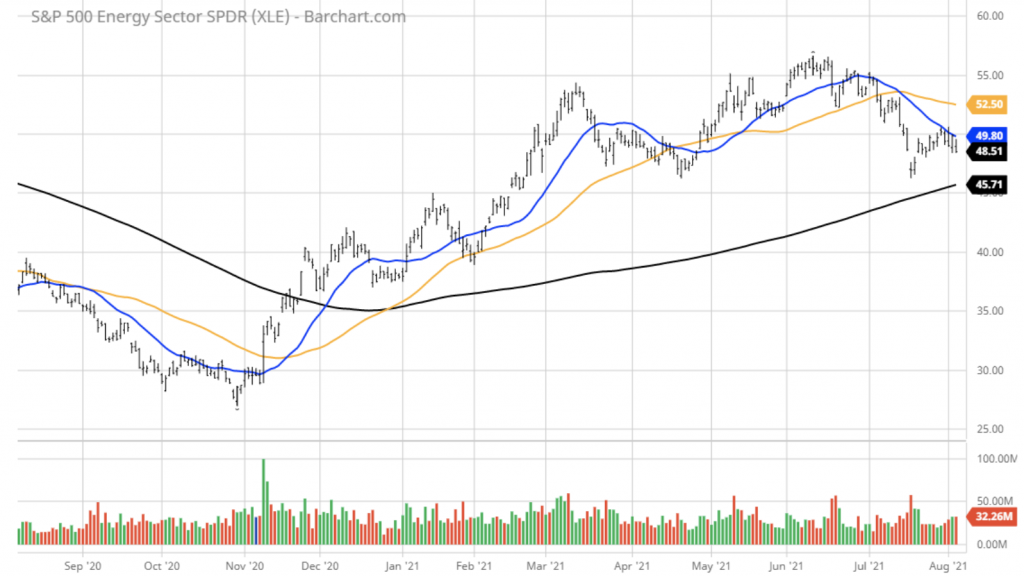

As to what looks attractive within our AI models, the correction in the energy sector is looking compelling within our AI platform. After trading up to $75/bbl, WTI crude has retreated to the $68 level following an unexpected bump in weekly crude inventories that triggered some short-term selling pressure.

The fundamentals for crude prices to maintain above $60/bbl are pretty solid with the global recovery still intact. As such, the probability of another rally in crude to recent highs is good and makes for an attractive investment proposition.

When the entire sector comes under consolidation pressure, it many times proves best to buy the leading ETF as there tends to be more downside protection without sacrificing upside gain. With this in mind, shares of the Energy Select Sector SPDR ETF (XLE) are ideal for taking a long-side position with oil prices having pulled back to where it is testing a solid uptrend off the 200-day MA.

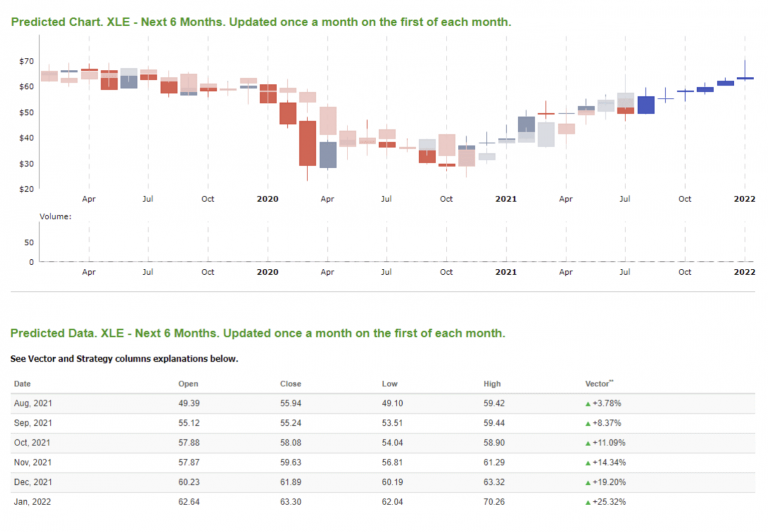

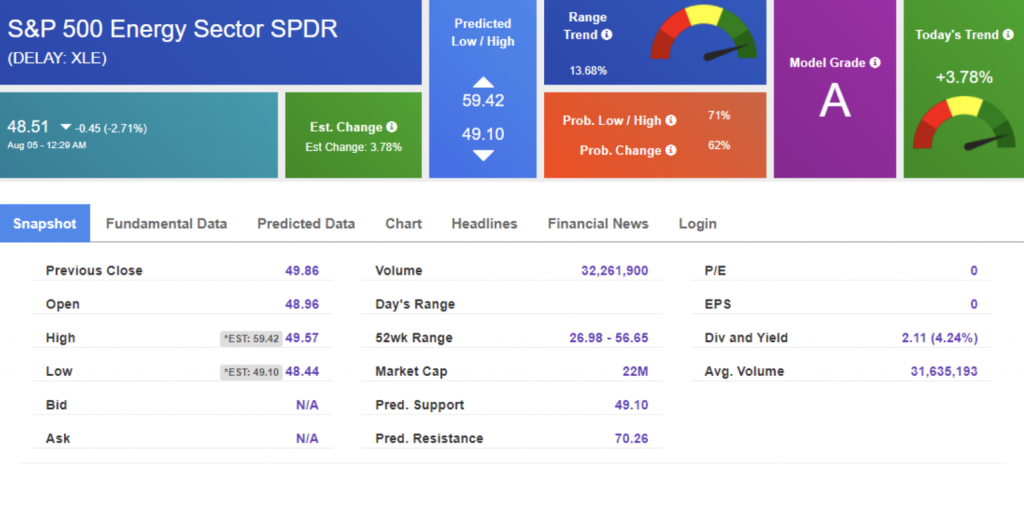

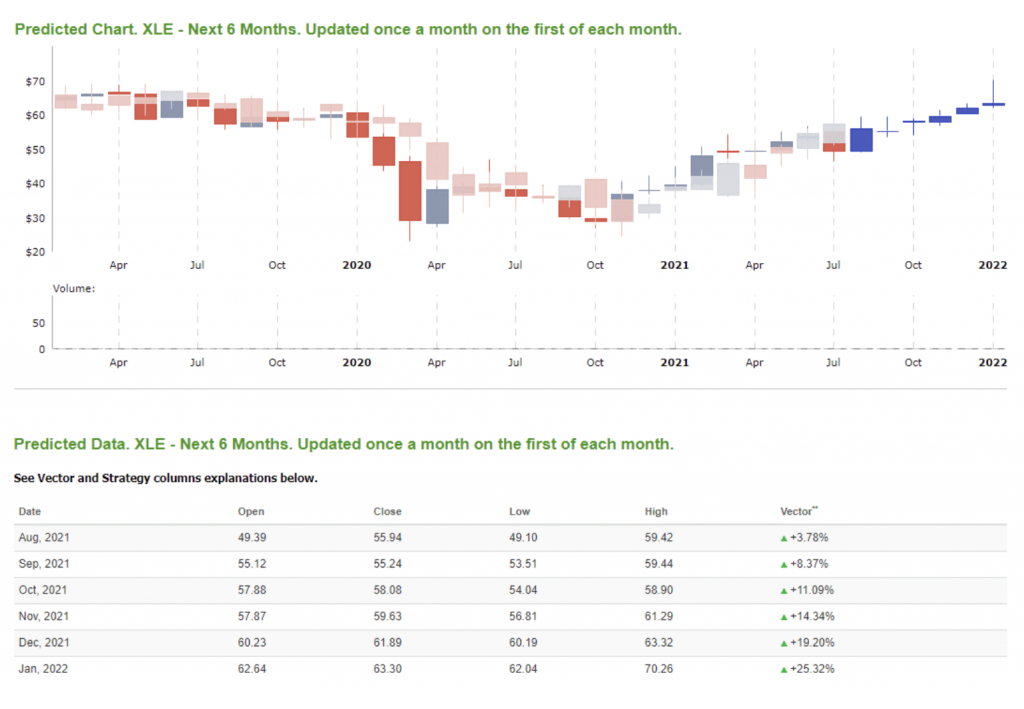

Turning to our AI platform, the Forecast Toolbox is flashing an “A” Model Grade rating. With a Predicted Resistance price target of $70.26. It implies a move higher of 44.81% higher from its current price of $48.61 over the next 6 months.

This kind of potential is what makes our AI system so unique for our RoboInvestor members. The service identifies and recommends blue-chip stocks and ETFs in all manner of market indexes. Also sectors, commodities, currencies, interest rates, and volatility. We will also employ short strategies by way of inverse ETFs when our indicators lead us to do so.

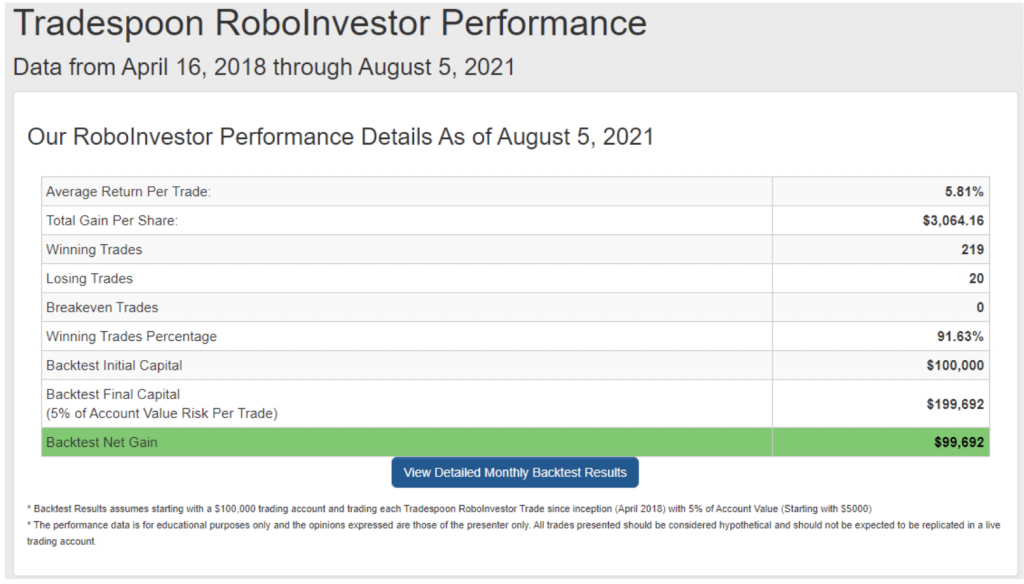

As is with any investment advisory service, the track record is where it matters most. And for RoboInvestor, our Winning Trades Percentage of 91.63% says it all.

My personal capital invested in every trade alongside yours

Take a hard look at how your current investing style or system is working for your portfolio and highly consider joining our RoboInvestor community. I’ve spent over a decade cultivating and refining my proprietary AI platform to produce what is a real advantage to managing risk and generating financial rewards for our subscribers.

My personal capital is invested in every trade alongside yours, just to be in sync with my aim to pursue wealth creation together. It’s my life’s mission and my goal to enhance the investing experience with all our members to the utmost. Be a RoboInvestor today!

‘If you’re looking for free trading resources… click here’

“I’m investing my own money in each and every stock as my AI platform identifies.”

And remember we’re not talking about day-trading here.

Click Here – To See Where I Put My RoboInvestor Money

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.