AI Issues Fresh Buy Signal for Best In Class Drug Company

RoboStreet – September 6, 2018

Trap Door Sell Off in Tech Sector Catches Investors by Surprise

The summer stock market rally has been led by the heavily weighted IT sector which accounts for 26% of the S&P 500. Investors that have their portfolios heavy into the big-cap tech stocks are enjoying a good year of solid performance, right up until this week’s rout that shaved about 200 points off the Nasdaq like a hot knife through butter. While the hearings on Capitol Hill targeting Facebook, Google and Twitter over social media and search bias was a net negative, it was hardly the cause of the broad sell-off that caught most investors by surprise. The Nasdaq was overbought, plain and simple.

Like August, September is historically a trickier month to make money in the market and after the torrid August rally, it should be of no surprise if stocks oscillate for the next week to consolidate the market’s gains. As foreign markets lag, the U.S. market continues to be the oasis for capital flows targeting equity ownership. I think this condition will continue to benefit domestic stocks for now even as investors would love to pounce on beaten-down Chinese ADRs and other emerging market ETFs.

On the trade front, Treasury Secretary Steven Mnuchin have stated publicly that they are not willing to talk to China about trade at the moment. The conflict has already had a significant impact on China’s economic performance. A subindex of the purchasing managers’ index (PMI) that measures new export orders contracted for the third month in a row in August, pointing to a gloomy outlook for exporters in the months ahead.

“I’m investing my own money in each and every stock as my AI platform identifies.”

And remember we’re not talking about day-trading here. I’m looking for 50-100% gains inside of the next 3 months, so my weekly updates are timely enough for you to act.

Click Here – To See Where I Put My RoboInvestor Money

Similarly, PMI data for Guangdong showed that manufacturing in the southern province, which is at the heart of China’s export industry, contracted in August for the first time in 29 months. And this is in response to $50 billion in announced tariffs. The notion of another $200 billion in new tariffs on Chinese imports could severely weigh on China’s market as well as that of most emerging markets.

China may further devalue the yuan, down 8 percent since May to help its exports, but too much depreciation could trigger capital flight. “It’s what they’re fearful of,” said Josef Jelinek, senior China analyst at Frontier Strategy Group, speaking to CNBC’s “Street Signs Europe” on Wednesday. “On the one hand, a depreciated currency helps them offset some of these tariffs. But if it falls too far too fast, then investors may get frightened and they could see huge capital outflows, which is exactly what they don’t want right now.”

China’s stock market has retraced 50% of the gains from the 2016 lows and currently sits on key technical support. This could be a terrific entry point if a resolution to the trade impasse or a Waterloo moment for that market if it breaks down from here. A violation of $40 would take the FXI down through its long-term moving average and opens the way to a full retest of the 2016 low $29. Such a breakdown will reverberate heavily among Asian markets, other emerging regions and quite possibly fragile European markets where growth has been slowing.

Beyond the threat of a heightening of the trade war with China, negotiators are working hard into the late evenings to craft a new deal so as to make NAFTA a workable agreement among the U.S., Mexico and Canada. This situation looks like a glass-half-full outcome and any headline detailing a new NAFTA deal will be very well received by the market. Europe is also likely to turn out in favor of a widespread deal being reached while China is going to depend on how that government reacts to new tariffs that could escalate to $506 billion of total Chinese imports to the U.S. This is moving from tit-for-tat to full-scale hardball, and so far, the market hasn’t been concerned. That might change if the full weight of tariffs is levied on China.

Although, in sheer numbers, higher costs on $506 billion of Chinese goods is a small percentage of the $19 trillion domestic economy, the negative psychology associated with the breakdown in the U.S.-China relationship is a potential negative for the market over the near term. However, the inertia of global capital flows into the dollar and U.S. equities will far outweigh the perceived risks of an ongoing trade war with China.

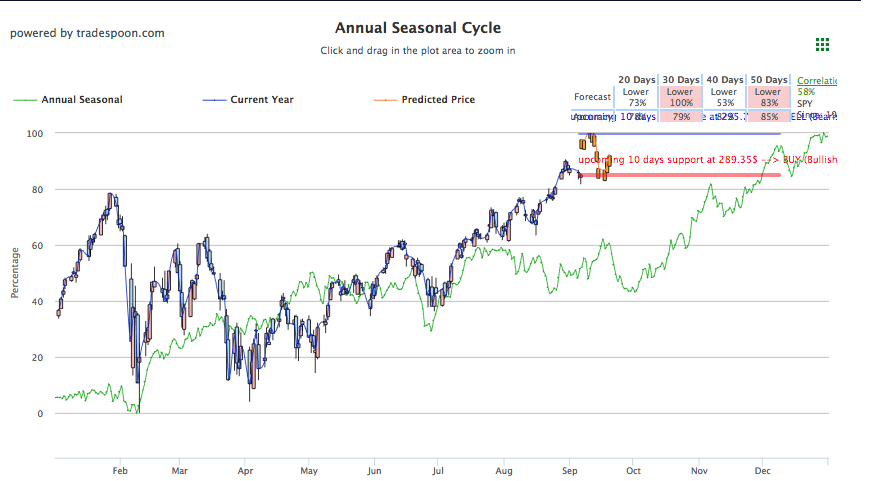

When the emerging markets do right themselves, investors want to be raising their exposure to U.S. multinational companies that are engaged in the biggest emerging markets. One name we’ve added to our RoboInvestor Portfolio recently is Abbott Laboratories (ABT). The company is a huge player in pediatric medicine and is launching no less than 100 new drugs in emerging markets over the next five years that puts it squarely in an enviable position within its peer group. The stock broke out recently to a new all-time high hitting $67.33 and has come in a couple points where we got involved. Additionally, the big pharma sector has been seeing bullish rotation of late and with Abbott Labs being on the receiving end of that rotation.

Source: Barchart.com

While volatility picks up dramatically for the coveted tech sector, my AI platform is steering our attention to other areas of the market where low risk and high return probability is being recognized for steady gains in the weeks ahead against a very choppy investing landscape. Now is not the time to go at it alone, but rather, putting the power of AI to work is, in my view, is essential.

A trap door sell-off in what is a very crowded tech sector can do a lot of damage to one’s portfolio. Of the 15 positions we own in the RoboInvestor portfolio, we are long on just two tech related stocks – Salesforce.com and GrubHub Inc. My AI system had us reaping excellent profits in tech stocks leading up to this week’s tech wreck correction and in good time it will signal to me when to buy back our favorite tech stocks. Until then I’ll be more than content making money for RoboInvestors and myself in non-tech sectors that are enjoying fresh fund inflows. Have a good week investing and watch out for those trap doors.

“I’m investing my own money in each and every stock as my AI platform identifies.”

And remember we’re not talking about day-trading here. I’m looking for 50-100% gains inside of the next 3 months, so my weekly updates are timely enough for you to act.