Alert! Short The Dollar Now With This Strategy

RoboStreet – October 8, 2020

Big Spending Will Pressure The Dollar

No matter what happens on Election Day, what is certain is there is going to be some post-election spending that will inflate the Fed’s balance sheet and national debt to levels that were once thought not possible.

Last week, Fed Chair Jerome Powell maintained the Fed will continue to keep wide open their quantitative easing efforts, but also appealed to Congress to backstop the Fed with further fiscal stimulus. This week has shown there remains a wide divide in getting a sweeping bill passed with a more ala carte approach being forwarded.

As of Thursday, Speaker Nancy Pelosi stated there would be no airline aid unless a more comprehensive stimulus package was passed. So, the back and forth goes on amid political posturing, but the market sees stimulus as an eventuality in the making.

The market’s bullish action of the past few days is pricing in an eventual wave of spending and not necessarily something that has to happen immediately. The market tends to take a longer-range view even though headlines drive short-term swings.

Bigger spending will come in the form of a massive infrastructure deal after the election and is one reason the transportations, industrials, and materials sectors have shown bullish relative strength this week. The analyst community is also raising ratings and price targets for some of the leading stocks within these sectors.

“I’m investing my own money in each and every stock as my AI platform identifies.”

And remember we’re not talking about day-trading here. I’m looking for 50-100% gains inside of the next 3 months, so my weekly updates are timely enough for you to act.

Click Here – To See Where I Put My RoboInvestor Money

The SPY retested the main overhead resistance at $342 level after the president of the United States stated that smaller scale relief package might be passed prior to the elections. This reminds me of the phase one agreement with China. The US Dollar, DXY, sold off after the news of the smaller stimulus package.

On the downside, the $318 level on the SPY is the bottom for the market until the elections and potentially can still be re-tested prior to the elections. Currently, the key support level is at $330, then a hard retest of $318 level is still on the table.

As long as the SPY is trading below the $342 level, key overhead resistance, expect additional volatility. I would be a buyer using any short-term corrections and use a dollar-cost averaging strategy to accumulate positions at this level. A clean break above the $342 level opens the way to a test of $360.

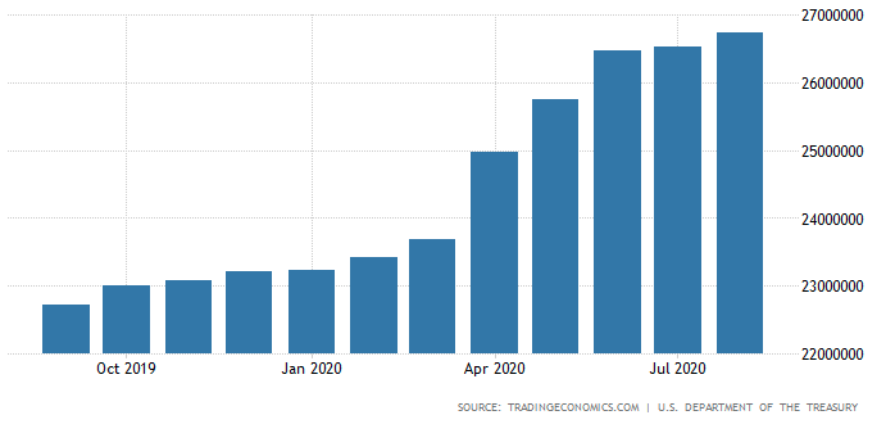

As of last week, the Fed’s balance sheet is currently at $7.1 trillion. Total government debt now stands at $27 trillion (and growing). Gross federal debt equals debt held by the public plus debt held by federal trust funds and other government accounts.

The Congressional Budget Office is on record saying U.S. government debt will nearly equal the size of the entire economy for the first time since World War II, and approaching 100% of GDP, up from 79% in 2019. A $3.3 trillion budget deficit in 2020 created from the pandemic is fueling the soaring debt load.

The weight of future stimulus spending in addition to a big infrastructure spend no matter who wins on November 3 is very likely to cause the dollar to lose value and for Treasury yields to rise as buyers of U.S. debt command to be paid better when the currency is in decline combined with higher projected inflation. The Dollar Index (DXY) rallied in mid-September when the stock market was in short-term turmoil and has since resumed its downside bias.

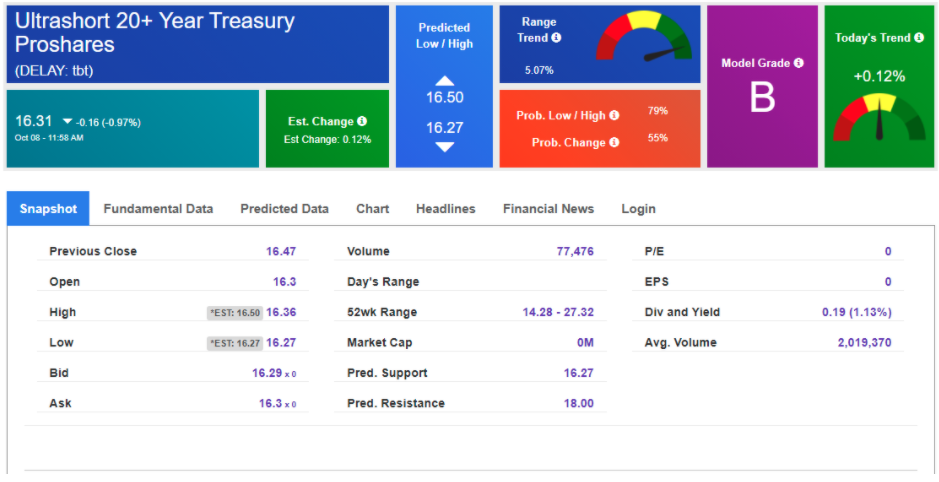

These two forces build a strong case for going long shares of Invesco DB US Dollar Bearish Fund (UDN) and ProShares UltraShort 20+ Treasury ETF (TBT).

Taking into account both these ideas, when we apply our AI models, we get some bullish readings. For the Invesco DB US Dollar Bearish Fund (UDN), when we plug in UDN into our Seasonal Chart we are seeing three out of four “Higher” probability readings for the next 20, 30, and 40-day periods, making for a strong candidate for being added to our RoboInvestor Portfolio.

When we apply shares of TBT to our Stock Forecast Toolbox, we see the stock, currently trading at $16, poised to make an initial move up to $18. Here too, we might be adding UDN to the RoboInvetor Portfolio where I put my money into every stock or ETF that is recommended in the RoboInvestor advisory service.

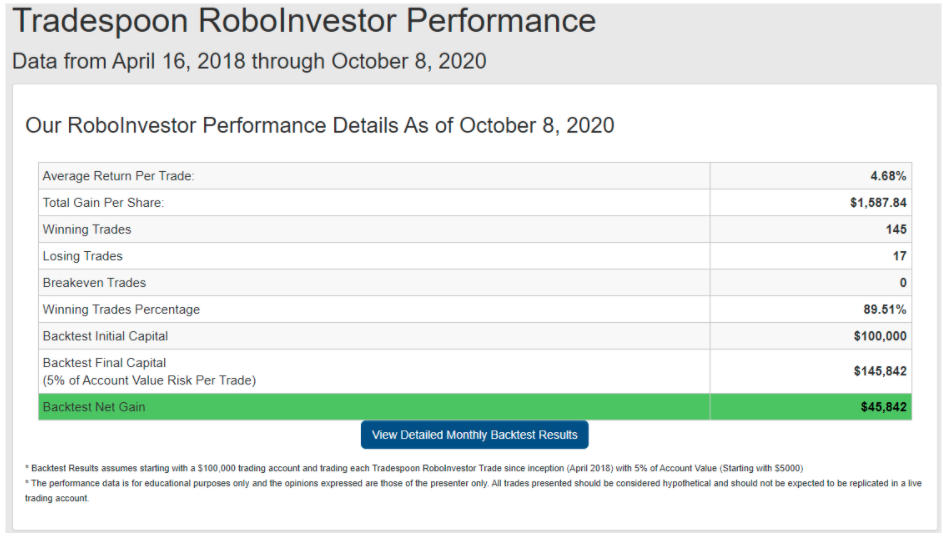

While the market has been indeed volatile this year, RoboInvestor subscribers have enjoyed a strong winning streak going back to April when we recorded the only loss since then. We profit almost 90% of the time we risk capital in the market.

Below is a table of our most recently closed trades and a good example of the kinds of stocks and holding periods we strive to achieve.

Considering the elevated level of uncertainty surrounding the potential outcome of the elections, the prospects of a vaccine that may or may not be well received by the public, rising tensions with China, and forward economic growth, it just makes sense to have a powerful AI platform helping guide and steer your portfolio on a profitable path.

We issue two new recommendations every Sunday for RoboInvestor members to act on come Monday morning. They can be stocks, the sector plays currencies, precious metals, interest rates, volatility, or long/short indexes. Our AI model for investing is unrestrained, generating fresh recommendations every day from which we select what is best suited for the RoboInvestor Portfolio.

Take me up on my offer to have my team and tools come alongside you and your portfolio to produce a big finish to 2020 and beyond. Make RoboInvestor your best trade of the year and let’s grow our wealth together.

“I’m investing my own money in each and every stock as my AI platform identifies.”

“I’m investing my own money in each and every stock as my AI platform identifies.”

And remember we’re not talking about day-trading here. I’m looking for 50-100% gains inside of the next 3 months, so my weekly updates are timely enough for you to act.

Click Here – To See Where I Put My RoboInvestor Money

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.