An Earnings Season Trading Strategy That’s Produced an 81% Win Rate

In prior articles, I’ve discussed how I apply the concept of Post Earnings Premium Crush (PEPC) to produce 80%-150% gains on earnings trades. However, as much as PEPC provides an edge, there’s still some risk of the stock moving more than expected, or in a different direction.

This is the reason that my Earnings360 also employs a more conservative strategy which delivers consistent returns over the course of a four-day period without actually holding the position through the report.

Did You Miss Friday’s EXCLUSIVE Earnings360 Webinar? Click Here for Your FREE Replay Video!

In over 14 quarters, Earnings360 has made 67 Pre-Earnings Premium Expansion (PEPE) trades, achieving an 81% win rate for an average gain of 27%!

The strategy takes advantage of the implied volatility increase that precedes earnings and avoids the actual event altogether. Just as PEPC is predictable, so is the pumping up of premium leading into the event (PEPE).

<The first Earnings Trades begin Tomorrow. Last Chance. Don’t miss Out>

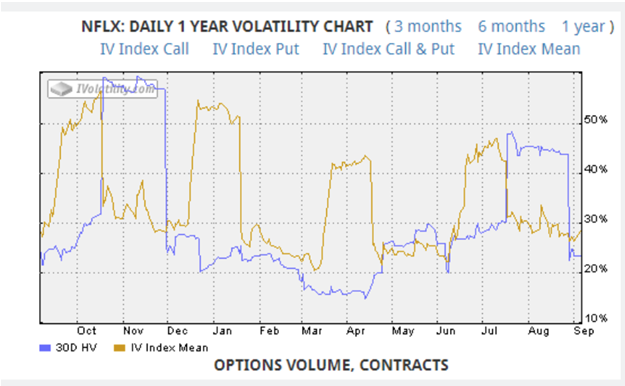

PEPE’s more subtle than PEPC in that it occurs incrementally over the course of many days. Here, you can see Schwab’s (SCHW) implied volatility climb in the days leading up to the earnings release before reverting lower after the report.

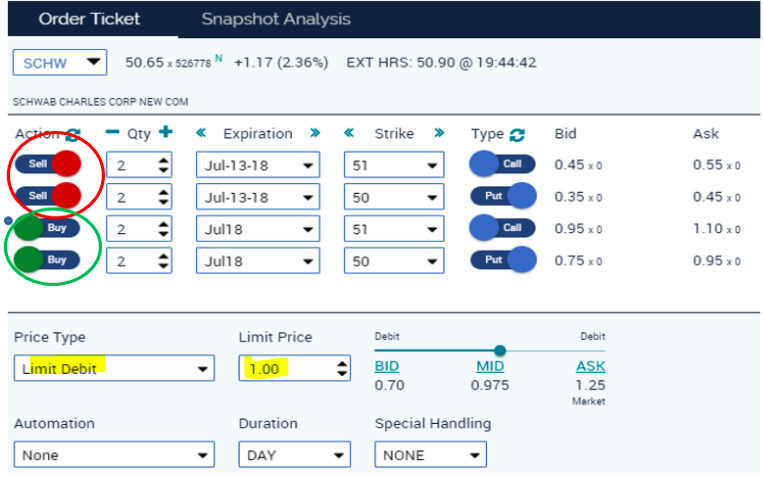

A strategy for taking advantage of rising IV leading into earnings is calendar spread where you sell an option that expires prior to the earnings Simultaneously you are purchasing one that expires after the event. Here, you can see the SCHW order that Earnings360 placed. We sold the weekly puts and calls that precede the earnings report while buying the following week, which contains the report.

[TIME SENSITIVE] Claim Your FREE Earnings360 Replay Video — Before It Is Too Late!

Like any calendar spread, it benefits from the accelerated decay of the nearer-dated options sold short. But, this has the added tailwind of when earnings approach the option, including the earnings, will see it rise, causing the spread value to increase. To keep the position delta neutral, both the put and call calendars should be established.

Earnings360 27% average gain on an 82% win rate

These positions must established in advance and closed before the actual earnings. The profits might not be as dramatic as catching a huge post-earnings move, but they can be substantial. More importantly, they can be consistent and have a high probability. All told over 14 quarters, Earnings360 has made 67 PEPE trades for a 27% average gain on an 82% win rate.

‘If you’re looking for free trading resources… click here’

Plenty of situations in the weeks ahead

With weekly options, there should be plenty of situations in the weeks ahead to take advantage of the rise in IV, leading into earnings, by using the PEPE double calendar strategy as a means of producing consistent 30% returns — without taking the risk of holding the position through the earnings report.

The post An Earnings Season Trading Strategy That’s Produced an 81% Win Rate appeared first on Option Sensei.