Battlegrounds Being Drawn Ahead of 1Q Earnings Season

- The whipsaw action this week has been incredible to watch (and trade) as the bears and bulls try to establish key support and resistance levels ahead of the first-quarter earnings season.

- Tariff news has been the center of attention but that subject could move to the back burner as over 70 countries will now be negotiating with the US for new trade deals.

- The technical outlook remains damaged but could improve if positive earnings and new trade deals are announced throughout the month. This is also assuming there will be some follow thru and higher highs into this Friday’s closing bell.

Volatility has remained elevated throughout the week with Wednesday’s blowout gains clearing key near-term resistance levels. New tariffs of a cumulative 104% tariff rate were implemented on Chinese goods at midnight and ahead of the market’s open which accounted for another round of selling pressure. However, a massive turnaround occurred after President Trump announced a 90-day pause on his reciprocal tariff plans for all countries excluding China.

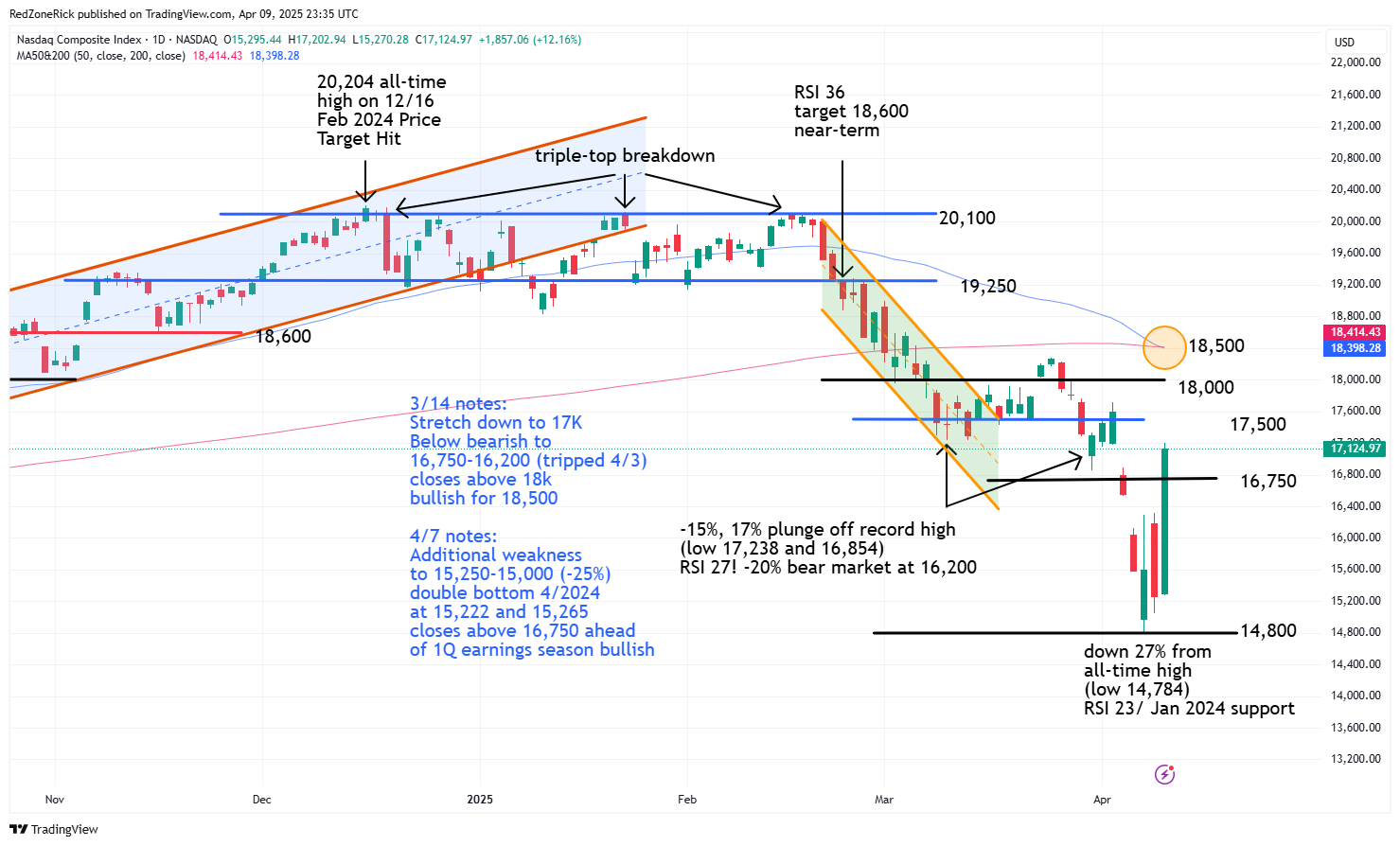

The Nasdaq traded up to 17,202 while settling at 17,124 (+12.2%). Resistance at 17,000 was recovered. Support is at 16,750.

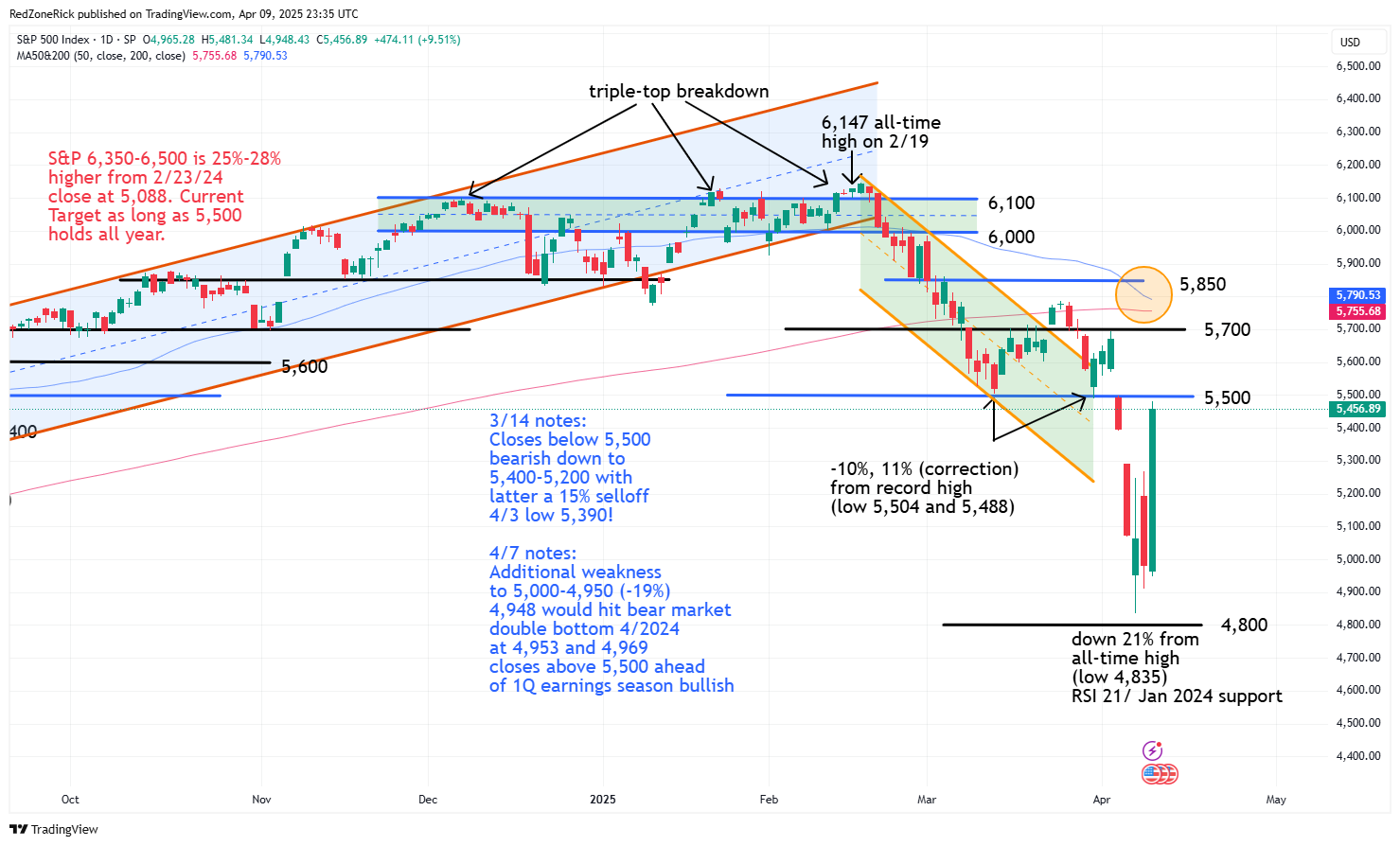

The S&P 500 closed at 5,456 (+9.5%). Resistance at 5,500 held. Support is at 5,400.

The Dow made a run to 40,778 before finishing at 40,608 (+7.9%). Resistance at 40,500 was cleared and held. Support is at 40,000.

Earnings and Economic News

Before the open: Byrna Technologies (BYRN), CarMax (KMX), Lovesac (LOVE)

After the close: None

Economic news:

Initial Jobless Claims – 8:30am

Consumer Price Index – 8:30am

Technical Outlook and Market Thoughts

The whipsaw action this week has been incredible to watch (and trade) as the bears and bulls try to establish key support and resistance levels ahead of the first-quarter earnings season. Of course, tariff news has been the center of attention but that subject could move to the back burner as over 70 countries will now be negotiating with the US for new trade deals.

Wednesday’s gains recovered the previous Friday’s losses for the market with the major indexes within striking distance of erasing last Thursday’s drubbing, as well. We often say the bears like taking the elevator to lower lows while the bulls prefer the steps to higher highs but the velocity of yesterday’s move higher was very impressive.

The technical outlook remains damaged but could improve if positive earnings and new trade deals are announced throughout the month. This is also assuming there will be some follow thru and higher highs into this Friday’s closing bell.

The Russell 2000 tested a high of 1,930 with key resistance at 1,900 getting cleared and holding. We mentioned coming into the week if 1,875 was topped, a gap up to 1,925-1,975 could come quickly. We also said closes back above 2,000 ahead of earnings season, or mid-April, would be slightly bullish. So far, so good for the bulls.

New support is at 1,875-1,850. A close below 1,825 would be a renewed bearish development.

The Nasdaq zoomed past the 16,750 level while easily recovering 17,000. Continued closes above this level keeps a near-term retest to 17,500 in focus.

Shaky support is at 17,000-16,750. A move below 16,500-16,250 would be another warning sign that the recent selling pressure is not over. The 50-day moving average officially closed below the 200-day moving average to form a death cross. This is typically bearish for lower lows down the road.

The S&P fell just shy of reclaiming key resistance at 5,500 and last Thursday’s opening high at 5,499. Continued closes above these levels could lead to a quick trip up to 5,550-5,600.

Support is at 5,400 with stretch down to 5,350. A close below 5,300 would be a warning sign for another round of selling pressure.

The Dow recovered 40,500 with last Thursday’s low at 40,513. Wednesday’s close above these levels implies possible upside towards 42,000 and the 200-day moving average.

Support is at 40,250-40,000 followed 39,750-39,500. Closes back below 39,000 would be a slightly bearish development with backtest potential to 38,500-38,000.

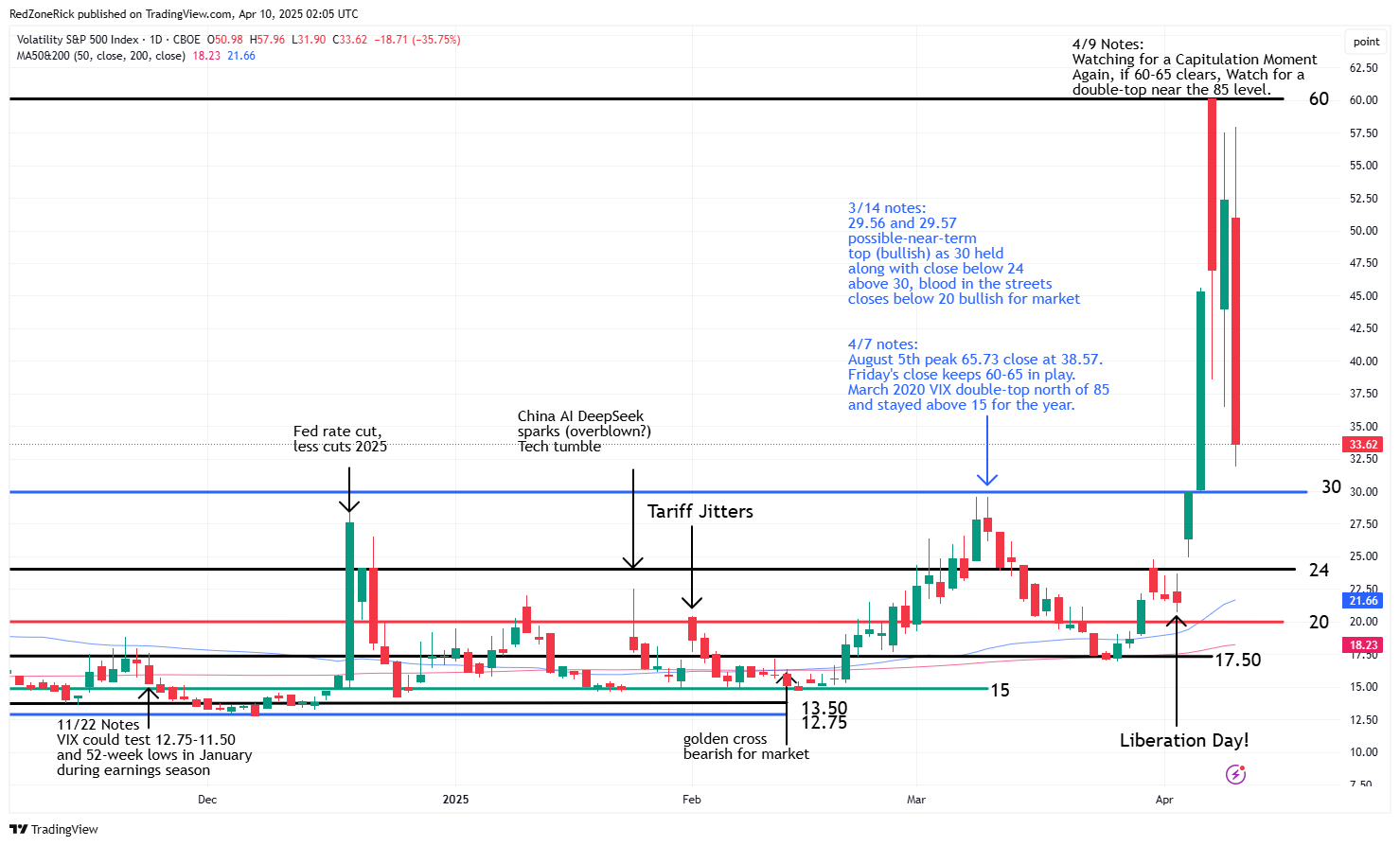

The Volatility Index (VIX) peaked at 57.96 while holding crucial resistance at 60. There is stretch up to 65 with a move above this level leading to another round of panic selling. The plunge to 31.90 afterwards held key support at 30. These two areas, 60 and 30, have defined the past four days of action.

Closes back below 30 this week would help bullish sentiment but that multiple closes below 24-20 are needed before we can start to trust any kind of recovery rally.

We were looking for a capitulation moment this week in the market and we may have gotten it after the pause in tariffs. However, it didn’t FEEL like other times such as the selling pressure during the 2020 covid crisis. In any event, the algorithms starting buying when the Dow and S&P briefly hit bear market territory.

Wall Street will likely need to see more stability in trade policy for any market bounce to have legs and the VIX remains at a very high level.