Bracing for the Inevitable August Pull Back

RoboStreet – August 9, 2018

Protecting and Hedging an Overbought Market

It was only ten trading sessions ago the Nasdaq tanked 300 points in 48 hours when it was thought that the FAANG stocks had hit a wall after two members’, Netflix and Facebook, shares were slammed after failing to live up to Wall Street’s second quarter expectations. Since that time both Amazon.com and Apple have traded to new all-time highs with Alphabet/Google not behind to refortify the FAANG trade. As a result, the S&P 500, Nasdaq and Russell 2000 are all within 10 points of posting new record highs with only the Dow lagging primarily due to a very strong dollar.

It’s an incredible snapback rally with the tech sector fully leading the way, in large part due to Apple, Amazon, and Microsoft, the three top weightings in the Nasdaq making up 31.26%. The top ten holdings make up 55.69% of the index. They include Alphabet/Google (A&B), Facebook, Intel, Cisco Systems, Netflix and Comcast.

Knowing these top ten components are responsible for doing the heavy lifting, I say with some level of certainty that of the top ten holdings only Apple, Amazon, Microsoft and Alphabet/Google are technically strong while at the same time very overbought on a short-term basis. So, with the Nasdaq trying to establish a new all-time high, it is doing so on four of the most crowded trades within the entire market, and at prices where each of this fab four are already technically extended and are elevating on declining daily volume.

In my view, this is a recipe for a mid-August pull back in the tech-rich Nasdaq. Because the S&P 500 is much more diverse in weighting it might hang in better, but is still vulnerable.

“I’m investing my own money in each and every stock as my AI platform identifies.”

And remember we’re not talking about day-trading here. I’m looking for 50-100% gains inside of the next 3 months, so my weekly updates are timely enough for you to act.

Click Here – To See Where I Put My RoboInvestor Money

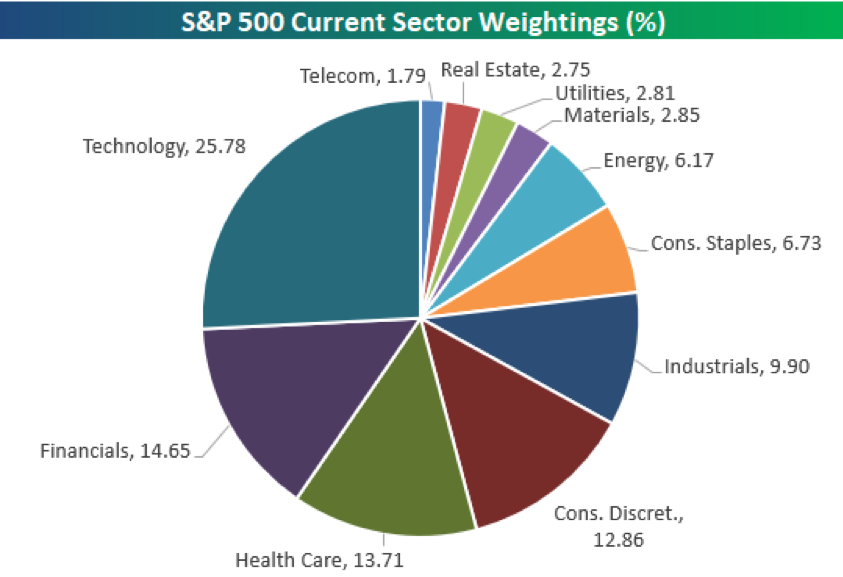

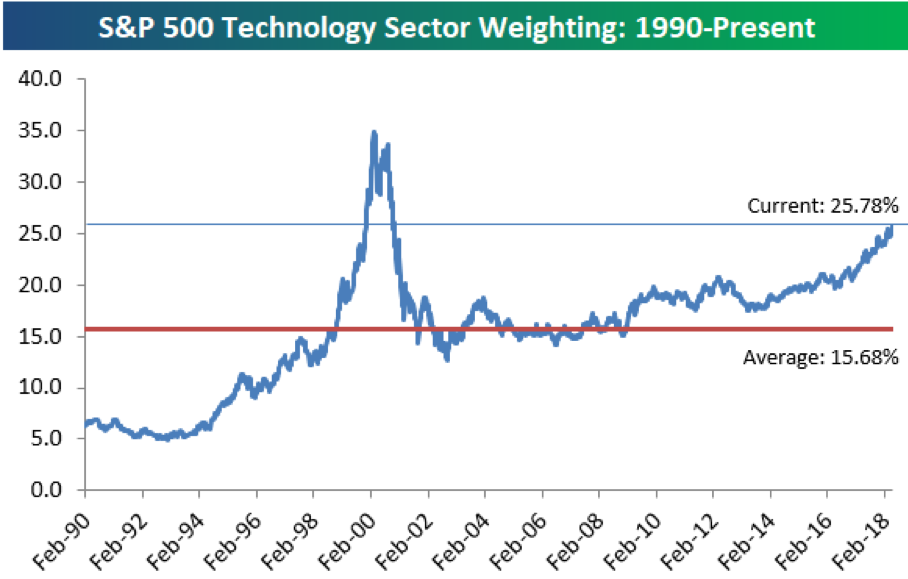

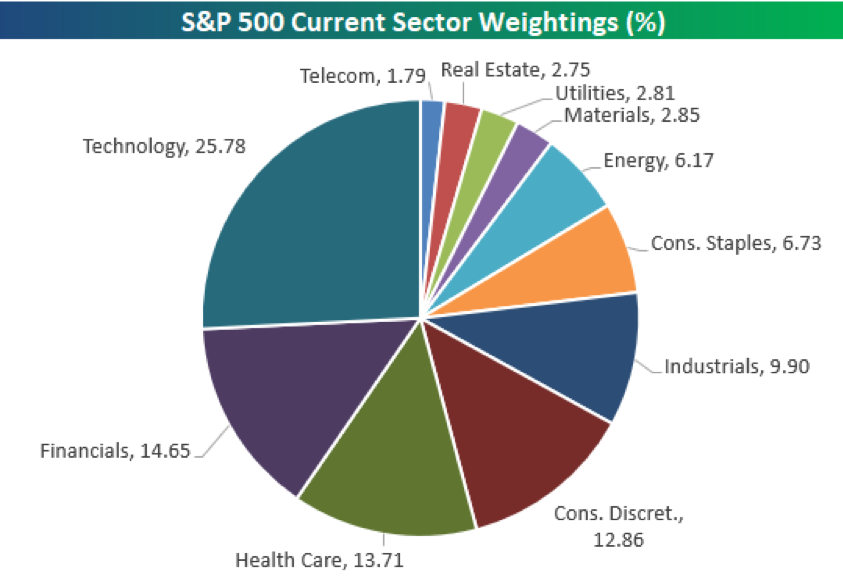

Over time the S&P 500 Technology Sector weighting has increased, only being exceeded by the 2000 crash when the sector was 35.0% of the S&P. Its average going back 30 year has been about 15.7%, so here again Wall Street’s love affair with technology has the market’s benchmark index depending heavily on the tech sector.

Back when investors were partying like it’s 1999 many of the company’s that comprised the Nasdaq were trading at ridiculous valuations that have only grown into more responsible Price Earnings Ratios. When the Nasdaq peaked in 2000, the list of the top 15 stocks in the index includes several of today’s larger components. Microsoft was king, Cisco, Intel, Oracle and Dell. Sun Microsystems was acquired by Oracle for $7.4 billion, which sounds measly by today’s market cap valuations.

Qualcomm and Applied Materials have since thrived with Yahoo! being sold to Verizon last year for $4.48 billion after years of declining revenue. Veritas Software merged with Symantec in a deal valued at $13.5 billion. Juniper Networks is still around. Uniphase split into two companies Viavi Solutions and Lumentum Holdings, both of which trade today and are doing well whereas Sycamore Networks, Palm Inc. and Internet Capital Group went from tens of billions in valuations to zilch.

I thought it might be interesting to take a trip down Memory Lane, but it just goes to show how even relatively trusted list of stocks can get overheated relative to historical value and while forward earnings growth looks good, the Nasdaq is trading at the upper end of its historical range and could easily provide for a mid-August pull back that refreshes the longer-term bull trend.

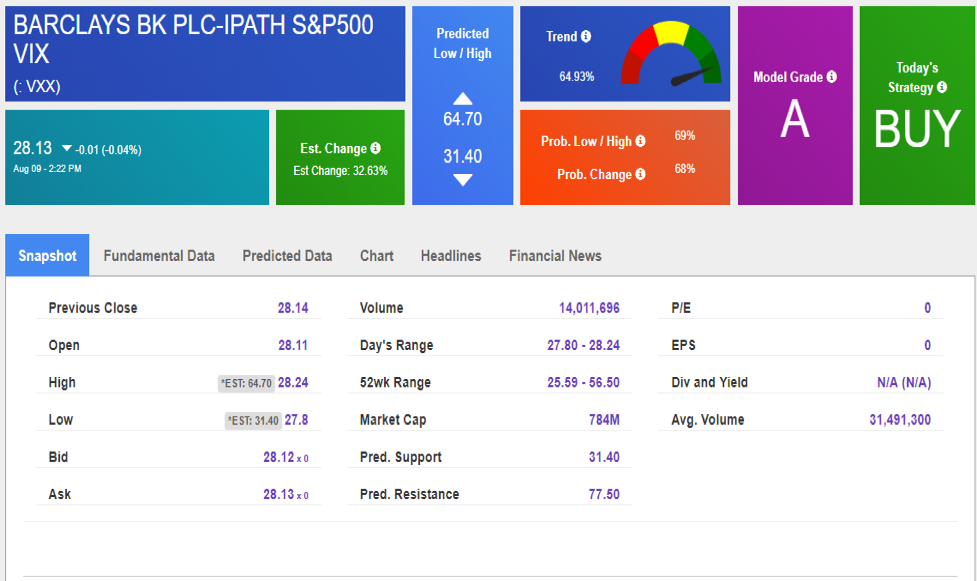

I recently put out a report on market volatility that illustrates the use of either buying calls on the CBOE Volatility Index (VIX) or buying shares of the Barclays Bank PLC iPath S&P 500 VIX Short-Term Futures ETN (VXX). For those investors seeking an unleveraged hedging tool to utilize, they can work with the ProShares Short S&P 500 ETF (SH), which represents a 1:1 inverse relationship with the SPDR S&P 500 ETF Trust (SPY). And while there are a slew of other portfolio hedging options and straight out bearish instruments to choose from, these are what I gravitate to if I’m looking to short the market or put on some protection.

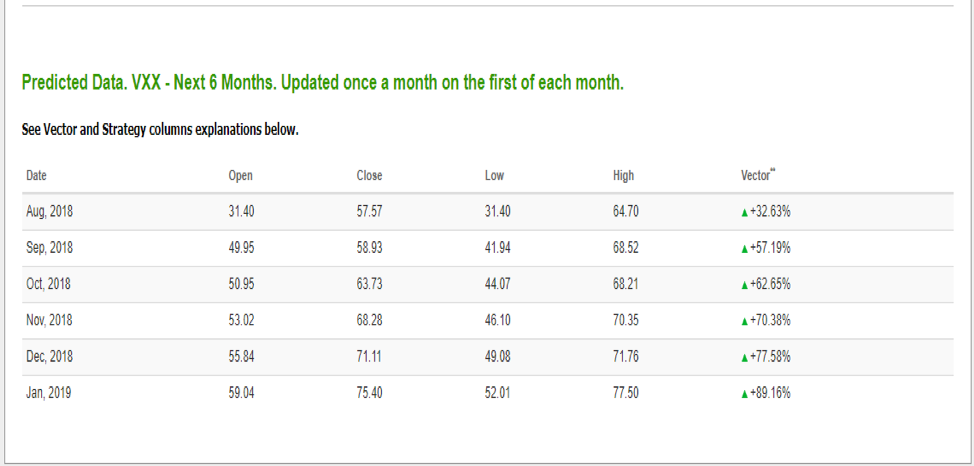

Looking at the Stock Forecast Toolbox, my AI platform is flashing a buy signal to go long the VXX with the model predicting market volatility to rise over the balance of the year. One never knows when the Teflon bull market will pay closer attention to other inherent risks, but with the VIX trading below 11.0 this week, there is widespread complacency among investors, which usually results in a bout of profit-taking.

The risk/reward proposition of laying on a market hedge looks attractive to me and for RoboInvestors, we’ve already added portfolio insurance in the event the market decides to consolidate. And though the Nasdaq has rallied about 4% during the past two weeks, it has done so on low volume. Check out RoboInvestor and follow my lead on when and how to manage market volatility. It might cost a little bit of money up front, but could save a ton of portfolio valuation later. Volatility is about to make a comeback and fortunately RoboInvestor has your back.

“I’m investing my own money in each and every stock as my AI platform identifies.”

And remember we’re not talking about day-trading here. I’m looking for 50-100% gains inside of the next 3 months, so my weekly updates are timely enough for you to act.