Bulls Back to Pushing Record Highs

- Coming into the week, the major indexes were flashing overbought RSI (relative strength index) levels at 70 and above. Monday’s volatile session and pullback helped ease some of the froth but Wednesday’s return to higher highs is keeping the action elevated.

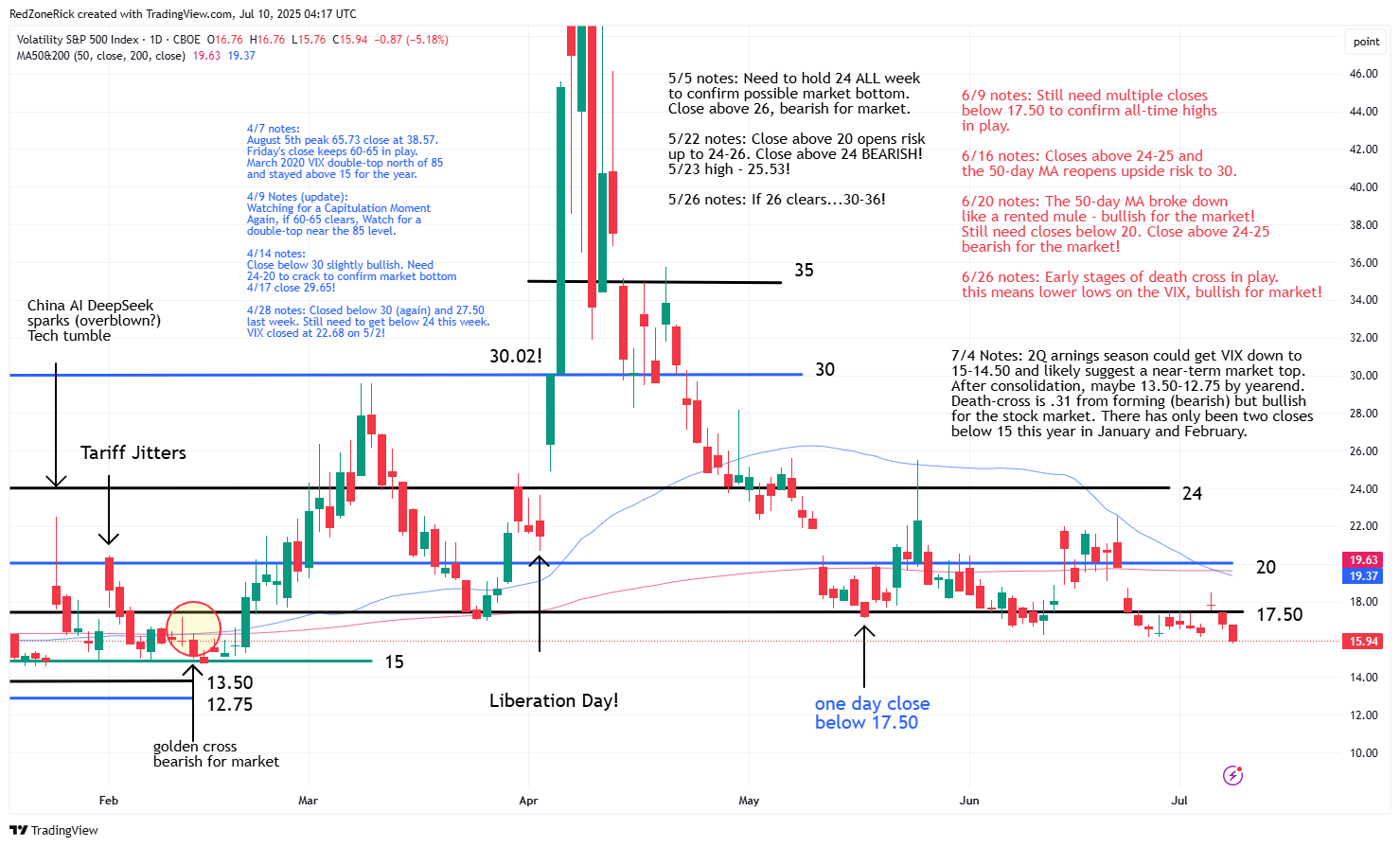

- Near-term support levels and the readjusted uptrend channels have been holding all week. Volatility tagged a fresh multi-month low on Wednesday. All signs are still pointing to higher highs and our near-term price targets.

- The second-quarter earnings season gets underway next Tuesday morning (July 15th) with a number of big players in the Financial sector announcing numbers. Netflix (NFLX) will report earning after next Thursday’s closing bell. The results and how the market responds should give us a good clue on how the next few weeks will unfold.

The stock market showed strength for the second-straight session following Monday’s slight selloff on trade deals and tariff tantrums. The rebound has pushed fresh weekly and all-time highs for the major indexes with the technical outlook remaining bullish.

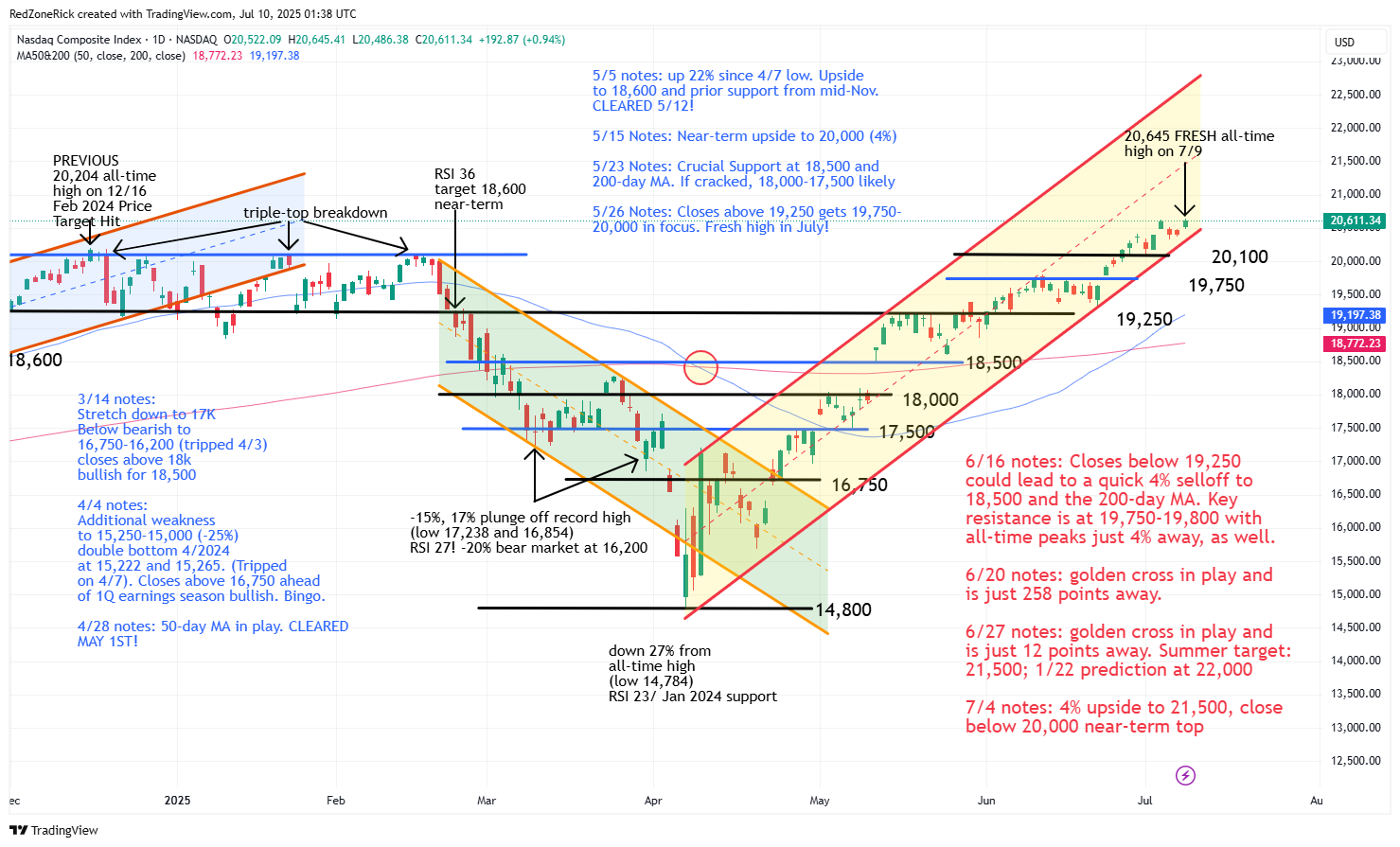

The Nasdaq hit a record high of 20,645 before ending at 20,611 (+0.9%). Undefined key resistance at 20,750 held. Support is at 20,350.

The S&P 500 closed at 6,263 (+0.86%) with the peak at 6,269. Resistance at 6,250 was cleared and held. Support is at 6,200.

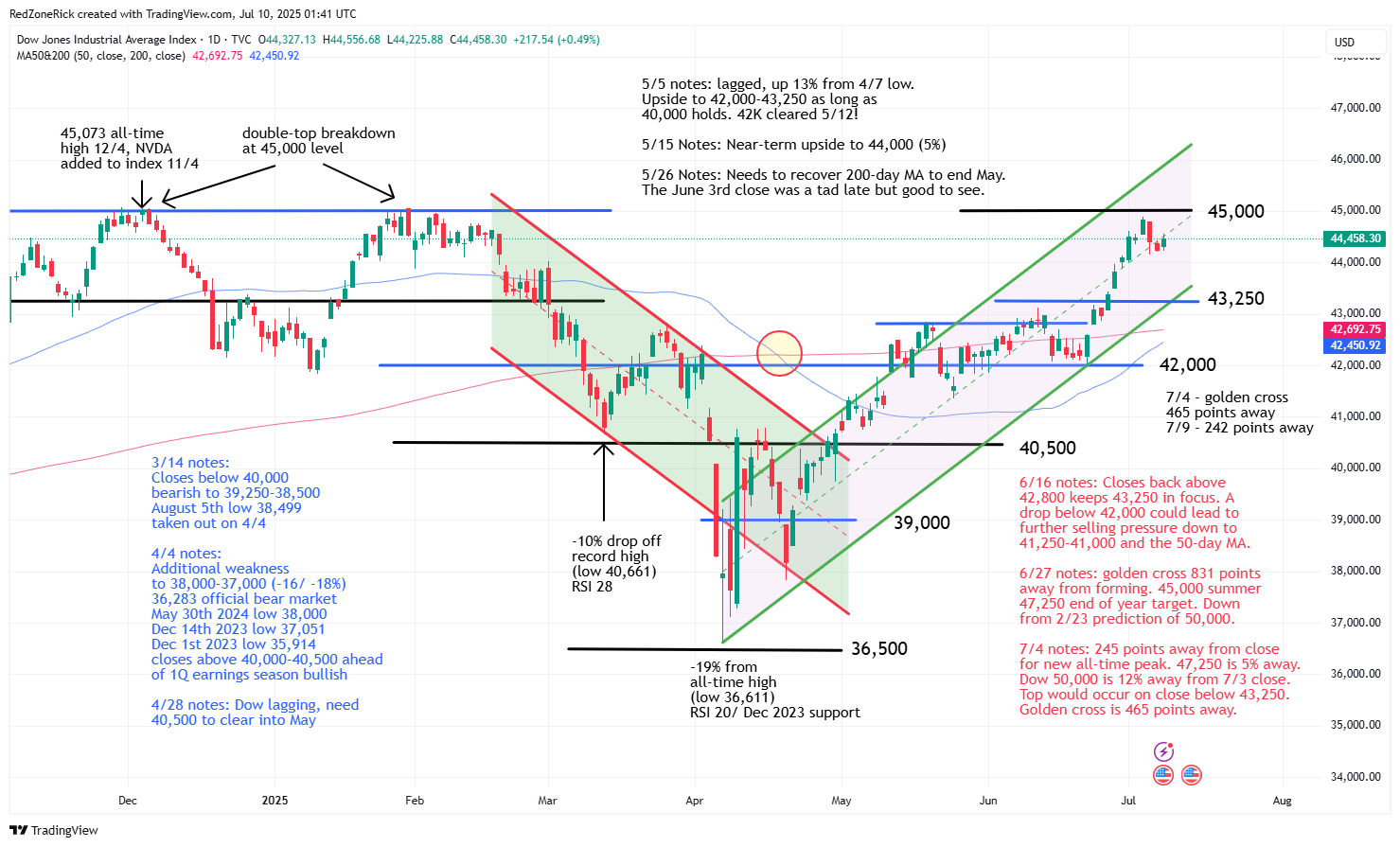

The Dow made a run to 44,556 while settling at 44,458 (+0.5%). Resistance at 44,750 was recovered. Fresh support is at 44,250.

Earnings and Economic News

Before the open: Delta Air Lines (DAL), Conagra Brands (CAG), Simply Good Foods (SMPL)

After the close: Levi Strauss (LEVI), PriceSmart (PSMT), WD-40 (WDFC)

Economic news:

Initial Jobless Claims – 8:30am

Technical Outlook and Market Thoughts

Coming into the week, the major indexes were flashing overbought RSI (relative strength index) levels at 70 and above. Monday’s volatile session and pullback helped ease some of the froth but Wednesday’s return to higher highs is keeping the action elevated.

As of Wednesday’s close, the RSI on the Dow closed at 66; the Nasdaq at 69; the S&P 500 at 70; and the Russell at 68. We mentioned RSI readings can get stretched into the 80’s and all of the major indexes pushed this area last June and July. In fact, the Dow’s RSI peaked near 85 last summer.

History can often repeat itself and the setup for another 4% run from current levels would likely get RSI into the 80’s across the board. Some investors might be waiting for a near-term pullback based on overbought conditions but a stock or an index can also stay elevated for weeks and even months. This is why we do the homework.

Near-term support levels and the readjusted uptrend channels have been holding all week. Volatility tagged a fresh multi-month low on Wednesday. All signs are still pointing to higher highs and our near-term price targets.

The Nasdaq is on track to push undefined and lower resistance at 20,750-21,000 over the few weeks. Our near-term target is at 21,500 and represents another 4% of upside for the index at current levels.

The bottom of the uptrend channel has moved up 20,500. A close back below 20,100-20,000 would suggest a near-term top with downside risk towards 19,750.

The S&P 500 came within 15 points of last Thursday’s record high at 6,294. Our Price Targets for the index from February 23rd are at 6,350-6,500 and represent another 2%-4% upside.

The bottom of the uptrend channel is at 6,200 and key support. A close below this level would likely lead to a retest to 6,100-6,050.

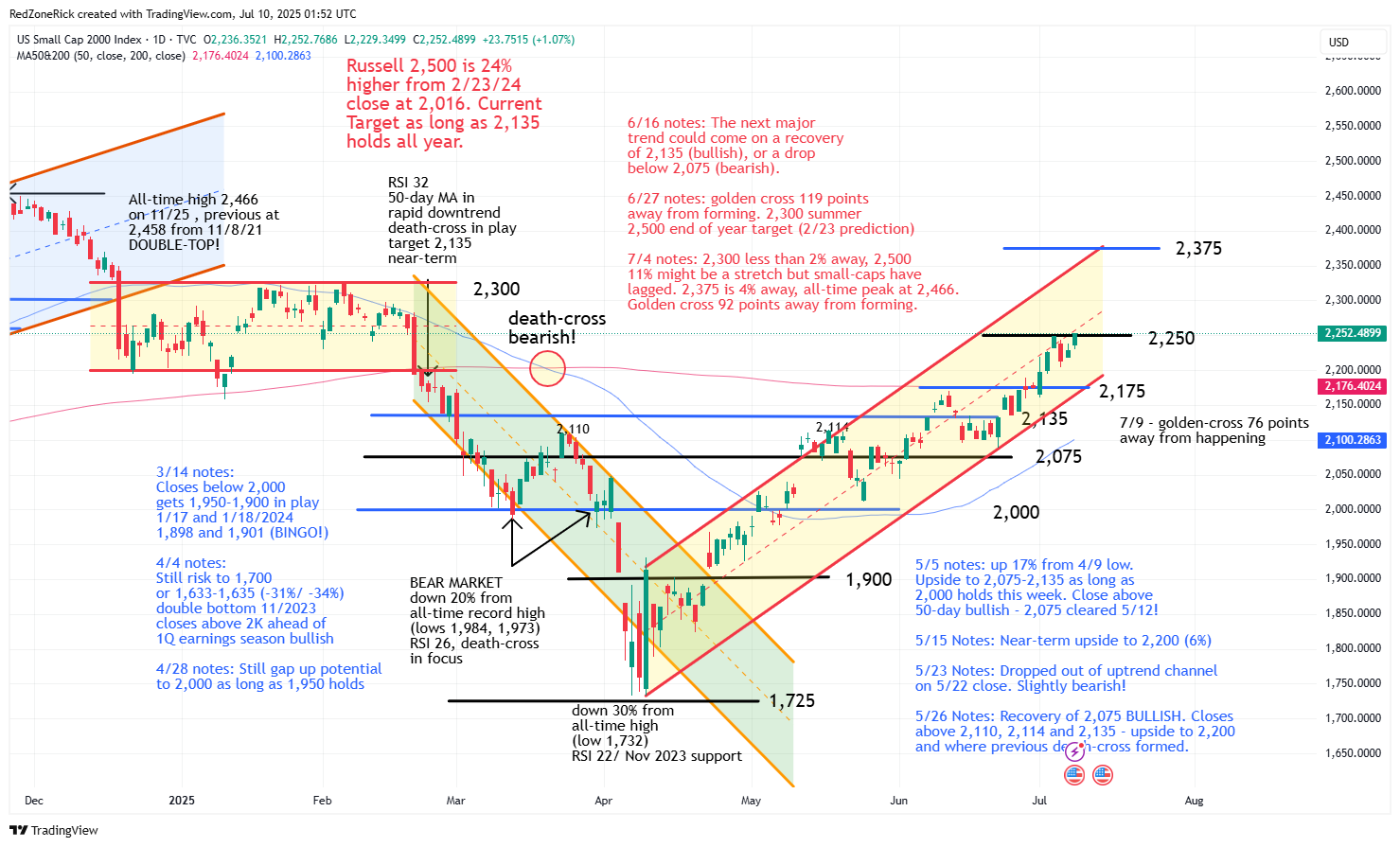

The Russell 2000 is just below the middle of its adjusted uptrend channel with key resistance at 2,250 getting cleared and holding. The close on the session high was a bullish signal and gets 2,300 in focus. Our summertime target is at 2,375 and is 5% away from Wednesday’s close. A golden cross is 76 points away from happening for the small-caps.

The bottom of the uptrend channel remains at 2,175 and the 200-day moving average. A move below this level could lead to further weakness back down to 2,135.

The Dow is just below the middle of its uptrend channel and is 242 points away from forming a golden cross. Our near-term target is at 47,250 on continued closes above 45,000 and last December’s lifetime top at 45,073. This would represent another 6% pop for the blue-chips from Wednesday’s close.

Support is 44,250-44,000 with the bottom of the uptrend channel at 43,500. A drop below 43,250 would likely suggest a near-term top.

The Volatility Index (VIX) tagged a new multi-month low at 15.76 with fresh and upper support at 16-15.50 getting breached and holding. A move below the latter gets 15-14.50 in play.

Resistance is at 17.50 and a level that has been holding in nine of the past 10 sessions. A close above 20 and the 50/ 200-day moving averages would be a bearish development for the market.

A death cross has officially formed with the 50-day moving average now below the 200-day moving average. This technical indicator is implying lower lows for the VIX over the near-term and an ongoing bullish signal for the market.

The second-quarter earnings season gets underway next Tuesday morning (July 15th) with a number of big players in the Financial sector announcing numbers. Netflix (NFLX) will report earning after next Thursday’s closing bell. The results and how the market responds should give us a good clue on how the next few weeks will unfold.