Buy Alert! Bullish Reversal In Emerging Market ETF

RoboStreet – January 13, 2022

Weaker Dollar Triggers Rally In Emerging Markets

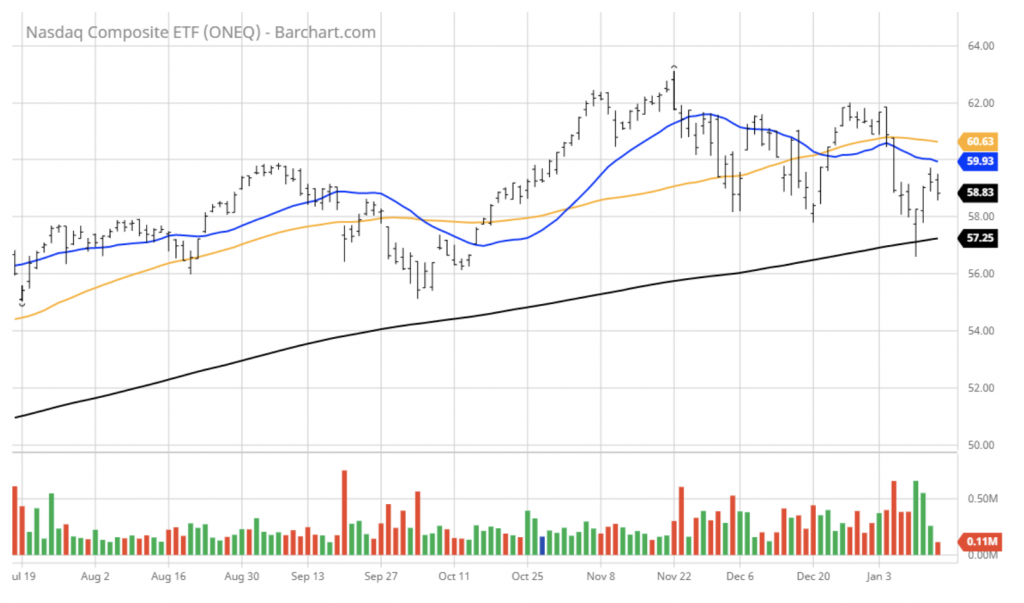

The three-day rally for the Nasdaq off of its 200-day moving average ran out of steam yesterday after the second inflation data point was released, showing further upside pressure on prices at the wholesale level. Treasury yields are inching higher across the curve and the Nasdaq Composite hit up against its 20-day moving average where the price action turned negative. Hence, a retest of the recent low looks highly probable in the next week that should set the stage for a rally into earnings season.

Rotation out of high price-to-sales stocks continues to be the focus of the selling but is also dragging the mega-cap FAANG, MSFT, ADBE, NVDA leaders into the selling wave that has rewarded energy, financials, materials, and even consumer staples. Investor sentiment has concluded that the yield on the 10-yr Treasury is going up to 2.0% from its current level of 1.73%.

If this assumption holds true, then the Nasdaq will continue to underperform the Dow and S&P 500 until the market is convinced yields have topped out where stock multiples will stop contracting regardless of strong earnings. It’s just how markets work and no one wants to battle the tape when the tide is going out.

Conversely, the S&P looks fine, and is only 1% off its high, supported by strong bids under the noted above that are on the receiving end of strong fund flows. The Fed has pivoted aggressively and the market is adjusting according to the new narrative.

“I’m investing my own money in each and every stock as my AI platform identifies.”

And remember we’re not talking about day-trading here. I’m looking for 50-100% gains inside of the next 3 months, so my weekly updates are timely enough for you to act.

Click Here – To See Where I Put My RoboInvestor Money

The $SPY is lagging, closing at $471, and right on the previous breakout at $471. The value/reflationary fell short of the $SPY by closing flat; it reached a new all-time high. The technology is heading up toward 50 DMA; it’s now up 0.4% just above the key long-term support level at $380.

The $DXY was under pressure and broke down at $95 above the key long-term breakout level of $94.5. The $TLT closed lower, down 0.3%, and closed below the 200 DMA. The $VIX traded lower, at 17 levels.

The $SPY short-term support level is at $456 (key short-term support) followed by $450. The SPY overhead resistance is at $472.

After the recent rebound, the Technology stocks broke the long-term bull trend. The $QQQ can continue the recent rebound and potentially reach 50-DMA, best case scenario the December highs. I would be a seller of the high beta stocks into the rallies and continue rotating the portfolio into the value stocks ($XLE, $XLI, and $XLF). Since the DXY broke the long-term bull trend, I would accumulate $EEM, $XME, $SLV, $FCX).

The $VIX has never reached the “extreme” levels one should expect another retest of recent lows in the next 2-3 weeks.

I would consider rebalancing my portfolio at this time and have an overall market NEUTRAL portfolio. I do expect potential sharp pullbacks (10-15%) followed by a rebound in the next 2 months.

If you are trading options consider selling premium with March and April expiration dates. Based on our models, the market (SPY) will trade in the range between $450 and $480 for the next 2-4 weeks.

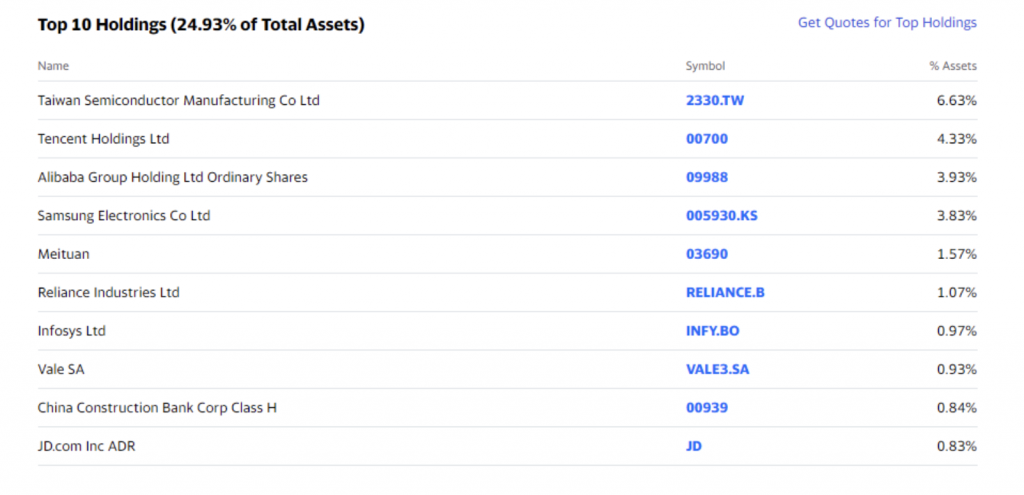

The most notable rotation popping up on my screens is the move out of the dollar and into emerging markets. A weaker dollar pulls money out of U.S.-based assets and into emerging markets that are seeing great demand and pricing power for commodities of all kinds as well as major providers of manufacturing outsourcing.

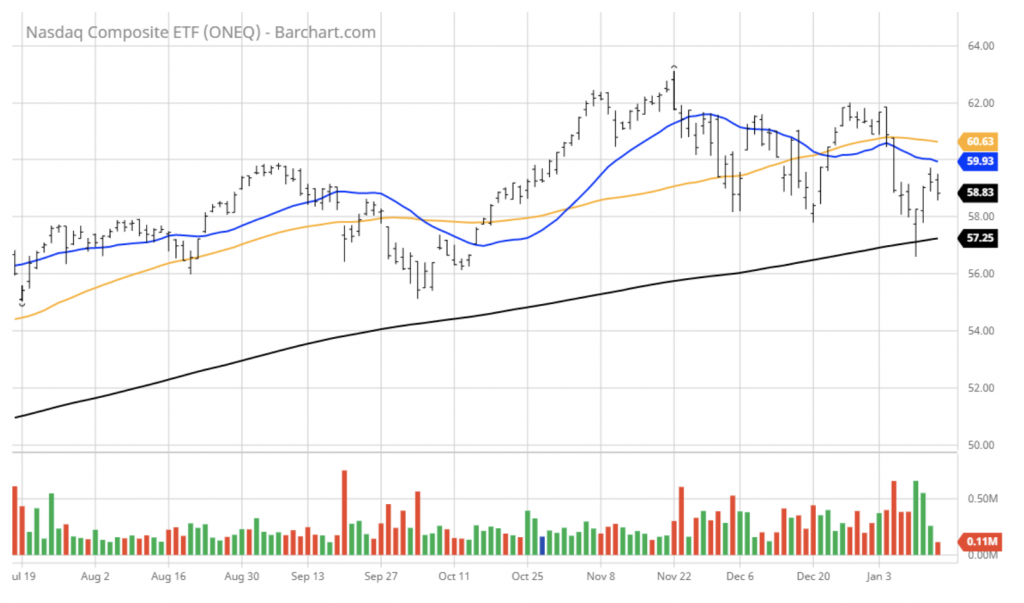

The iShares MSCI Emerging Markets ETF (EEM) is an attractive way to own the emerging market sector with Taiwan Semiconductor Manufacturing Inc. (TSM) as its top holding after the company reported excellent sales, earnings, and raised guidance yesterday.

Our RoboInvestor advisory service utilizes our proprietary artificial intelligence platform to identify and analyze the highest-quality trades in both ETFs and stocks. I’ve been honing the algorithms that drive the platform for years so as to constantly improve the selection process for our members. Trading and investing without AI in this day and age is like stepping into a boxing arena to fight with one hand tied behind your back.

One of our AI-driven tools, the Seasonal Chart, shows an early buy signal being triggered for the next 20 days following a protracted period of steady selling. At least over the next month, this rotation looks bullish per our readout, and confirmation of the reversal will show up in future “Higher” readings for the next 30, 40, and 50-day periods if, in fact, a trend is in place.

From the chart below of EEM, one can see how bullish the current price action is, however, there has been a series of false breakouts in prior months, so we need to pay special attention to whether this is the genuine reversal that builds on itself.

Based on my work, I believe this is the bullish pivot investors have been waiting for and that EEM shares will surge higher in the weeks and months ahead against a weaker dollar and the prospects for a global economic recovery post-Omicron. Under this scenario, it would highly behoove readers of this column to become members of RoboInvestor before we add this trade to our model portfolio.

Within the RoboInvestor service, our AI platform helps us craft a portfolio of blue-chip stocks and ETFs of indexes, sectors, sub-sectors, commodities, precious metals, currencies, interest rates, and volatility. It’s an unrestricted model that may have us go long Microsoft and short the Russell 2000. It just depends on where the best risk/reward ratios are that carry the highest probability ratings for profit potential.

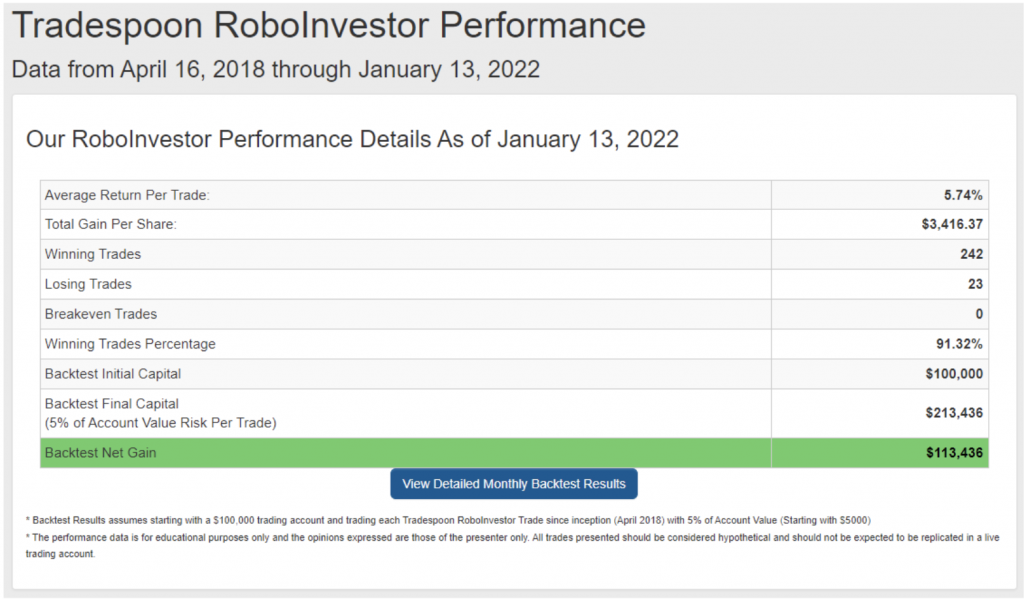

Our winning trades percentage going back almost three years since launching the service is 91.32% – a track record that stands on its own.

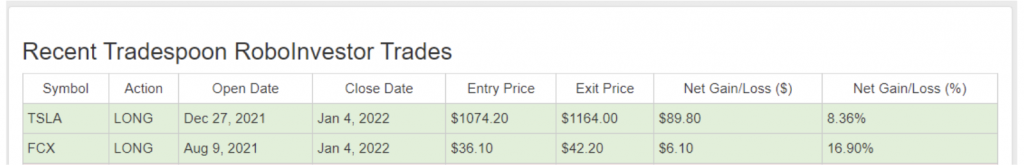

As an example, we recently closed out these two trades for our RoboInvestor portfolio.

Seeing as how market conditions have become considerably more difficult with the sudden change in Fed policy, having the power of AI at work in one’s portfolio is an excellent way to help navigate 2022 and beyond. My team does all the work and members simply follow my lead. I invest my own capital in every trade recommended, so I’m on the same journey to building wealth with blue-chip trades combined with a well-managed risk profile. Make RoboInvestor your best trade for January, and let me be the first person to welcome you aboard!

“I’m investing my own money in each and every stock as my AI platform identifies.”

And remember we’re not talking about day-trading here. I’m looking for 50-100% gains inside of the next 3 months, so my weekly updates are timely enough for you to act.

Click Here – To See Where I Put My RoboInvestor Money

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.