Buy Alert! China Ecommerce Giant Breaking Out

RoboStreet – October 1, 2020

Stocks Rally With Stimulus Bill and Earnings Season On Deck

The bulls are re-asserting themselves as the fourth quarter gets off on an upbeat tone of optimism surrounding a pending stimulus bill and the prospect of a better-than-forecast third-quarter earnings season. Hopes are running high for both factors to power the markets back up to previous highs last seen in early September.

The market continued to push higher and the SPY has retested the $339 level which corresponds to the February 2020 highest level, right before the sell-off due to the pandemic started. Short-term, the market is overbought, and due for a pullback, potentially retesting recent lows (small probability event).

SPY should retest and break the $342 level in the next two weeks

The DXY continues to pull back off its recent rally attempt. The SPY should retest and break the $342 level in the next two weeks. The upcoming September unemployment numbers can potentially break the SPY from the $320-344 range.

(Want free training resources? Check our our training section for videos and tips!)

“I’m investing my own money in each and every stock as my AI platform identifies.”

And remember we’re not talking about day-trading here. I’m looking for 50-100% gains inside of the next 3 months, so my weekly updates are timely enough for you to act.

Click Here – To See Where I Put My RoboInvestor Money

$318 level on the SPY is the bottom for the market until the elections

On the downside, the $318 level on the SPY is the bottom for the market until the elections. The SPY should break the $342 level in the next two weeks. I would be a buyer using any short–term corrections and use a dollar-cost averaging strategy to accumulate positions at this level. The SPY should continue to rebound the first two weeks of October with shallow corrections.

As uncertainty is running high here in the U.S. with a lot on the line per the election cycle, there is more clarity in the economic recovery in China where politics is never really a talking point. Recent data out of China shows that economy seeing decent momentum heading into the fourth quarter, led by an uptick in factory activity and consumer spending. Retail sales turned positive in August for the first time this year after slowing down this summer behind coronavirus shutdowns and concerns.

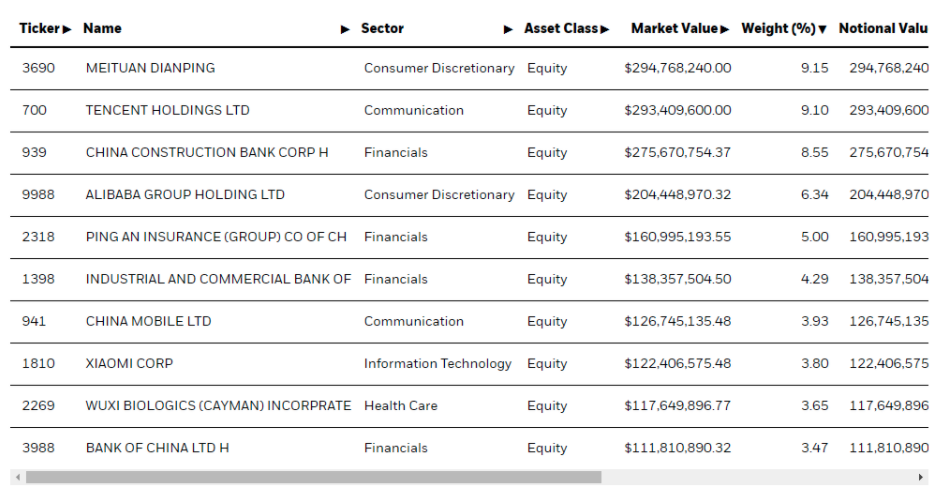

The most widely-held vehicle for tracking China’s market is the iShares China Large-Cap ETF (FXI) with over $3.2 billion in assets. The top ten holdings are skewed towards consumer discretion, communications, and financials.

Shares of FXI used to have a much bigger weighting in manufacturing, but as China’s economic policy has moved toward a consumer-based economy, the makeup of its composition is decidedly more retail and online oriented to reflect this transition.

(Want free training resources? Check our our training section for videos and tips!)

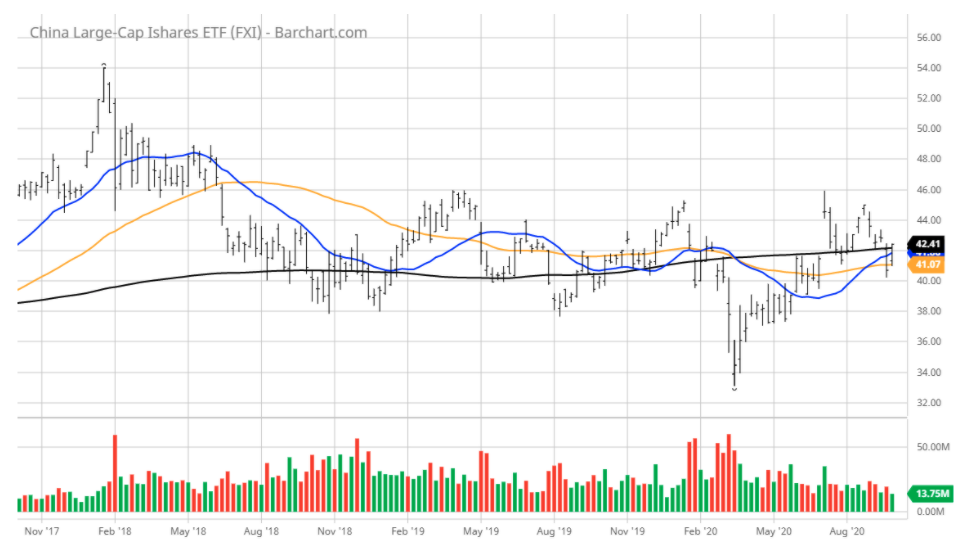

FXI on the verge of retaking its 200-week moving average

The 3-year chart shows FXI is on the verge of retaking its 200-week moving average that would be a very bullish event, and considering the top holdings within FXI, I expect this event to be a matter of when and not if.

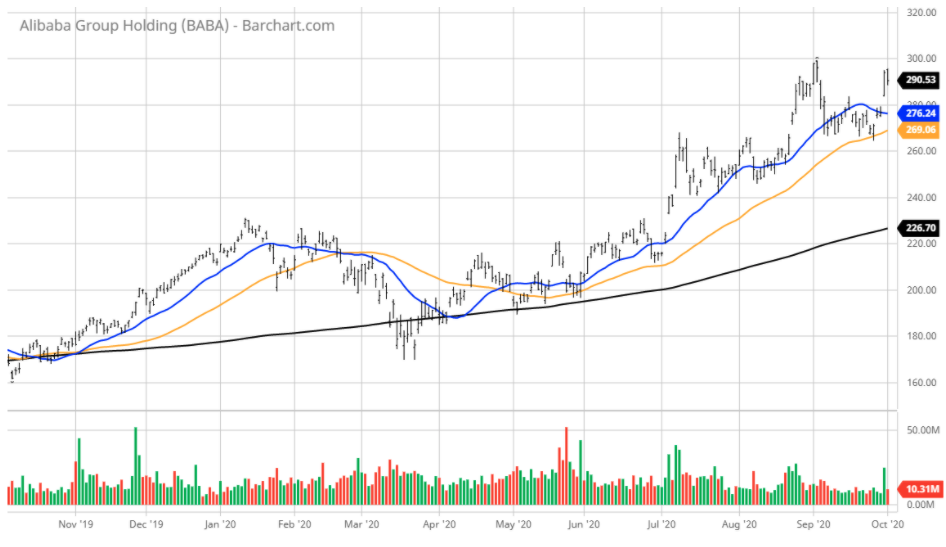

Of the biggest positions held in FXI, shares of Alibaba Group Holding Ltd. (BABA) as the lodestar of the fund. As the premier online B2B and consumer eCommerce platform in greater China, BABA is a favorite holding among fund managers and retail investors alike, sporting a $728 billion market cap.

Coined the Amazon of China, Alibaba is putting up similar growth rates to is U.S. counterpart. For 2020, sales are expected to jump by 35% and approach $99 billion with earnings to climb by 23% to $9.30 per share.

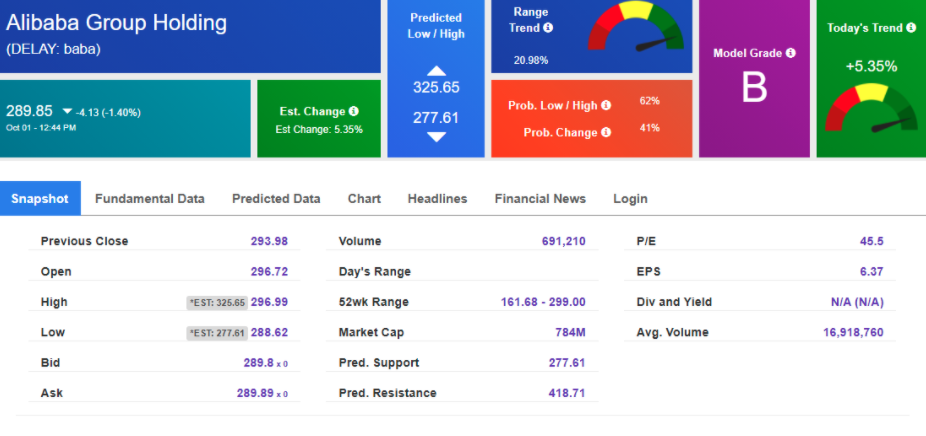

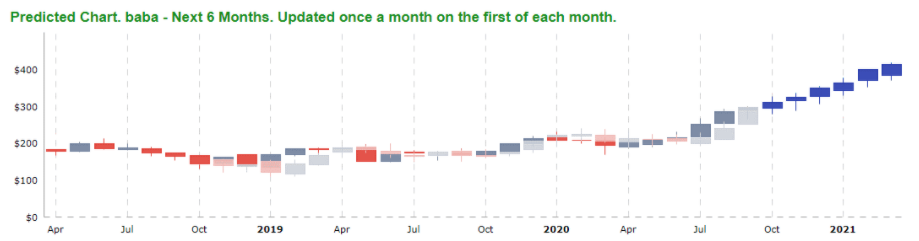

Our AI tools gives 44% higher value than where BABA currently trades at $290

When we apply our AI tools to shares of BABA, the Stock Forecast Toolbox gives the stock a “B” Model Grade with a six-month price target of $418.71 which is about 44% higher than where the stock currently trades at $290. That’s a powerful move and one that we’ll very likely be participating in through our RoboInvestor advisory service that owns a blue-chip set of holdings within the RoboIvestor Portfolio.

The technical picture for BABA is very bullish as the stock has broken out above its 20-day moving average on a big spike in volume. The stock should provide for a brief period of back and filling that gives investors an attractive entry point and one that we’ll be putting forth to our RoboInvestor members in due course when we get that buy signal. That’s a buy signal you don’t want to miss out on.

For a stock with a 20-point short-term trading range, having the right AI indicators to provide the proper buy point is key to overall performance. And this also holds true for when to sell a position. Most investors have no problem or lack of confidence buying a stock or ETF but struggle mightily with selling a position where indecision weighs heavy due to a number of factors.

(Want free training resources? Check our our training section for videos and tips!)

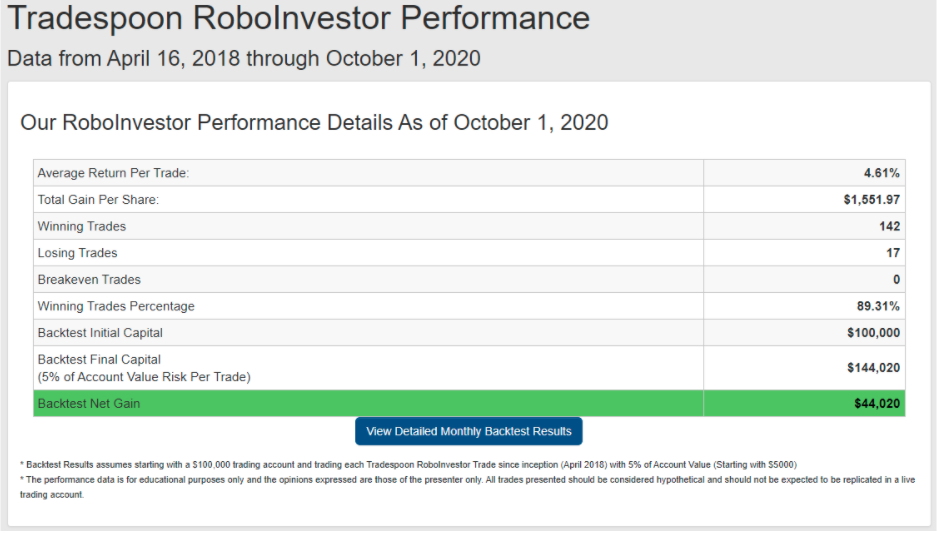

Booking gains on 9 out of every 10 trades

Our Winning Trade Percentage is one number of investors should really focus on. Booking gains on 9 out of every 10 trades where the money is at risk is an incredible track record going back two and a half years in what has been a turbulent investing landscape.

Every Sunday two new recommendations

The RoboInvestor Portfolio currently holds standout stocks like Amazon.com (AMZN), PayPal, Incl (PYPL), Workday, Inc. (WDAY), Microsoft Inc. (MSFT), CSX Corp. (CSX), and SPDR Gold Shares ETF (GLD), just to name a few. Every Sunday, we publish a weekly hotline with two new recommendations.

Unrestrained model that affords us unlimited opportunities

Depending on what our AI platform generates to us during the week, we might advise on buying a stock, or sector ETFs in Treasuries, oil, natural gas, foreign currencies, indexes, volatility, and other asset classes of interest. We run an unrestrained model that affords us unlimited opportunities – something that’s not available with most advisories.

Take us up on our offer to invests in all markets powered by an always thinking, always learning AI system that is producing amazing results for everyday investors. I personally look forward to coaching, teaching, and guiding all our members on a mutual journey of wealth creation that is my life’s passion. Come alongside, and join RoboInvestor today. We’ll make a great team!

(Want free training resources? Check our our training section for videos and tips!)

“I’m investing my own money in each and every stock as my AI platform identifies.”

“I’m investing my own money in each and every stock as my AI platform identifies.”

And remember we’re not talking about day-trading here. I’m looking for 50-100% gains inside of the next 3 months, so my weekly updates are timely enough for you to act.

Click Here – To See Where I Put My RoboInvestor Money

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.