Buy Alert: Two Recession ETFs For Big Profits!

RoboStreet – August 15, 2019

Big Profits from Gold and Bonds

Head-spinning swings in stock prices have investors and traders feeling like the market is highly vulnerable to an untenable sell-off that takes out major support levels due to a confluence of macro-economic and geopolitical events.

Dow dive 800 points after china and Germany slowdown in industrial production

This week saw the Dow dive 800 points after it was reported both China and Germany were seeing a marked slowdown in industrial production. The headlines sent bond yields decidedly lower and gold prices decidedly higher as rising concerns of global recessionary pressure took further hold on investor sentiment.

Political global tensions fuel feelings of instability

There protests in Hong Kong, political upheaval in Argentina and the potential military escalation between India and Pakistan on the Kashmir border are fueling feelings of instability that is exacerbating an already very nervous investing climate. Additionally, central banks are promoting the devaluation of currencies to gain favorable exchange rates for exports, which is also playing havoc with equity markets.

(Want free training resources? Check our our training section for videos and tips!)

“I’m investing my own money in each and every stock as my AI platform identifies.”

“I’m investing my own money in each and every stock as my AI platform identifies.”

And remember we’re not talking about day-trading here. I’m looking for 50-100% gains inside of the next 3 months, so my weekly updates are timely enough for you to act.

Click Here – To See Where I Put My RoboInvestor Money

(Want free training resources? Check our our training section for videos and tips!)

S&P 500 from new all-time high of 3,027 to 2,800 in just two weeks

The combined effect has had a sudden and dramatic impact on the stock market’s momentum where just two weeks ago, saw the S&P 500 trading at a new all-time high of 3,027. As the week progressed, the S&P 500 is retesting the low end of the current trading range where the 200-day moving average comes into play at 2,800 where there is good technical support. A breach of this level opens the way lower to 2,700 and further longer-term support at 2,600.

U.S. GDP for 2019 will exceed $21 trillion

Growth in the U.S. is forecast to be somewhere between 2.0%-2.5% which defines the U.S. economy as an oasis because of its almost self-sufficient nature. U.S. GDP for 2019 will exceed $21 trillion. In 2018 total U.S. trade with foreign countries was $5.6 trillion where exports accounted for $1.5 trillion and $2.4 trillion accounted for imports or 18% of total GDP. And this number is coming down as the U.S. becomes ever more energy independent.

Creation a new headwind for the dollar

However, the recent shift in Fed policy to cease the runoff of the Fed’s balance and begin lowering short-term rates to address and counter the inversion of the yield curve created a new headwind for the dollar. And the Fed will have to act aggressively over the next six months if they intend to get back in front of the bond market and steepen the curve to where long-term rates are once again yielding more than short-term rates.

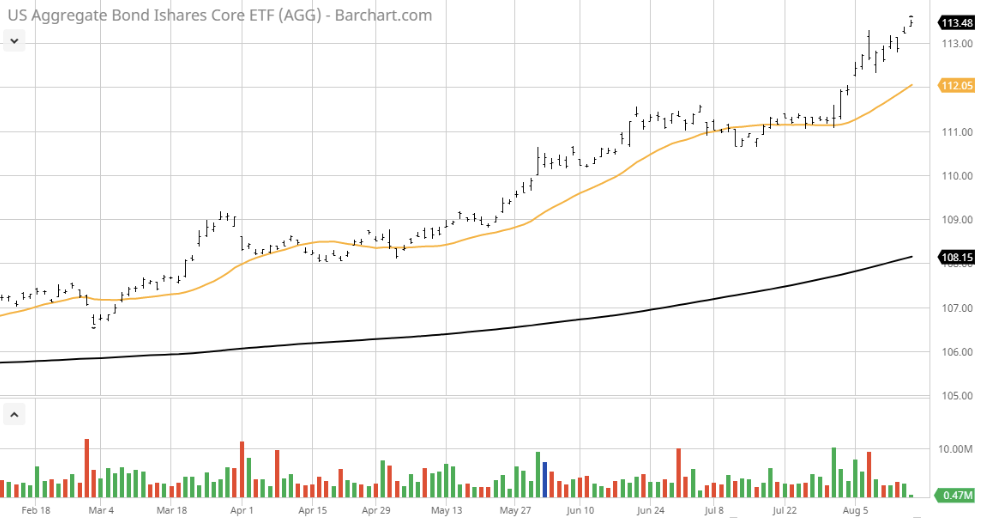

RoboInvestor subscribers profit from buying AGG

Case in point, for our RoboInvestor subscribers, I recommended buying the iShares Core U.S. Aggregate Bond ETF (AGG) back on July 22 right before it broke out and started its most recent up-leg to new highs.

Bond yields go zero by 2021

This past week, Morgan Stanley stated they see bond yields going to zero by 2021. If they are half right, then there is much more to be made from the bond market, and with the adroit timing of my AI tools, RoboInvestor subscribers stand to profit richly from this secular move. buying dips and selling rallies.

(Want free training resources? Check our our training section for videos and tips!)

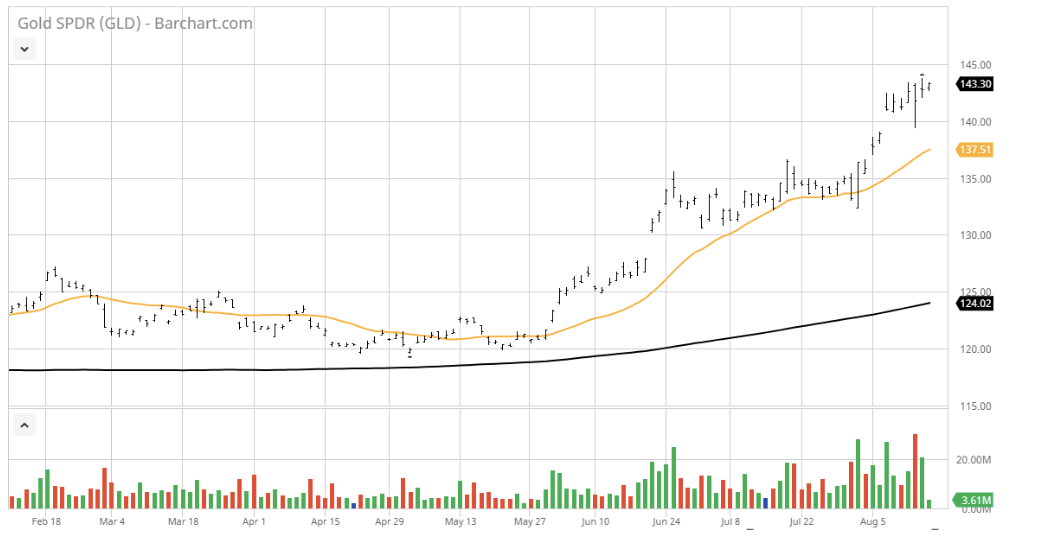

Price above $1,500 not seen since 2013

As I noted above, gold prices shot higher under the presumption that the trade war has turned rapidly into a currency war with the yuan trading 7:1 to the dollar, a level not seen since 2008. The move had the U.S. claiming China a “currency manipulator” which put a strong bid under the gold market sending the price above $1,500 per troy ounce and a level not seen since 2013.

(Want free training resources? Check our our training section for videos and tips!)

Bonds and gold breakouts are legit

After such a tumultuous week, both bonds and gold are overbought and due for some back and filling consolidation. But leave no doubt, the dual breakouts are legit and do offer overwhelming opportunity in the weeks and months ahead if the entry and exit points are managed properly and precisely.

AGG is short-term overbought but has a strong probability reading for the next 50 days out

My AI-driven Seasonal Chart illustrates just how we can position capital into shares of AGG over the next few months. As noted, AGG is short-term overbought but has a strong probability reading for the next 50 days out. Getting in at the right time during the next 20 days is my job and RoboInvestor subscribers will be the first to know when to jump in.

(Want free training resources? Check our our training section for videos and tips!)

(Want free training resources? Check our our training section for videos and tips!)

RoboInvestor advisory service make money 88.5% of the time

A couple of things I want to mention about our RoboInvestor advisory service is that it’s making money 88.5% of the time. Right before the market sold off this past week, our AI indicators flashed sell signals in Coca Cola, PayPal, Honeywell, Amazon, Walmart, Microsoft, and JPMorgan. And all these stocks with the exception of Walmart can be bought back at steep discounts from where we sold them.

System keep losses at a minimum

The system is also designed to keep losses at a minimum. Our sell signal for the broad market triggers the sale of six stocks for an average loss of just over 10%. Those same stocks are trading considerably lower with the broad market sell-off. In fact, we normally maintain an average of 20 positions in the RoboInvestor Portfolio and prior to the current sell-off, we held 9 positions, most of which are in defensive stocks and ETFs.

Since I put my own capital at risk with each recommendation, I’m very proactive about how the RoboInvestor Portfolio is traded. I want to encourage everyone to join today and look for my next two recommendations due out this weekend. The ground has shifted under the market and trading and investing will be considerably more challenging going forward. Let RoboInvestor lead the way for your portfolio and become a member as your next smart trade.

(Want free training resources? Check our our training section for videos and tips!)

“I’m investing my own money in each and every stock as my AI platform identifies.”

“I’m investing my own money in each and every stock as my AI platform identifies.”

And remember we’re not talking about day-trading here. I’m looking for 50-100% gains inside of the next 3 months, so my weekly updates are timely enough for you to act.

Click Here – To See Where I Put My RoboInvestor Money

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.