Market Update

by

Knowledge Resources

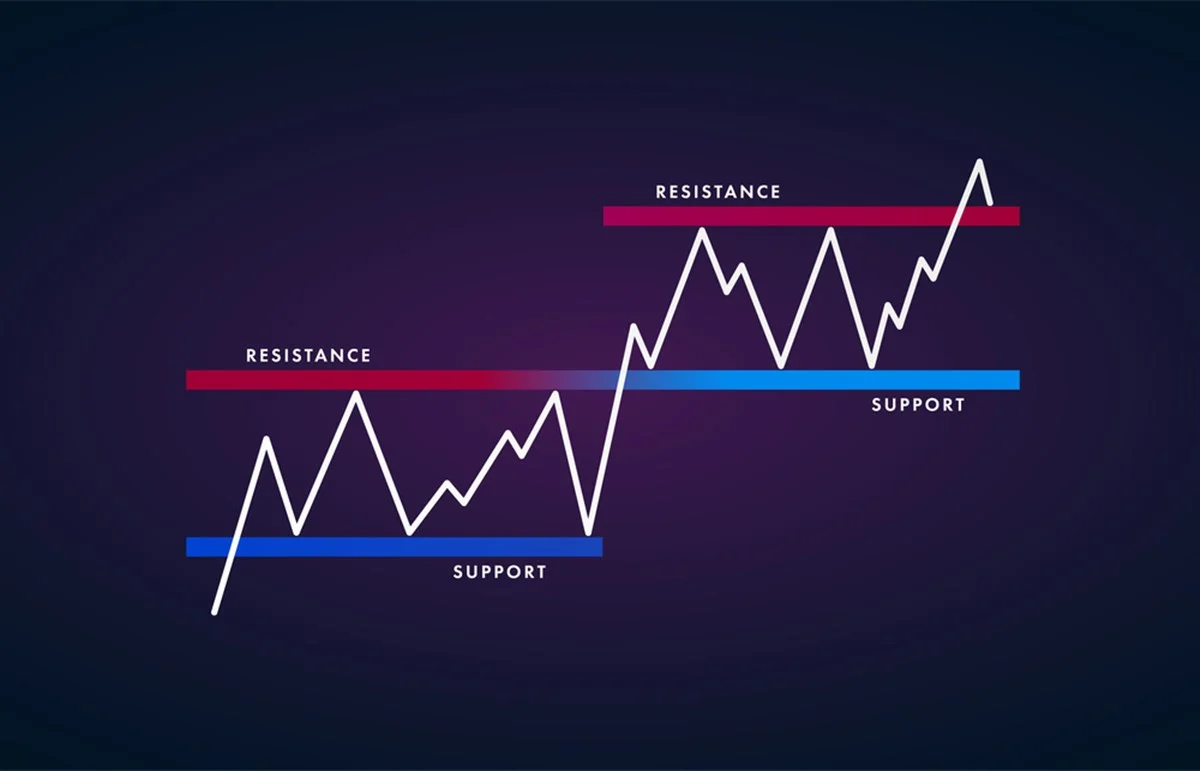

All of the major indexes broke above key resistance levels on Tuesday following a cease fire deal between Israel and Iran. Oil stabilized, and for now, tension in the Middle East has calmed down.

Last week’s consolidation period was...

Read More

by

Knowledge Resources

For the week, the Nasdaq rose 0.2% while the S&P slipped 0.2%. The Dow and the Russell were up nine points each. The only major index that is still holding its uptrend channel is the Nasdaq but that is showing signs of cracking after...

Read More

by

Knowledge Resources

The Fed kept rates in a range of 4.25% to 4.5% but the central bank still signaled two rate cuts this year while simultaneously hinting at a stagflationary threat. Fed Chair Powell said they are beginning to see some effects of tariffs on...

Read More

by

Knowledge Resources

For the week, the Nasdaq slipped 0.6% while the S&P was dipped 0.4%. The Dow fell 1.3% and the Russell stumbled 1.4%. The market pullback stalled momentum while volatility settled above a key level of resistance.

The bright spot...

Read More

by

Knowledge Resources

The opening gains on Wednesday was a result of a positive Consumer Price Index report which showed inflation is slightly easing. There have been, and still remain, concerns that President Trump’s tariffs would accelerate the rate of...

Read More

by

Knowledge Resources

For the week, the Nasdaq jumped 2.2% while the S&P rose 1.4%. The Dow was up 1.2%. The big story was the Russell as the small-caps soared over 3%. All of the major indexes are still holding current and adjusted uptrend channels with...

Read More

by

Knowledge Resources

Tuesday’s pop above key resistance levels was a bullish signal for the major indexes as there was some follow thru on Wednesday. The bullish action this week has kept the uptrend channels intact and previous resistance will now try to hold as...

Read More