testing_stock

by

Options Sensei

The last time we discussed using a stock replacement strategy was back in February when the “SPDR 500 (SPY – Get Rating)” was hitting an all-time high. With nothing but clear skies, no visible ‘overhead’ on the charts, and an economy...

Read More

by

Vlad Karpel

We will be a buyer into any short term corrections

Following several sectors breaking through their recent overhead resistance levels, we no longer believe the market will retest $260 SPY level and we will be a buyer into any short term...

Read More

by

Options Sensei

A few years ago there was an “Interactive Broker (IBKR)” commercial that used to run with frequency showing a woman arriving late for dinner saying “sorry, the market’s a mess, it’s down 2% and everyone’s selling, I needed to...

Read More

by

Options Sensei

Sell In May? No Way.

Investment adages that rhyme seems to occupy a special hold in people’s brains, and with the recent run-up and still lingering COVID-19 concerns, the advice to “sell in May and Go Away” has taken an especially firm perch...

Read More

by

Vlad Karpel

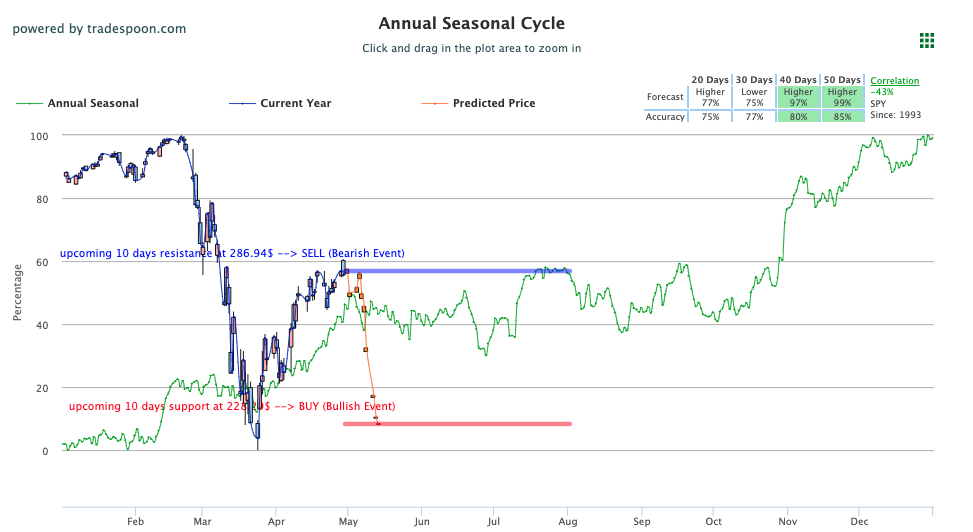

Dow and S&P trading in the red while the Nasdaq holds on to small gains

Based on our models, SPY will trade between $270-$295 level in the next 2-3 weeks. The market can overshoot support and resistance levels when VIX is trading near $40 level....

Read More

by

Options Sensei

With the recent rebound in stocks, the “SPDR Trust (SPY)” has now regained more than half its losses and is just 11% from all-time highs. It makes sense to look at some hedging or portfolio protection strategies.

How Much Protection & For...

Read More

by

Vlad Karpel

Government-run clinical trials coming out great news for the market

Ahead of today’s FOMC announcement, U.S. stocks saw sharp gains with several positive reports regarding government-run clinical trials coming out. The latest news was able to...

Read More