testing_stock

by

Options Sensei

Today is the quarterly event known as quadruple witching in which 1) S&P 500 futures, 2) options on those futures, 3) options on individual equities and 4) single stock futures all expire. In the past, these ‘witching’ days have been...

Read More

by

Options Sensei

Every investor wants high returns but with low and limited risk. This especially the attraction of using options. But in times of high volatility and sharp straight line moves such as has occurred over the past week the losses can be sweeping and...

Read More

by

Vlad Karpel

Overnight, futures hit the limit-down halt

Stocks and futures are seeing continued pressure as Coronavirus spread and concern grows. Overnight, futures hit the limit-down halt while stocks hit the 15-minute halt midday following a 7% drop by the...

Read More

by

Options Sensei

The CBOE Volatility Index (VIX) is often referred to as the “fear gauge” as it tends to rise as uncertainty and concern enter the market. It has definitely earned that moniker this past week.

As stocks have suffered one of the worst sell-offs...

Read More

by

Options Sensei

It’s very dangerous and scary trying to catch a falling knife or to pick a bottom in this stock market. But, with the “SPDR Trust (SPY)” off some 30%, and many individual stocks down 50% or more, it’s time for investors, especially younger...

Read More

by

Vlad Karpel

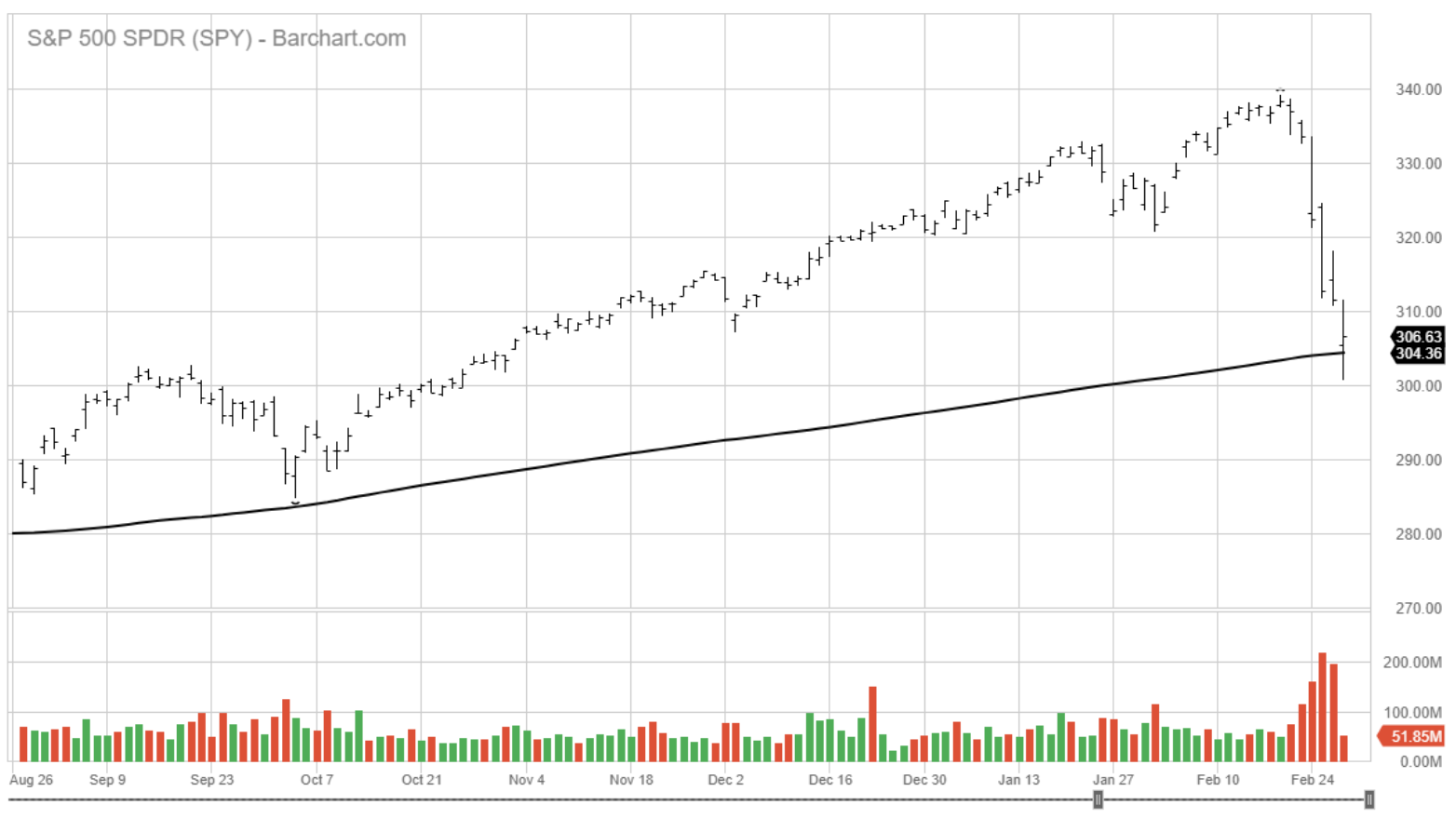

RoboStreet – February 27, 2020

Feels Like Capitulation Selling Taking Over

Yesterday’s trading session had the look and feel of investors throwing in the towel on even the best of breed stocks to raise cash out of genuine fear. Sell programs...

Read More

by

Vlad Karpel

Markets hit the 7% circuit breaker this morning

Markets hit the 7% circuit breaker this morning shortly after the opening bell only to continue trading lower as the day went on. All three major U.S. indices are down over 8% today with the global...

Read More