testing_stock

by

Options Sensei

On numerous occasions, I’ve written about the options trading surge creating a new set of market dynamics. Overall, options volume has surged 85% over the past 18 months with the trading bulk being individual names vs index-based ETFs. Let’s...

Read More

by

Options Sensei

After a record-setting run where the three major indices, SPDR S&P 500 (SPY), PowerShares Nasdaq (QQQ) and IShares Russell 2000 (IWM) hit all-time highs, all three are taking a breather today.

This gives us time to put in perspective and...

Read More

by

Options Sensei

Did you miss the training session I did yesterday with my publisher Adam Mesh?

It was an amazing session where I spilled the beans on how I have been able to beat the market every year since the launch of Options360, my concierge trading...

Read More

by

Options Sensei

I sent this email yesterday, but I wanted to make sure you got a chance to watch the replay.

This is your last chance, so don’t dally…

Here’s yesterday’s email:

Did you miss the training session I did yesterday with my publisher...

Read More

by

Vlad Karpel

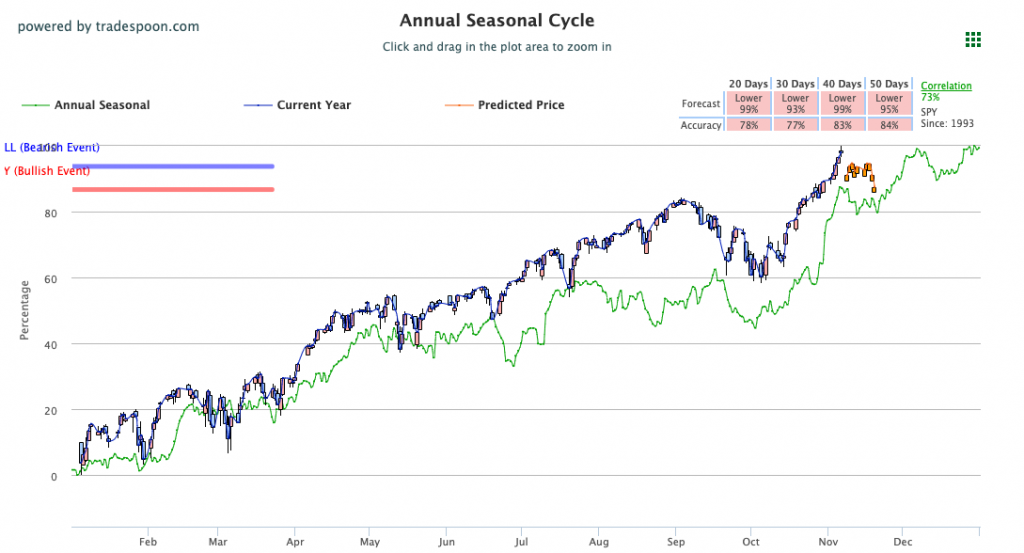

Last week markets reached record territory off strong employment and the latest Federal Open Market Committee meeting, which, as expected, announced no interest hike. A slow down of the Fed’s bond-buying program, as well as the expectation of...

Read More

by

Options Sensei

The financial publishing industry is an unusual industry.

It is rife with people who over promise and under deliver. That’s no secret, after all, it seems like the FTC is going after financial publishers all the time.

In that...

Read More

by

Vlad Karpel

RoboStreet – November 4, 2021

Tech Sector Melt Up Under Way

The key takeaway from the FOMC meeting this week was that of a more dovish fiscal policy pathway being embraced by the Fed. They will begin tapering the pace of its asset purchases...

Read More