Chinese-U.S. Trade Outlook Improves While Dems and Trump Clash Over Border Security Budget

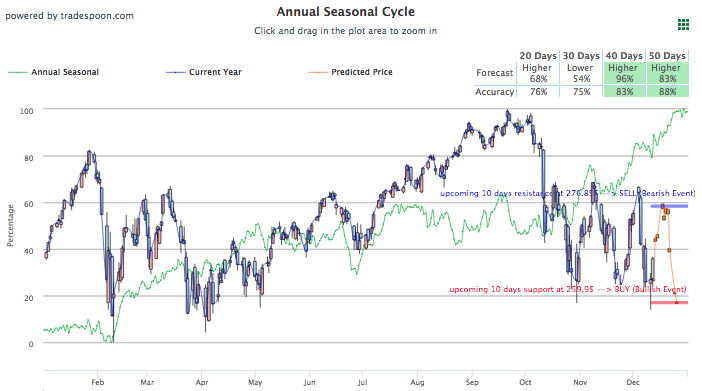

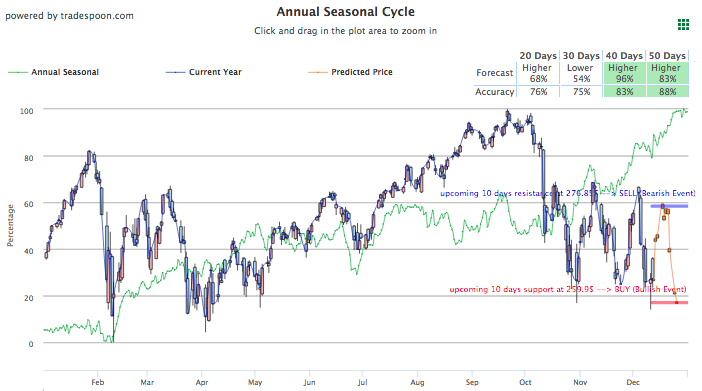

Markets are up today after encouraging statements from both Chinese and U.S. officials have reignited optimism in tariff de-escalation and easing trade tensions. Still, there is some cause for concern as talks of a U.S. government shutdown continue to intensify after yesterday’s meeting between President Trump and Democratic leaders Nancy Pelosi and Chuck Schumer. Overseas, Members of Parliament are considering challenging Prime Minister May’s leadership over the recent handling of the Brexit deal while the ongoing unrest in France over taxes continues to grow. Although markets have recovered from yesterday’s volatility, if we break $255-$260 support level for SPY, on above-average volume, expect the market to endure another 5-10% correction. Short-term overhead resistance for SPY is at $272 and key support level remains at $260. For reference, the SPY Seasonal Chart is shown below:

Yesterday, President Trump met with Democratic leaders to discuss border security, specifically funding for next year, and how the two sides could come to an agreement and avoid a government shutdown. The meeting was initially open to reporters and featured a contentious back and forth between Schumer, Trump, and Pelosi. Trump is looking to receive increased funding for border security, in the range of $5 billion, and preferably a wall while Democrats are looking to replicate last year’s efforts which increased funding to a little under $2 billion. Several government agencies will run out of funding on December 21 and although initially both sides wanted to avoid any type of show-down or shutdown it now looks like both are now real possibilities. Trump stated plainly that if he does not receive the funding he will go forth with the government shutdown while Pelosi urged the President to take one of the two offers she presented, which she claims would pass both the house and senate. The meeting was continued in private though it is unclear if any progress would occur as both sides seem defiant to adjust their respective positions.

Globally, trade tensions between China and the U.S. seemed to have eased off while geopolitical concerns in Europe have only escalated. Speaking to Reuters, President Trump said he would intervene in the arrest of Huawei’s CFO Wanzhou to help progress a trade deal with China. And while the G20 Summit help set up the framework for resolving the trade, recent Chinese reports have only furthered that agenda. Yesterday, China announced it will lower tariffs on U.S. auto while a Wednesday morning report signaled China is willing to make substantial changes to its industrial policies. All three efforts look to show good faith in both sides at continuing discussions and resolving trade concerns. In Europe, British conservative leaders are considering voting to remove PM Theresa May while May has since responded firmly that she will not resign. Last week’s unrest in France over taxes has continued throughout this week and unfortunately has been host to a terror attack that has left three dead after a shooting at the Strasbourg Christmas Market. France has upgraded its security level and a manhunt for the suspect continues.

Globally, European and Chinese markets closed higher today. Look for the Consumer Price Index and Federal Budget reports for November to release today while Retail Sales and Industrial Production to release on Friday. Next week, the FOMC will meet and a fourth interest rate hike is expected.

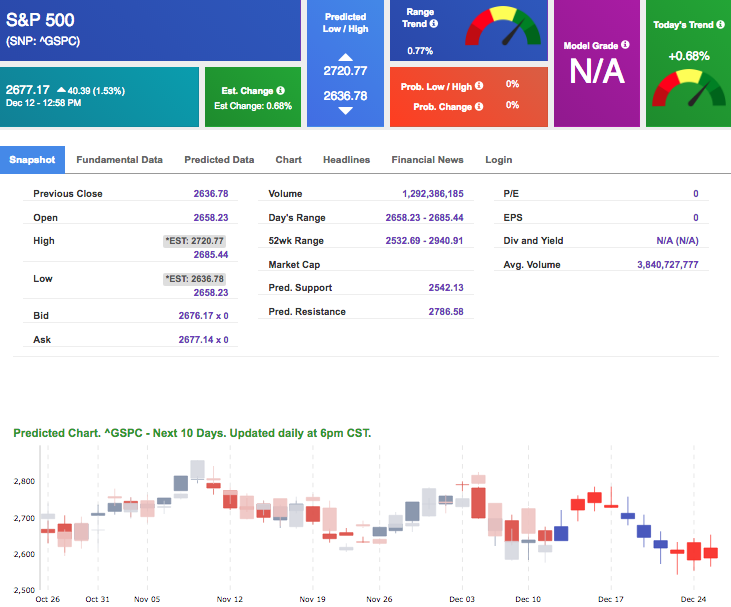

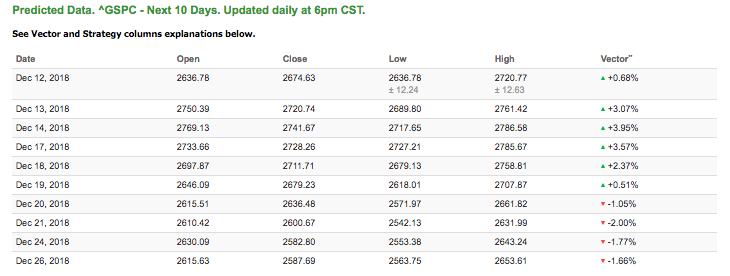

Using the “^GSPC” symbol to analyze the S&P 500, our 10-day prediction window shows mixed signals. Today’s vector figure of +0.68% moves to -1.05% in six trading sessions. The predicted close for tomorrow is 2,926.72. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Holiday Sale: LIFETIME ACCESS to Tools Membership!

Get Lifetime Access to our entire suite of trading tools, and after your initial payment, you will never be billed again for as long as you remain a member!

In addition, you will get Lifetime Access to our ActiveTrader and ActiveInvestor services which includes exact entry/exit prices!

Just click the link below and it will take you to an upgrade page where you can claim this special offer!

Click Here to Sign Up

Highlight of a Recent Winning Trade

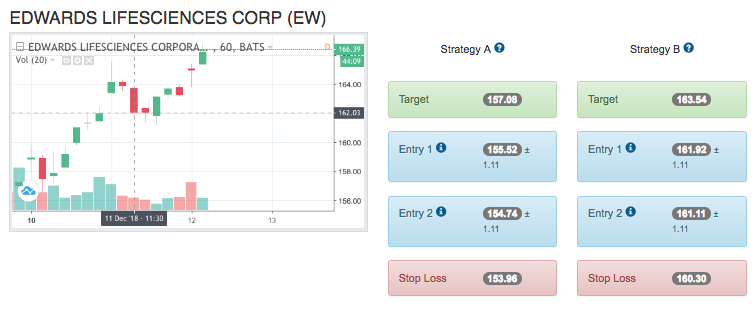

On December 11th, our ActiveTrader service produced a bullish recommendation for Edwards Lifesciences Corp (EW). ActiveTrader is included in all Tradespoon membership plans and is designed for intraday trading.

Trade Breakdown

EW entered the forecasted Entry 1 price range of $161.92 (± 1.11) in its third hour of trading and hit its Target price of $163.54 in that second to last hour of trading that day. The Stop Loss was set at $160.30.

Live Trading Room Update

See how we traded in volatile conditions and what you might expect in our next Live Trading Room. During recent volatility, we held Live Trading Room Session, on December 11th, where we recorded 12 out of 12 winning trades!

Symbol Net Gain%

| PYPL (Option) | 31.31% |

| SBUX | 1.49% |

| AAP (Option) | 15.38% |

| COST (Option) | 25.00% |

| DUK (OPTION) | 25.00% |

| AMAT (Option) | 31.25% |

| SBUX (OPTION) | 25.00% |

| SBUX (Option) | 31.25% |

| SPY (Option) | 33.33% |

| AVGO (Option) | 45.45% |

| SPY (Option) | 18.64% |

| PFE (Option) | 9.09% |

Our Live Trading Room is open every trading day from 9:15 am Eastern Time for the first hour of trading, but these Live Trading Sessions are only available for Premium and Elite Members.

We wanted to share the recording with you so you can see the profits you might be missing- even during volatile markets.

Click Here to Watch the Recording

Thursday Morning Featured Stock

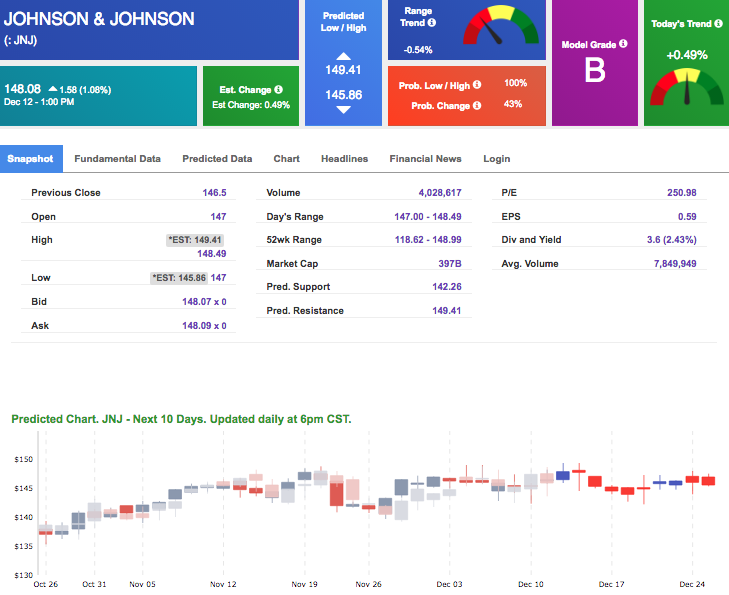

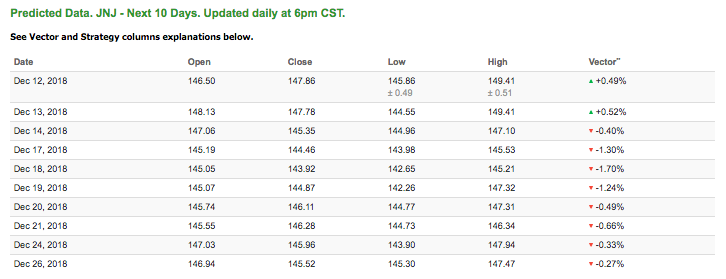

Our featured stock for Thursday is Johnson & Johnson (JNJ). JNJ is showing a confident vector trend in our Stock Forecast Toolbox’s 10-day forecast. This stock is assigned a Model Grade of (B) indicating it ranks in the top 25th percentile for accuracy for predicted support and resistance, relative to our entire data universe.

*Please note: Our featured stock is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader or ActiveInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

The stock is trading at $148.08 at the time of publication, up 1.08% from the open with a +0.49% vector figure.

Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Note: The Vector column calculates the change of the Forecasted Average Price for next trading session relative to the average of actual prices for the last trading session. The column shows expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

Oil

West Texas Intermediate for January delivery (CLF9) is priced at $51.85 per barrel, up 0.29% from the open, at the time of publication. Looking at USO, a crude oil tracker, our 10-day prediction model shows positive signals. The fund is trading at $10.97 at the time of publication, up 0.18% from the open. Vector figures show +0.85% today. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Gold

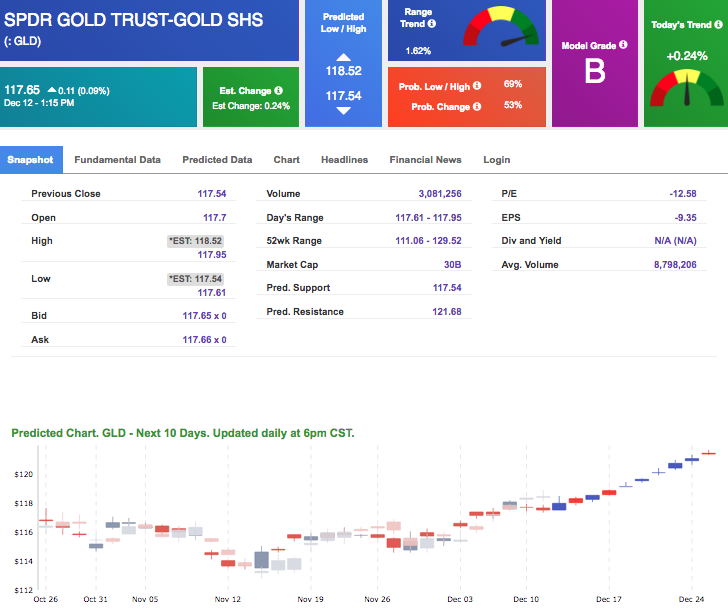

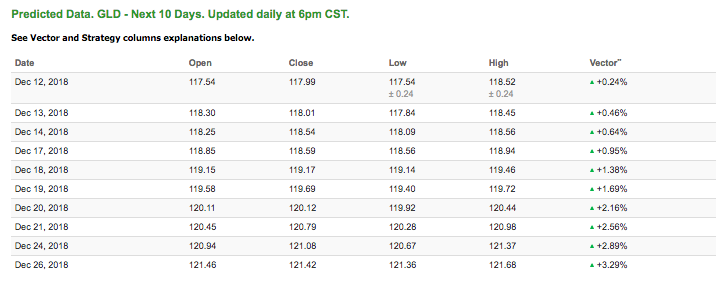

The price for February gold (GCG9) is up 0.17% at $1,249.30 at the time of publication. Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows positive signals. The gold proxy is trading at $117.65, up 0.09% at the time of publication. Vector signals show +0.24 % for today. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Treasuries

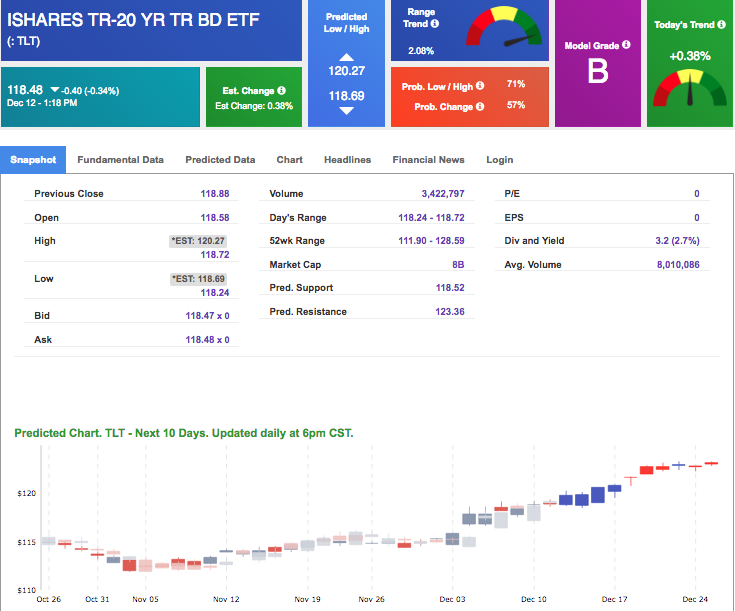

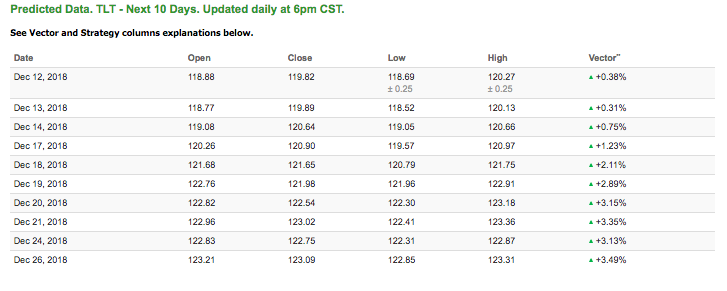

The yield on the 10-year Treasury note is up 0.90% at 2.90% at the time of publication. The yield on the 30-year Treasury note is up 0.41% at 3.14% at the time of publication.

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see positive signals in our 10-day prediction window. Today’s vector of +0.38% moves to +1.23% in three sessions. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Volatility

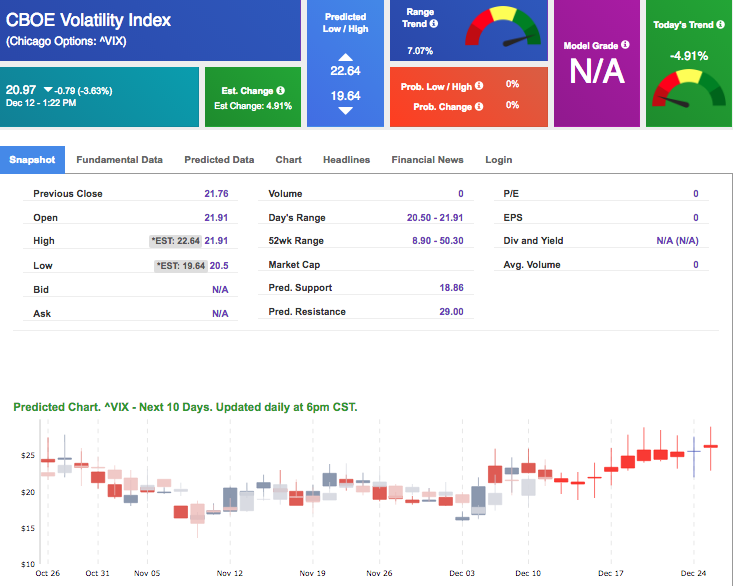

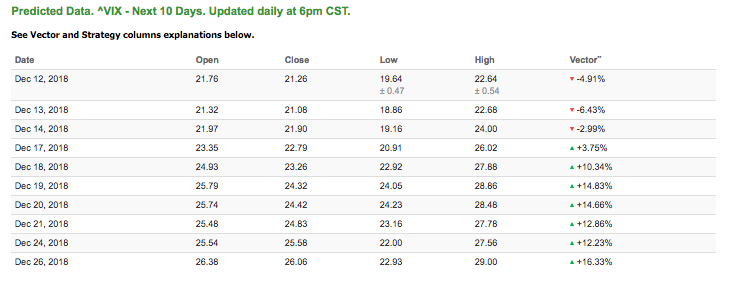

The CBOE Volatility Index (^VIX) is down 3.63% at $20.97 at the time of publication, and our 10-day prediction window shows mixed signals. The predicted close for tomorrow is $21.08 with a vector of -6.43%. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Holiday Sale: LIFETIME ACCESS to Tools Membership!

Get Lifetime Access to our entire suite of trading tools, and after your initial payment, you will never be billed again for as long as you remain a member!

In addition, you will get Lifetime Access to our ActiveTrader and ActiveInvestor services which includes exact entry/exit prices!

Just click the link below and it will take you to an upgrade page where you can claim this special offer!