Dow Records Bear-Market Recovery, Tesla Joining S&P

With the market prone to further corrections, the next level of support is set at $350. All three major U.S. indices closed in the green today with the Dow leading as the index neared its first record close in over 10 months. Positive reinforcement from Dr. Fauci and President-Elect Biden supported stocks today as the former supported the latest developments from Pfizer while the latter received guidance from his COVID advisors against a national lockdown. With this news, several sectors, such as airlines, rallied.

Tesla stock saw a 9% boost as the company stated it will join the S&P 500. October retail sales, import price index, and industrial production reports are due to release on Tuesday; key earnigs to monitor this eek include Walmart, Home Depot, Target, and Nvidia.

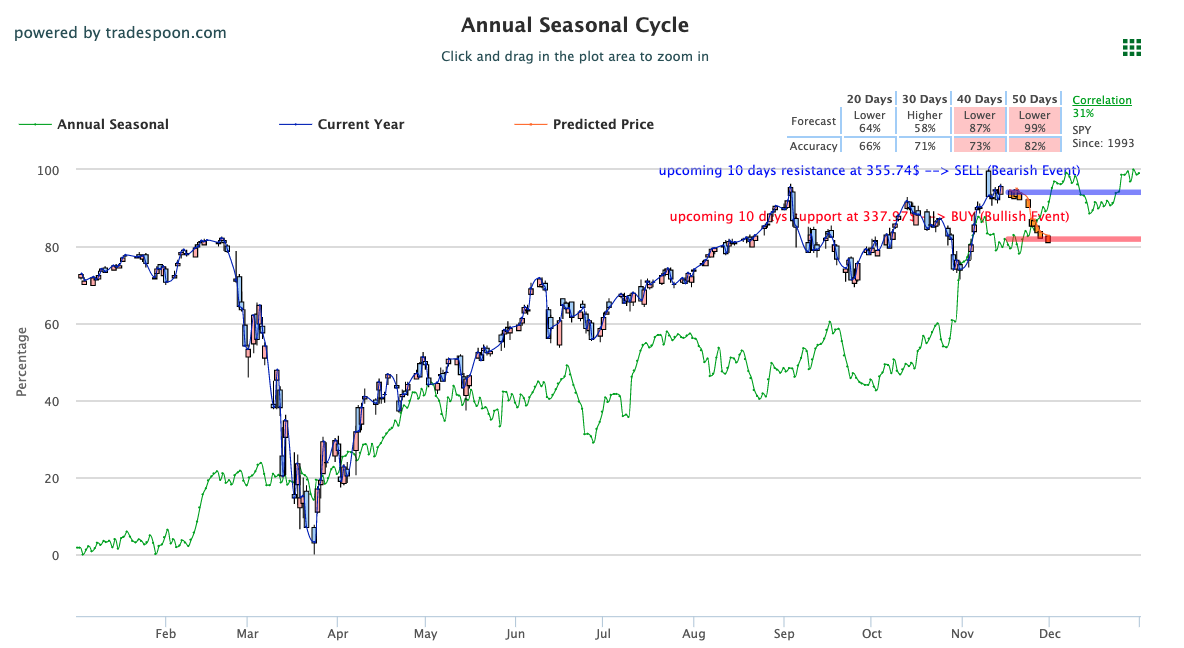

Last week, markets briefly traded above all-time high levels. Keeping this in mind, our latest models are projecting the SPY to trade between the $340-$360 levels until an additional breakout is confirmed. We continue seeing strong rotation from growth to value stocks and believe the SPY is on its way to retest its recent highs. Similarly, we will continue monitoring VIX levels, as the market can overshoot support and resistance levels when VIX is trading near the $25 level. We encourage all market commentary readers to maintain clearly defined stop-levels for all positions. For reference, the SPY Seasonal Chart is shown below:

Key U.S. Economic Reports/Events This Week

- Retail Sales (October) – Tuesday

- Import Price Index (October) – Tuesday

- Industrial Production (October) – Tuesday

- Capacity Utilization (October) – Tuesday

- Business Inventories (September) – Tuesday

- Housing Starts (October) – Wednesday

- Building Permits (October) – Wednesday

- Weekly Jobless Claims (11/14) – Thursday

- Index of Leading Economic Indicators (October) – Thursday

Upcoming Earnings

- JD – JD.com – Monday

- WMT – Walmart – Tuesday

- HD – Home Depot – Tuesday

- NVDA – Nvidia – Wednesday

- LOW – Lowes – Wednesday

- TGT – Target – Wednesday

- TJX – TJX Companies – Wednesday

- LB – L Brands – Wednesday

- M – Macy’s – Thursday

- INTU – Intuit Inc. – Thursday

- WDAY – Workday – Thursday

- FL – Foot Locker – Friday

(Want free training resources? Check our our training section for videos and tips!)

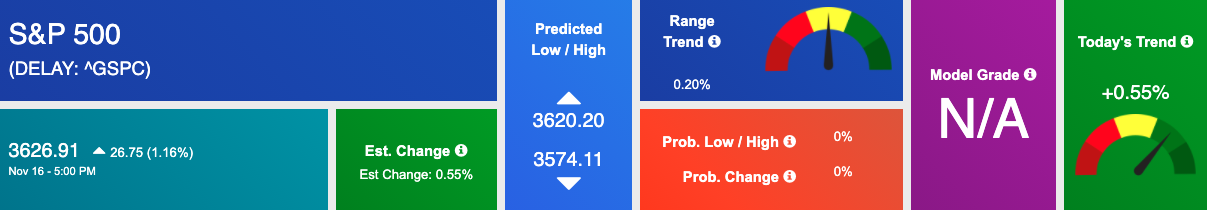

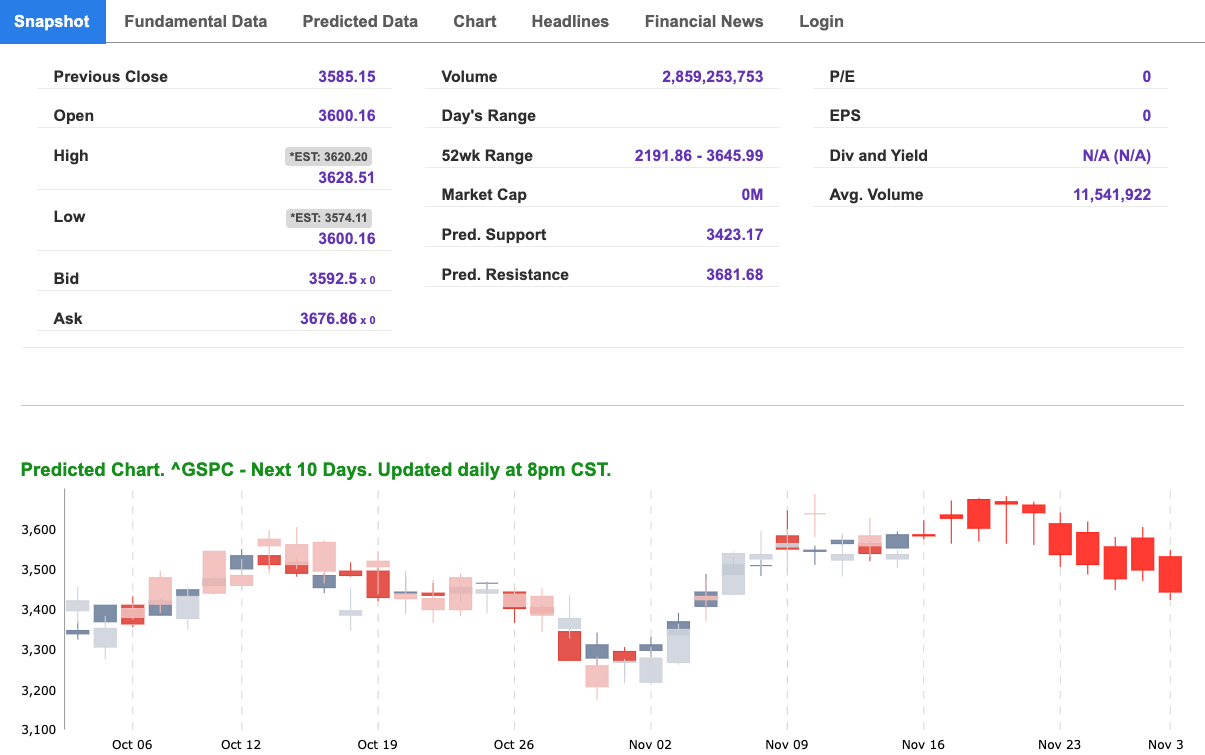

For reference, the S&P 10-Day Forecast is shown below:

Using the “^GSPC” symbol to analyze the S&P 500 our 10-day prediction window shows a near-term mixed outlook. Prediction data is uploaded after the market closes at 6 p.m. CST. Today’s data is based on market signals from the previous trading session.

Vlad’s Portfolio Lifetime Membership!

DO AS I DO… AS I DO IT WATCH LIVE AS I WORK THE MARKETS! TRY IT NOW RISK-FREE!

Click Here to Sign Up

Tuesday Morning Featured Symbol

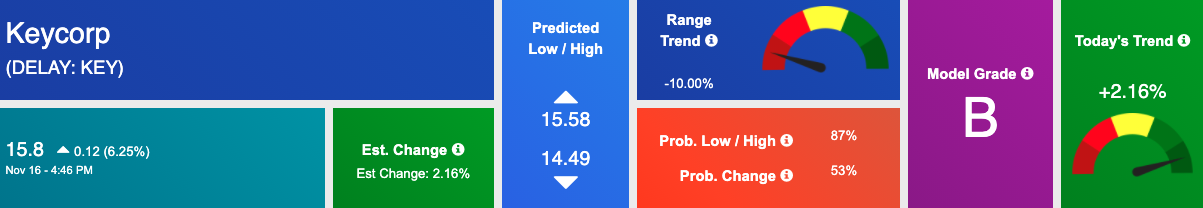

Our featured symbol for Tuesday is KeyCorp (KEY). KEY is showing a steady vector in our Stock Forecast Toolbox’s 10-day forecast.

The stock is trading at $15.8 with a vector of +2.16% at the time of publication.

10-Day Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Note: The Vector column calculates the change of the Forecasted Average Price for the next trading session relative to the average of actual prices for the last trading session. The column shows the expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

*Please note: At the time of publication Vlad Karpel does not have a position in the featured symbol, GM. Our featured symbol is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, or MonthlyTrader recommendations. If you are interested in receiving Vlad’s picks, please click here.

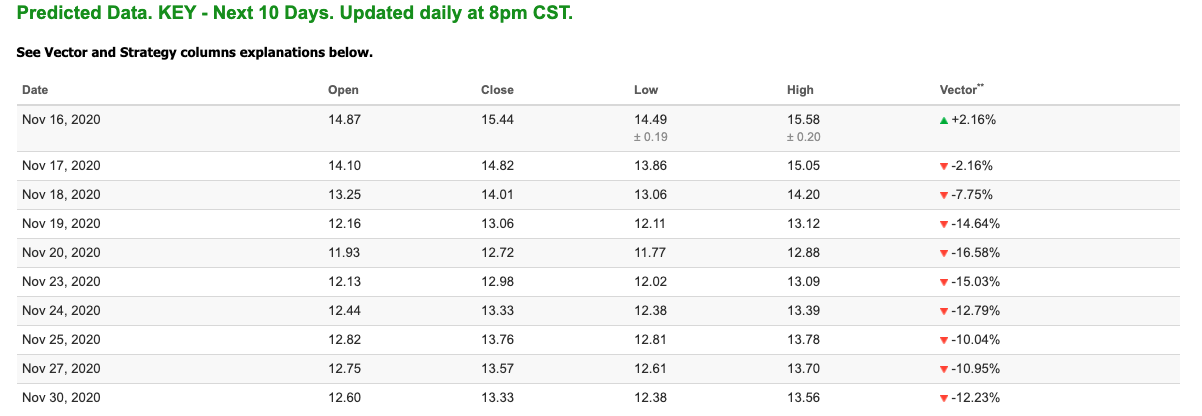

Oil

West Texas Intermediate for Crude Oil delivery (CL.1) is priced at $4.43 per barrel, up 0.22% at the time of publication.

Looking at USO, a crude oil tracker, our 10-day prediction model shows mixed signals. The fund is trading at $29.04 at the time of publication. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

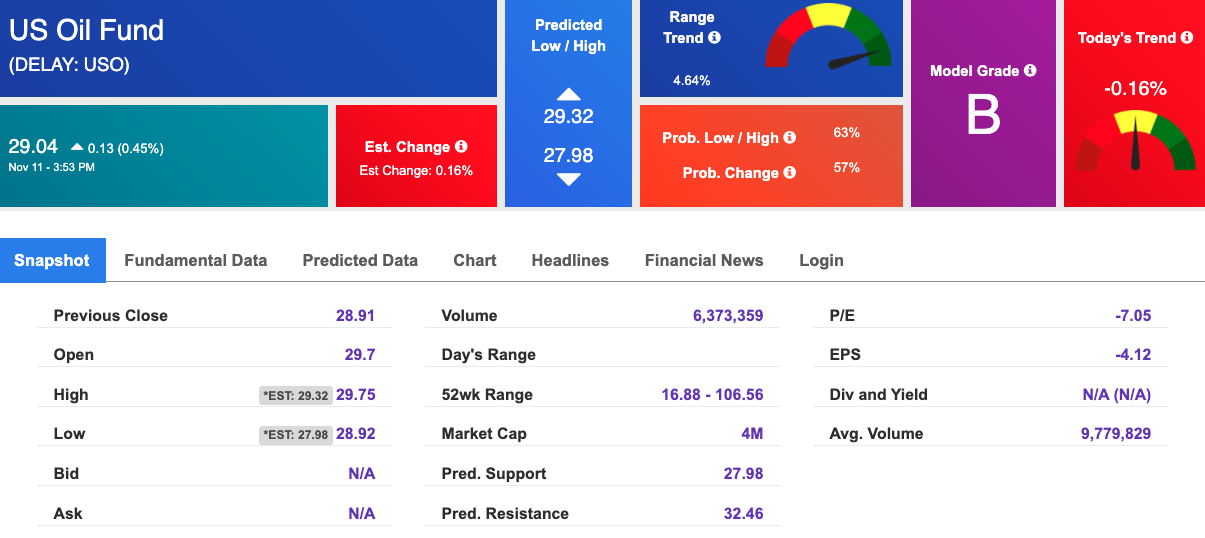

Gold

The price for the Gold Continuous Contract (GC00) is up 0.01% at $1887.50 at the time of publication.

Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows mixed signals. The gold proxy is trading at $174.9, at the time of publication. Vector signals show +0.09% for today. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

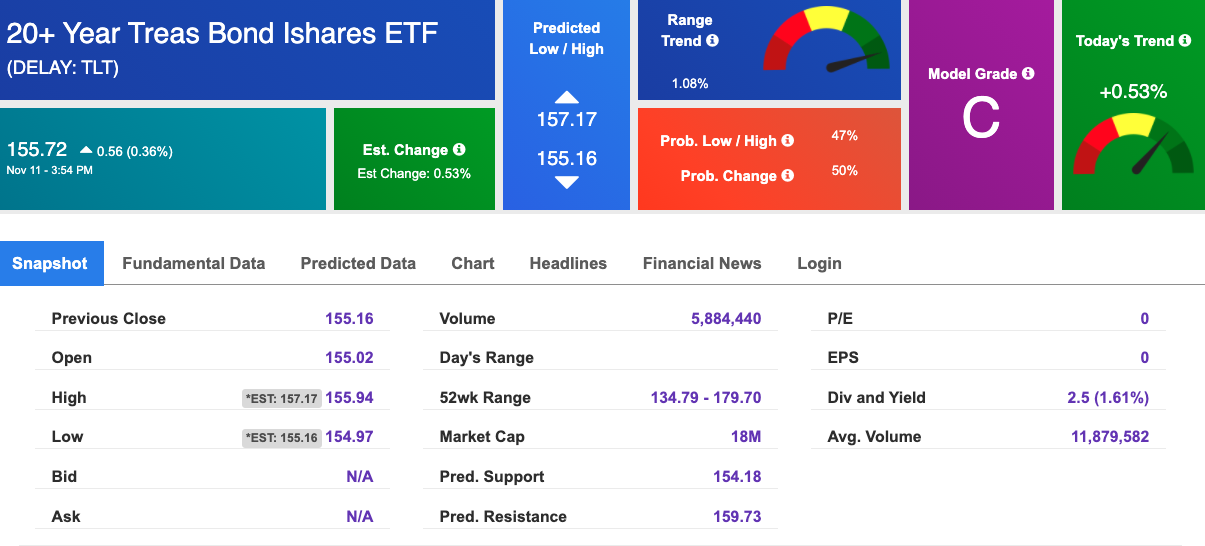

Treasuries

The yield on the 10-year Treasury note is up, at 0.935% at the time of publication.

The yield on the 30-year Treasury note is up, at 1.717% at the time of publication.

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see mixed signals in our 10-day prediction window. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Volatility

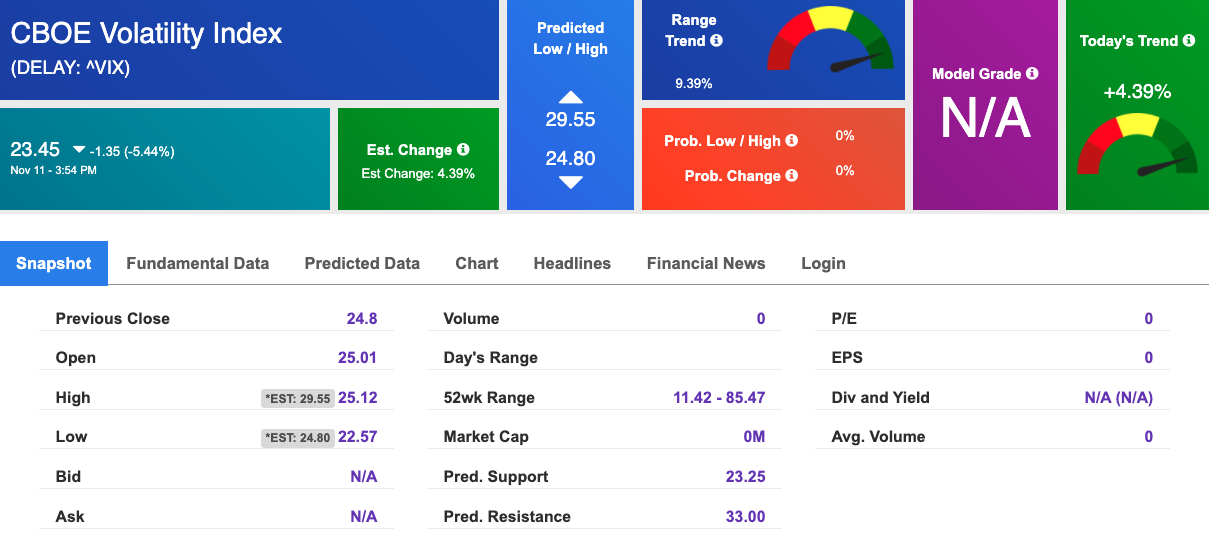

The CBOE Volatility Index (^VIX) is $23.45 at the time of publication, and our 10-day prediction window shows mixed signals. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.