Earnings Kickoff With Citi, Netflix and Major Banks Report This Week

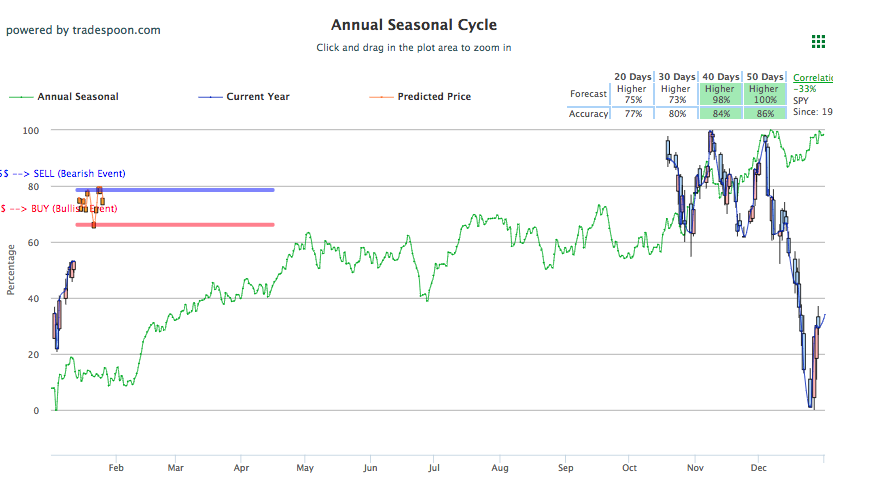

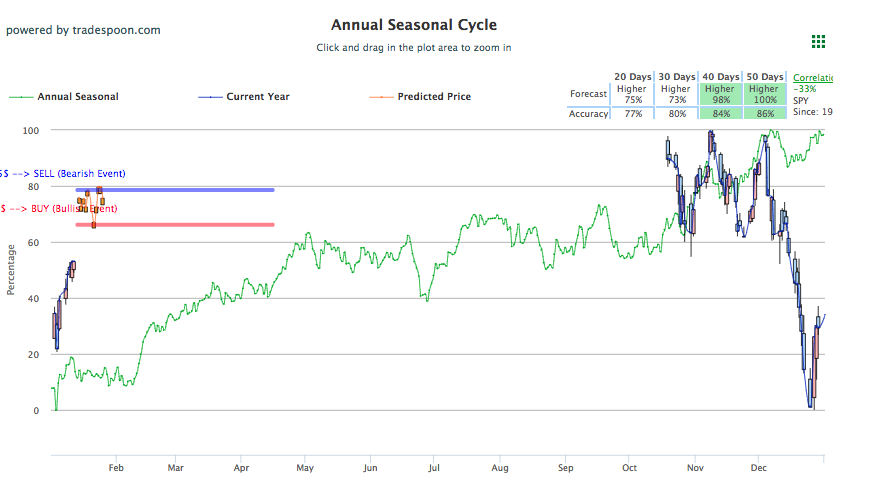

Markets opened lower today and continued to lower in the afternoon amid growing global concerns, lack of progress regarding the U.S. government shutdown, and tepid anticipation of earnings and data reports. Fourth quarter reporting usually supports the market this time of year but having a turbulent end to 2018 corporate America looks to be prepping for less promising earnings. Escaping the $254 resistance level and reestablishing it as its new support for the SPY, markets defined the next level of resistance at $260-$264, concurring with 50-days moving average. The unofficial start of earnings season begins this week with major banks JPMorgan, Charles Schwab, and Wells Fargo reporting later in the week while Citigroup reported pre-market today. As long as market trades below the 50-day moving average expect volatility to come back and, likely, a market retrace back to $254 level, or worst case $245. This can stem from any negative earnings news or further global trade complications or tension. While we suspect a “V” shaped recovery is unlikely to occur, we still could see the market reach $280 level in the first quarter of 2019. Nevertheless, volatility is expected this quarter. For reference, the SPY Seasonal Chart is shown below:

Several expanding global concerns such as Brexit, China negotiations, and the continued Russia investigation are weighing down markets today and erasing early morning gains recorded by all three major U.S. indices. In the U.K., Parliament will vote on Theresa May’s Brexit deal tomorrow, which many doubt will have the votes to support it. May’s leadership will likely be challenged if the deal does not go through as the March 29th deadline to properly exit the European Union is fast approaching and the lack of a deal will likely push the deadline back. Elsewhere, recently released China data fueled more concern and worry over the impact of the trade tension between two of the world’s biggest economies and the state of the global economy. December data showed Chinese exports dropped unexpectedly, the trade surplus with the U.S. rose significantly, and several signs point to a slowing Chinese and global demand. Both European and Asian markets, apart from Japan’s Nikkei index, closed lower today.

Back in the U.S., the Russia investigation looks to have been reignited in the news cycle. Several major publications are reporting on a story Trump concealed details of his meeting with Russian President Vladimir Putin and the recent discovery by the New York Times that the FBI opened an investigation in 2017 to determine if Trump has ever secretly worked for Russia in the past after James Comey’s firing. Trump denied these claims over the weekend.

Fourth-quarter earnings season has unofficially kicked off today with Citigroup reporting before market open today as several major banks, airlines, and retailers are set to report this week. Citi earnings beat profit expectations but fell short on revenue estimates, up 4%. Other companies reporting this week include Netflix, Delta Air Lines, UnitedHealth Group, BlackRock, Goldman Sachs, and more. Major market-movers today include PG&E, which is down a whopping 45% after announcing they will file for bankruptcy this month, and Lululemon Athletica, currently up 7% after the company raised their earnings estimates for the fourth quarter. Apple is slightly down as more earnings fears flood the market, the U.S.-based tech company is scheduled to report on 1/29/2019.

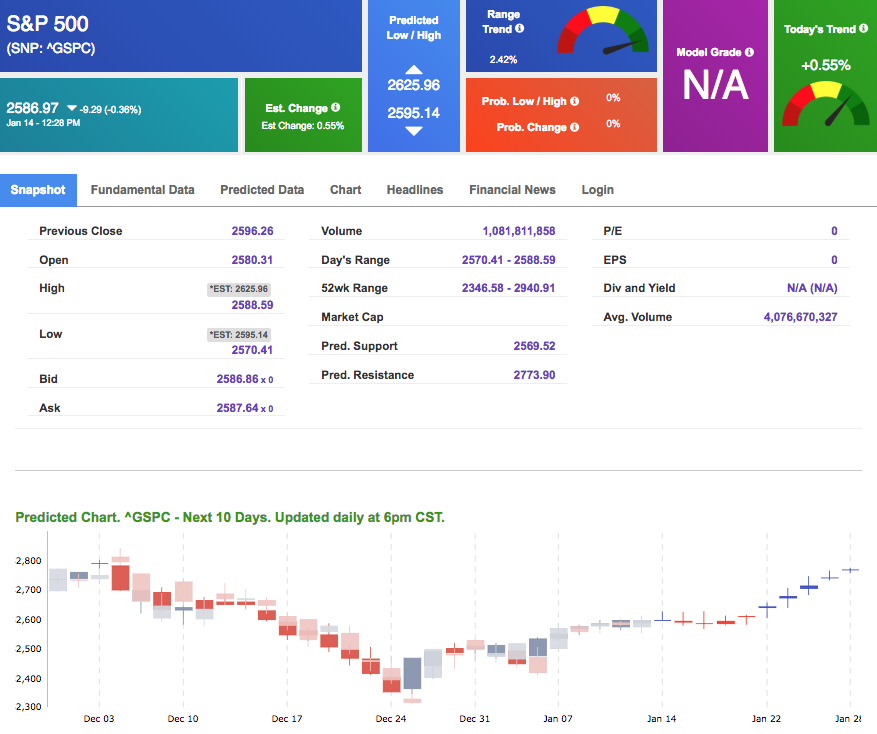

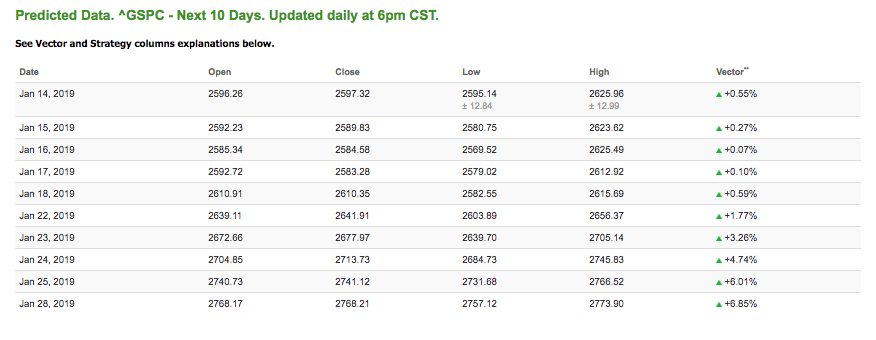

Using the “^GSPC” symbol to analyze the S&P 500, our 10-day prediction window shows positive signals. Today’s vector figure of +0.55% moves to +1.77% in five trading sessions. The predicted close for tomorrow is 2,589.83. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Limited-Time Opportunity (Only 50 Spots Available):

Test Drive our “game-changing” Elite Trading Circle!

The Elite Trading Circle membership is a close-knit group of self-directed traders with exclusive transparency into Vlad Karpel’s trading activity and extended Live Trading Room sessions.

This membership also includes our new WeeklyTrader service- based on a newly developed prediction algorithm optimized for 2-5 day stock and option positions.

Click Here to Learn More and Check on Availability

Highlight of a Recent Winning Trade

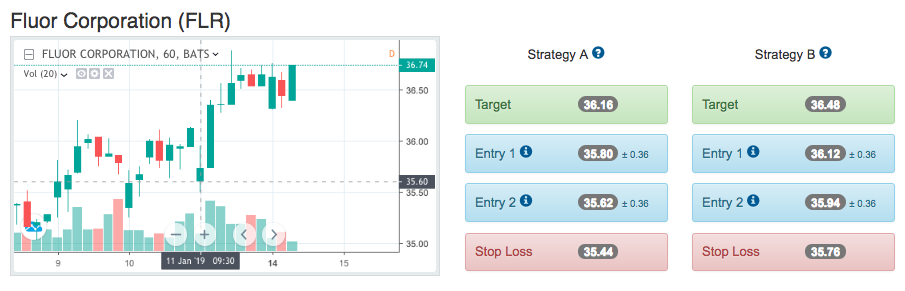

On January 11th, our ActiveTrader service produced a bullish recommendation for Fluor Corporation (FLR). ActiveTrader is included in all paid Tradespoon membership plans and is designed for day trading.

Trade Breakdown

FLR opened in its forecasted Strategy A Entry 1 price range $35.80 (± 0.36) and passed through its Target price $36.18 within the second of trading. The Stop Loss price was set at $35.44.

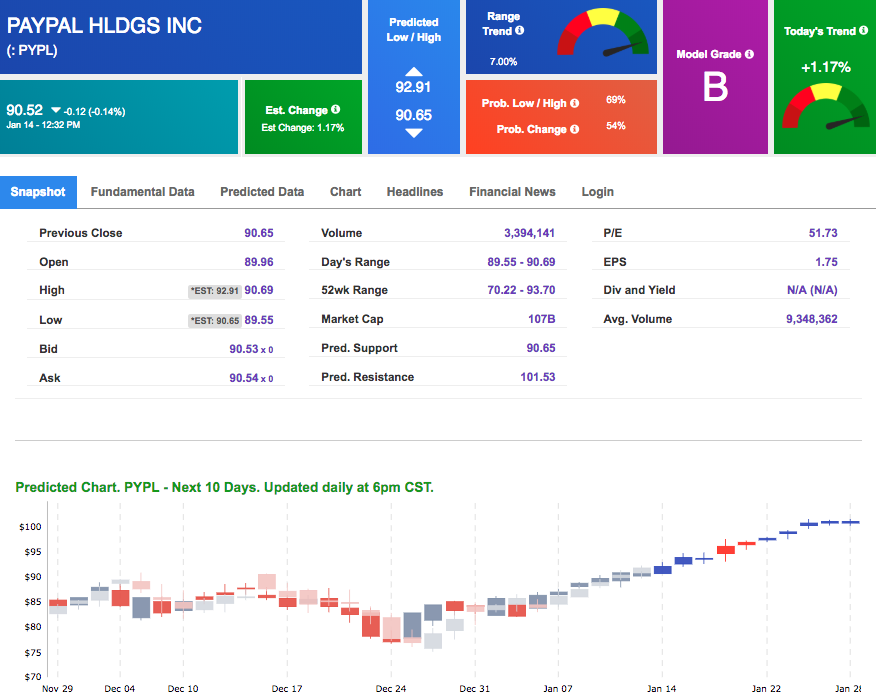

Tuesday Morning Featured Stock

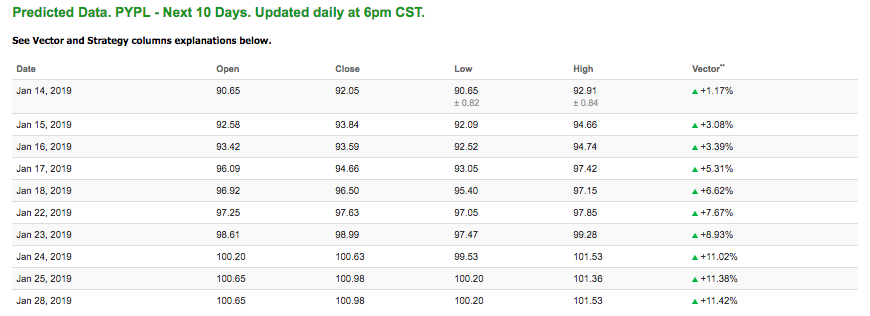

Our featured stock for Tuesday is Paypal Holdings Inc. (PYPL). PYPL is showing a confident vector trend in our Stock Forecast Toolbox’s 10-day forecast. This stock is assigned a Model Grade of (B) indicating it ranks in the top 25th percentile for accuracy for predicted support and resistance, relative to our entire data universe.

*Please note: Our featured stock is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader or ActiveInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

The stock is trading at $90.52 at the time of publication, down 0.14% from the open with a +1.17% vector figure.

Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Note: The Vector column calculates the change of the Forecasted Average Price for next trading session relative to the average of actual prices for the last trading session. The column shows expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

Oil

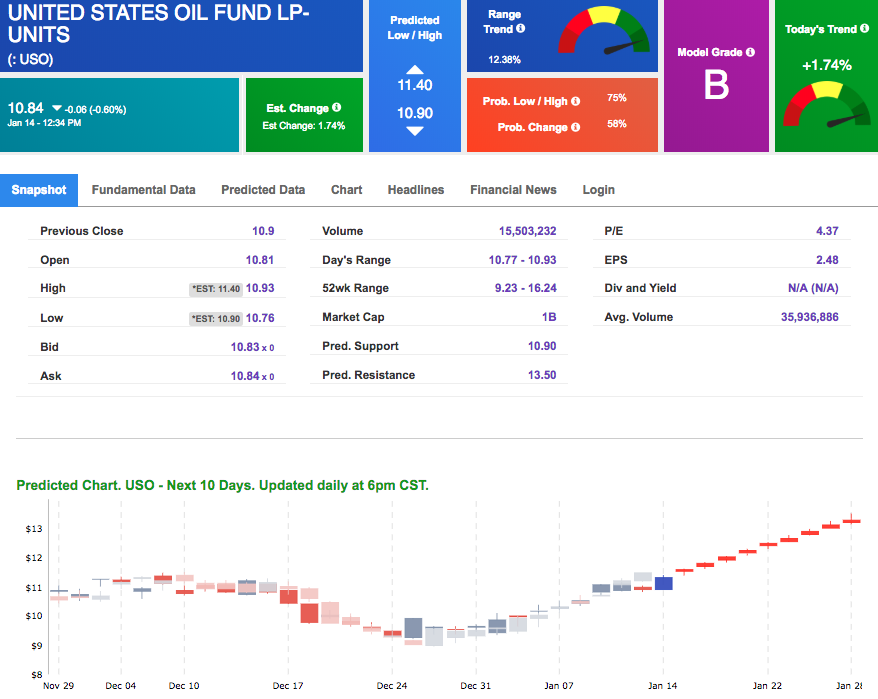

West Texas Intermediate for February delivery (CLG9) is priced at $51.33 per barrel, down 0.52% from the open, at the time of publication. Looking at USO, a crude oil tracker, our 10-day prediction model shows positive signals. The fund is trading at $10.84 at the time of publication, down 0.60% from the open. Vector figures show +1.74% today, which turns +13.70% in five trading sessions. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Gold

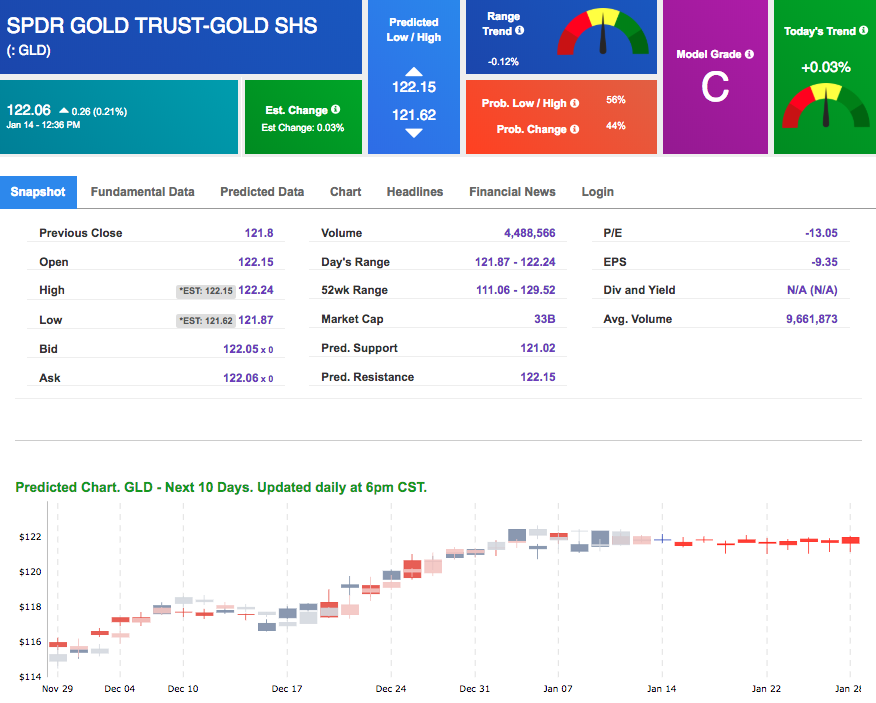

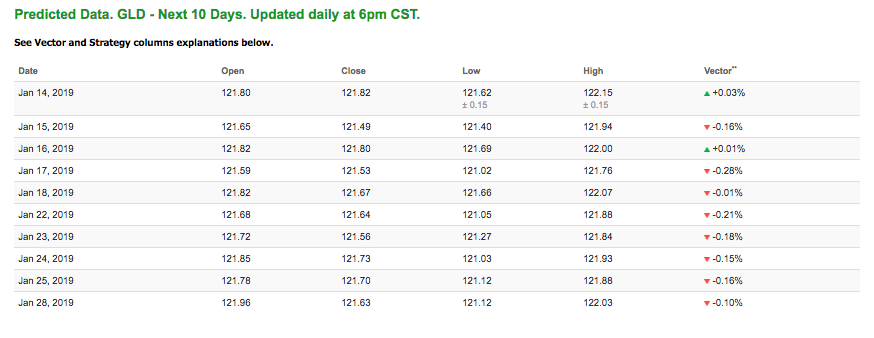

The price for February gold (GCG9) is up 0.16% at $1,291.60 at the time of publication. Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows mostly negative signals. The gold proxy is trading at $122.06, up 0.21% at the time of publication. Vector signals show +0.03% for today. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Treasuries

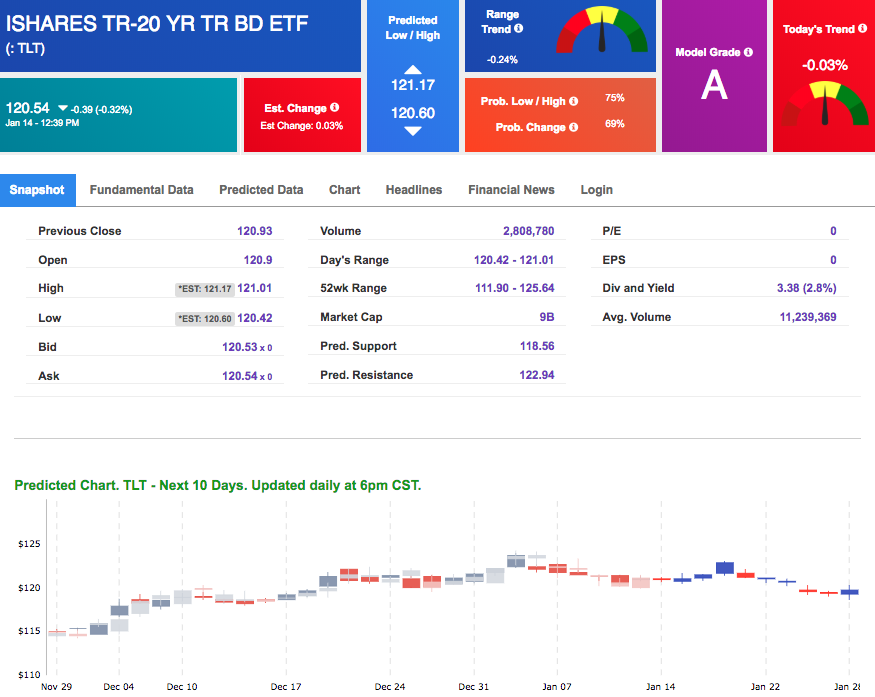

The yield on the 10-year Treasury note is down 1.58% at 2.70% at the time of publication. The yield on the 30-year Treasury note is down 0.61% at 3.05% at the time of publication.

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see mostly negative signals in our 10-day prediction window. Today’s vector of -0.03% moves to +1.01% in three sessions. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

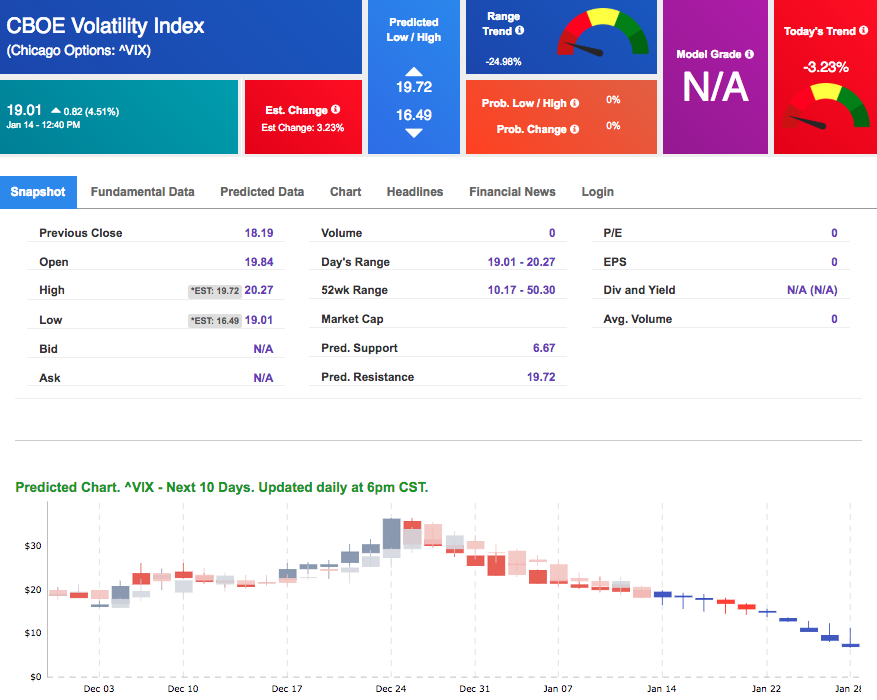

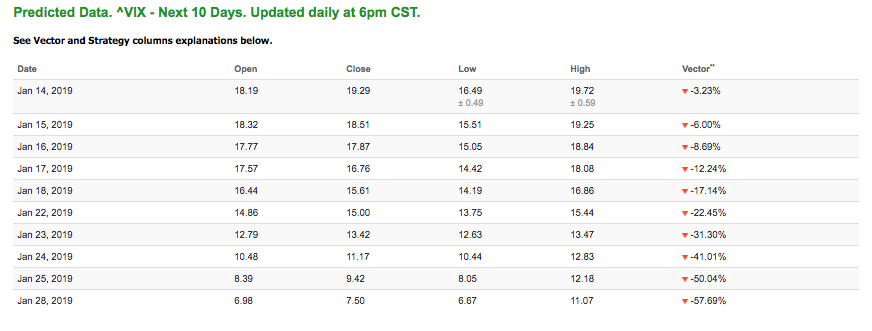

Volatility

The CBOE Volatility Index (^VIX) is up 4.51% at $19.01 at the time of publication, and our 10-day prediction window shows negative signals. The predicted close for tomorrow is $18.51 with a vector of -6.00%. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Limited-Time Opportunity (Only 50 Spots Available):

Test Drive our “game-changing” Elite Trading Circle!

The Elite Trading Circle membership is a close-knit group of self-directed traders with exclusive transparency into Vlad Karpel’s trading activity and extended Live Trading Room sessions.

This membership also includes our new WeeklyTrader service- based on a newly developed prediction algorithm optimized for 2-5 day stock and option positions.