Fed Comments Stall Momentum

Fed Comments Stall Momentum

- The first clue the market needed to see this week that a possible near-term bottom could be forming is the easing in volatility. That has failed to materialize.

- We talked about the bulls likely needing multiple closes below 24-20 on the VIX before a near-term bottom could be CONFIRMED for the market and Wednesday’s low reached 29.48.

- As a reminder, the market will be closed for Good Friday and Thursday is options expiration for regular monthly April options. This could add some extra spice to today’s session, especially if the first wave of support levels fail to hold.

Wall Street showed weakness on Wednesday after Fed Chair Powell said tariffs could drive up inflation over the near-term while pushing them further away from their goals. He went on to say the central bank could find itself in a dilemma between controlling inflation and supporting economic growth. This spooked the major indexes and forced a rejection at key resistance levels.

The Nasdaq traded to a low of 16,066 before settling at 16,307 (-3.1%). Support at 16,250. Resistance remains at 16,750.

The S&P 500 closed at 5,275 (-2.2%) with the intraday low hitting 5,220. Support at 5,200 held. Resistance is at 5,400.

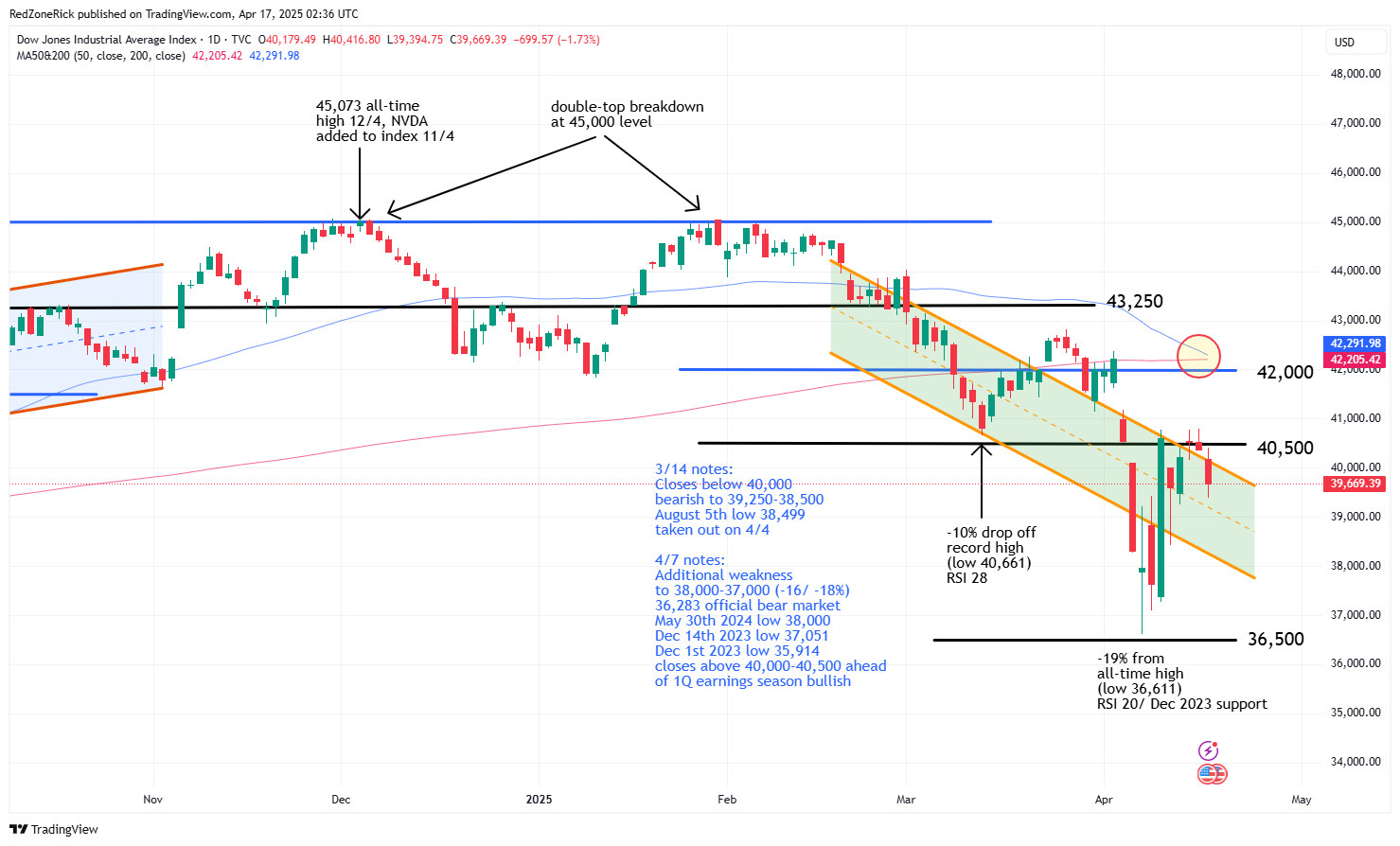

The Dow slipped to a low of 39,394 while ending at 39,669 (-1.7%). Support at 39,500 held. Resistance remains at 40,500.

Earnings and Economic News

Before the open: Alley Financial (ALLY), Blackstone (BX), Charles Schwab (SCHW), KeyCorp (KEY), Snap-On (SNA), Taiwan Semiconductor (TSM), UnitedHealth Group (UNH)

After the close: Marten Transport (MRTN), Netflix (NFLX)

Economic news:

Initial Jobless Claims – 8:30am

Philadelphia Fed Manufacturing Survey – 8:30am

Building Permits – 8:30am

Housing Starts- 8:30am

Technical Outlook and Market Thoughts

The first clue the market needed to see this week that a possible near-term bottom could be forming is the easing in volatility. That has failed to materialize. Given the fact that it is also the start of the first-quarter earnings season, as well, multiple closes below 30 in the VIX was needed.

The Volatility Index (VIX) flirted with closing below key support at 30 on Monday and Tuesday and for the first time since April 3rd. This also marked the start of a massive three-day selloff that has established a trading range between 30-60 since the close above the former. Tuesday’s low at 28.29 pushed the next layers of support at 27.50-27.

We talked about the bulls likely needing multiple closes below 24-20 on the VIX before a near-term bottom could be CONFIRMED for the market and Wednesday’s low reached 29.48. The reversal to 34.96 was slightly bearish and likely won’t convince traders to stay long over the upcoming three-day weekend.

Resistance is at 35 followed by 37.50. A move above 40 likely gets 45-60 back in focus. A move above 65 and the August 5th peak at 65.73 could get 85 and the November 2023 highs in focus. This is where we also predict a capitulation moment for the market might occur although some may argue it already has.

The Nasdaq cleared and held key resistance at 16,750 to start the week and on Tuesday’s slight weakness. Additional hurdles remain at 17,000-17,250 following Wednesday’s 3% drubbing.

Support for Thursday is at 16,000-15,750. A move below the latter would indicate a retest to 14,800 with the prior Monday’s low at 14,784.

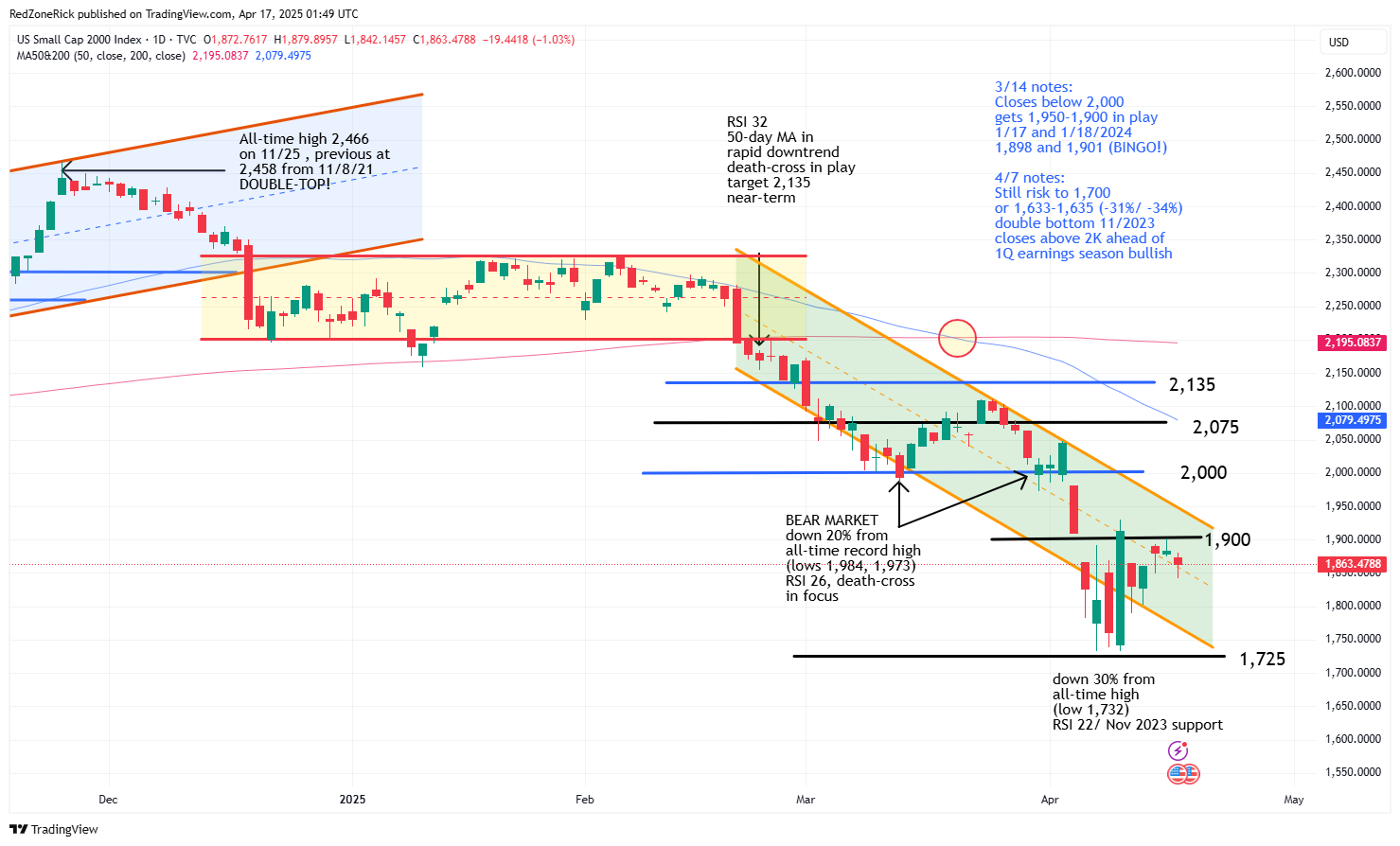

The Russell 2000 closed at 1,863 (-1%) with the low at 1,842. Upper support at 1,850-1,825 was tripped but held. A close below 1,800 likely leads to a further fade back to 1,750-1,725.

Key resistance remains at 1,900 with Tuesday’s top at 1,902. Multiple closes above this level keeps a possible 5% pop to 2,000 in play.

The S&P came within 1% of clearing key resistance at 5,500 on Monday and Tuesday but never really mounted a serious threat. Closes above this level and out of the current downtrend channel would be slightly bullish.

Support is at 5,200 with Wednesday’s bottom at 5,220. There is stretch down to 5,100 with a close below this level implying another retest down to 4,900-4,800 with last Monday’s low at 4,835. The 50-day moving average recently fell below the 200-day moving average to form a death-cross and typically signals lower lows.

The Dow recovered key resistance at 40,500 on Monday but closed back below this level on Tuesday. Multiple closes above 40,500 would suggest strength to 42,000. The 50-day moving average is less than 100 points away from falling below the 200-day moving average.

Support is at 39,500. Closes below this level would indicate weakness towards 37,000-36,500 with the prior Monday’s low at 36,611.

As a reminder, the market will be closed for Good Friday and Thursday is options expiration for regular monthly April options. This could add some extra spice to today’s session, especially if the first wave of support levels fail to hold.