Feds Cut Rates, Powell Downplays Further Cuts Causing Markets to Lower

FOMC meeting paint stocks in red

Stocks lowered following the conclusion of the two-day FOMC meeting which introduced an interest rate cut. The Federal Reserve decided to cut rates by a quarter percentage point and indicated more rate cuts could follow in the upcoming Federal Open Market Committee meetings. Currently, all three major U.S. indices are on track to close in the red.

Apple stocks hit a 2019 high

Yesterday, Apple stocks hit a 2019 high following strong earnings report that beat analyst expectations, which also helped the Dow.

Notable earnings reports next to watch

Today we will see Qualcomm, Prudential, and Metlife report earnings after the market closes while tomorrow General Electric, Humana, and Spotify report.

Trade Deficit report on Friday

Look for July manufacturing data to be released tomorrow and Trade Deficit report on Friday.

(Want free training resources? Check our our training section for videos and tips!)

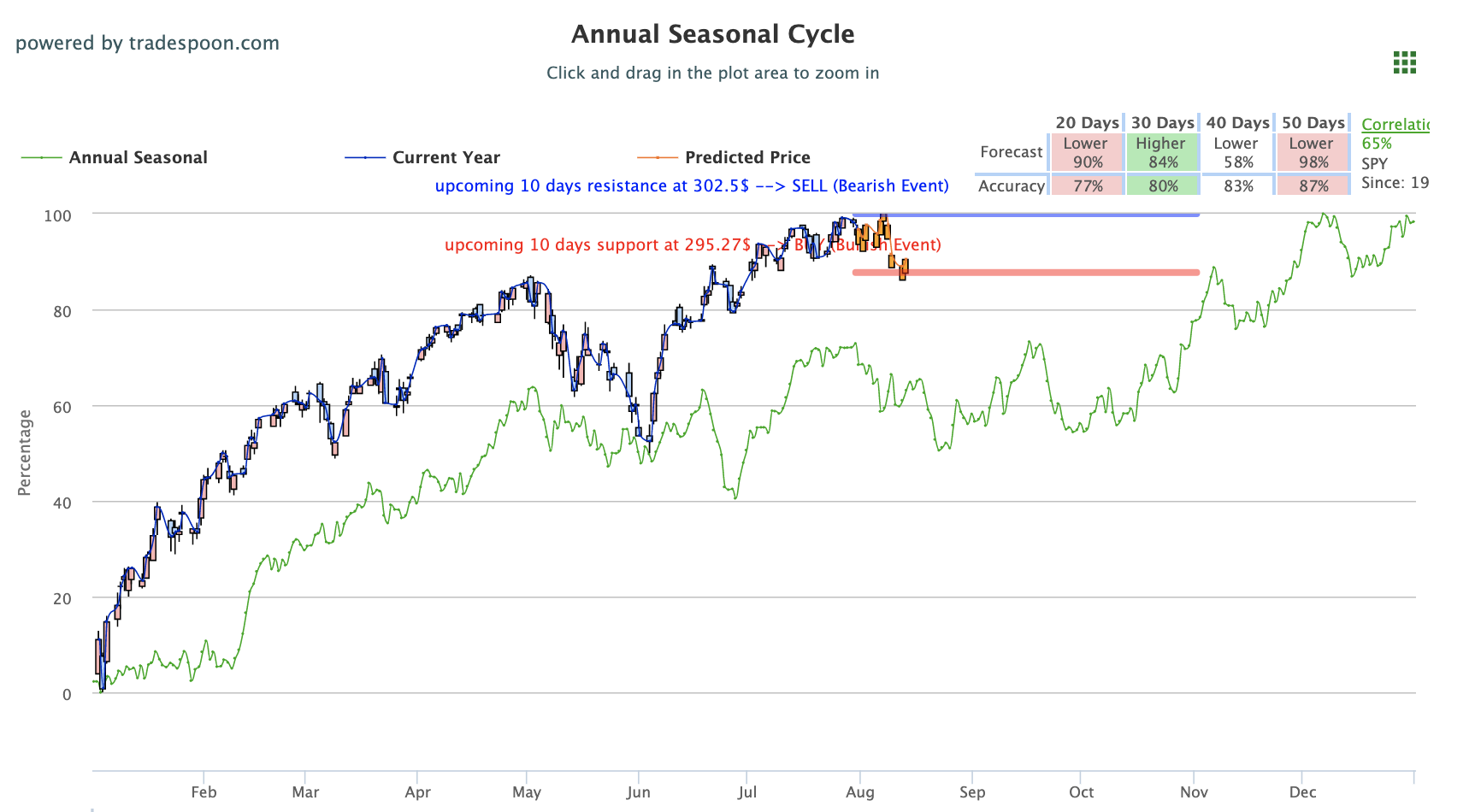

Consider SPY buying closer to $290

With the FOMC decision behind us, we do not see market momentum pushing SPY much higher than $300, potentially overshooting to $305. Still, the SPY continues to trade near an all-time high level and we encourage our readers to avoid chasing near $300 level and consider buying closer to $290. For reference, the SPY Seasonal Chart is shown below:

Sign up now for Lifetime Access and pay less than the cost of just 1 year and lock in …

PERMANENT UNLIMITED ACCESS!

-

Subscribe now for less than the cost of one year at the regular rate!

-

With 36 month trailing gains of 1,276%, and an 75% win-rate, a lifetime Membership could easily turn $100,000 into $1,375,798

-

Tradespoon Premium is the only trading service you’ll ever need.

CLICK HERE TO SIGN UP

Fed cut interest rate by 0.25%

After weeks of speculation, the Fed went through with an interest rate cut in its latest policy update. The 0.25% cut sent stocks lower and according to Fed Chair Powell was done in response to weakness in inflation and the current global economic landscape.

This is not the start of “a lengthy cutting cycle”

While many saw this move leading to further cuts in future FOMC meetings this year and the next, Powell reiterated in his post-meeting press conference that this is not the start of “a lengthy cutting cycle.”

Also noted in his press conference, Powell stated weakness in capital spending was tied to global trade tensions but not the sole reason for the decline. For future policy decisions, the Fed will look at global growth, trade, and inflation primary, while also monitoring employment and housing.

With FOMC decision behind us, focus returns to Q2 corporate earnings which just saw major releases from Apple and MasterCard. Still ahead are earnings from Verizon, Square Inc., and General Motors tomorrow, Exxon and Chevron on Friday. Still in focus are China-U.S. trade relations. Recently, trade representatives from both nations met in Shanghai but no significant progress has yet been reported. China recently stated they are not looking to rip off the U.S., as Trump had previously stated, but are not planning on making major concessions to their trade demands. Globally, Asian markets closed lower while European markets were mixed.

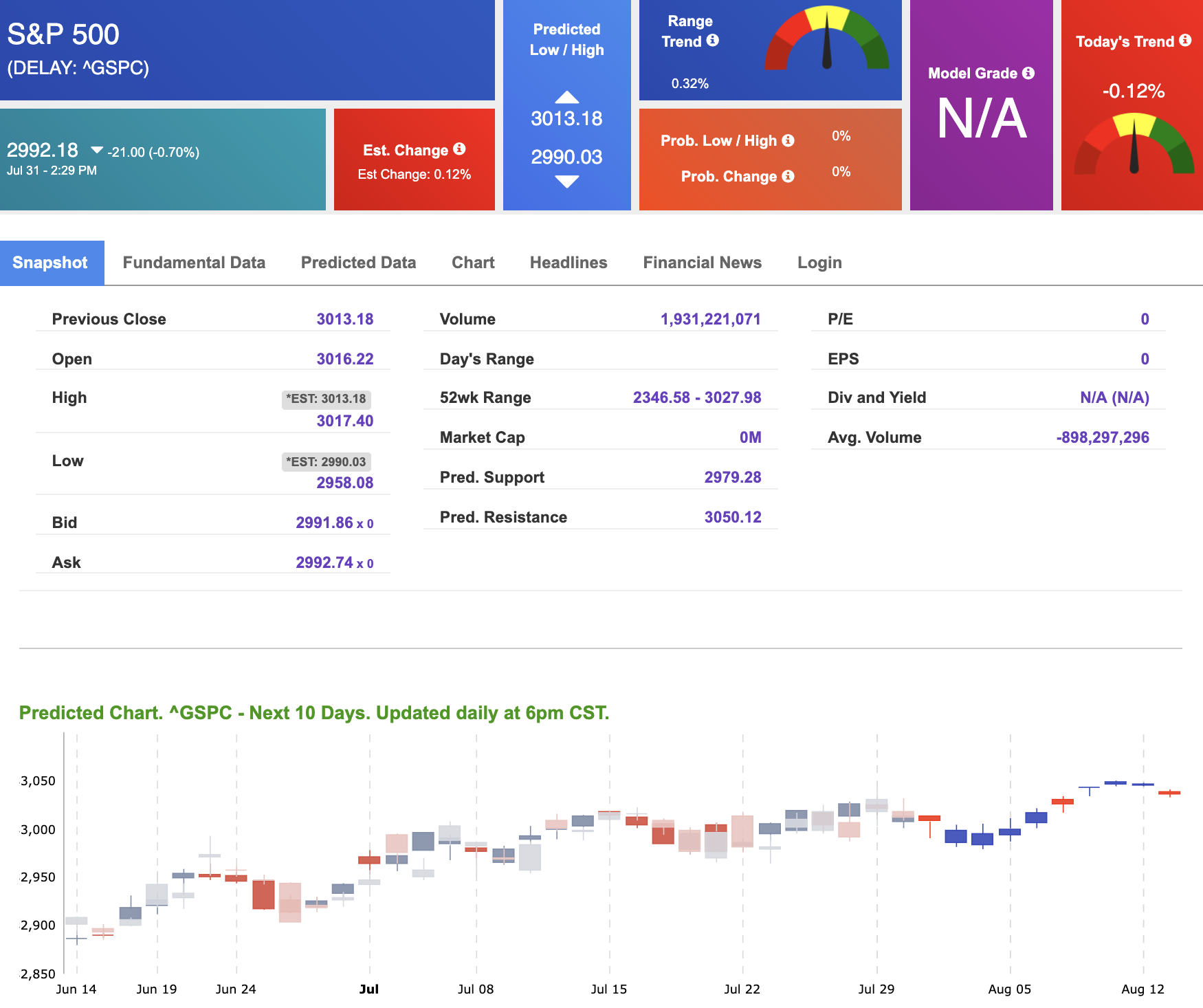

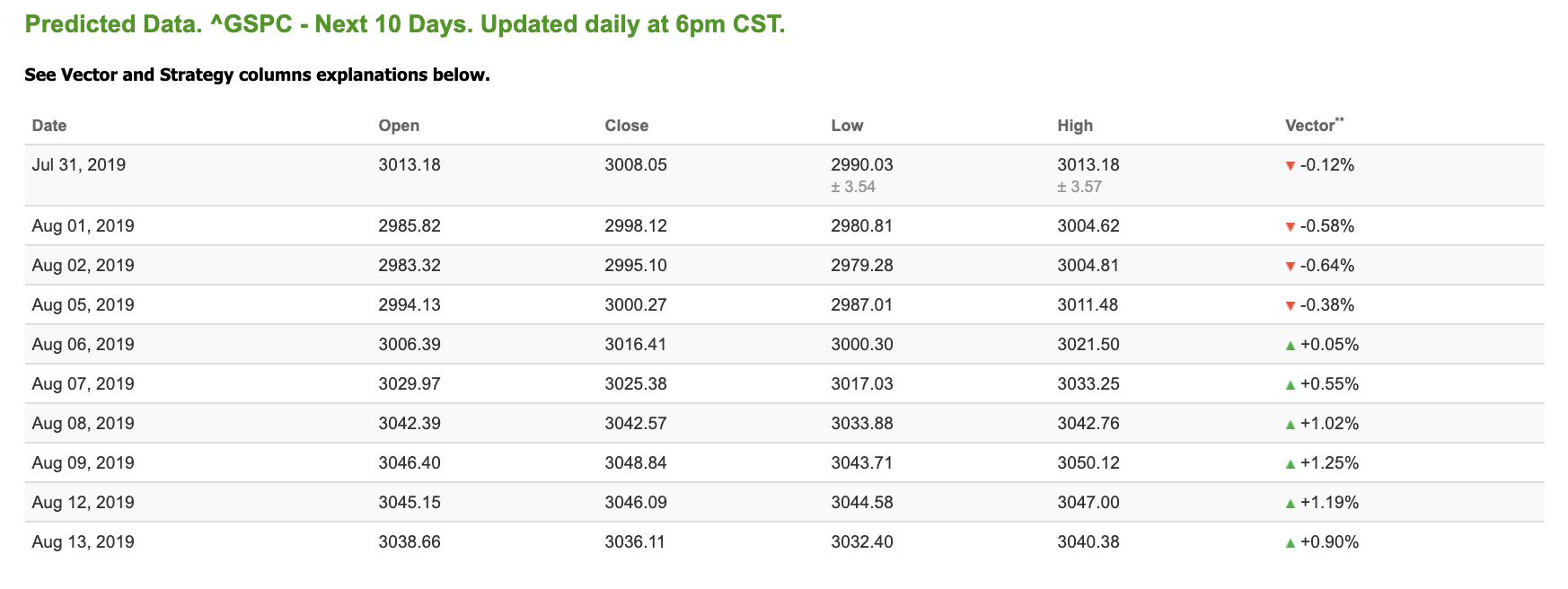

Using the “^GSPC” symbol to analyze the S&P 500 our 10-day prediction window shows mixed signals. Today’s vector figure of -0.12% moves to +0.55% in five trading sessions. Prediction data is uploaded after the market close at 6pm, CST. Today’s data is based on market signals from the previous trading session.

Sign up now for Lifetime Access and pay less than the cost of just 1 year and lock in …

PERMANENT UNLIMITED ACCESS!

-

Subscribe now for less than the cost of one year at the regular rate!

-

With 36 month trailing gains of 1,276%, and an 75% win-rate, a lifetime Membership could easily turn $100,000 into $1,375,798

-

Tradespoon Premium is the only trading service you’ll ever need.

CLICK HERE TO SIGN UP

Highlight of a Recent Winning Trade

On July 17th, our ActiveTrader service produced a bullish recommendation for AES Corporation (AES). ActiveTrader is included in all paid Tradespoon membership plans and is designed for day trading.

Trade Breakdown

AES entered its forecasted Strategy B Entry 1 price range $17.29 (± 0.07) in its first hour of trading and passed through its Target price $17.46 in the second hour of trading that day. The Stop Loss price was set at $17.12

Thursday Morning Featured Symbol

*Please note: At the time of publication we do not own the featured symbol, GOOGL. Our featured symbol is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader or MonthlyTrader recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

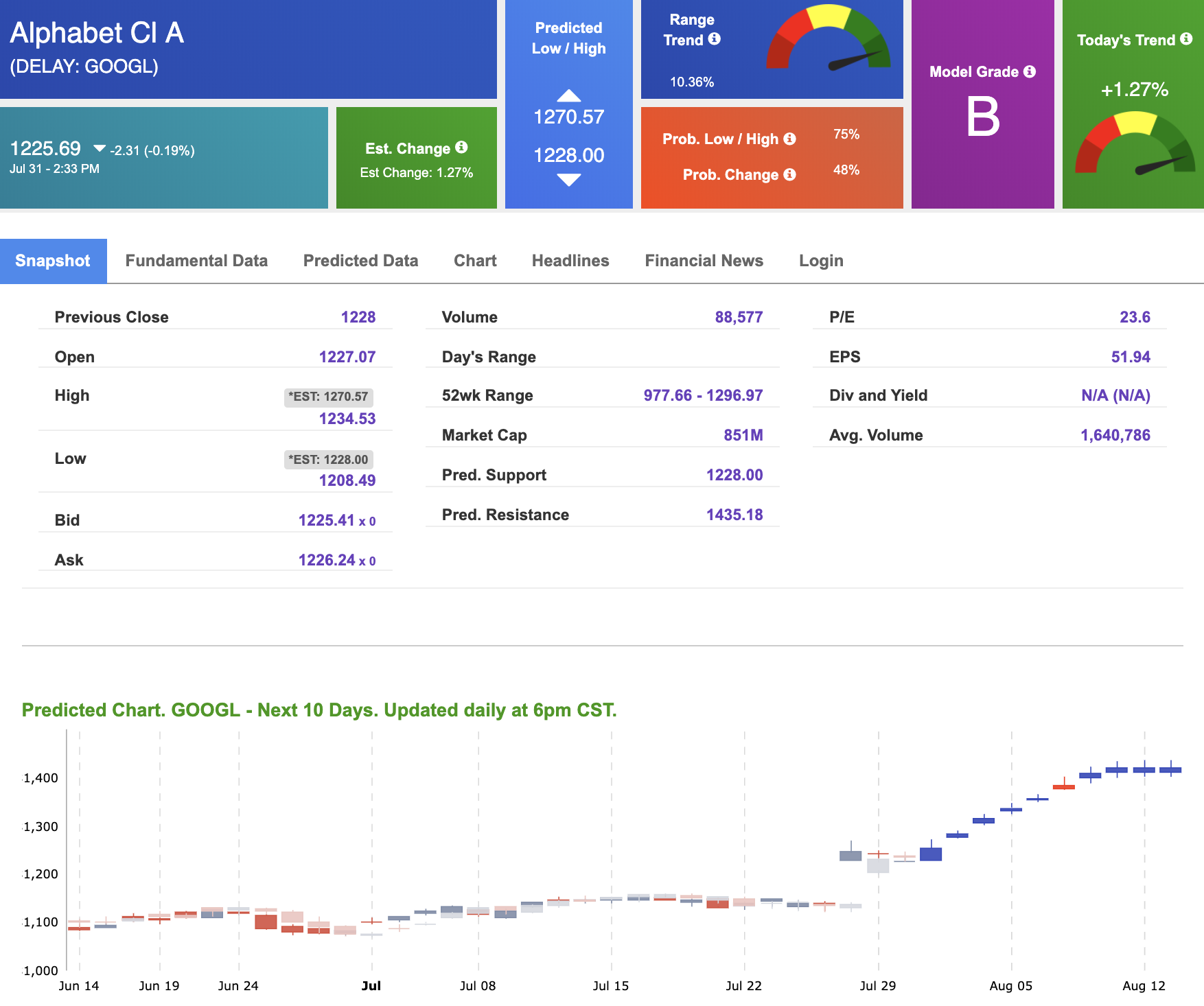

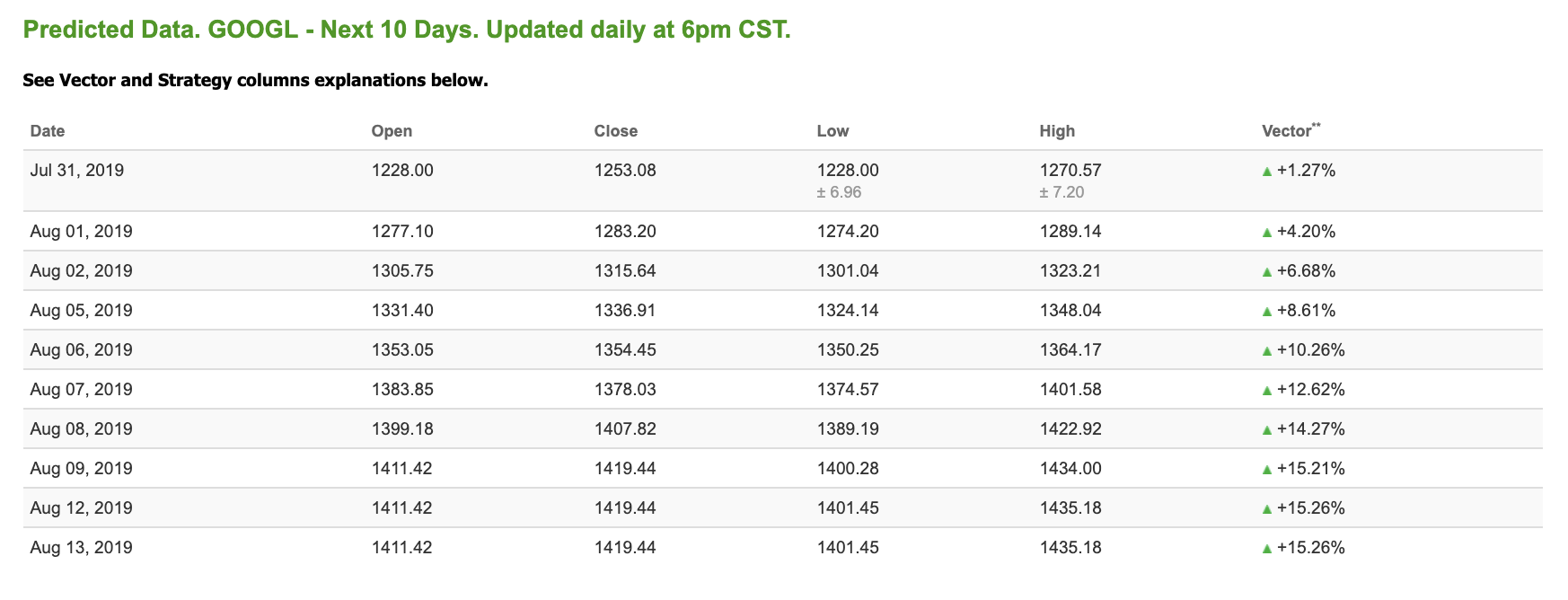

Our featured symbol for Thursday is Alphabet Inc. (GOOGL). GOOGL is showing a confident vector trend in our Stock Forecast Toolbox’s 10-day forecast. This stock is assigned a Model Grade of (B) indicating it ranks in the top 25th percentile for accuracy for predicted support and resistance, relative to our entire data universe.

The stock is trading at $1225.69 at the time of publication, up -0.19% from the open with a +1.27% vector figure.

Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Note: The Vector column calculates the change of the Forecasted Average Price for the next trading session relative to the average of actual prices for the last trading session. The column shows expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

Oil

West Texas Intermediate for Crude Oil delivery (CL.1) is priced at $58.00 per barrel, down 0.09% from the open, at the time of publication.

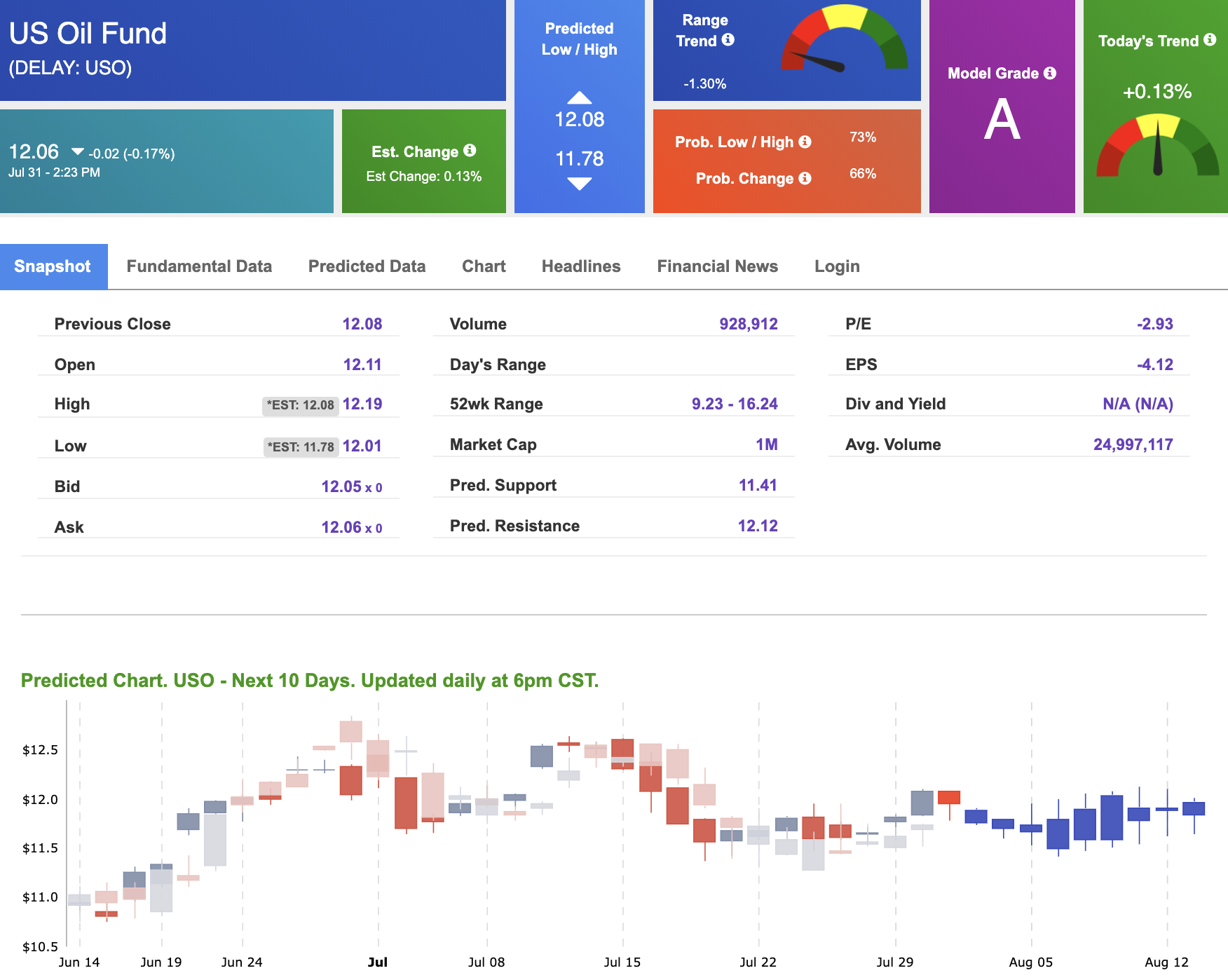

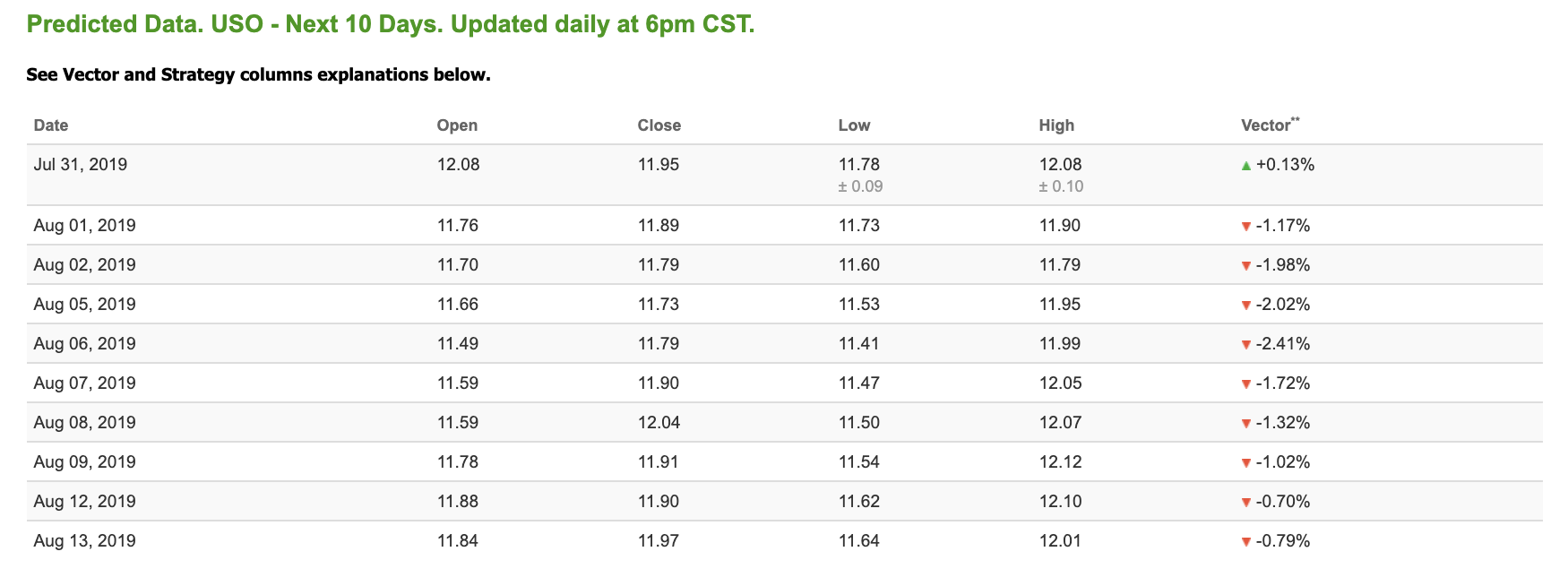

Looking at USO, a crude oil tracker, our 10-day prediction model shows negative signals. The fund is trading at $12.06 at the time of publication, down 0.17% from the open. Vector figures show +0.13% today, which turns -1.72% in five trading sessions. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

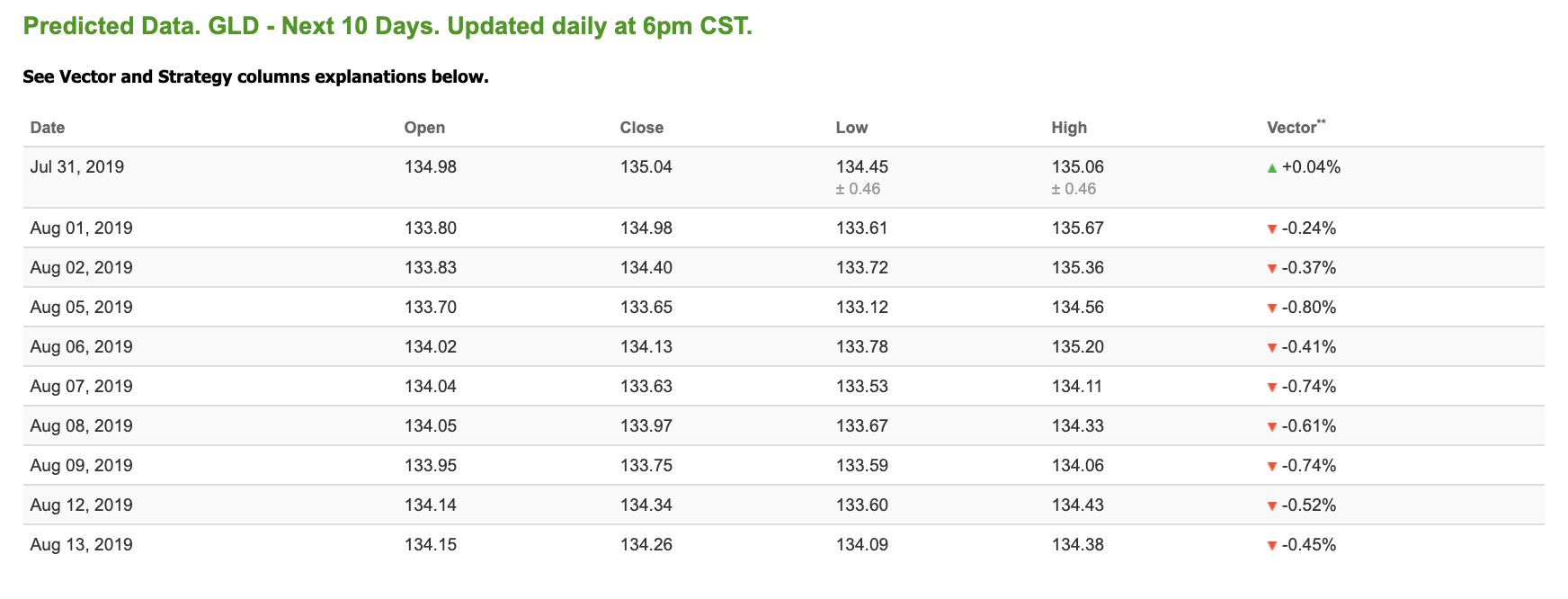

Gold

The price for the Gold Continuous Contract (GC00) is down 1.18% at $1,424.80 at the time of publication.

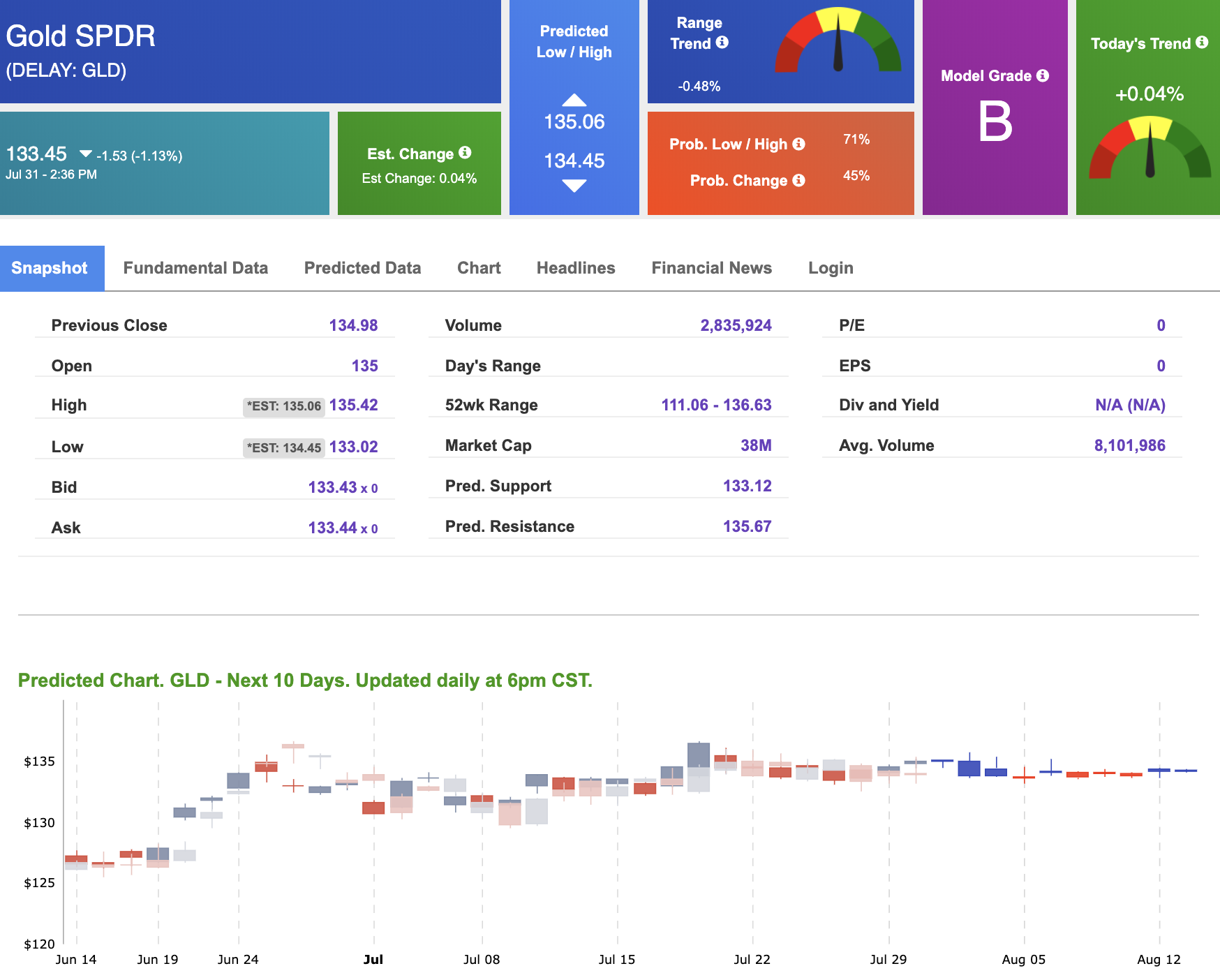

Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows mostly negative signals. The gold proxy is trading at $133.45, down 1.13% at the time of publication. Vector signals show +0.04% for today. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

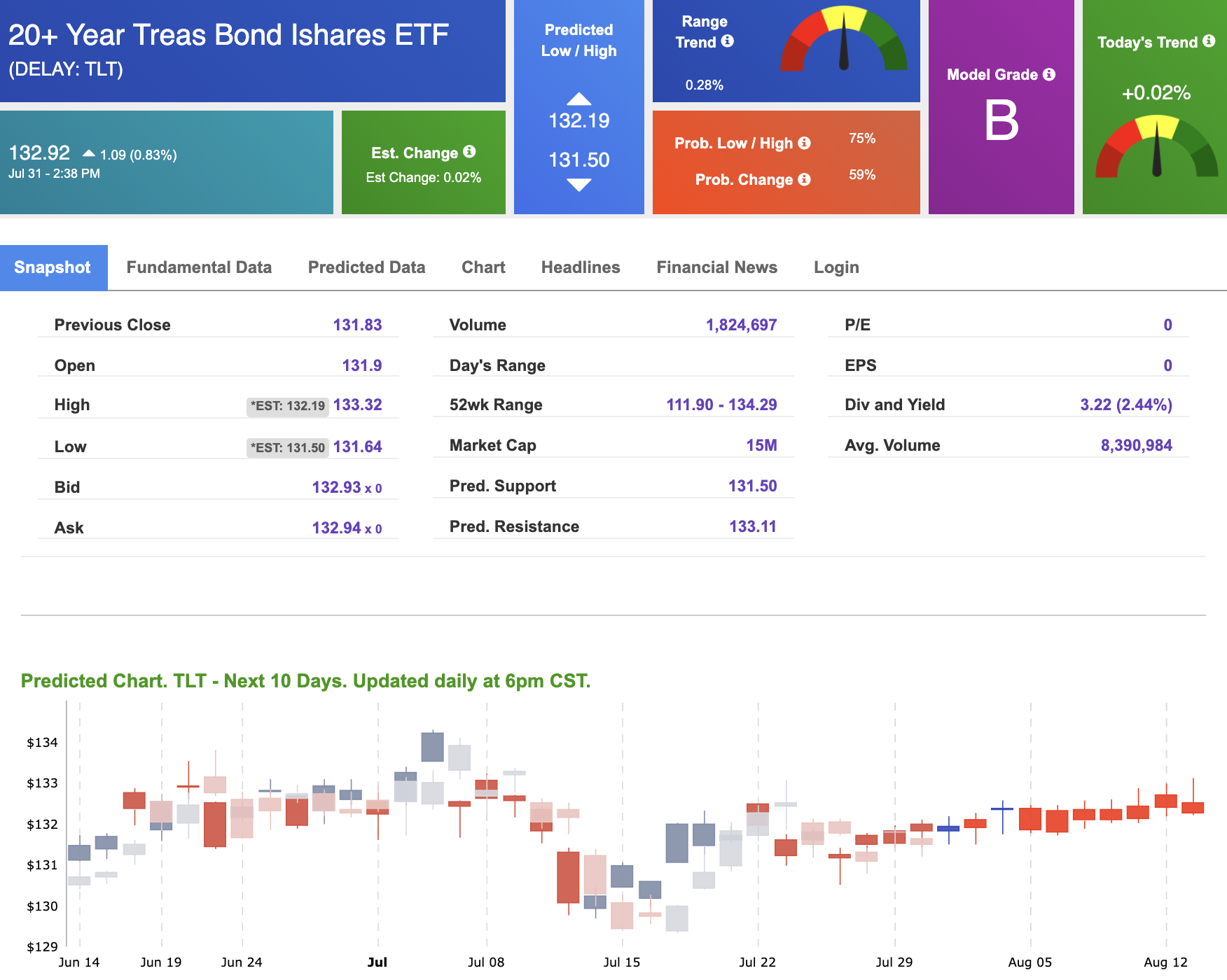

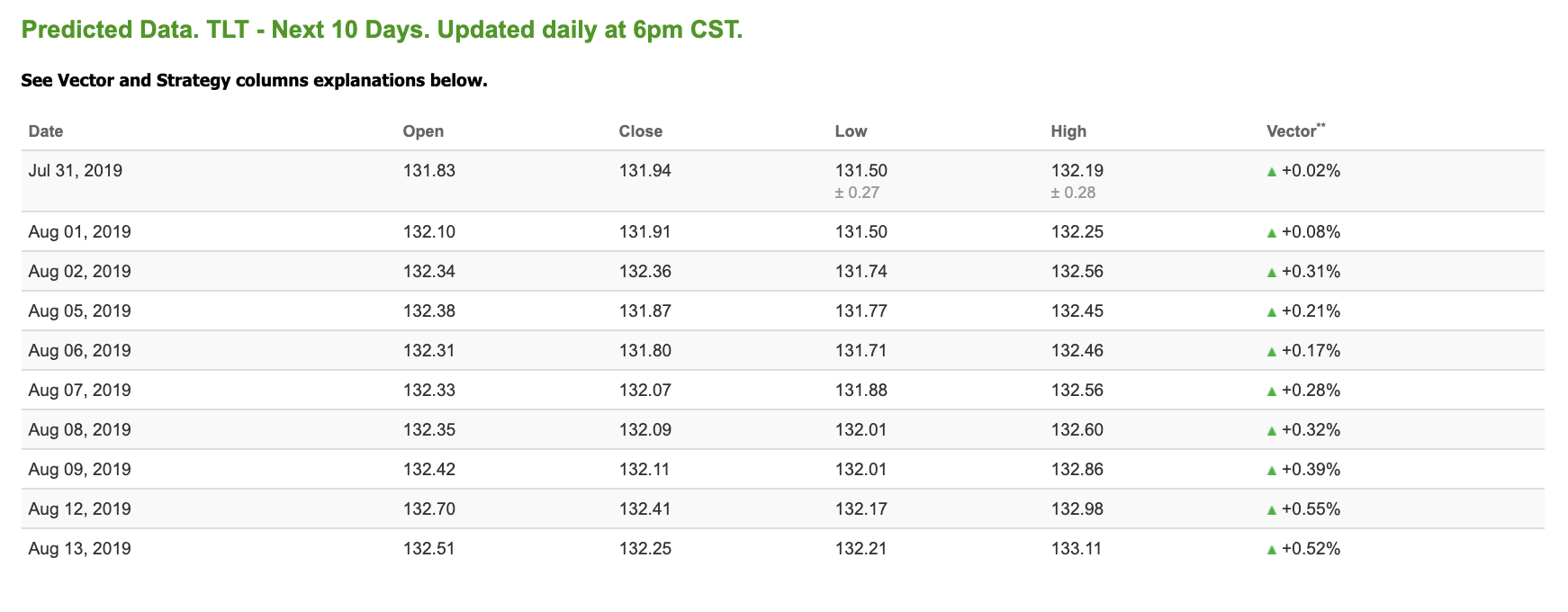

Treasuries

The yield on the 10-year Treasury note is down 2.28% at 2.01% at the time of publication. The yield on the 30-year Treasury note is down 2.04% at 2.53% at the time of publication.

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see positive signals in our 10-day prediction window. Today’s vector of +0.02% moves to +0.21% in three sessions. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

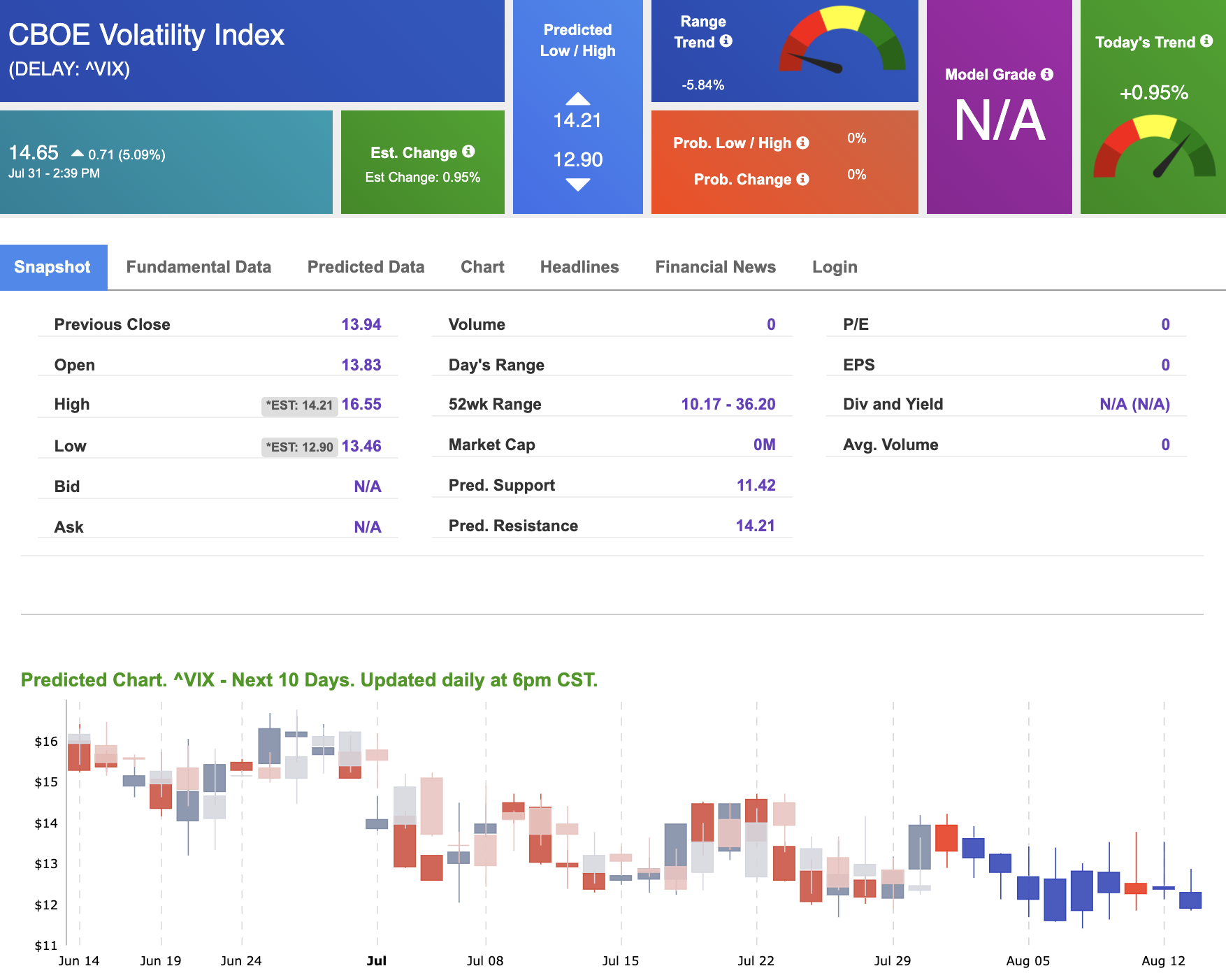

Volatility

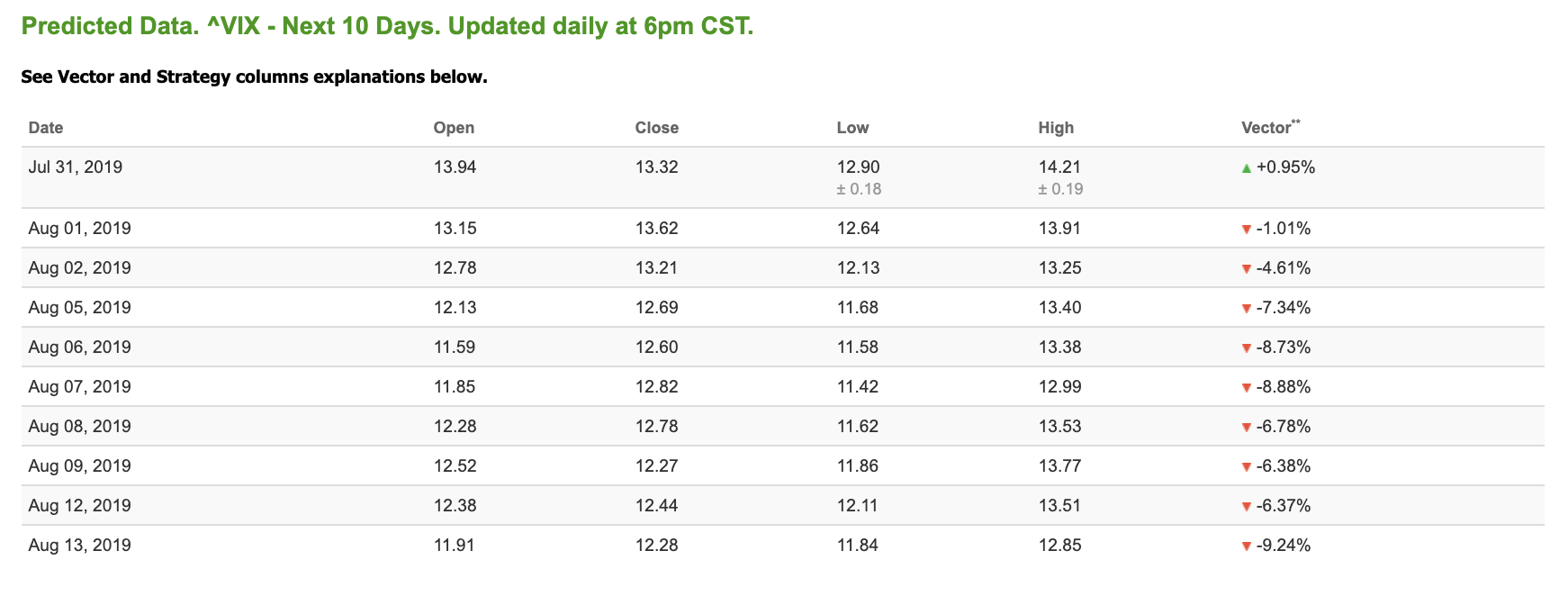

The CBOE Volatility Index (^VIX) is up 5.09% at $14.65 at the time of publication, and our 10-day prediction window shows negative signals. The predicted close for tomorrow is $13.62 with a vector of -1.01%. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Sign up now for Lifetime Access and pay less than the cost of just 1 year and lock in …

PERMANENT UNLIMITED ACCESS!

-

Subscribe now for less than the cost of one year at the regular rate!

-

With 36 month trailing gains of 1,276%, and an 75% win-rate, a lifetime Membership could easily turn $100,000 into $1,375,798

-

Tradespoon Premium is the only trading service you’ll ever need.