Find Out: My Trading Track Record for 2021

No one can say 2021 wasn’t a wild one.

However, the Options360 Concierge Trading Service tried to guide the investing plane with equanimity, taking a few lumps; occasionally being wrong, but always sticking with our plan to deliver steady and superior returns.

CLICK HERE for your $19 Options360 Concierge Trading Service deal to get started right now!

There are still a few days remaining until 2022. However, I doubt I’ll become too tepid — nor succumb to the rush of chasing adrenaline — to steer the ‘up and to the right’ return Options360 achieved in 2021.

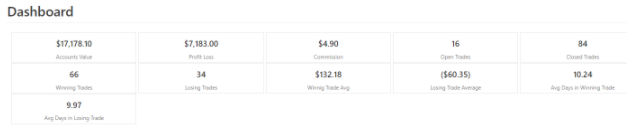

The Options360’s portfolio is on pace to profit 71% in 2021, more than doubling the S&P 500 Index (SPY) and the Power Share 100 (QQQ) Nasdaq. This was our sixth year of 54% annual returns.

And, with less than half the volatility than much more aggressive funds that relied on MEMEs, leveraging with YOLO calls, or simply lacking discipline.

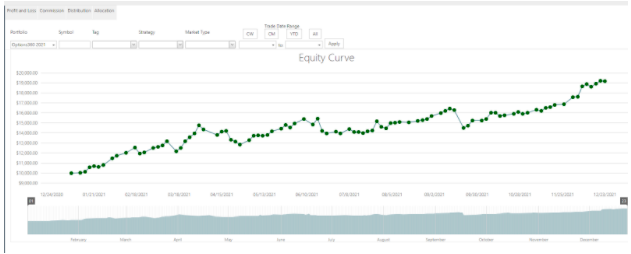

Behold the beauty of the smooth equity curve. It actually accelerated into the most volatile fourth quarter, as Options360 took advantage of a dynamic trading environment.

Options360 kept true to our mission and approached each trade with a focus in managing risk while maximizing rewards, which the image below shows over the course of the year:

Total winning trades: 66 vs 34 losers. A near 2:1 win right. An average profit of $132.18 versus the average loser of ($60.35).

Meaning, winners double losers in frequency and profitability.

Grab your $19 trial subscription and get ready for another record year in 2022!

I hope you all have a great holiday!

The post Find Out: My Trading Track Record for 2021 appeared first on Option Sensei.