Finding More Tech Diamonds in the Rough

RoboStreet – February 7, 2019

Finding More Tech Diamonds in the Rough

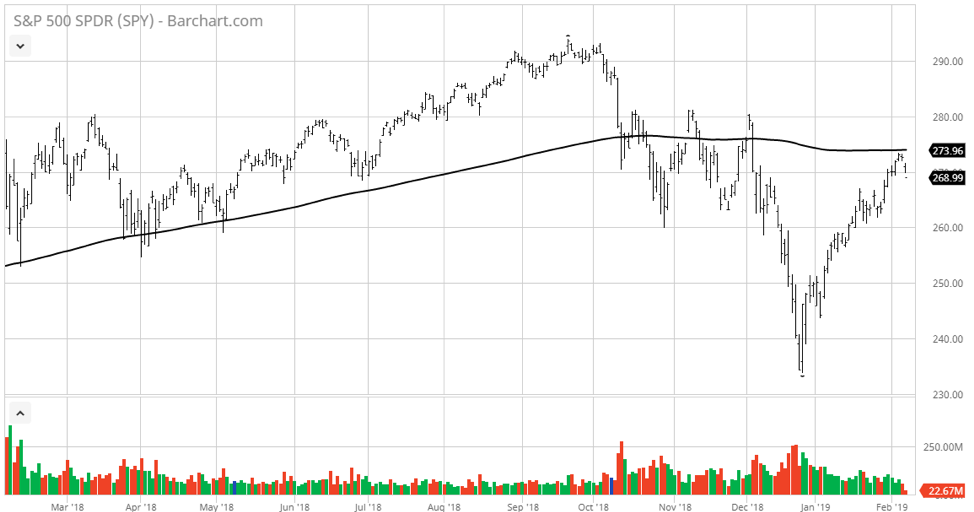

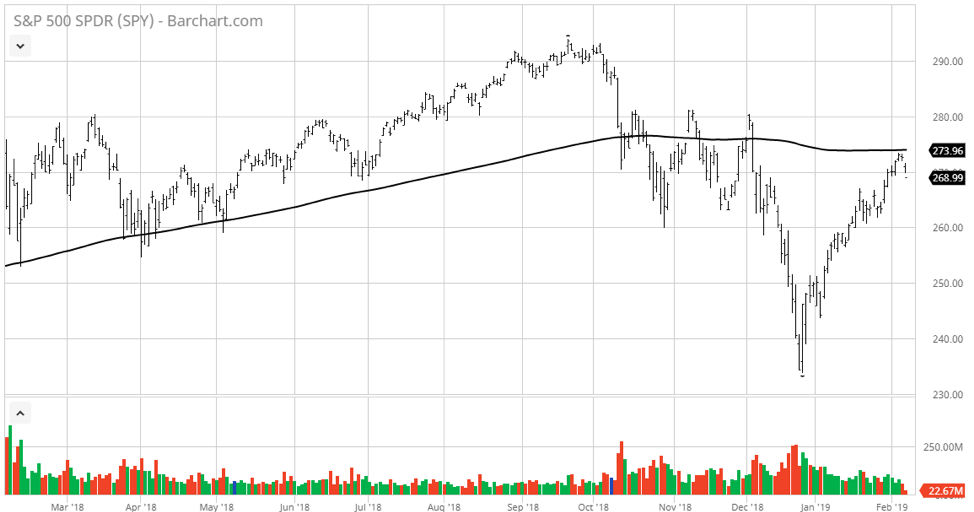

After seven weeks of steady gains, the stock market is taking a pause as overhead technical resistance provides an opportunity for investors and traders to book some gains. Many leading stocks are quite overbought so some consolidation is warranted and it will be interesting to see how much the market gives back. To date, bad news has been shrugged off with any and all dips being bought.

The narrative surrounding the revamped Fed policy taking a wait-and-see approach on further rate increases has fueled the recent rally while earnings from most of the companies reporting haven’t disappointed. Economic data has been mixed to positive and bond yields have stayed low, prompting the purchase of equities across all eleven sectors of the market.

Aside from the FAANG stocks making a recovery, there has also been strong leadership from the IT sector as a whole. Semiconductor and software stocks have been trading very well with some even trading to new all-time highs. This shows where fund managers and investors believe the best value propositions are for future sales and earnings growth in a global economy where growth is tapering.

“I’m investing my own money in each and every stock as my AI platform identifies.”

And remember we’re not talking about day-trading here. I’m looking for 50-100% gains inside of the next 3 months, so my weekly updates are timely enough for you to act.

Click Here – To See Where I Put My RoboInvestor Money

In what is a big story outside the U.S., the Bank of England lowered its 2019 GDP outlook to 1.2% from 1.7% and the EU Commission lowered its 2019 GDP forecast for the eurozone to 1.3% from 1.9%. Germany’s outlook for 2019 GDP growth was cut to 1.1% from 1.8% and Italy’s GDP forecast was cut to 0.2% from 1.2%. This is a full one-third cut in forward guidance and no doubt rekindles the notion of a global slowdown that has been all but ignored for the past several weeks.

One of the big themes within business investment for 2019 is protecting data and enterprises from cyber breaches. It’s a rapidly growing problem for all corporations and consumers, making for a strong investment proposition for those companies that combat cyber threats. China has previously faced heat over allegations regarding attempts to hack U.S. corporations, federal, state and local governments as well as the military. Just last December, two Chinese nationals with ties to the Chinese government were charged with breaching U.S. Navy, NASA, and the Department of Energy for theft of personal information on over 100,00 service members.

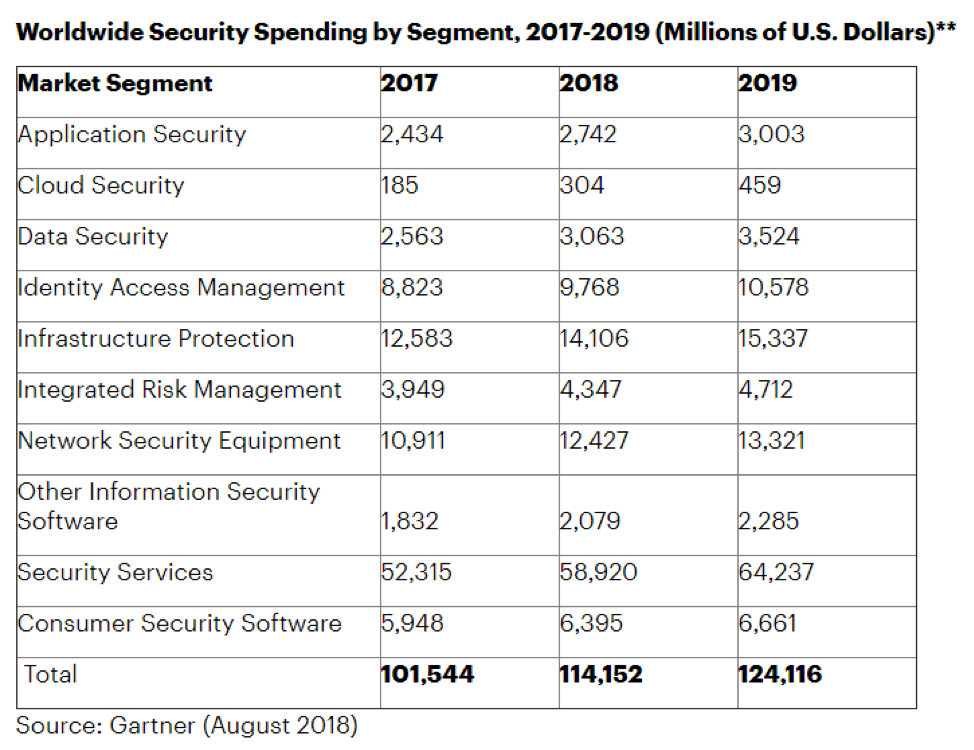

Gartner, the de facto IT research firm, forecasts that worldwide information security spending will top $124 billion in 2019 or 8.7% higher than in 2018. Within the Gartner surveys, subscription-managed services will represent better than 50% of security software spending by 2020. This is a trend where the best-positioned companies stand to reap terrific growth and where investors can cash in on stock performance.

For investors, the number of companies that are software security “pure plays” reside on a short list. Picking and choosing which companies to allocate capital to is not such a major task as it is buying them right. One legacy company that is getting some fresh institutional interest is Symantec Corporation (SYMC).

Sales and earnings have been increasing following the acquisition of Blue Coat Systems back in 2016. Its suite of cybersecurity software and hardware are a top choice among enterprises for securing networks and managing user authentication.

In the most recent release of quarterly results, Symantec delivered earnings of 44 cents per share that exceeded Wall Street forecasts of 39 cents. Revenue of $1.21 billion also came in above estimates of $1.18 billion. The company also raised guidance and announced it will increase its share buyback program by $500 million to $1.3 billion.

It was a great quarter for Symantec all around and the stock responded accordingly. Shares of SYMC traded from $20.50 to $24 on the earnings headline and have since done some constructive back and filling to $22.50 where an attractive entry point is being presented for new money that wants exposure to this rapidly growing industry.

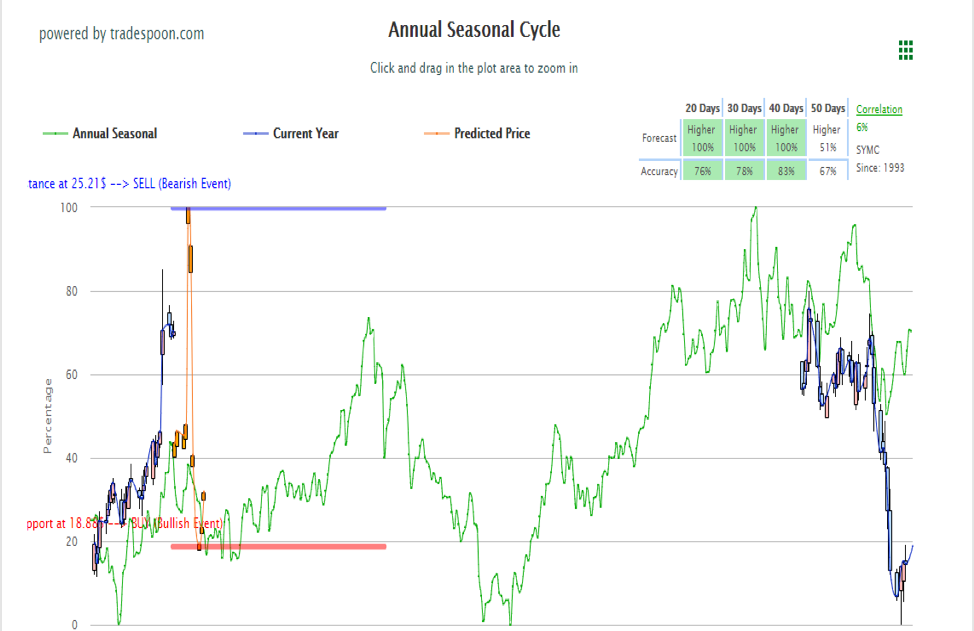

My Tradespoon Seasonal Chart is giving four thumbs up for the stock as well. As of this week, my AI-driven platform is giving a rare sweeping buy across all four time periods as per the chart below. This is pretty compelling for such an attractively priced stock.

Find a stock like Symantec with such strong fundamentals and an improving outlook is exactly why the power of artificial intelligence is so key to ferreting out great investment opportunities. My Tradespoon tools are at the heart of RoboInvestor, a custom stock portfolio advisory that has my own capital invested in every portfolio holding. In a market where volatility is here to stay and the year ahead offers visibility that is murky at best, having smart tools that have a plethora of internal indicators that reduce risk and provide timely buy and sell recommendations is not a luxury, it’s a necessity. Put RoboInvestor to work today and be a smarter and richer investor tomorrow.

*Please note: Any specific stocks mentioned on this page are part of our free subscription service. They are not included in any paid Tradespoon subscription services. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader or MonthlyTrader recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

“I’m investing my own money in each and every stock as my AI platform identifies.”

And remember we’re not talking about day-trading here. I’m looking for 50-100% gains inside of the next 3 months, so my weekly updates are timely enough for you to act.