Flash Alert! Large Cap China Stock Set To Break Out

RoboStreet – November 5, 2020

Bullish Tape Takes Market Back Up To Previous Highs

The market has enjoyed a roaring four-day pre-and-post election rally that is drawing cash off the sidelines and forcing the shorts to cover. Even though the final results of the elections appear to be a done deal, investors have bought into the notion that the GOP will retain control of the Senate, implying a corporate tax hike is off the table.

Stimulus package right after the elections

As it stands, the odds favor Joe Biden getting the win for the White House, but not without a massive legal battle from President Trump targeting the mail-in ballots still being counted. However, the current consensus is that Senate Majority Leader Mitch McConnel’s statement that a stimulus package needs to happen right after the elections is very welcome news to a market starving for fiscal action.

(Want free training resources? Check our our training section for videos and tips!)

“I’m investing my own money in each and every stock as my AI platform identifies.”

And remember we’re not talking about day-trading here. I’m looking for 50-100% gains inside of the next 3 months, so my weekly updates are timely enough for you to act.

Click Here – To See Where I Put My RoboInvestor Money

$340-344 level key support for the bulls

The SPY continued the rally as market participants realized the senate most likely will be controlled by Republicans and the balance of power will continue. The SPY has broken through the main overhead resistance at the $340-345 level. The $340-344 level is key support for the bulls. The market has rebounded from the extreme oversold levels but is prone to further weakness after the elections.

As long as the SPY is trading above the $342-345 level market is range-bound between $342-$360 till the end of the year. I still expect a potential retest of $320 level this week after but at this point the break of $320 level is unlikely.

The U.S. Dollar ($DXY) is trading below the $94 level and U.S. Treasuries (TLT) staged a strong rebound as stimulus package size and timing are uncertain.

My opinion has not changed. We are in the middle of the consolidation phase before the bull market will resume by the end of NovemberDecember. I would be a buyer using any short-term corrections and use a dollar-cost averaging strategy to accumulate positions at this level. If you are trading options consider selling premium with February and March expiration dates.

iShares China Large-Cap ETF challenge the 2018 high of $54.

Against this wild election week investing landscape, China’s big-cap market index has broken out to the upside on the notion of a Biden Presidency implies fewer tensions and fewer tariffs. Hence, the iShares China Large-Cap ETF (FXI) has taken out overhead resistance at $46 and now looks to challenge the 2018 high of $54.

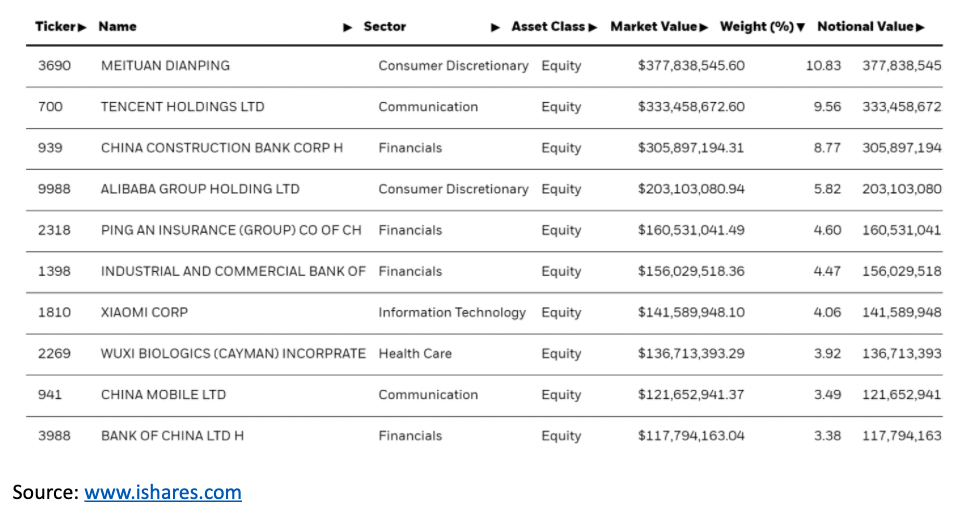

The top ten holdings comprise a nice mix of consumer, communications, and financial companies whose stocks are all in strong uptrends. These top positions also account for roughly 56% of total fund assets, so as these stocks go, so goes FXI shares. The concentration on the consumer reflects China’s economic policy to move more towards a consumer-driven economy and less on manufacturing.

We’ve owned FXI in our RoboStreet Portfolio on more than one occasion within the past couple of years, and as is with any major technical breakout, shares of FXI should offer a healthy pullback in the coming days that provide an attractive entry point.

Alibaba is the Amazon.com of China

Within these top holdings, my AI platform is especially fond of Alibaba Group Holding Ltd (BABA), China’s largest B2B and consumer eCommerce business. The company is sometimes referred to as the Amazon.com of China, and for good reason, it’s growing rapidly and has a bigger audience.

Earnings are forecast to jump by 35% to $12.70 per share

BABA is forecast to grow revenues to $100 billion in 2020 and then as much as $147 billion in 2021, the high end of estimates. Earnings are forecast to jump by 35% to $12.70 per share. With China’s economy picking up speed in the current quarter, the bullish analyst estimates look to hold up.

(Want free training resources? Check our our training section for videos and tips!)

BABA currently around $285 and our AI model forecast $442.34

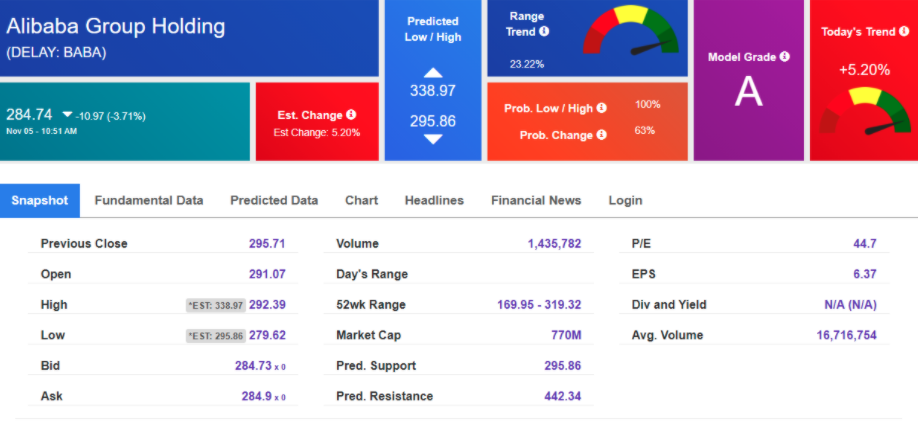

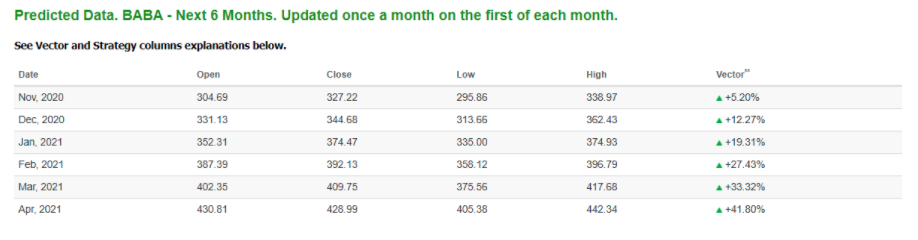

When we apply our AI tools to BABA, we also get some bullish readouts. Our Stock Forecast Toolbox gives BABA an “A” Model Grade rating. Shares of BABA are currently trading around $285 and our AI model is forecasting the stock to trade as high as $442.34 within the next six months, implying 55% upside appreciation potential.

As a member of RoboInvestor, you’ll be sure to be in on when I pull the trigger on BABA when my short-term indicators flash a buy signal. These are precisely the kinds of blue-chip stocks we place into our RoboInvestor Portfolio every week.

Two new recommendations twice a month

Twice a month, I send out a RoboInvestor newsletter with two new recommendations that will involve stocks or ETFs in all manner of asset classes. Be it equities, indexes, commodities, sectors, currencies, volatility, etc. we’re investing in those assets crunched by my AI tools that have the highest probability of producing profits.

(Want free training resources? Check our our training section for videos and tips!)

Winning Trades Percentage of 90%

Our AI-driven investing system is producing a Winning Trades Percentage of 90%. That means every time you invest with RoboInvestor, you’re making money in 9 out of every 10 trading strategies. That’s unheard of performance anywhere in the industry.

The investing landscape is going to remain volatile

Take me up on my offer and join up today and put RoboInvestor to work for your portfolio. The investing landscape is going to remain volatile with the cross-currents of politics, the pandemic, and stimulus still very fluid. And yet our AI platform finds great trades and investing strategies that tune out all the noise and simply work with the underlying reams of data that drive our recommendations.

Make RoboInvestor your best year-end trade and let’s look to enhance our portfolios together for the balance of 2020 and into 2021.

(Want free training resources? Check our our training section for videos and tips!)

“I’m investing my own money in each and every stock as my AI platform identifies.”

“I’m investing my own money in each and every stock as my AI platform identifies.”

And remember we’re not talking about day-trading here. I’m looking for 50-100% gains inside of the next 3 months, so my weekly updates are timely enough for you to act.

Click Here – To See Where I Put My RoboInvestor Money

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

(Want free training resources? Check our our training section for videos and tips!)