Flash Alert! Trading China Deal for Big Profits

RoboStreet – November 7, 2019

Market Gaps Higher on Rosier Outlook for China Deal

Stocks are extending their record-setting gains after a spokesperson for China’s Commerce Ministry reportedly said both the U.S. and China have agreed to cancel some tariffs in place on each other’s goods as part of the “Phase One” trade deal negotiations. At the same time, it was also communicated that the deal would fail to be completed without the simultaneous rollback of in-place tariffs. Investors are taking the news at face value as being a positive development.

(Want free training resources? Check our our training section for videos and tips!)

Iran and Hong Kong as inherent risks to the broader market

Even though there are other inherent risks to the broader market landscape – namely Iran violating the 2015 nuclear pact by fueling centrifuges to weapons-grade levels – a highly symbolic and serious breach. The months-long protests in Hong Kong remain at a fever pitch with the threat of Chinese military intervention a high-risk probability.

(Want free training resources? Check our our training section for videos and tips!)

A hard-Brexit from the E.U. still a possibility

A hard-Brexit from the E.U. is still a possibility, even though the deadline was yet again delayed and the impeachment inquiry against President Trump is at present not a concern to the stock market but is still a fluid situation that could take some sizzle off the rally if it becomes more serious.

(Want free training resources? Check our our training section for videos and tips!)

“I’m investing my own money in each and every stock as my AI platform identifies.”

“I’m investing my own money in each and every stock as my AI platform identifies.”

(Want free training resources? Check our our training section for videos and tips!)

And remember we’re not talking about day-trading here. I’m looking for 50-100% gains inside of the next 3 months, so my weekly updates are timely enough for you to act.

Click Here – To See Where I Put My RoboInvestor Money

(Want free training resources? Check our our training section for videos and tips!)

Bullish sentiment has spread to global markets

The S&P 500 is traded to 3,100 on the encouraging market tone with banks, industrials, semiconductors, and transportations continuing to lead the way higher. Bullish sentiment has spread to global markets with European markets seeing fresh upside momentum on the perception that the slow growth has troughed.

(Want free training resources? Check our our training section for videos and tips!)

Rapid rotation out of defensive sectors into cyclical sectors

The steepening yield curve has market strategists raising their growth outlook for global growth prospects and is factoring heavily in the rapid rotation out of defensive sectors into cyclical sectors.

(Want free training resources? Check our our training section for videos and tips!)

Easy for the major averages to get overbought

While the rally is a most welcome development, it is easy for the major averages to get overbought as under-invested fund managers chase the rally. The CBOE Volatility Index (VIX) is trading back down to 12.50 as of yesterday, a clear sign of investor complacency.

(Want free training resources? Check our our training section for videos and tips!)

Each time this year the VIX at 12-13 level, the market has correction soon thereafter

Each time this year the VIX has traded down to the 12-13 level, the market has correction soon thereafter. We are indeed in a seasonally strong time of the year, but investors just need to heed this development and its predictive accuracy of prior bouts of market consolidation.

(Want free training resources? Check our our training section for videos and tips!)

(Want free training resources? Check our our training section for videos and tips!)

Headline-driven high-frequency trading prop shops control over 70% of the average daily volume

Without a hard and fast agreement with China that is signed, sealed and delivered, the prudent path to managing the upsurge for stocks is to pare gains in highly extended positions, reduce and forego the use of margin and maintain a trailing mental and/or physical stop-loss on one’s portfolio. What the market giveth, it can also take away, especially when headline-driven high-frequency trading prop shops control over 70% of the average daily volume of the entire market.

(Want free training resources? Check our our training section for videos and tips!)

S&P rally up to 3,150 in a frothy move by month-end from current levels

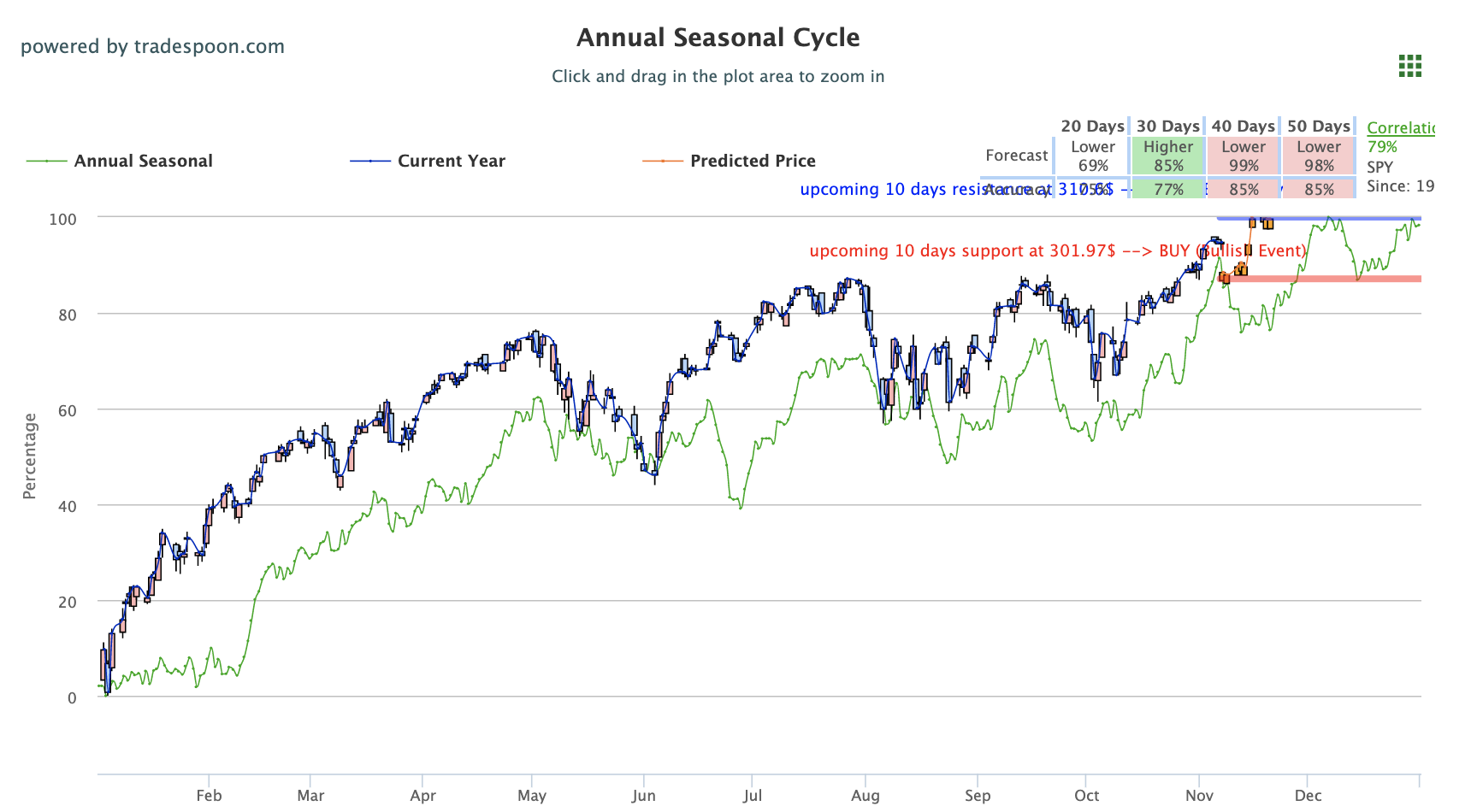

The Tradespoon Seasonal Chart indicates the S&P could rally up to 3,150 in a frothy move by month-end from current levels. A constructive pullback to support at 2,950-3,000 would be an attractive level to commit capital assuming a deal with China does, in fact, get done. For now, momentum begets momentum and positive fund flows coupled with the widespread short covering is driving the market higher.

(Want free training resources? Check our our training section for videos and tips!)

(Want free training resources? Check our our training section for videos and tips!)

Having a powerful set of AI tools is essential

With the market entering a new trading range, having a powerful set of AI tools that will guide portfolio performance going forward is in my view essential.

(Want free training resources? Check our our training section for videos and tips!)

RoboInvestor Portfolio boasts an 87.63% Winnings Trade Percentage

My Tradespoon tools are custom-tailored algorithms the I personally code to exacting standards for selecting the highest quality stocks and ETFs with precision timing for buy and sell points. We incorporate these advanced tools into managing our RoboInvestor Portfolio which boasts an 87.63% Winnings Trade Percentage.

(Want free training resources? Check our our training section for videos and tips!)

Volatility will return

Take control of the year-end opportunity to trade this rally in a manner the maximizes your investment capital. Volatility will return and when it does, you’ll want to have booked profits and be holding plenty of powder to buy back in on a big dip.

(Want free training resources? Check our our training section for videos and tips!)

Timing is everything

Timing is everything and my AI market tools are super accurate as to when to add and take off risk – and our RoboInvestor track record is a testament to this all-important aspect of winning in the stock market on a consistent basis.

(Want free training resources? Check our our training section for videos and tips!)

Take me up on my offer to invest alongside me and join RoboInvestor today!

(Want free training resources? Check our our training section for videos and tips!)

“I’m investing my own money in each and every stock as my AI platform identifies.”

“I’m investing my own money in each and every stock as my AI platform identifies.”

And remember we’re not talking about day-trading here. I’m looking for 50-100% gains inside of the next 3 months, so my weekly updates are timely enough for you to act.

Click Here – To See Where I Put My RoboInvestor Money

(Want free training resources? Check our our training section for videos and tips!)

RoboStreet is part of your free subscription service

RoboStreet is part of your free subscription service*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

(Want free training resources? Check our our training section for videos and tips!)