G20 Summit Begins Tomorrow, Stocks Slide Today

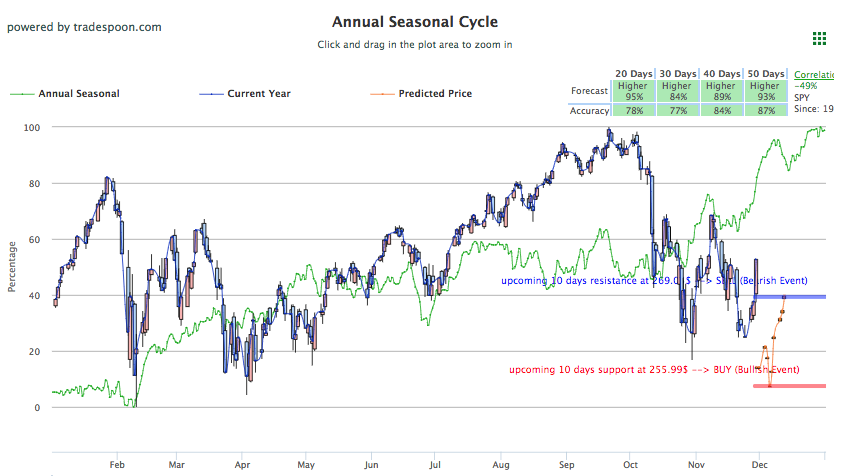

U.S. Stocks started the day trading slightly lower, losing steam from the Black Friday/Cyber Monday retail-push that helped stocks to a three-day rally, before recouping losses in the late afternoon. It looks like the market has formed the bottom after this week’s impressive rally and investors should consider buying on any corrections. Also assisting stocks was the renewed sense of optimism in global trade with the upcoming G20 summit, scheduled to begin tomorrow. With world leaders set to meet in Argentina, there is hope global trade relations could be improved and the recent tariff back and forth between China and the U.S could be addressed. Other likely points of interest for G20-attendees looks to be global economic growth, slumping oil, and climate change. The market decline also comes one day after Fed Chairman Powell delivered a dovish speech that helped stocks and bonds rally. More news set to hold investors attention today looks to be the remaining release schedule of economic reports including minutes from the early November FOMC meeting, Pending Home Sales, Weekly Jobless Claims, and Core Inflation. Current SPY overhead resistance is at $280. For reference, the SPY Seasonal Chart is shown below:

Hosting both President Trump and President Xi, the G20 summit will provide a good platform for the two leaders currently embattled in tariff-off to build the framework for a potential deal or future negotiations to improve trade relations and halt the tariff escalation. Oil slid in early morning action, dropping below $50 a barrel for the first time this year, before mounting a rebound to hover around $51. Look for more on news on oil to also come from the upcoming G20 summit were leaders from Russia and Saudi Arabia will be present.

Chairman Powell’s lighter, dovish comments were received well as they helped support stocks through a midday rally yesterday that sustained the impressive three-day rally. Still, yesterday’s optimism looks to be weighed down today by the recently released economic reports. U.S. home sales slid in October while unemployment rose last week, and is at its highest in the last six months. Year-over-year inflation remained at 2% while consumer spending and income slightly rose for October. Today’s downward movement coupled with the modest economic reports point to looming concerns and uncertainty regarding upcoming global trade negotiations.

Some market-movers to note today include Abercrombie & Fitch Co., which is currently up 20% after earnings released today beat estimations, and Dollar Tree, currently up 5% and also received a nice boost from positive earnings. Twitter is sliding, down 6%, after a recent report pointed out Fox News and their correspondents have boycotted the platform and haven’t posted since November 8th. Globally, Asian stocks lowered today while European markets were modestly up.

Using the “^GSPC” symbol to analyze the S&P 500, our 10-day prediction window shows mixed signals. Today’s vector figure of +1.35% moves to -2.84% in five trading sessions. The predicted close for tomorrow is 2,788.70. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Highlight of a Recent Winning Trade

On November 23rd, our ActiveTrader service produced a bullish recommendation for Genworth Financial Inc. (GNW). ActiveTrader is included in all Tradespoon membership plans and is designed for intraday trading.

Trade Breakdown

GNW entered the forecasted Entry 1 price range of $4.47 (± 0.04) in its first hour of trading and hit its Target price of $4.54 in the second hour of trading, reaching a high of $4.54 for the trading day. The Stop Loss was set at $4.43.

LAST CHANCE: $uper Cyber Week $pecial!!!

What better way to celebrate Cyber week than by offering Market Commentary subscribers a Ridiculously Awesome Deal!

We are offering LIFETIME ACCESS to our Premium Membership for less than the regular price we normally charge for only 1 year of service!

I want to make this offer a complete no-brainer! Would you rather sign up for just one year of service or get Lifetime Access for an even lower price?

This offer is only available until Midnight, so please act Fast before you miss out!

Just click the link below and it will take you to an upgrade page where you can claim this special offer!

Click Here to Sign Up

NEW! Best Mobile Trading iPhone App –Buy, Sell and Learn!

Truly unique among stock trading apps. It acts as your gateway to the ultimate trading experience with our Tradespoons’ Stock Forecast Toolbox — all of which gives you a big edge in trading stocks profitably.

CLICK HERE To Download the Stock Forecast Toolbox FREE iPhone App Now!

* Note: Stock Forecast Toolbox Subscription or Higher Required

Friday Morning Featured Stock

Our featured stock for Friday is Cisco Systems Inc. (CSCO). CSCO is showing a confident vector trend in our Stock Forecast Toolbox’s 10-day forecast. This stock is assigned a Model Grade of (B) indicating it ranks in the top 25th percentile for accuracy for predicted support and resistance, relative to our entire data universe.

*Please note: Our featured stock is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader or ActiveInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

The stock is trading at $47.42 at the time of publication, up 0.26% from the open with a +0.60% vector figure.

Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Note: The Vector column calculates the change of the Forecasted Average Price for next trading session relative to the average of actual prices for the last trading session. The column shows expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

Oil

West Texas Intermediate for January delivery (CLF9) is priced at $51.91 per barrel, up 3.22% from the open, at the time of publication. Looking at USO, a crude oil tracker, our 10-day prediction model shows mixed signals. The fund is trading at $10.9 at the time of publication, up 2.25% from the open. Vector figures show -1.14% today, which turns -7.49% in five trading sessions. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Gold

The price for December gold (GCG9) is down 0.07% at $1,229.10 at the time of publication. Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows mostly positive signals. The gold proxy is trading at $115.73, up 0.30% at the time of publication. Vector signals show +0.12% for today. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Treasuries

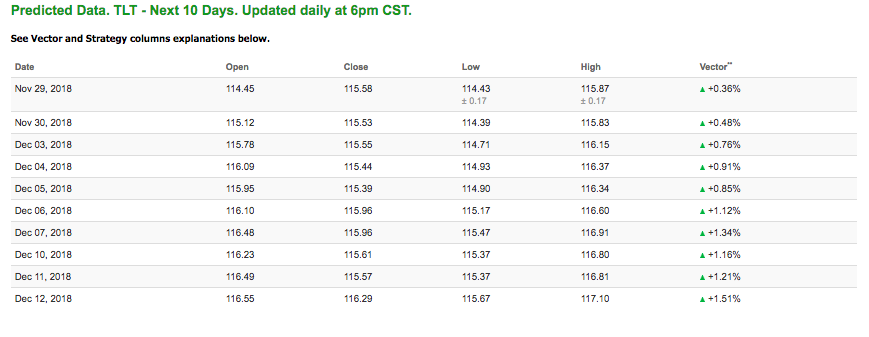

The yield on the 10-year Treasury note is down 0.60% at 3.04% at the time of publication. The yield on the 30-year Treasury note is down 0.2 5% at 3.34% at the time of publication.

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see positive signals in our 10-day prediction window. Today’s vector of +0.36% moves to +0.91% in three sessions. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

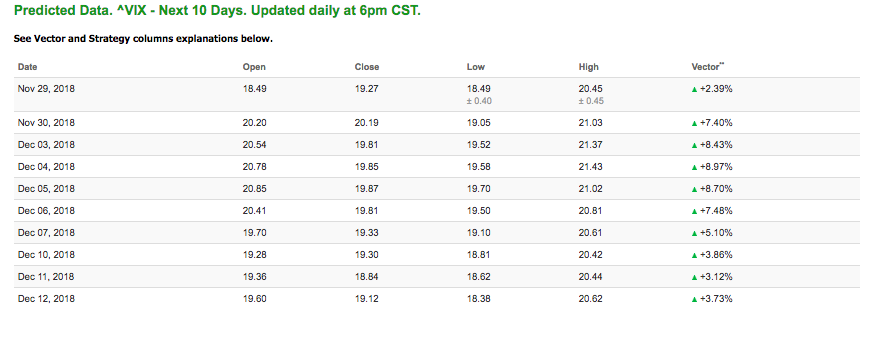

Volatility

The CBOE Volatility Index (^VIX) is up 1.73% at $18.81 at the time of publication, and our 10-day prediction window shows positive signals. The predicted close for tomorrow is $20.19 with a vector of +7.40 %. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

LAST CHANCE: $uper Cyber Week $pecial!!!

What better way to celebrate Cyber week than by offering Market Commentary subscribers a Ridiculously Awesome Deal!

We are offering LIFETIME ACCESS to our Premium Membership for less than the regular price we normally charge for only 1 year of service!

I want to make this offer a complete no-brainer! Would you rather sign up for just one year of service or get Lifetime Access for an even lower price?

This offer is only available until Midnight, so please act Fast before you miss out!

Just click the link below and it will take you to an upgrade page where you can claim this special offer!

Click Here to Sign Up

NEW! Best Mobile Trading iPhone App –Buy, Sell and Learn!

Truly unique among stock trading apps. It acts as your gateway to the ultimate trading experience with our Tradespoons’ Stock Forecast Toolbox — all of which gives you a big edge in trading stocks profitably.

CLICK HERE To Download the Stock Forecast Toolbox FREE iPhone App Now!