Global Markets Rise Behind News China-U.S. Trade Deal “90%” Done

All three major U.S. indices are riding multi-day winning streak and are on track to close in the green today as well. Stocks are receiving support from positive news regarding a possible China-U.S. trade deal that has been reported to be 90% done. With signs of successful meetings between the two sides, both in Beijing last week and in D.C. this week, coupled with positive PMI data from both countries, global trade sentiment has vastly improved. Still, Brexit uncertainty remains and continues to drag the pound down. Prime Minister May will cross party lines to meet with opposition leader Jeremy Corbyn today in hopes of establishing some commonalities for a possible Brexit deal. Earnings season is set to pick up with over 50 reports next week and almost triple that the following. The market has broken out of range and short-term support now sits at $280-284. Continue monitoring seasonal charts and 200-day moving average for guidance as the market is on its way to retest 52 weeks high of $294. For reference, the SPY Seasonal Chart is shown below:

After several positive manufacturing reports from both the U.S. and China, this week’s news of solid progress on a deal that is “90% done,” according to U.S. Chamber of Commerce member Myron Brilliant, helped domestic and global markets further gains. The high-level discussions will likely preclude a meeting between President Xi and Trump many predict to happen this month. Commodities are also seeing wide-spread rallies with oil, gold, and many more rising significantly in 2019. Avocados, for example, displayed some of the biggest growth with 34% gains just yesterday. Talks of a hard-shutdown to the southern U.S. border by President Trump as well as recent California heatwaves likely spurred the surge.

Over in U.K., Prime Minister May is scheduled to meet with opposition party leader Corbyn as Brexit turmoil continues to show no clear path for an exit from the EU. The two leaders will try to establish commonalities between their respective goals, methods, and parties in order to present some deal before the EU’s deadline. May has previously offered her resignation for an agreed upon deal, but that did not seem to move the needle as over eight other plans have died on the Parliament floor, as well as May’s deal thrice. Several members of Parliament view this meeting as a betrayal of their party, for both May and Corbyn, however, with little progress since the previous deadline fall apart, this move seemed all but inevitable.

Other news to note includes Lyft slight rebound after a two-day tank following their IPO release, Bitcoin’s recent 10% surge, and GameStop’s stock harsh tumble post-earnings which widely missed expectations. Look for Constellation Brands to report earnings tomorrow while next week’s earnings feature Delta Airlines, Blackrock, and several major banks on Friday. Jobless claims for last week will release tomorrow and on Friday we will see unemployment rate and average hourly earnings for the month of March.

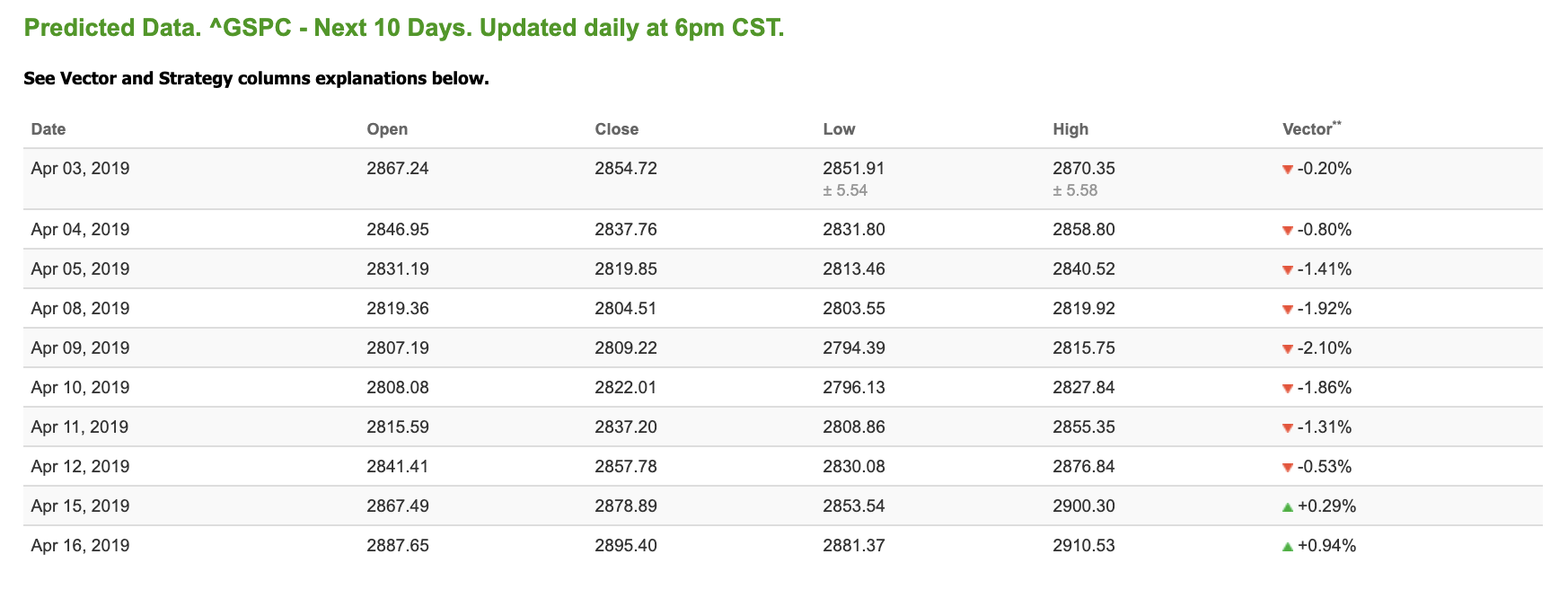

Using the “^GSPC” symbol to analyze the S&P 500, our 10-day prediction window shows mixed signals. Today’s vector figure of -0.20% moves to -1.86% in five trading sessions. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Trailing 36-month return. . . 1,114%!

That can turn $100,000 into $1,214,260 in just 36 months!

Tradespoon Premium Service is the ultra-high-tech, sophisticated, limited-access, secret weapon that’s been making fortunes for select, savvy investors since 2012!

It’s an easy-to-use, real-time trading service that makes it easy to cash in, like a full-time professional trader, on breaking trade developments.

Now that you’ve seen us in action, sign up now for Lifetime Access and pay less than the cost of just 1 year and lock in!!

Click Here, one-time offer expires midnight tonight…

Highlight of a Recent Winning Trade

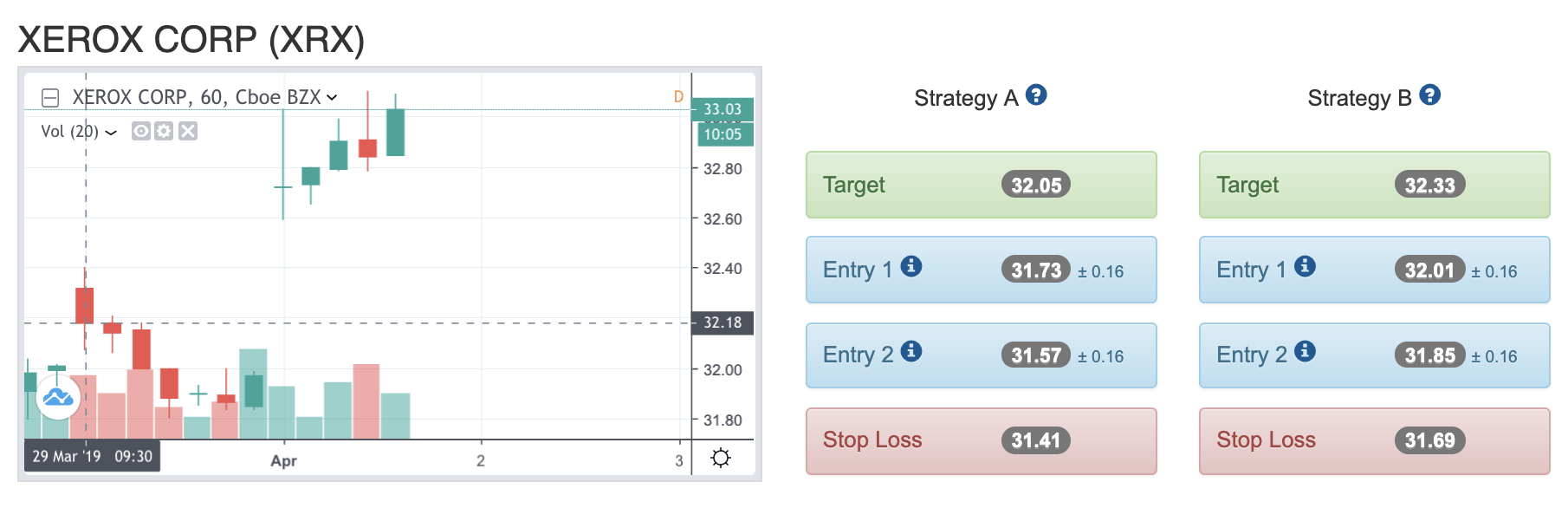

On March 29th, our ActiveTrader service produced a bullish recommendation for Xerox Corp (XRX). ActiveTrader is included in all paid Tradespoon membership plans and is designed for day trading.

Trade Breakdown

XRX entered its forecasted Strategy B Entry 1 price range $32.01 (± 0.16) in its second hour of trading and passed through its Target price $32.33 in the first hour of trading the following trading day. The Stop Loss price was set at $31.69.

Thursday Morning Featured Stock

*Please note: Our featured stock is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader or MonthlyTrader recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

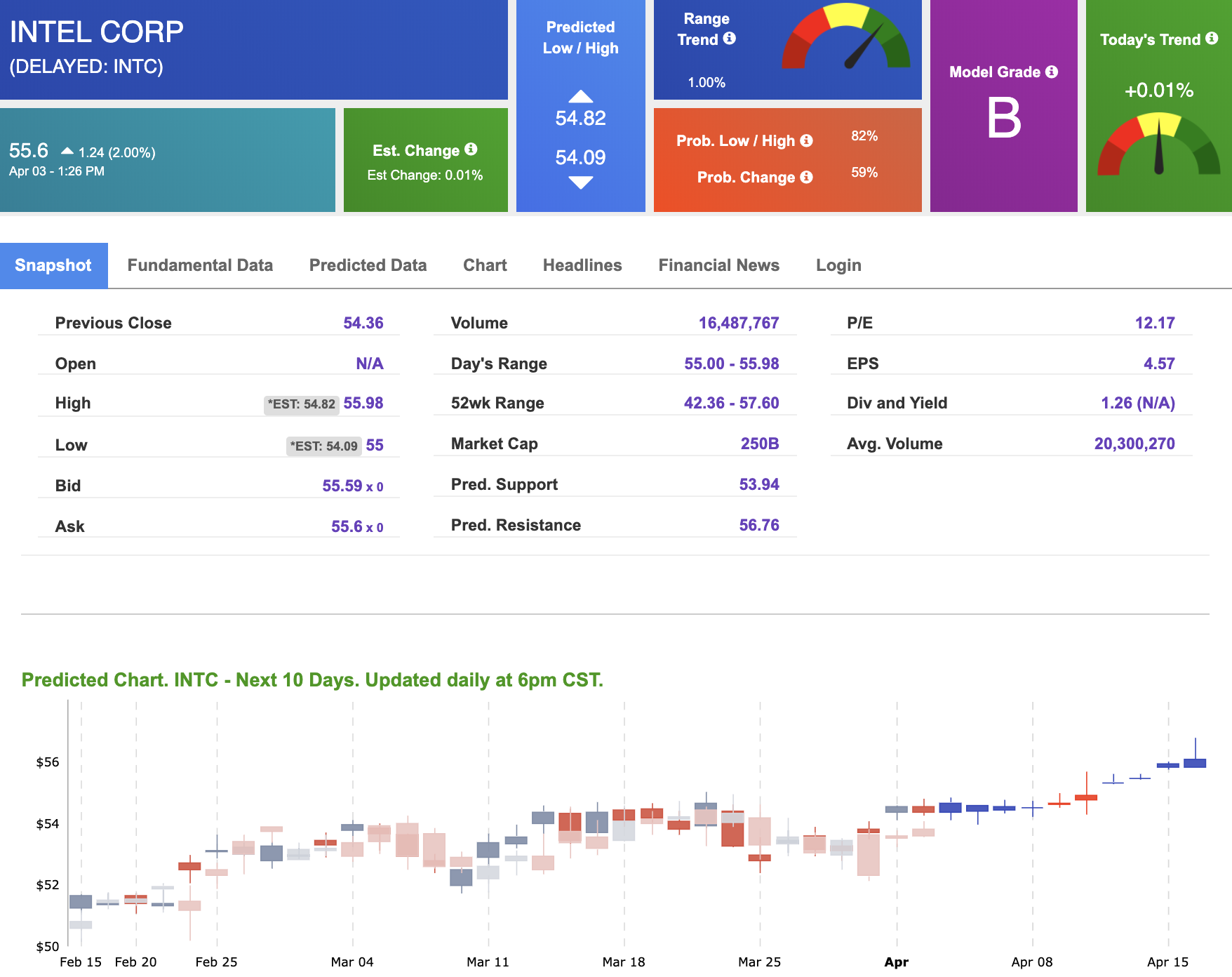

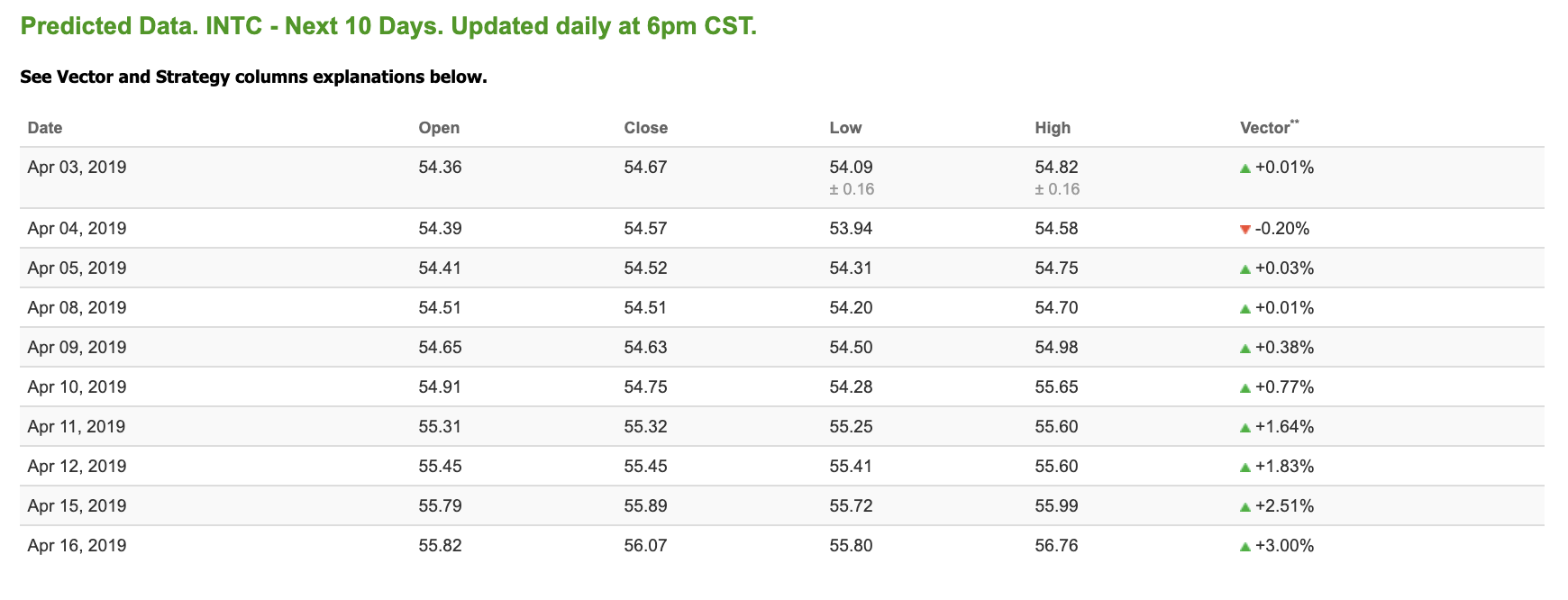

Our featured stock for Thursday is Intel Corp. (INTC). INTC is showing a confident vector trend in our Stock Forecast Toolbox’s 10-day forecast. This stock is assigned a Model Grade of (B) indicating it ranks in the top 25th percentile for accuracy for predicted support and resistance, relative to our entire data universe.

The stock is trading at $55.6 at the time of publication, up 2.00% from the open with a +0.01% vector figure.

Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Note: The Vector column calculates the change of the Forecasted Average Price for the next trading session relative to the average of actual prices for the last trading session. The column shows expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

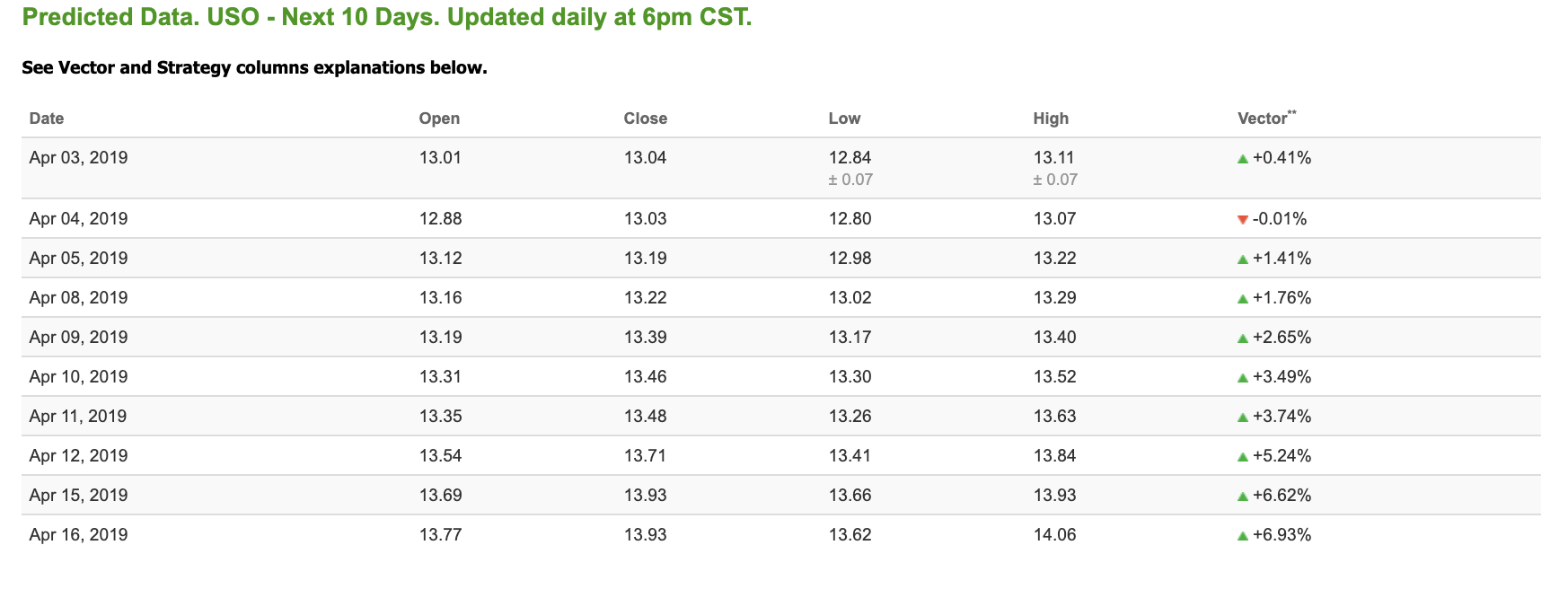

Oil

West Texas Intermediate for May delivery (CLK9) is priced at $62.37 per barrel, down 0.35% from the open, at the time of publication.

Looking at USO, a crude oil tracker, our 10-day prediction model shows positive signals. The fund is trading at $12.94 at the time of publication, down 1.00% from the open. Vector figures show +0.41% today, which turns +3.49% in five trading sessions. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Gold

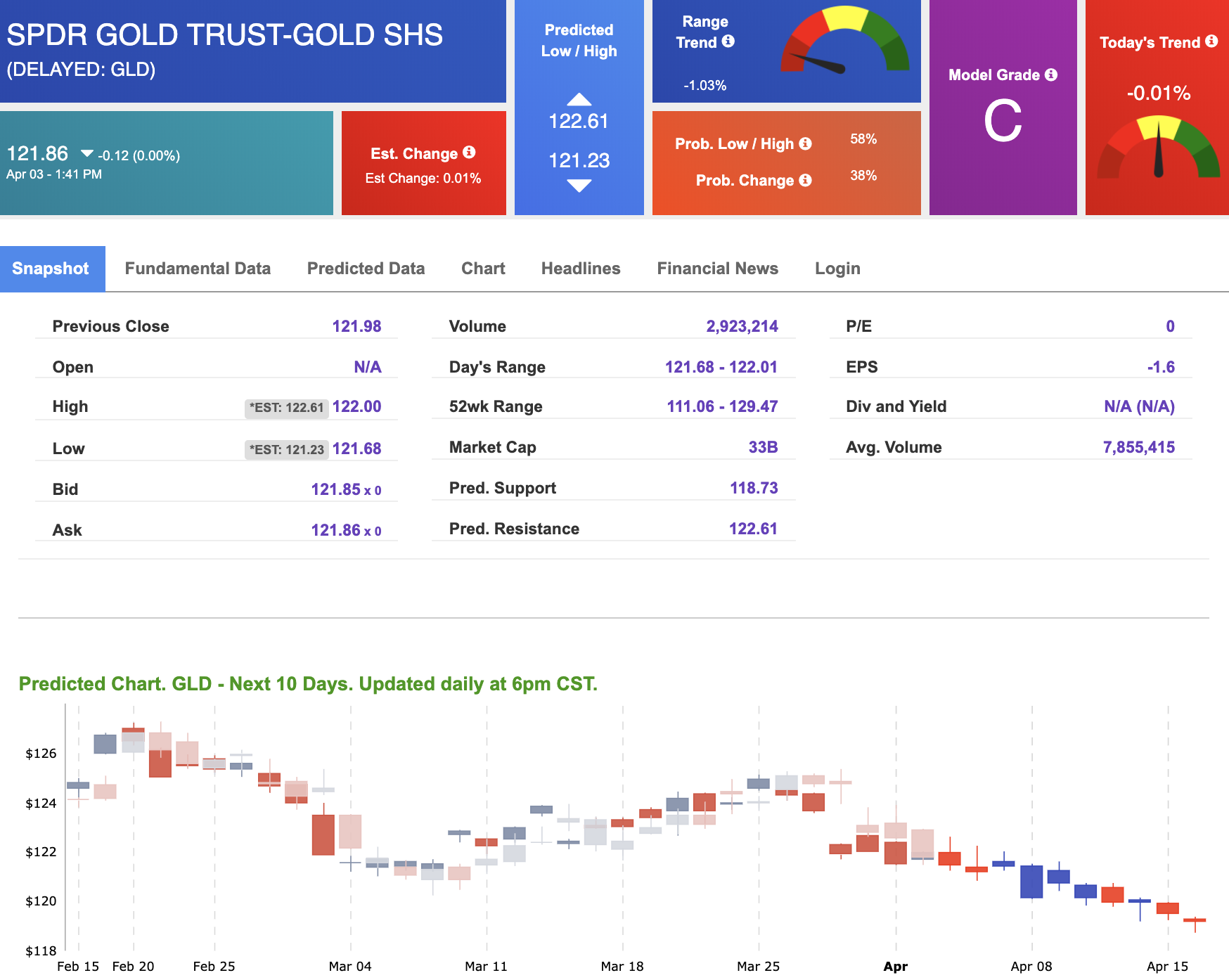

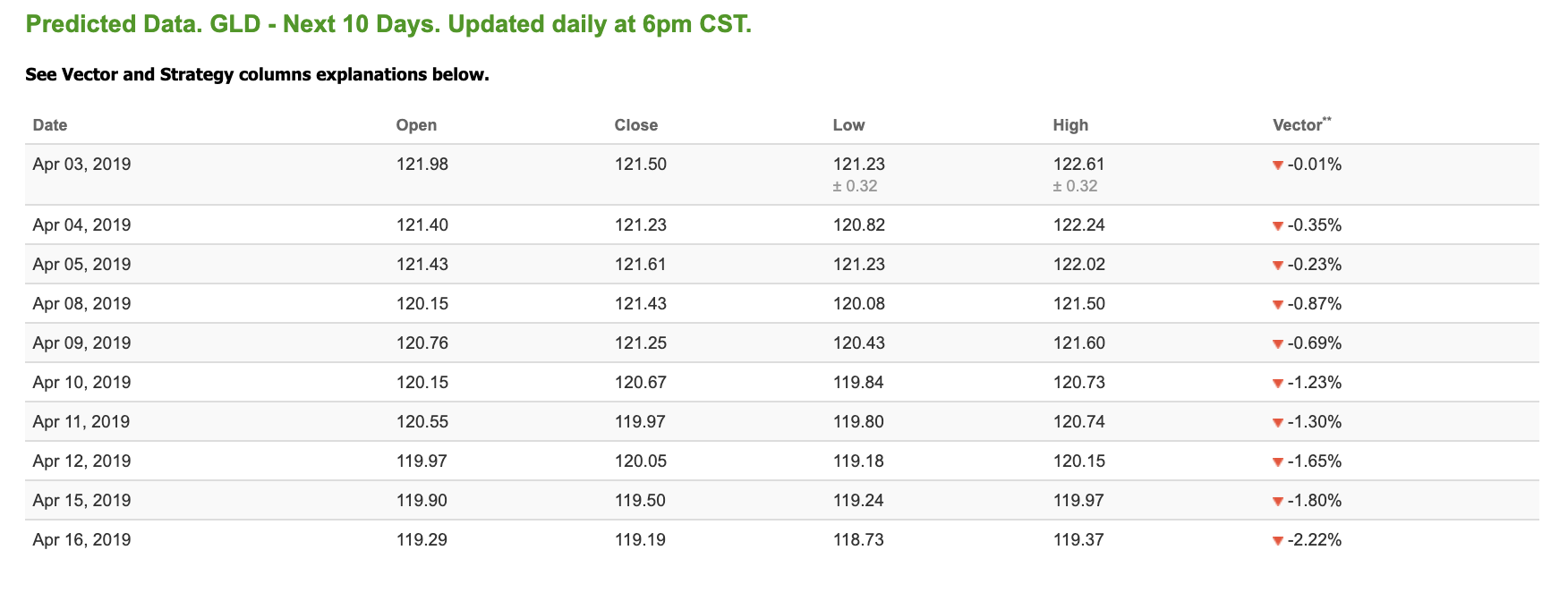

The price for June gold (GCM9) is down 0.02% at $1,295.30 at the time of publication.

Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows negative signals. The gold proxy is trading at $121.86, at the time of publication. Vector signals show -0.01% for today. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Treasuries

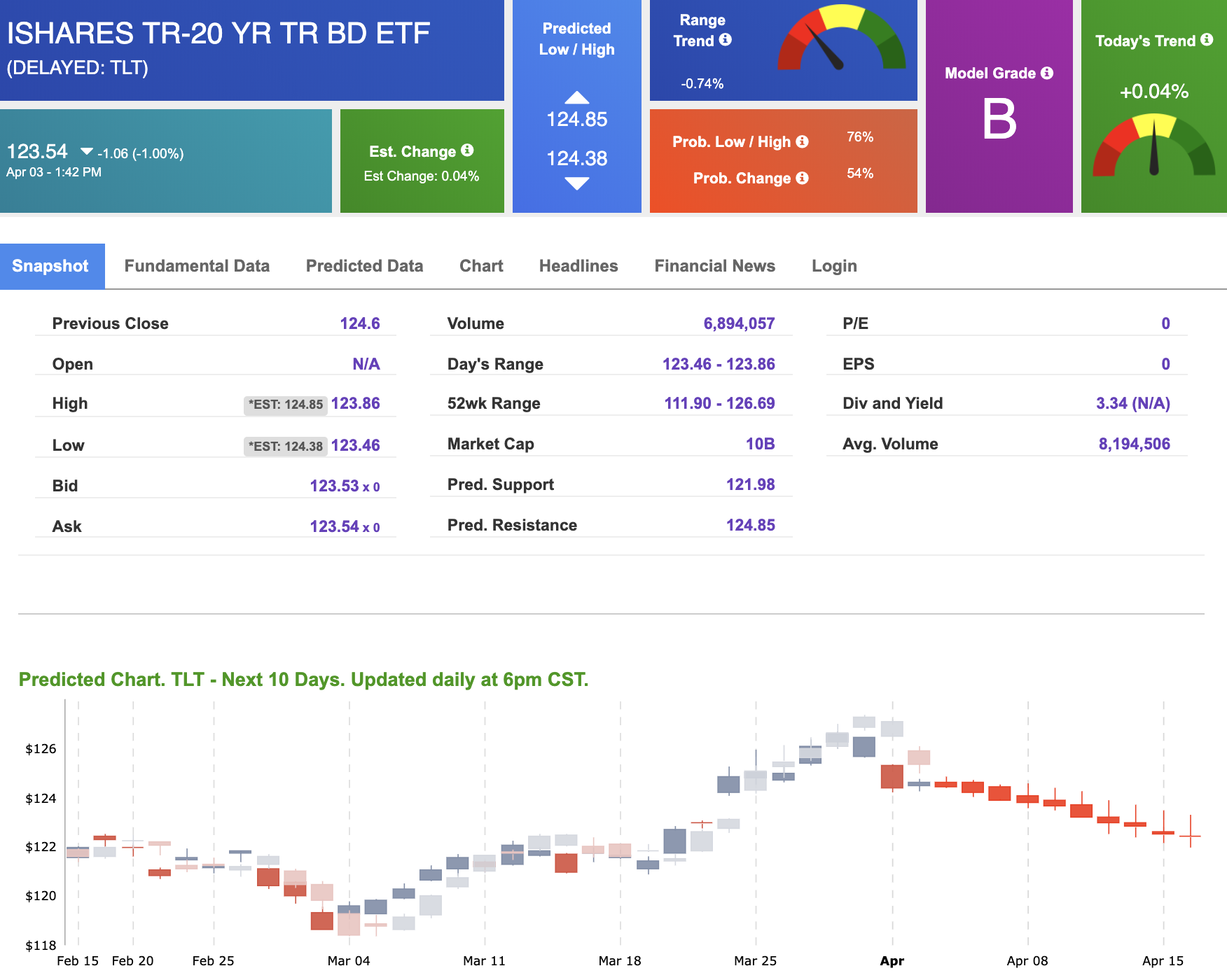

The yield on the 10-year Treasury note is up 1.76% at 2.52% at the time of publication. The yield on the 30-year Treasury note is up 1.60% at 2.93% at the time of publication.

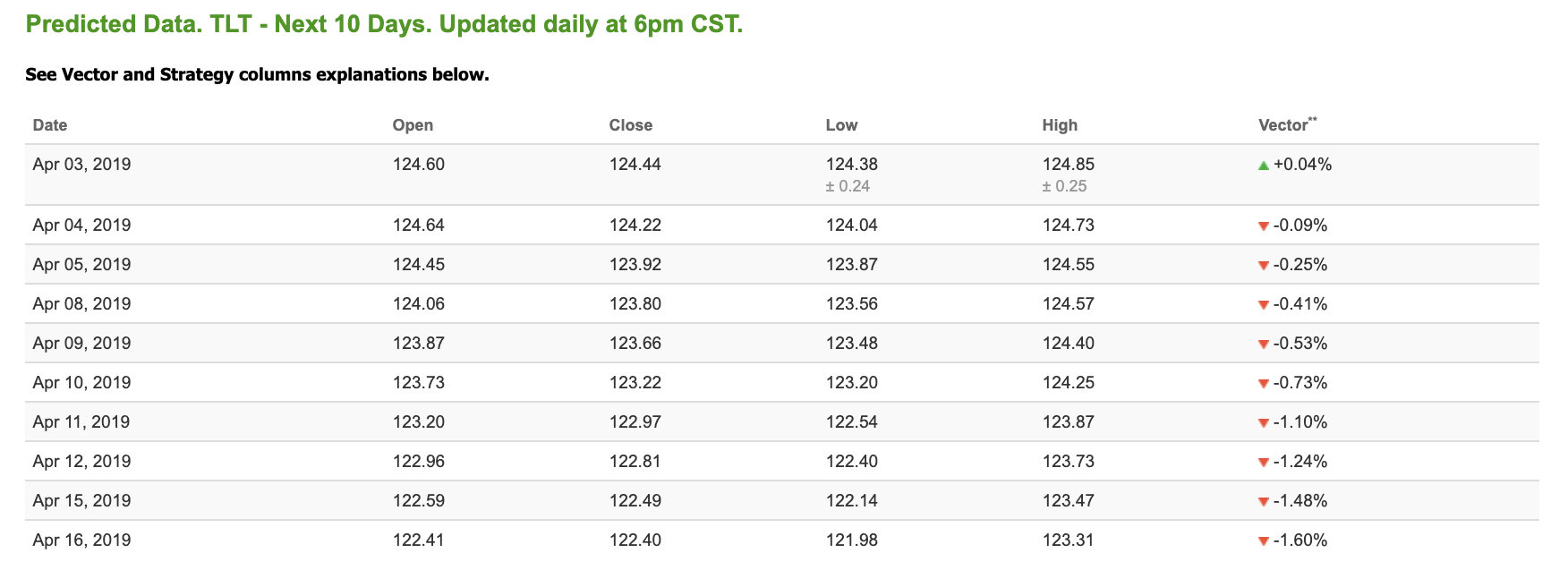

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see negative signals in our 10-day prediction window. Today’s vector of +0.04% moves to -0.41% in three sessions. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Volatility

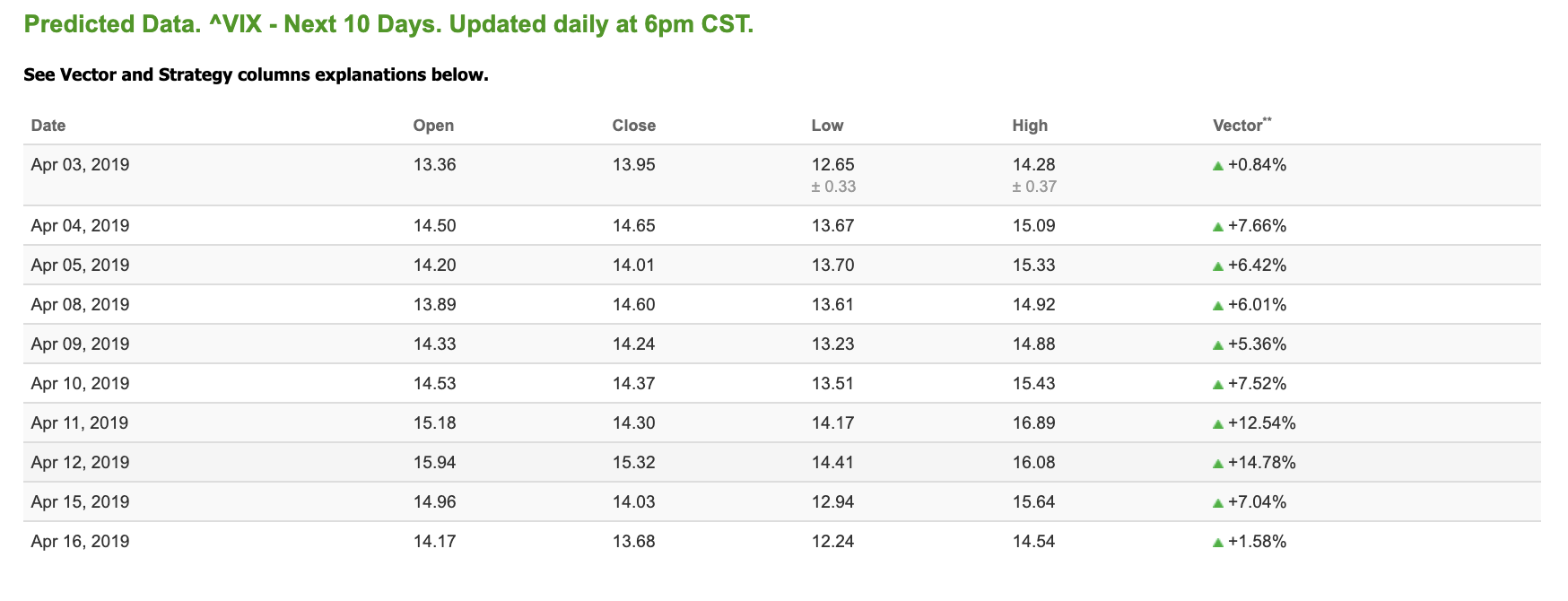

The CBOE Volatility Index (^VIX) is up 5.09% at $14.04 at the time of publication, and our 10-day prediction window shows positive signals. The predicted close for tomorrow is $14.65 with a vector of +7.66%. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.