Global Trade Developments and More Facebook Issues

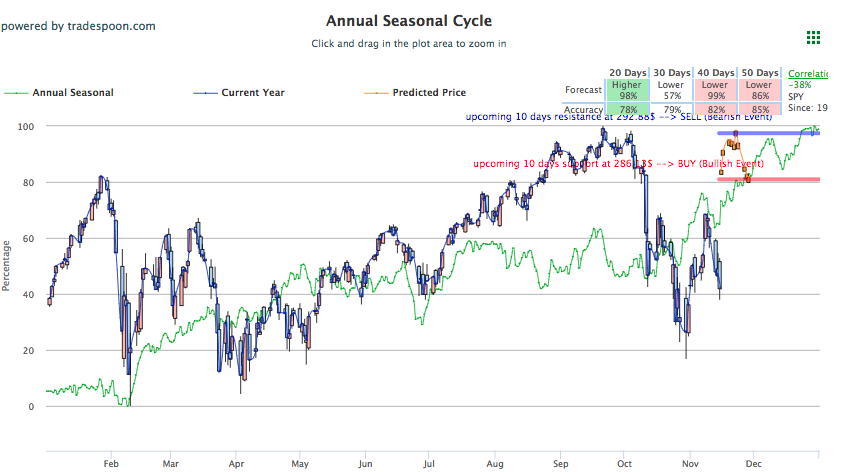

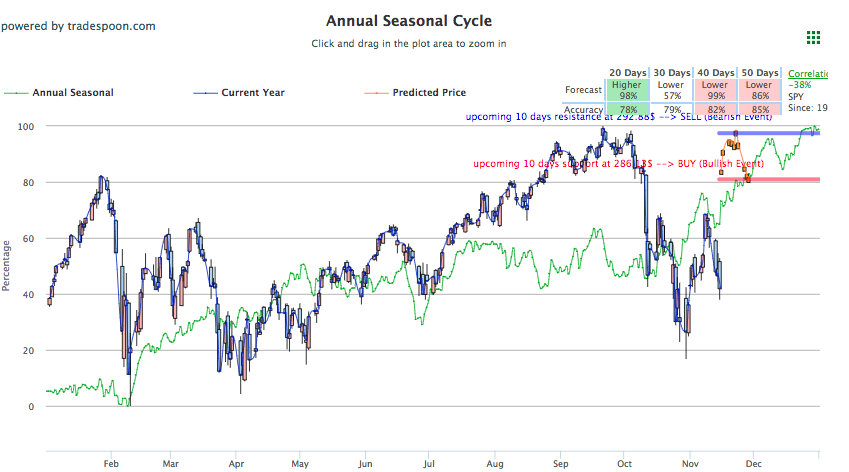

Stocks retreated in early morning action before rebounding during the midday, muting most movement and returning major indices to today’s open or just slightly above. Important news to note today includes the pound plummeting after turmoil began to brew following recent Brexit developments and renewed optimism in global trade as Chinese officials outline steps to resolve the tariff and trade standoff. The market is still subject to volatility and investors should avoid chasing. Major support and resistance for the SPY have remained in the same range this week, $270-282, offering good opportunities to buy into the dips. For reference, SPY Seasonal Chart is shown below:

The market seesawed today, initially down but currently on the move up, bringing the daily change for major indices just barely over into positive territory. Recent developments regarding the trade with China are likely influencing the market’s reverse in course as Chinese officials outlined some potential concession they are willing to make ahead of the G20 summit. These concessions will likely satisfy some Trump administration demands in the tariff standoff between the two economic powerhouses. Simultaneously, further news of negotiations between the two sides continues to come out. Treasury Secretary Steven Mnuchin and China’s main economic emissary, Liu He, spoke last Friday, while Larry Kudlow, head of Trump’s National Economic Council, is also continuing the discussion with Chinese officials and reported the two sides have been in touch on “all levels.” Globally, this helped Chinese Markets, rebounding today after a string of bad sessions, while European stocks recorded modest losses, with the pound under mounting pressure following the Brexit deal.

Other important news to note today include Facebook’s worrisome admission, the California wildfires, and the final stretch of third-quarter earnings season. News began to circulate today that the Facebook board tried to push CEO Mark Zuckerberg and Sheryl Sandberg, the second-in-command, to “move faster” on Russian interference in the U.S. presidential election. This latest report, coming from the board today, is another in a growing list of controversies that surrounded the social media giant this year and will certainly not help Facebook shares in the near future. In California, firefighters are fighting two separate wildfires that have continued to spread, totaling over 50 deaths and are forcing relocation and concern for many individuals and business in the area. PG&E, a northern California utilities company, is under added pressure as stocks are taking a major hit after the company announced it has exhausted its credit lines and a recent investigation into the source of the fire has shifted towards PG&E utilities and locations. And finally, in the final days of third-quarter earnings Walmart shares took a noticeable hit, near 2%, after the retail giant reported third-quarter profit and revenue misses expectations. Cisco rose 4% after the company reported well above expectations while J.C. Penny missed expectations but still rose, up 8% today. Others still set to report today after close or tomorrow include NVIDIA, Nordstrom, Post Holdings, and Viacom.

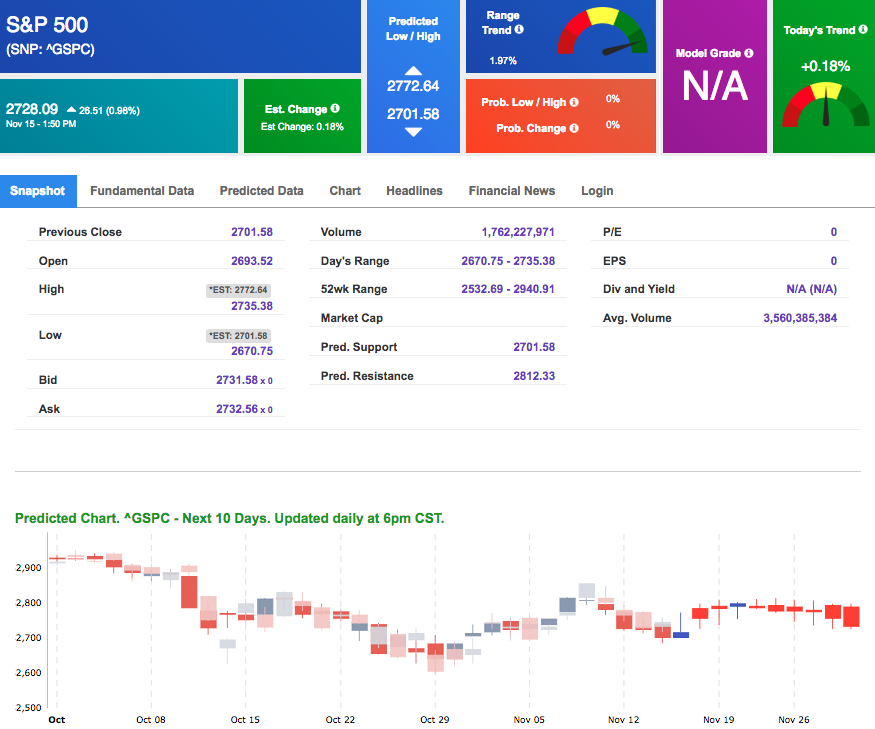

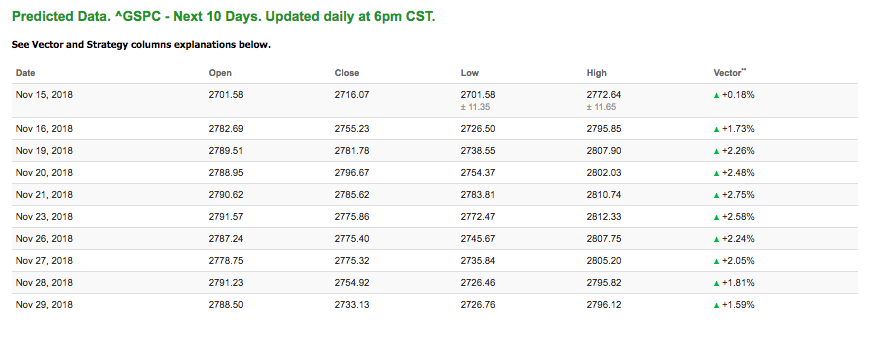

Using the “^GSPC” symbol to analyze the S&P 500, our 10-day prediction window shows mixed signals. Today’s vector figure of +0.27% moves to -0.66% in five trading sessions. The predicted close for tomorrow is 2,926.72. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Highlight of a Recent Winning Trade

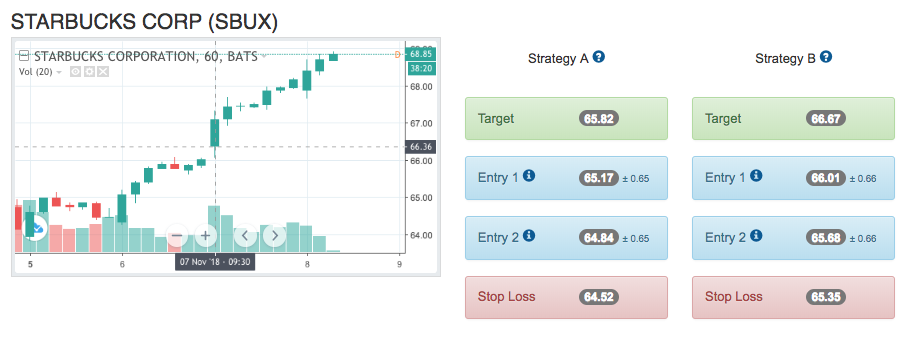

On November 7th, our ActiveTrader service produced a bullish recommendation for Starbucks Corp. (SBUX). ActiveTrader is included in all Tradespoon membership plans and is designed for intraday trading.

Trade Breakdown

SBUX entered the forecasted Entry 1 price range of $66.01 (± 0.66) in its first hour of trading and hit its Target price of $66.67 that hour, reaching a high of $68.14 for the trading day. The Stop Loss was set at $65.35.

YOUR LAST CHANCE!

YEAR-END FEEDING FRENZY

(Explosive Season Begins Next Week)

The recording of our event has been posted!

CLICK HERE TO WATCH NOW

Friday Morning Featured Stock

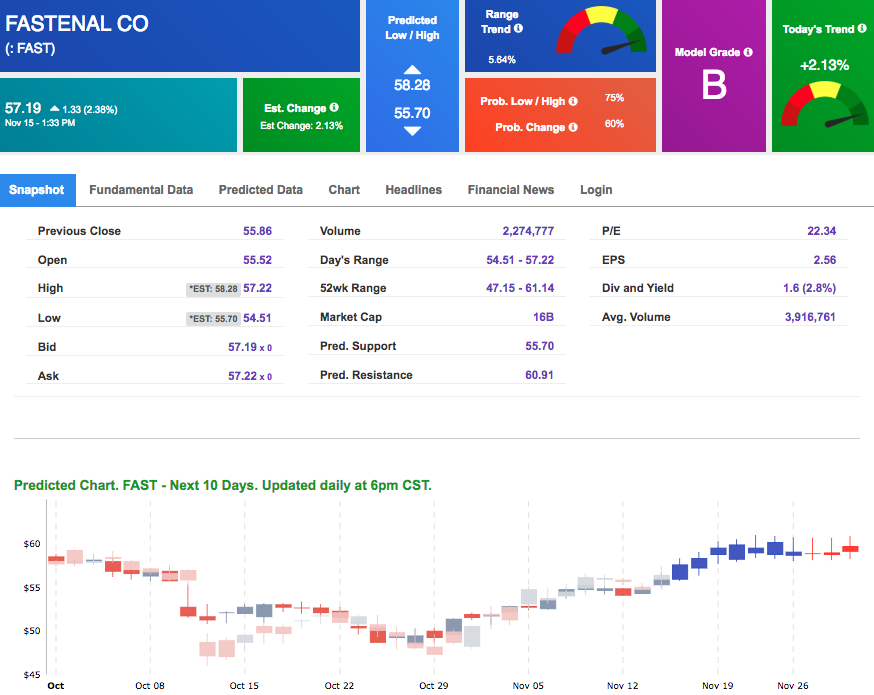

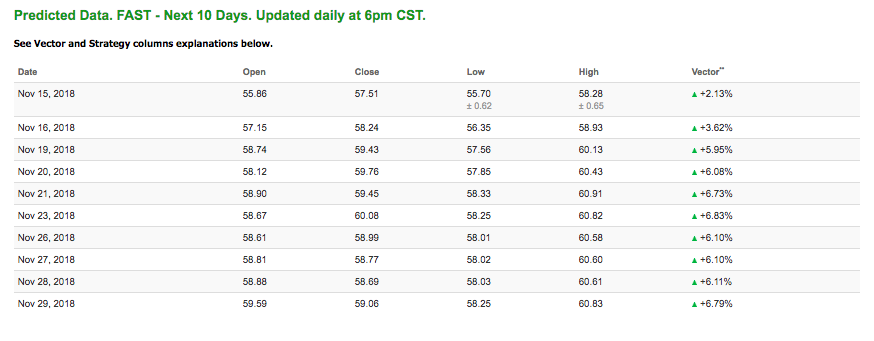

Our featured stock for Friday is Fastenal Co. (FAST). FAST is showing a confident vector trend in our Stock Forecast Toolbox’s 10-day forecast. This stock is assigned a Model Grade of (B) indicating it ranks in the top 25th percentile for accuracy for predicted support and resistance, relative to our entire data universe.

*Please note: Our featured stock is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader or ActiveInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

The stock is trading at $57.1? 9 at the time of publication, up 2.38% from the open with a +2.13% vector figure.

Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Note: The Vector column calculates the change of the Forecasted Average Price for next trading session relative to the average of actual prices for the last trading session. The column shows expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

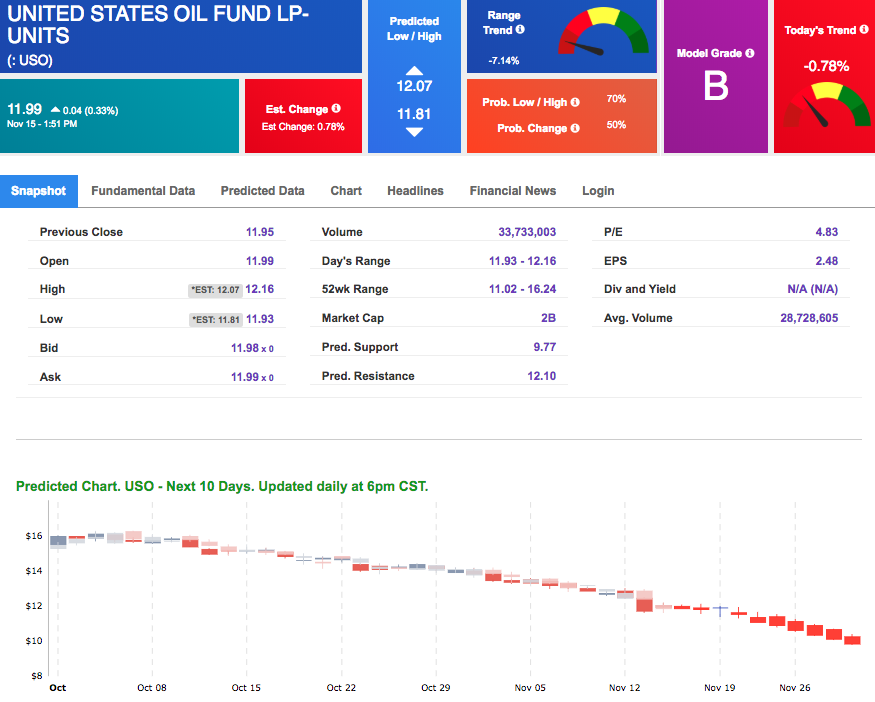

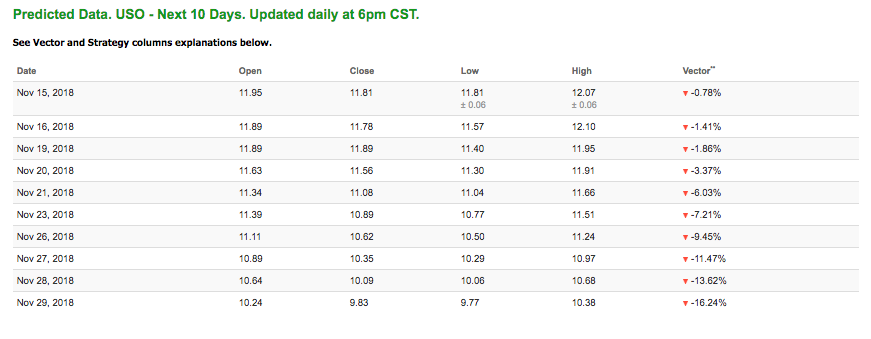

Oil

West Texas Intermediate for December delivery (CLZ8) is priced at $56.45 per barrel, up 0.12% from the open, at the time of publication. Looking at USO, a crude oil tracker, our 10-day prediction model shows negative signals. The fund is trading at $11.99 at the time of publication, up 0.33% from the open. Vector figures show -0.78% today, which turns -7.21% in five trading sessions. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

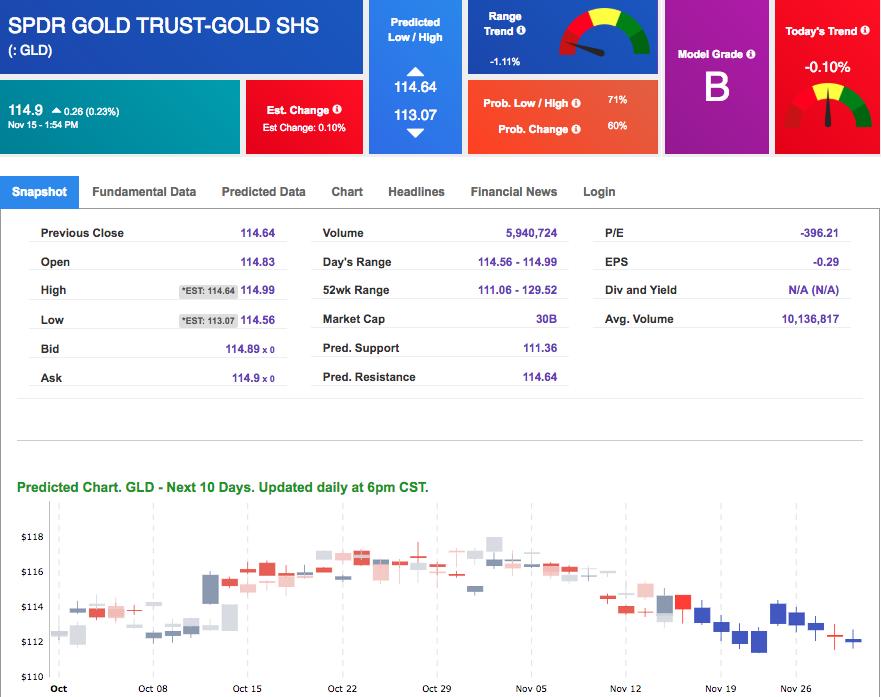

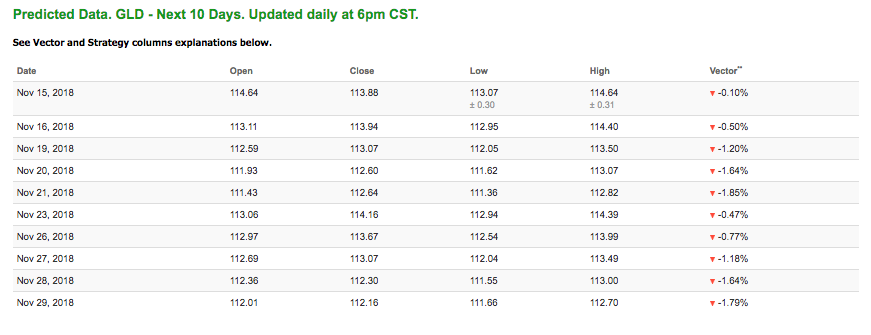

Gold

The price for December gold (GCZ8) is up 0.35% at $1,214.30 at the time of publication. Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows all negative signals. The gold proxy is trading at $114.9, up 0.23% at the time of publication. Vector signals show -0.10% for today. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Treasuries

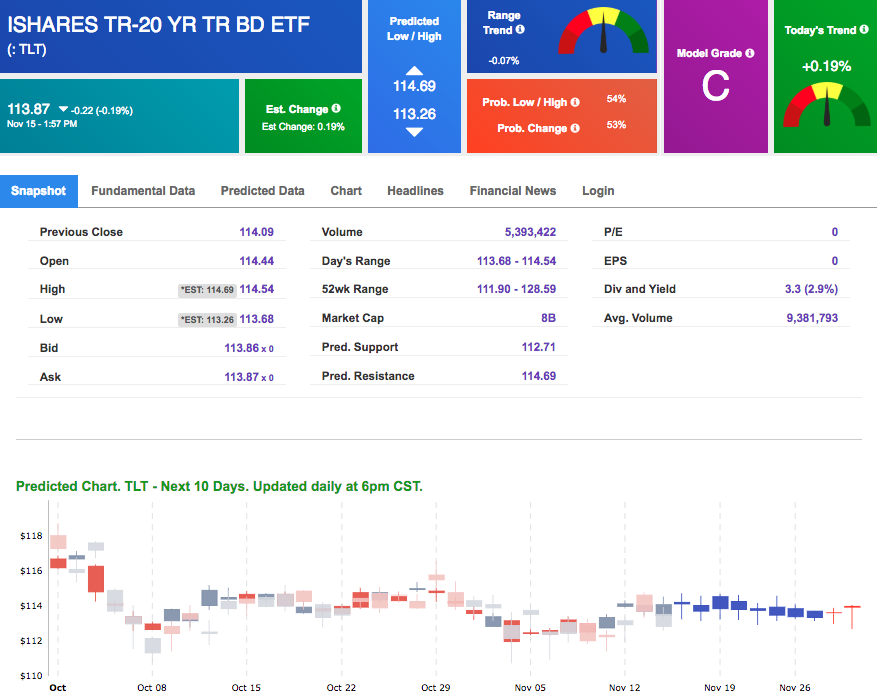

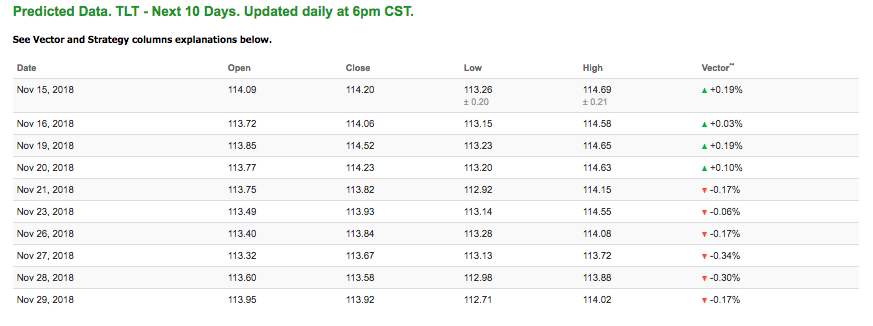

The yield on the 10-year Treasury note is down 0.38% at 3.11% at the time of publication. The yield on the 30-year Treasury note is down 0.15% at 3.36% at the time of publication.

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see mixed signals in our 10-day prediction window. Today’s vector of +0.19% moves to -0.17% in four sessions. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

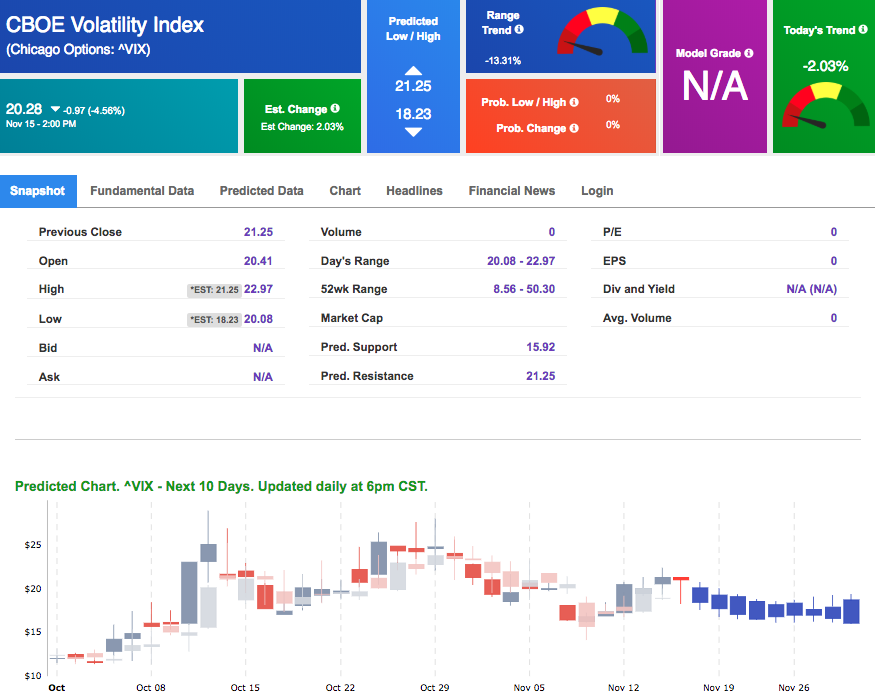

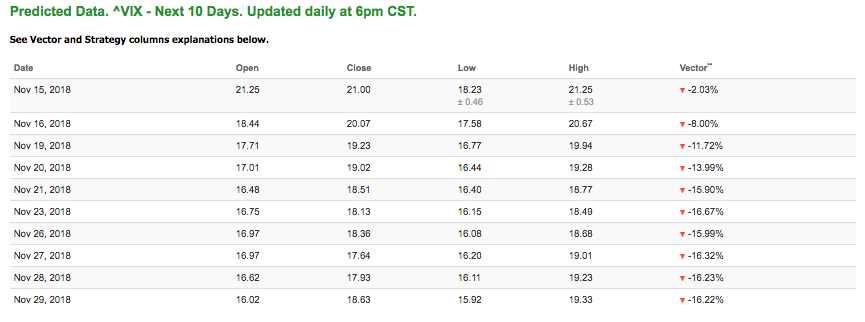

Volatility

The CBOE Volatility Index (^VIX) is down 4.56% at $20.28 at the time of publication, and our 10-day prediction window shows negative signals. The predicted close for tomorrow is $20.07 with a vector of -8.00%. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

YOUR LAST CHANCE!

YEAR-END FEEDING FRENZY

(Explosive Season Begins Next Week)

The recording of our event has been posted!