Happy Bargain Hunting!

RoboStreet – October 25, 2018

Bottom Forming or Just a Big Bounce

Yesterday’s rebound gave investors the bounce in equities that might have signaled a bottom to the three-week correction that has seen the S&P decline 9.9%- and the Nasdaq 12.2%- from the recent high to Wednesday’s low. If so, it would qualify as a “garden variety” correction, or the pause that refreshes. But with the fluidity of the factors impacting investor sentiment, we won’t know this answer for a couple weeks.

There is no way to sugar-coat the current trading landscape. It’s damaged and in need of serious short-term repair. The market is extremely oversold and a solid earnings season should see the selling dry up and buyers return. Much of the downward pressure is attributed to external forces outside what is otherwise a healthy domestic economy. When and how the market realizes and differentiates this fact is unknown and much will depend on corporate forward guidance for the current fourth quarter.

Stock valuations have undergone a full reset in the past three weeks with many of the leading stocks trading at key technical support levels. Yesterday’s rebound gave rise to the notion that valuations are again attractive to traders and investors. But one day does not make for a trend and we’ll need to see each recurring bout of selling met with the same kind of enthusiasm in order to rinse the market of its short-term bearish bias.

There is definitely a divide as to how professional money and retail investors feel about the current investing landscape. For the third week in a row, individual investors bought stocks while institutional and hedge funds were net sellers- shown by data on client flows compiled by Bank of America. Thanks to retail demand, equity buying by all the firm’s clients rose last week to the highest level since late May, suggesting the latest selloff is another dip that’s worth buying with fourth quarter earnings growth running at 20% and valuations falling.

Happy Bargain Hunting! Any day now…

The Fintech Effect is about to disrupt the old long term investing style…topple Buffet…and help you generate consistent profits of 46 to 142 percent with 78% accuracy. It should happen any day now…

Click Here to Learn More…

Conversely, hedge funds and proprietary trading desks see a congregation of forces that threatens to slow the 9 1/2-year bull market: higher bond yields, slowing profit growth, and persistent political tensions at home and abroad. Mid-term elections are less than two weeks away and both the House and Senate are up for grabs. A split of the GOP winning the Senate and the Dems winning the House will be seen as market neutral, whereas if the Dems win both the House and the Senate, the market will react negatively as President Trump’s agenda will face major headwinds.

Market participants have been pricing in a long-term tariff standoff with China and see the European Central Bank as stepping in to salvage Italy’s troubled banks if necessary. This leaves the discontent with the Fed’s raising of interest rates and whether investors and the market can transition successfully with the notion that higher interest rate accompany a strong economy. The fact that the Fed has maintained their policy rhetoric from the FOMC minutes released this week to raise the Fed Funds Rate in December, and maybe next year, carries the conclusion that they must collectively believe the recent slide in housing, auto and retail sales data is temporary and that a resumption to momentum to these three pivotal sectors of consumer spending is highly probable. We shall see.

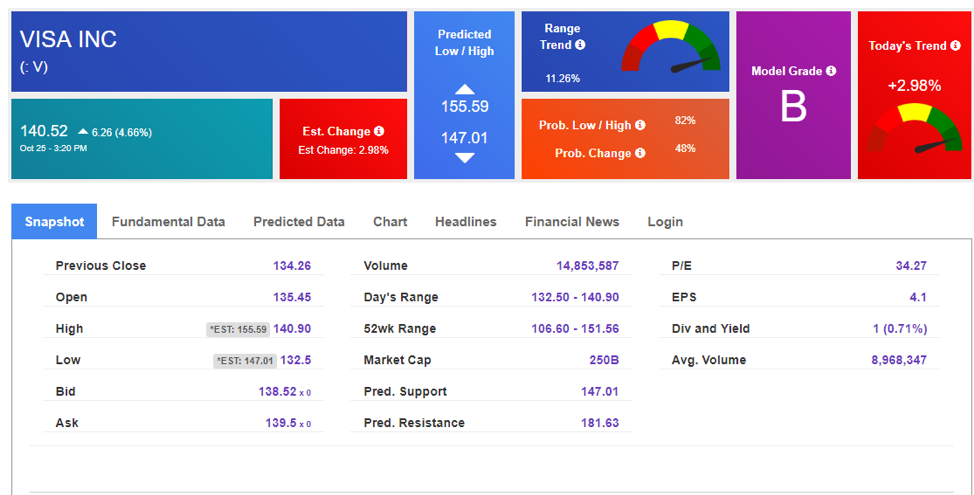

This week is all about earnings, and for our RoboInvestor Model Portfolio, the reporting season delivered mostly better-than-expected Q3 results. So far, it’s been a clean sweep of meeting or beating estimates with Visa being yesterday’s star performer for RoboInvestor subscribers. The stock gapped higher by 6 points or 4.4% after the payments processor and Dow component posted results that beat on the top and bottom line. It’s the very kind of stock this market is embracing – super high quality, liquid and a category or sector leader.

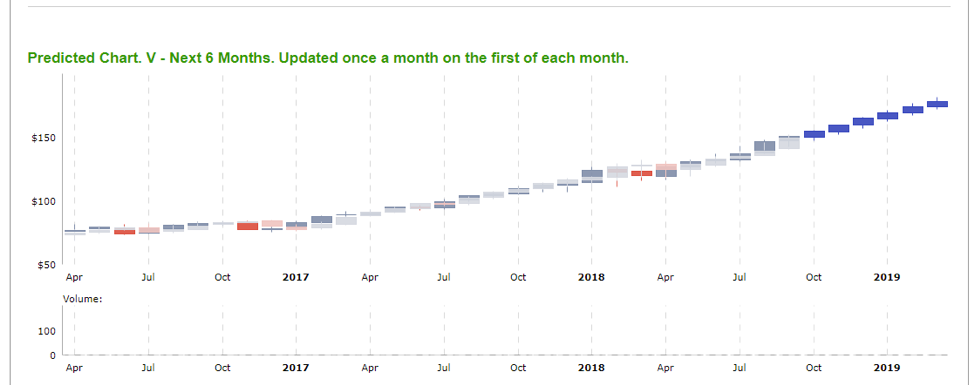

My Tradespoon Stock Forecast Toolbox has a 6-month price target of $181 for Visa, or 30.8% higher than where the stock closed yesterday. However, the stock trades in a 15-point short-term range and getting the right entry point in a choppy market is not easy, making my AI platform hugely valuable in the process of initiating or adding to a current position. It matters greatly to the total return when the timing is optimized by AI tools.

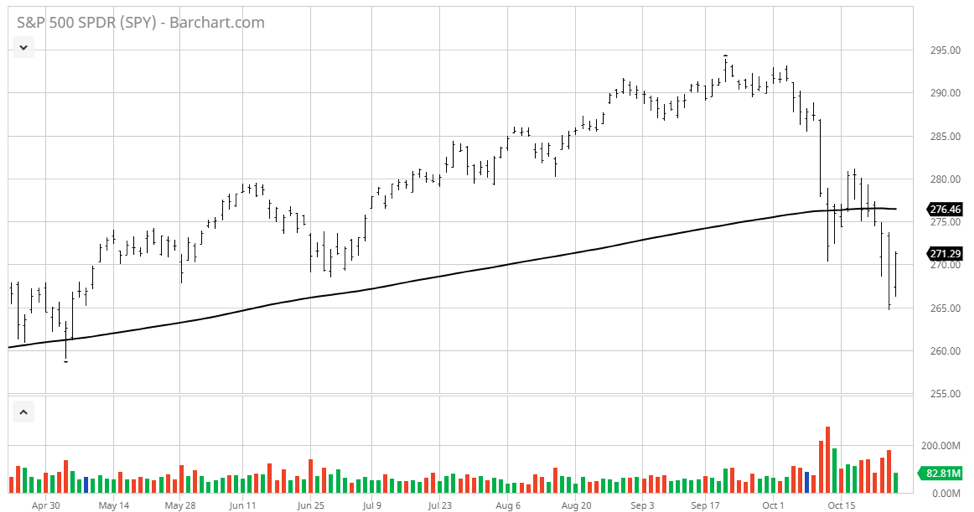

Looking at the technical picture for the market as a whole, the S&P 500 broke down through its key 200-day moving average at 2,767 on October 11 and then again, this past Monday whereby it plumbed a low of 2,650 on Wednesday before rebounding Thursday. (see 1-year chart below)

What was support now becomes resistance and as such, the S&P has to not only clear and stay above 2,700 but also retake the high ground by clearing 2,770 on big volume. Here too, once the mid-term elections are out of the way and the holiday shopping season kicks in we’ll know if the seasonal bullishness that accompanies a good market revives the S&P and the rest of the major averages.

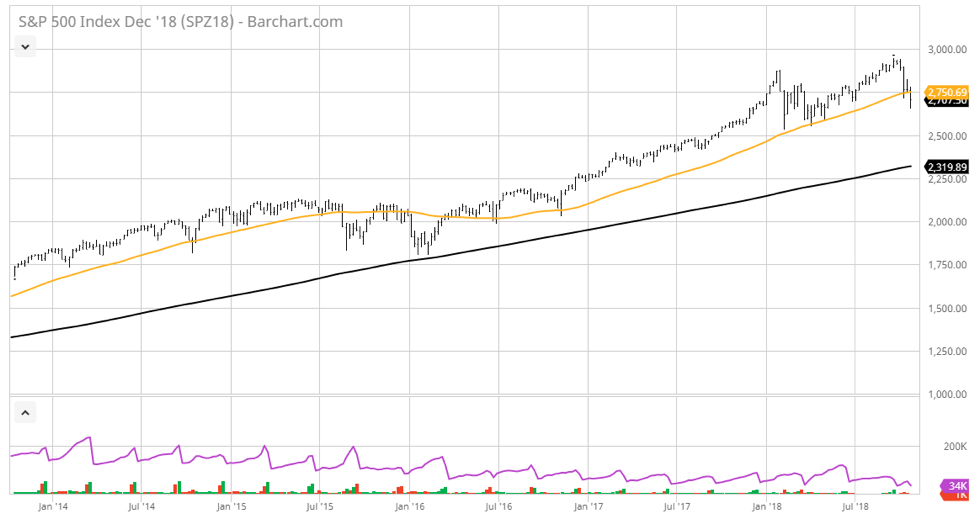

While the short-term outlook remains uncertain, the long-term path for the market looks constructive. The 5-year chart below shows the primary bull trend is in tact with only a minor breach of the 50-week moving average (orange line), which in the past has been violated during periods of consolidation. The rising 200-week moving average that has defined the 9.5-year bull market lies at 2,320 which was last tested in the first quarter of 2016 when the S&P endured a 13% correction.

Sometimes it really helps to take a step back and view the market from a longer time line than the day-to-day attention investors tend to be glued to. Assuming the market consolidates at current levels and builds a higher-low formation from the prior sell-off the first quarter of 2018, the market will be set up for what should be a solid finish to the year. Having my AI platform and Tradespoon tools to navigate and position one’s investing capital is crucial to owning the right stocks and buying them at the right time. Now is not the time to go it alone. Come join our RoboInvestor community and make the most of this market opportunity.

Happy Bargain Hunting! Any day now…

The Fintech Effect is about to disrupt the old long term investing style…topple Buffet…and help you generate consistent profits of 46 to 142 percent with 78% accuracy. It should happen any day now…