Hot Pot Stock “Under $10”

RoboStreet – March 7, 2019

Turning Marijuana Plants into Diamond Profits

Before I get fully into what I think is likely the most compelling pot stock trade under $10, let’ take a quick view of the current trading landscape and the most likely investing landscape for the next few weeks. It’s pretty clear the market has gone into a plateau where selling on strength is the trade of choice for the past five-of-six trading sessions.

And why not? After nine weeks of straight up, a lot of profits on paper are only that, unless you book them – and we’re seeing some of that this past week, which is well deserved. The market tried twice to break above key technical resistance at 2,815 and failed as nervous longs overwhelmed the fear-of-missing-out (FOMO) camp. Quite frankly, there is an immediate shortage of market catalysts to propel stocks higher while a growing chorus of how the market is going to absorb no less than 220 IPOs this year is making the rounds.

Bear in mind the top ten IPOs are not young companies. These unicorns have been through as many as ten rounds of private market funding and when they go live on Wall Street, many will be fully, if not over-valued on day one of trading. To that point, the market can absorb somewhere around $80 billion in new entrants with names like Uber, Planatir, Lyft, Pinterest, Rackspace, Slack, Robinhood and Cloudfare on deck. Historically, anytime there is a massive wave of IPOs, the market struggles.

If the market needed an excuse to pull back to near-term support, this might be one to them as a trade deal with China seems imminent while hard Brexit is looking more unlikely. Aside from those risks, the S&P should find good support at 2,740 and very strong support at 2,680 assuming that level even comes into question. From my trading station, I think 2,740 where the 200-day m.a. comes into play will invite fresh buyers given the reasonably solid economic data.

And remember we’re not talking about day-trading here. I’m looking for 50-100% gains inside of the next 3 months, so my weekly updates are timely enough for you to act.

Click Here – To See Where I Put My RoboInvestor Money

Managing our RoboInvestor Portfolio in the midst of this pause has been earmarked by some timely exits – this past week in half our position in Whirlpool Corp. (WHR) for +10% profits and the iShares MSCI Emerging Markets ETF (EEM) for a small gain. I continue to work down our total number of longs, currently 19, while adding fresh names like Medtronic (MDT) and Alphabet Google (GOOGL) that are bucking the trend and breaking out to the upside. There is always a bull market somewhere.

This week, I’m going to highlight a special situation in the cannabis market where some of the pieces are starting to come together. When Wall Street analysts put their reputations on the line in an unproven industry, it pays to listen, because they have a lot more Street cred to lose than gain by venturing into high PE, high valuation stocks where barriers to entry are minimal. Such would be the case for the pot industry. For a well-heeled Wall Street firm to march out of with a “Buy” recommendation, that’s big.

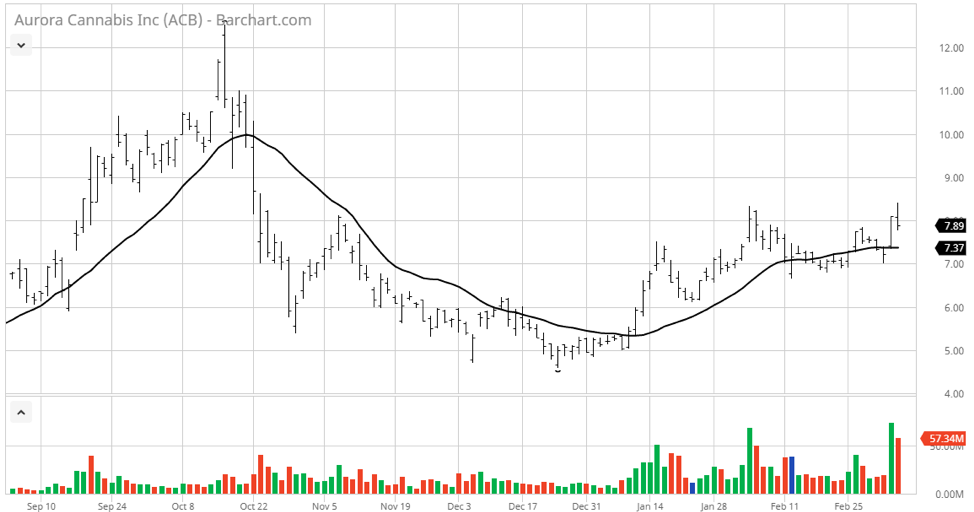

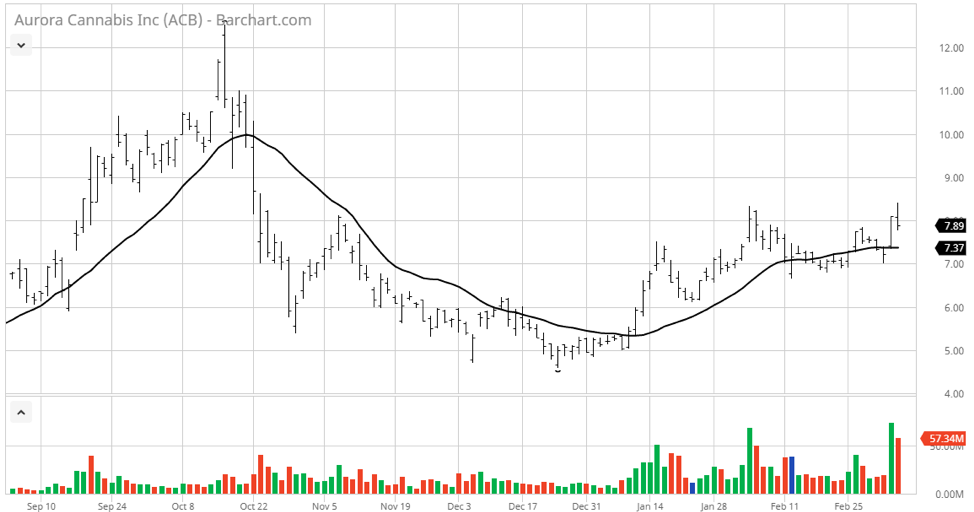

And that’s just what Cowen & Co. did this past week. They designated Aroura Cannabis (ACB) as not only a standout within the fledgling industry, but tagged the company as its Top Pick in the sector, highlighting a huge opportunity for the company to flourish in the recreational market as well as the rapidly expanding medicinal market for cannabis. As to the upside price, Cowen assigned a $10.50 number that is 35% above its current price of $7.80. And rest assured, if the business model delivers according to plan, Cowen will gladly raise their price target accordingly.

Just in the last week, the stock is averaging 10 million shares a day in trading volume on a float of 154 million shares with the stock trading in excess of 50 million shares last Wednesday and Thursday after the Cowen upgrade. Friends, when Wall Street wants to get long a sector, you just need to be in the way of that gusher of money flow that will lift stocks like Aurora Cannabis to new highs. At $7.90 per share, there is a clear and solid floor under the stock at $7.00. So, the downside looks like one point and the upside is whatever the market will bear.

What is most impressive about Aurora Cannabis is that it isn’t just a play on the Canadian and U.S. markets, but rather has the largest foothold on the international marketplace. The company is set to produce over 500,000 kg per year and has been busy acquiring foreign companies that now have the company operating in 23 countries. At its current rate of growth, Aurora Cannabis is on pace to become the world’s largest producer in a market that is forecast to expand by up to 50-fold.

This is a bit like buying Tesla when it was trading at $50 five years ago. Today, it trades at $300 and is one of the most hated companies by Wall Street bears that “missed out”. I think there is a lesson in all of this – look at the big picture and leave the short-term stuff to the day traders. Aurora Cannabis (ACB) is not just smoke and mirrors, but rather the “real deal” in the burgeoning pot industry. More importantly, sign up for RoboInvestor so you can pull the trigger on the hottest pot stocks and other market leaders in the cloud, cybersecurity, 5G, IoT, e-commerce, mobile banking, big data, AI and consumer-specific discretionary stocks that are trading to new highs consistently even as the market pauses. My AI platform provides cutting-edge analysis for stock and ETF selection. It’s exciting to see hundreds of investors coming alongside me to build their wealth with my Tradespoon intelligence. Make RoboInvestor your #1 investing advisory and let’s have a huge year together.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

“I’m investing my own money in each and every stock as my AI platform identifies.”

And remember we’re not talking about day-trading here. I’m looking for 50-100% gains inside of the next 3 months, so my weekly updates are timely enough for you to act.

Click Here – To See Where I Put My RoboInvestor Money